Published on July 23, 2024 by Sandeep Khandelwal and Manju Patel

What is investment monitoring?

Investment monitoring is a continuous process of tracking and evaluating the performance of an investment portfolio, ensuring that it is in accordance with an investor’s financial goals, regulatory requirements and risk tolerance. It helps investors track investment returns, identify potential issues, respond to market volatility and make informed decisions about their investments.

The main goal of investment monitoring is to protect and grow the investor's capital, maintain optimal asset allocation, manage risk exposure and ensure regulatory compliance in order to avoid reputational damage and hefty penalties.

The investment-monitoring process

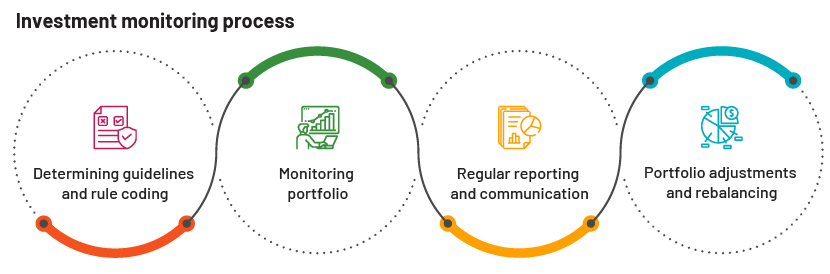

The following are the key steps involved in investment monitoring:

1. Determining guidelines and rule coding

The first step in investment monitoring is interpreting client guideline documentation such as IPS/IMA/prospectus/SAI. These documents detail the agreement between the client and the portfolio manager. They list the fund’s investment objectives and describe the risk and return profile, asset allocation, etc., helping the portfolio monitoring manager make informed decisions that meet the client’s ultimate objective.

After interpreting client guidelines, the rule-coding grid needs to be created to capture all the client’s specifications and regulatory restrictions. Once the grid is completed, all these restrictions need to be fed into the compliance engine after user acceptance testing (UAT).

2. Monitoring portfolio

Monitoring the portfolio in the compliance engine involves pre-trade, post-trade and end-of-day batch monitoring. This is a critical stage in the investment-monitoring process, as it helps identify potential client guideline/regulatory breaches and analyse all active, passive and false alerts.

3. Regular reporting and communication

After identifying active/passive breaches, a notification is sent to the portfolio manager. Active breaches are those that result from voluntary acts of the portfolio manager or the absence of action when a breach was predictable and avoidable. Passive breaches are those that result from market movement, corporate action, etc., which are beyond the control of a portfolio manager.

4. Portfolio adjustments and rebalancing

Once the notification is sent, the portfolio manager takes corrective action based on active/passive breaches such as portfolio rebalancing, restricting additional buy/sell and drafting a rectification plan of action to make the portfolio compliant.

Operational challenges in investment monitoring

Operational challenges refer to problems in the day-to-day work cycle that affect overall workflow, profitability, operational performance, etc., hinder growth and increase risk exposure. The following are some of the main operational challenges faced in investment monitoring:

1. Data quality and accessibility

Data quality is defined based on the accuracy, timeliness, consistency, validity, uniqueness and completeness of data. Investment monitoring relies on accurate, timely and complete data to assess portfolio performance and the associated risks. Challenges such as human error, inaccurate data, missing data, data duplication, data overload, outdated data and inconsistent data are common examples of data-related challenges. All such challenges could affect the effectiveness of investment monitoring and lead to false alerts, resulting in suboptimal monitoring decisions.

2. Market volatility and uncertainty

Market volatility and uncertainty can make investment monitoring more challenging due to rapid movement in market conditions such as changes in macroeconomic factors, sanctions imposed on countries and changes in rating by Nationally Recognized Statistical Rating Organizations (NSROs). Such factors can impact portfolio performance and increase risk exposure. A portfolio manager would adjust the client portfolio accordingly; this would increase the number of batch alerts that need monitoring.

