Published on January 16, 2025 by Monika Singh , Rabin Thakur and Ambarish Srivastava

Introduction

The Sustainability Accounting Standards Board (SASB) is an independent non-profit board that develops industry-specific disclosure standards across ESG criteria for reporting financially material, sustainability information. It was established as a voluntary standard with an aim to build a bridge between traditional financial reporting and the growing demand for companies to disclose information on ESG factors. It not only assists businesses to identify but also communicates and manages sustainability risks and opportunities that are likely to impact financial performance.

History

Launched in 2011 in San Francisco (California), the concept of Sustainability Accounting Standards Board (SASB) was derived by Jean Rogers, who is widely recognised for her efforts to integrate ESG into financial reporting. SASB addressed the rising demand for a standardised sustainability reporting framework that is financially substantial to investors. Originally, SASB’s objective was to build standards that allowed companies to communicate sustainability risks to investors in a consistent, comparable and transparent way. Over the years, SASB developed industry-specific standards and became a renowned framework for ESG disclosures. It worked with subject-matter experts, stakeholders and industry leaders to develop 77 industry-specific standards across 11 sectors, including financials, healthcare, energy and technology, which will focus on identifying the most relevant ESG issues likely to affect financial performance within a particular industry. In association with global organisations, SASB formed joint ventures, such as the International Integrated Reporting Council (IIRC) and the Climate Disclosure Standards Board (CDSB), to harmonise sustainability reporting frameworks.

In 2021, SASB merged with the International Integrated Reporting Council (IIRC) to form the Value Reporting Foundation, and its standards are being integrated into the International Financial Reporting Standards (IFRS) framework.

In 2022, IIRC established the International Sustainability Standards Board (ISSB) and integrated into the Value Reporting Foundation. As of now, the ISSB is responsible for the development and global implementation of SASB.

-

SASB is a voluntary board of standards for financially material ESG factors.

-

It was launched in 2011 in San Francisco.

-

In 2021, SASB merged with IIRC to form the Value Reporting Foundation.

-

ISSB, the nodal organisation of SASB, overlooks the implementation of standards across industries.

Characteristics

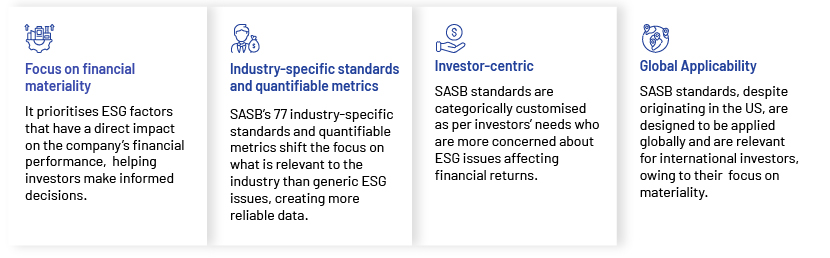

The Sustainability Accounting Standards Board (SASB) stands out, due to several unique features that make it a valuable framework for sustainability reporting, particularly for investors. SASB developed 77 industry-specific standards to ensure that companies report on the most material ESG factors specific to their industries or sectors. This approach helps the investors benchmark companies working in the same sector using standardised KPIs.

| Aspects | Details |

| Voluntary or mandatory | Voluntary |

| Region | Global (Europe, North America and Asia Pacific) |

| Launch date | July 2011 |

| Founding organisations | SASB |

| Key objectives | Offer industry-specific standards for consistent ESG reporting and promote transparency and consistency in reporting |

| Framework used by | <32,000 companies across 80+ jurisdictions |

| AUM | $84Tn |

| Reporting framework | 77 industry-specific standards on ESG factors most likely to impact financial performance |

| Key Initiatives | Collaboration with TCFD & IIRC, Partnership with GRI to foster comprehensive sustainability reporting |

| Website | https://sasb.ifrs.org/ |

SASB: https://sasb.ifrs.org/company-use/sasb-reporters/

SASB: https://sasb.ifrs.org/about/global-use/

Salient features of SASB

-

Industry-specific standards: The 77 industry-specific standards allow investors to benchmark sustainability performance across similar companies and provide tailored metrics for assessing ESG factors relevant to a particular industry.

-

Financial materiality: This core principle of SASB emphasises on ESG issues that are likely to impact a company’s financial performance and helps companies communicate risks and opportunities.

-

Integration with financial reporting: SASB is integrated with traditional financial disclosures, such as those required under Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). This integration helps provide a more holistic view of a company's overall performance, combining financial and non-financial data.

-

Voluntary but influential: SASB standards are voluntary; however, the rising demand from investors and growing pressure from stakeholders to disclose ESG-related risks have led many companies to voluntarily use SASB standards in their reporting.

-

Alignment with global sustainability frameworks: SASB standards’ alignment with other global sustainability frameworks, such as the Task Force on Climate-Related Financial Disclosures (TCFD) and the International Integrated Reporting Framework (IIRC), helps companies rationalise their reporting efforts and address multiple frameworks without duplication.

