Published on December 9, 2024 by Akshat Mehrotra

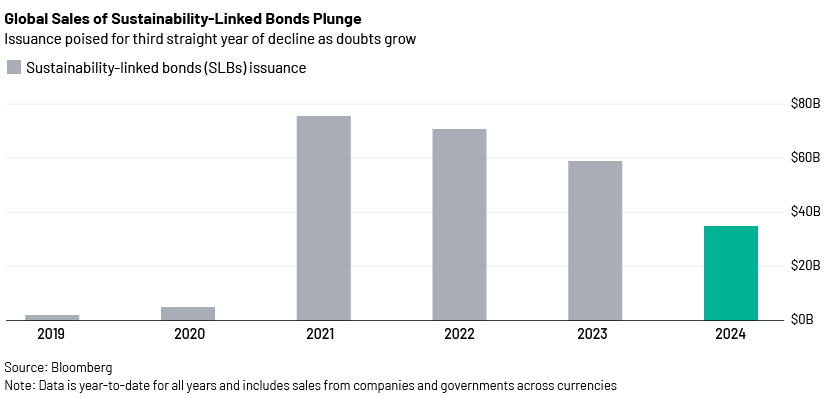

Growth of the ESG market was fuelled by the introduction of Sustainability Linked Bonds (SLBs) when Italian energy company ENEL introduced the product to the world in September 2019. Unlike green bonds (or other use of proceeds of ESG bonds) that finance specific projects, SLBs can be used for general corporate purposes – provided that issuers pledge to meet certain social or environmental thresholds such as cutting carbon emissions. The flexibility to choose targets and timelines led to a spike in interest in the product from issuers and investors. The rush (and FOMO) among investment managers to grow their portfolios of ESG-tagged products helped SLBs gain popularity and build strong orderbooks on issuances. The product, in a nascent stage in the 2019s and 2020s, boasted spectacular growth. Global issuance volume of SLBs was just USD1.7bn in 2019; it grew to USD4.9bn in 2020 and swelled to USD75.4bn in 2021 amid strong macroeconomic factors following pandemic-related stimulus efforts, according to Bloomberg.

The space was bombarded by issuance by sources ranging from energy companies (for their energy transitions) to consumer names to capitalise on opportunities while continuing to meet the targets set for SLBs. Issuance surged in 2021 as firms did not have specific green projects for which they needed funds and so took advantage of the flexibility that SLBs provided over the actual use of proceeds. However, the momentum faded soon, and instruments such as SLBs started dropping out of favour as corporates were seen falling short of achieving key emissions targets, resulting in penalties and higher interest rates. Investor scepticism on debt structures grew, and issuers became concerned about the possibility of overstating the bonds’ benefits for the environment and society.

Italian energy giant ENEL has an outsized role in the SLB market, being both a pioneer in issuing labelled debt in this format and the largest (having issued c.14% of the total SLB market), most prolific corporate issuer of SLBs. It announced in its March 2024 report that it missed its 2023 carbon-intensity target, citing higher-than-expected coal-based electricity generation due to Russia’s invasion of Ukraine and the subsequent disruption to European gas supplies. In another case, in September 2024, UK-based residential developer London & Quadrant revealed it had failed to cut its Scope 1 and 2 greenhouse gas emissions by the targeted 20% relative to the 2020 baseline, partly due to a temporary pause in buying renewable energy amid soaring energy prices.

