Published on August 22, 2024 by Manish Joshi, CFA FRM

Introduction

A data centre is a specialised facility meticulously designed to house and manage large-scale computing environments. It acts as a central hub for storing, processing and overseeing data and applications. Imagine it as a robust powerhouse that keeps the internet functioning seamlessly.

In today’s digital landscape, data centres play a pivotal role by providing the essential infrastructure for handling vast amounts of data. These facilities are purpose-built to ensure the reliability, security and optimal performance of information technology (IT) systems. Consequently, they are indispensable for businesses, governments and individuals to carry out their daily operations effectively. They serve a broad range of organisations, including cloud service providers, social networking platforms, network service providers, media and content companies, software-as-a-service providers and large enterprises.

Data-centre components require significant infrastructure to support the centre's hardware and software. This includes power subsystems, uninterruptible power supply (UPS), ventilation, cooling systems, fire suppression, backup generators and connections to external networks.

What are the types of data centre1?

There are various types of data centres, each serving specific needs:

-

Enterprise data centres: Dedicated facilities where organisations manage and store their critical IT infrastructure, including servers, storage and networking equipment (Meta, Walmart, JP Morgan)

-

Managed-services data centres: These facilities provide fully managed services, handling tasks such as maintenance, monitoring and security on behalf of clients (Dell, HPE, Rackspace)

-

Cloud data centres: Part of cloud service providers, these centres offer scalable and virtualised resources to users on a pay-as-you-go model (Amazon AWS, Microsoft Azure, Google Cloud)

-

Telecommunications data centres: Focused on supporting telecom networks, these centres house equipment for communication services and networking (AT&T, Verizon, Zayo, Cogent Communications)

-

Colocation data centres: Shared facilities where multiple businesses rent space for servers, benefiting from shared infrastructure and cost savings

-

Edge data centres: Located closer to end users, these centres reduce latency by processing data closer to the source. They enhance performance for applications such as IoT and content delivery

-

Hyperscale data centres: Synonymous with large-scale providers, such as Amazon, Meta and Google, these computing infrastructures maximise hardware density, while minimising the cost of cooling and administrative overheads

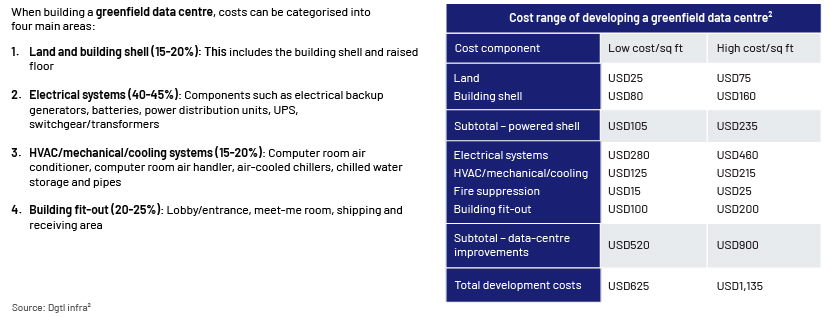

What are the components of building a data centre and their costs2?

Dgtl Infra estimates the cost of building a data centre at USD600-1,100/gross sq ft or USD7-12m/MW of commissioned IT load. Digital Realty’s estimates differ slightly by region2:

-

US:USD9.5m/MW and USD1,000/sq ft

-

Europe:USD14m/MW and USD1,200/sq ft

-

Asia Pacific:USD12m/MW and USD1,000/sq ft

Data centres are growing due to high demand and growth potential

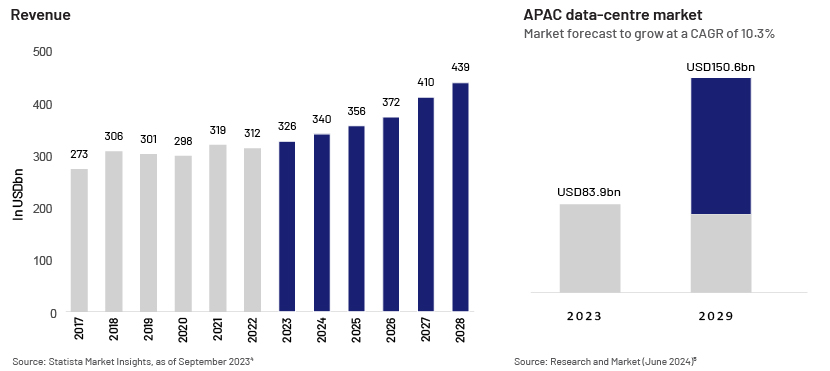

IDC predicts that global data generation may grow at a CAGR of 22%, reaching 22 zettabytes by 2027, driven by advancements in cloud computing, IoT and AI leading to increased demand for data-centre services related to storage and processing3.

-

Revenue from the data-centre market is expected to reach USD340.2bn by 2024, with network infrastructure dominating at USD197.8bn. The projected CAGR from 2024 to 2028 is 6.56%, resulting in market volume of USD438.7bn by 2028. The US is expected to generate the most revenue (USD99.2bn in 20244 ); the Asia Pacific data-centre market was valued at USD83.9bn in 2023; this is expected to reach USD150.6bn by 2029, growing at a CAGR of 10.3%5.

Attracting investors due to its potential benefits

A number of investors have started investing in data centres as a key part of their alternative investment strategies due to the following reasons:

-

Stable and predictable cash flow:

Data centres often establish long-term lease agreements with tenants. These agreements can range from 3-5 years for retail co-location customers and extend to 5-20 years for wholesale and hyperscale tenants. As a result, data centres generate stable, predictable cash flow, offering investors reliability and consistency3.