These features make SASB a powerful tool for companies seeking to improve their sustainability reporting and for investors looking to make more informed decisions based on financially material ESG factors.

Scope and implementation:

The Sustainability Accounting Standards Board (SASB) aims to provide a comprehensive framework for companies to disclose sustainability information that is financially material to investors. SASB’s standards are developed with investors’ needs in mind, providing them with relevant information to assess risks and opportunities related to sustainability.

The implementation of SASB standards involves several key steps:

-

Identify relevant standards: Review and determine the standards based on the sector of the company and identify which of the 77 industry-specific standards apply to the company.

-

Assess current reporting practices: Assess existing sustainability reporting practices to identify gaps and areas for improvement.

-

Engage stakeholders: Involve key stakeholders, including investors, management and operational teams, to understand their needs and expectations regarding ESG disclosures. This engagement helps align reporting with stakeholder interests.

-

Develop data collection processes: Establish systems and processes for collecting the relevant sustainability data to report on the SASB metrics.

-

Prepare disclosures: Create a structured report (e.g., 10-K filings) by compiling all data that adheres to SASB standards.

-

Review and validate: Conduct internal reviews to ensure that the reported information is accurate, complete and compliant with SASB standards. Consider third-party verification or audits for additional credibility.

-

Publish and communicate: Once the disclosures are finalised, publish them in a clear and accessible format and engage with stakeholders to communicate the findings with them, emphasising how the reported information is relevant to financial performance.

Advantages of SASB standards

Disadvantages of SASB standards

How can investors utilise SASB:

SASB standards can be utilised by investors in several ways to enhance their decision-making processes and investment strategies:

-

Assess financial risks and opportunities: These standards help investors evaluate the sustainability risks and opportunities associated with their investments. For example, investors can identify potential risks that may affect a company's financial performance, such as reputational risks or regulatory changes.

-

Enhanced due diligence: Incorporating SASB standards into their due diligence processes helps investors achieve a more holistic view and understanding of a company's ESG performance.

-

Integration into investment strategies: Institutional investors can integrate SASB metrics into their investment strategies by considering ESG performance, alongside traditional financial metrics, which will support the development of sustainable investment portfolios aligning with investors' ethics.

-

Regulatory compliance and reporting: SASB ensures that portfolio companies comply with relevant regulations and reporting requirements, thereby increasing transparency and accountability.

These features make SASB a powerful tool for companies seeking to improve their sustainability reporting and for investors looking to make more informed decisions based on financially material ESG factors.

Support received:

SASB has received considerable support from various stakeholders, including investors, corporations, industry associations and regulatory bodies. Over 310 institutional investors, with a combined AUM of USD84tn, endorse or utilise SASB standards in their investment processes. This signals a strong calibration between investor SASB’s objectives and interests.

Impact:

SASB has made a significant impact on corporate sustainability reporting and investment practices. Here are some key areas of its influence:

-

Increased transparency: SASB has driven greater transparency in corporate ESG disclosures, encouraging companies to report on sustainability issues. This shift has improved the quality and comparability of ESG data available to stakeholders.

-

Standardisation of ESG reporting: Provision of industry-specific standards by SASB has fixed a consistent framework that companies can follow, which has been instrumental in catering to the growing demand for sustainability data.

-

Regulatory alignment: SASB helps companies navigate challenges in compliance, thus enhancing corporate accountability.

-

Support from key stakeholders: With backing from over 310 institutional investors managing c.USD84tn in assets, SASB has garnered substantial support from the investment community, indicating a broad recognition of the value of its standards.

-

Influence on corporate behaviour: SASB has influenced corporate behaviour by highlighting the importance of sustainability performance, encouraging companies to adopt better ESG practices.

How Acuity Knowledge Partners can help

We support private-markets clients across asset classes including private equity, private credit/debt, secondaries and buyout firms with investment screening. We conduct positive, negative screening, UNGC signatory screening for target screening, LP/GP reporting and regulatory reporting. We also provide ESG support services across the investment lifecycle, with customised support for pre-deal and post-deal operations.

Sources:

Tags:

What's your view?

About the Authors

Monika has been working at Acuity Knowledge Partners as an Associate for 2.5 years within PM, and primarily involved in various ESG assignments, comprehensive SFDR reporting with in-depth research and analysis, sustainability report building, data extraction testing, and supports other ad-hoc ESG related tasks.

At Acuity, Rabin is overseeing multiple ESG engagements which includes research, analysis and reporting assignments for clients in the US and Europe. Overall, Rabin holds an experience of ~11 years which is spread across various areas of client management and interface within the domain of ESG and Sustainability. Rabin holds a post-graduate diploma in Sustainable Management from Indian Institute of Management, Lucknow

Ambarish has about 17 years of experience in business research, analysis and consulting. He is engaged in leading deep-dive strategic projects, due-diligence support, issue-focused trend analysis and similar assignments for our Private Markets clients. His previous experience includes tenures with startups, the Big Four and consulting organisations, where he focused on industry studies, price forecasting, company analysis, macroeconomic studies and other strategic engagements.

Like the way we think?

Next time we post something new, we'll send it to your inbox