Investors have been quick to identify such shortcomings of the product. SLBs have faced mounting criticism and scrutiny in recent months from market participants and other stakeholders who have noted weaknesses in the materiality and level of ambition of sustainability performance targets (SPTs) included in many issuers’ bond frameworks

The structure and credibility of Sustainability Linked Bonds (SLBs) are questioned because of the following:

-

The step-up (penalty) on the bonds is a standard, nominal 25bps (or more in some cases) and not a proportion of the coupon rate, which would ensure a more transparent structure. Of all SLBs issued by EU companies from 2021 to 2024, 70% featured a step-up of 25bps or less, according to Algebris Investments. In only 5% of these would the increase in the cost of funding for missing the target exceed 75bps. Moreover, the same 25bps penalty has been applied to all issuers, from corporates to sovereigns and from the investment-grade to junk categories. This brings into question the pricing, as it does not reflect the issuer’s broader risk profile. In contrast, the methodology of credit rating downgrade/upgrade versus the cost of borrowing for the issuer seems more satisfactory. In a higher-rate environment and for different ratings, the penalty should be different, requiring more of an impact from a step-up: say, single A paying 15bps while double-B pays a higher step-up of, say, 25-70bps. Another approach could be charging a percentage of the total financing cost where, for instance, a 10% penalty would be applied on the financing cost at the time of penalty, which would incorporate the credit health of the issuer. For example, a 25bps penalty for an issuer on a spread of 250bps at the time of issuance would be 10%. If at the time of assessment after three years, the issuer gets pricing at a spread of 500bps for its offering, the 25bps penalty would not be justified; hence, a penalty in percentage terms (which comes to 50bps) would make more sense.

-

Other point is the lack of standardisation across geographies and corporate sectors. Since KPIs for SLBs are self-determined, ensuring consistent and ambitious results can be challenging, and step-ups may not materialise even if ESG targets seem to be missed. The variation in methodologies of second-party opinion providers and the lack of homogeneity unlike in credit ratings add to the market’s credibility. As a starting point, an EU standard could be introduced for SLBs – similar to the approved EU Green Bond Standard. The standard should include a set of relevant and common KPIs to be used for SLB issuance, criteria to ensure ambition in target setting (e.g., a “waterfall” plan for SLB maturities covering the full decarbonisation path) and a methodology to evaluate the credibility of transition plans, ideally including independent verification (e.g., by the Science Based Targets initiative or similar institutions). This would enable unlocking the full potential of SLBs as a transition finance tool, while reducing the risk of greenwashing.

-

Another limitation is that the target observation date for some SLBs is set close to the bond’s maturity. This means the financial penalty triggered by the step-up mechanism in the event of a missed target does not present a material incentive to meet the target.

The idea behind a higher penalty and more transparency in SLBs is to make organisations and governments more sincere about meeting environmental objectives rather than backtrack on their pledges in the event of an increase in costs.

Conclusion

Recent events, including the penalties triggered for ENEL and L&Q, ensure credibility of the instrument and demonstrates that its structure works: falling short of targets leads to financial penalties and highlights plausible scenarios in which KPIs can be missed. The trough point of the curve could rise in the future if participants continue to provide transparent offerings and solutions while governments continue to stress the E of ESG to make organisations focus on SLBs. Following further research and development, transparency would ensure a long life for the product, which would prove to be a boon, especially for the transition sector aiming for decarbonisation.

How Acuity Knowledge Partners can help

Our wide range of customised analysis and support covers the entire spectrum of financing products along the sustainable finance investment lifecycle and enables investment banks and advisory firms to establish and grow their sustainable finance practices.

Our ESG domain expertise helps banks ramp up their onshore verticals, focusing on incorporating ESG in client analysis, saving a significant amount of senior bankers’ time. We also standardise templates and provide coverage across APAC, EMEA, the US and Sub-Saharan Africa, offering tailored Sustainable Finance Solutions to meet evolving client needs.

Sources:

What's your view?

About the Author

Akshat has been working in Debt Capital Markets domain since past ten years and has more than twelve years of work experience. He carries rich exposure of working in sustainable finance market along with investment Grade, Leverage Finance and FIG businesses with origination as well as Syndicate teams. Over the years, he has worked on RFPs, pitch books, sustainable finance projects, bond pricing, market commentary etc. Prior to his current role, he was working with Royal Bank of Scotland, where he focused on the leverage finance business for European corporate clients. He has also worked with a financial research firm, where he prepared

Like the way we think?

Next time we post something new, we'll send it to your inbox