3. Changes in regulatory requirements

Portfolio managers and compliance specialists need to stay abreast of changes to regulatory requirements, as failure to adhere to regulatory changes could lead to hefty penalties and reputational damage.

4. Diverse investment vehicles and strategies

The growing variety of investment vehicles and strategies can make investment monitoring more challenging, as different investments may require unique monitoring approaches and metrics. It, therefore, becomes difficult sometimes to code guidelines entirely within the compliance engine. It would require manual calculations, complicating the monitoring process and resulting in inappropriate monitoring. Compliance specialists must understand the various investment strategies in order to effectively monitor portfolios.

5. Technology

Not using automation in investment monitoring may lead to operational and technological risk. As regulations become stricter, investment monitoring requires investing in technology to ensure greater protection against compliance breaches and more efficient handling of breaches. Advanced portfolio monitoring services can bridge these gaps by enhancing data accuracy, streamlining processes, and reducing the chances of human error, thereby ensuring compliance specialists can focus on strategic oversight.

Overcoming operational challenges

The following could help overcome these challenges:

-

Data from different sources need to be filtered by removing irrelevant data. Periodic reconciliation of the compliance engine and custodian data improves data competence. Different types of data-quality tools can be used to enrich the data and reduce human error.

-

Periodic review of rule coding would optimise the rule and reduce the number of false alerts, enhancing monitoring efficiency.

-

Compliance analysts need to remain vigilant and adapt the monitoring strategies to respond effectively to market fluctuations and analyse accordingly.

-

They should also keep abreast of regulatory changes, implement processes for continuous monitoring and adapt to evolving compliance requirements.

-

Embrace advanced regulatory reporting solutions and use unique automation tools in the compliance domain that can execute highly complex and manual tasks, for example, guideline coding and drafting, and complex manual calculations.

-

Use best practices in investment monitoring.

We are pioneers in investment services, creating tailor-made dynamic functions with a robust, responsive and proficient control framework and process delivery. Our highly experienced tool-agnostic team provides support in investment compliance, trade surveillance and corporate, forensic and crime compliance. These services are supported by our proprietary suite of Business Excellence and Automation Tools (BEAT), which offer domain-specific contextual technology. Guidelines Compliance Manager (GCM) is our newly launched application. It not only reduces the time taken for coding by more than 40% but also greatly improves the accuracy of the coded guidelines.

Our teams of experts have a unique combination of skill sets. They have extensive experience in order management/compliance systems such as Bloomberg AIM, Ion’s Latent Zero Sentinel, Charles River Database (CRIMS), LDC, ThinkFolio. BlackRock’s Aladdin, BTCA and SMARTS.

Sources:

-

Common Challenges In Investment Performance Monitoring And How To FasterCapital

-

Investment Monitoring Process | Agnello Financial Group, Inc.

-

Investment Monitoring | Definition, Process, & Key Components (financestrategists.com)

-

Overcome Your Data Quality Issues with Great Expectations – KDnuggets

Tags:

What's your view?

About the Authors

Sandeep has overall 15 years of experience and is currently working as Investment compliance specialist in pre trade & post trade monitoring. He has worked with various firms including BNY Mellon Pershing, Standard Chartered Bank & HDFC Bank. His expertise spans across Retail Banking operations, Capital Market Operations & Compliance monitoring. At Acuity Knowledge Partners, he is working as a Delivery Manager supporting both post & pre-trade compliance services. He is a MBA graduate in Finance from GRD College of Management, Coimbatore.

Manju Patel has over 6 years total work experience, and is currently working as an investment compliance specialist in pre-trade, post-trade monitoring. She has worked for firm including State Street corporation. Her expertise spans across investment compliance sector. At Acuity Knowledge Partners she is working as an Associate supporting both post & pre-trade compliance services. Manju has done her BCOM from Maharani Lakshmi Ammanni College for women, Bangalore.

Like the way we think?

Next time we post something new, we'll send it to your inbox