-

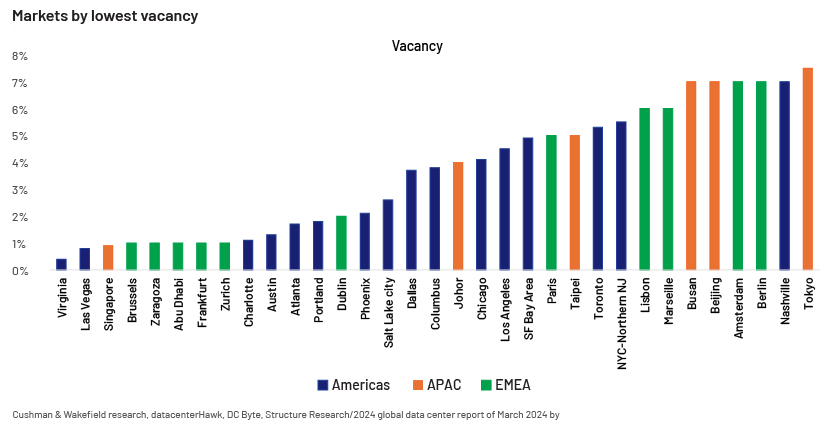

Low vacancy rate (2H 2023):

In the primary market (with at least 600MW of supply), preleasing activities are robust, with 83% (2,553.1MW) of the total 3,077.8MW under construction already preleased. While cloud providers still dominate the lease of available power capacity, AI also accounts for substantial demand. The overall vacancy rate in primary markets remains exceptionally low at 3.7%. Given limited relocation options, most tenants are opting to renew existing leases rather than search for new facilities6.

-

-

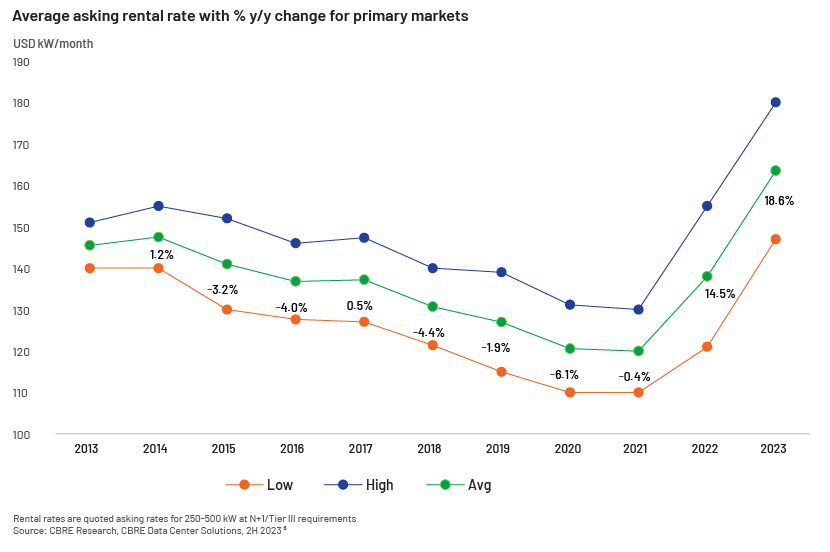

Rising rental rates:

With growing demand for data-intensive technologies, rental rates for data centres are expected to rise. Increased market rent dynamics have the potential to reduce cap rates and create opportunity for non-stabilised assets with contracts below the current market rate.

……………………….

……………………….

-

Capital appreciation:

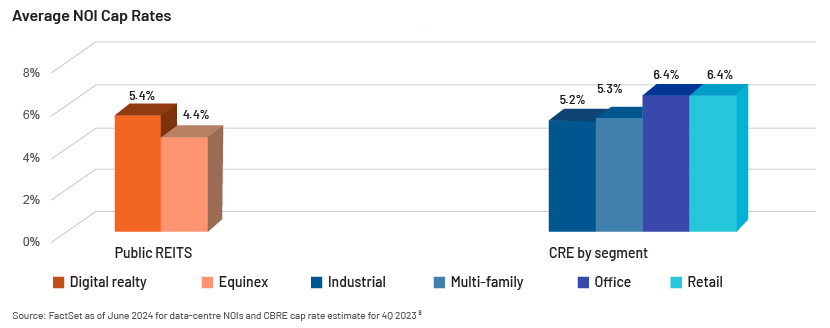

As digital technology progresses, data centres offer promising opportunities for appreciation. The net operating income (NOI) cap rate in the data-centre sector is typically lower than in traditional commercial real estate (CRE). The lower cap rate often indicates that rents are above market rates and could signal expectations of significant rent growth.

-

Others:

High tenant-retention rates, diversification benefits and potential tax advantages are some supplementary benefits in the data-centre sector. Data centres, with their specialised nature, ensure stable occupancy. Unlike traditional assets, data-centre performance is less volatile. Additionally, tax breaks from local governments attract investment from major tech companies.

How Acuity Knowledge Partners can help

We offer deep domain expertise in real estate and infrastructure investment research. Our experience spans the entire spectrum of the investment lifecycle and all property types, including digital infrastructure and data-centre assets, ensuring comprehensive and customised support.

Sources:

-

Data Center REITs, Stocks and ETFs: Investing in 2024 – Dgtl Infra

-

APAC Data Center Market Landscape 2024-2029 with HPE, IBM, (globenewswire.com)

Tags:

What's your view?

About the Author

Manish has four years of experience in financial modelling and investment research, with a focus on Digital real assets. He has worked with Private Equity, Consulting and Valuation firms on a variety of research and analysis assignments across the deal pipeline spanning target screening, due diligence support, portfolio monitoring. His previous experience includes working with sector-agnostic financial modelling. He holds a bachelor’s degree in economics and is a CFA and FRM Charter holder.

Like the way we think?

Next time we post something new, we'll send it to your inbox