Published on January 5, 2024 by Sandip Chakraborty

The asset management sector is always presented with new challenges and interesting opportunities due to the ever-changing landscape in which it operates. The latest of these is sustainable investing, a trend gathering momentum and likely to be a game changer. In response, institutional investors and pension fund managers are actively considering companies’ environmental, social and governance (ESG) practices when constructing their portfolios.

ESG characteristics are becoming increasingly important due to regulatory frameworks and the changing preferences of banks and institutional and retail investors. Regulators now need more transparency on how companies and investors operate in terms of environmental and social aspects.

BlackRock, the world’s largest asset manager, announced in a letter to clients in January 2020 that it would place sustainability, particularly relating to global warming, at the core of its risk management, portfolio construction, product design and business operations.

Changing investor demographics and their new benchmarks

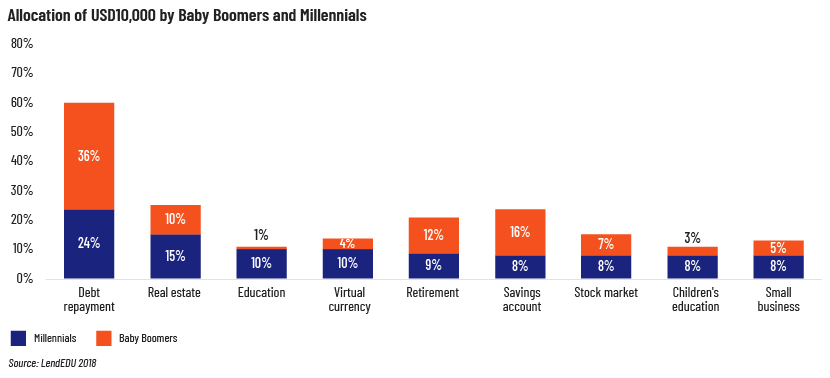

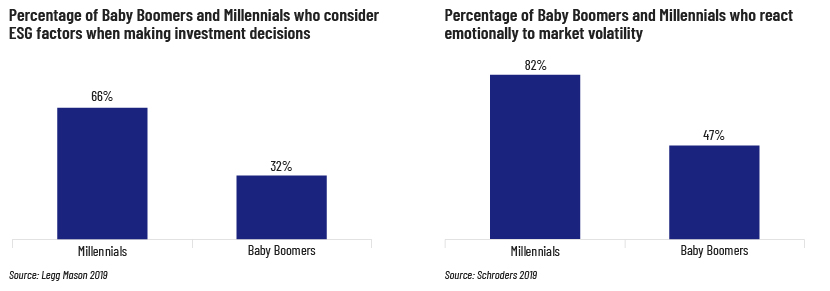

Gen Z and Millennials make up 43% of the US population and 49% of the global population. They actively promote sustainable investments and investments that incorporate ESG principles. Growing concern about climate change has been an important driver of economic growth, as they stand out for their strong commitment to environmental protection. The ESG reporting framework also actively considers practices such as corporate social responsibility (CSR) that bring issues such as sustainability and responsibility into a company’s business model. With younger generations at the centre of the largest wealth transfer in history – from Baby Boomers and Gen X to Millennials and Gen Z – companies are changing their reporting standards to keep these new-age investors engaged and loyal to their brands. For example, Google aims to achieve 24x7 carbon-free energy by 2030, and Microsoft has committed to being carbon-negative by 2030.

For Gen Z, consumption means having products or services, but not necessarily owning them. Gen Z shoppers prefer sustainable brands and are willing to pay more for sustainable products because sustainability is more important to them than brand names. According to Nielsen, 75% of Millennials are environmentally conscious to the extent that they are changing their shopping habits to favour eco-friendly products. Because of these changing preferences, action is also being taken at the level of policymaking. The Inflation Reduction Act (IRA) of 2022 is one of the US government’s most important commitments to reducing carbon emissions and the largest climate and energy investment in the US. With the transition, the country is likely to tackle the climate crisis, promote environmental justice and secure its position as a leader in clean-energy production. Similarly, the European Green Deal and the European Union’s response to the IRA are expected to increase subsidies and ease regulations to promote investment in clean energy and technology.

Changing industry dynamics

The asset management sector has reached a tipping point that requires rethinking the business model. For most of the past two decades, asset managers’ earnings growth has been fuelled by central-bank policies that have helped steer global markets. However, assets under management (AuM) fell by 10% globally to USD98tn in 2022, according to a Boston Consulting Group report. This is due to rising interest rates, which have reduced the value of stocks and bonds. While this may be a concern, fund managers should see this as an opportunity to change their approach to profitability. They could do this by understanding the costs and reasons for each function and by taking initiatives to optimise rather than reduce costs. As social and environmental pressures intensified, new interest groups began to formulate concepts such as the Sustainable Development Goals (SDGs) to integrate these practices into management models. Corporate sustainability has become part of business as usual over the past two decades, and more companies are considering social and environmental impacts as business concerns.

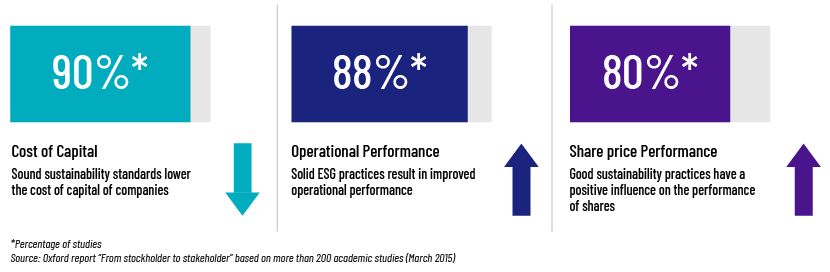

Studies show that a company with good ESG practices has the potential to generate higher risk-adjusted returns, which could benefit from a lower cost of capital and better operations.

They also show that the unpredictability of risk and liability management ultimately leads to reduced profitability and value. Organisations whose long-term growth strategies include ESG principles could reduce risk and drive profitable growth by investing in sustainable innovation.

Looking ahead

For environmental efforts to pay off financially, companies must take a long-term view and invest in cost-effective sustainable practices that ultimately lead to lower costs and better returns. By adding ESG ratings, companies could improve their relationships with shareholders, increase investments, achieve lower costs of capital and make more effective strategic decisions.

Did you know?

In 1994, John Elkington, a renowned British management consultant, coined the phrase “triple bottom line” as his way of measuring performance in corporate America. The idea was that a company can be managed in a way that not only makes money but also improves people’s lives and the wellbeing of the planet.

The theory says that companies should focus as much attention on social and environmental issues as they do on financial issues.

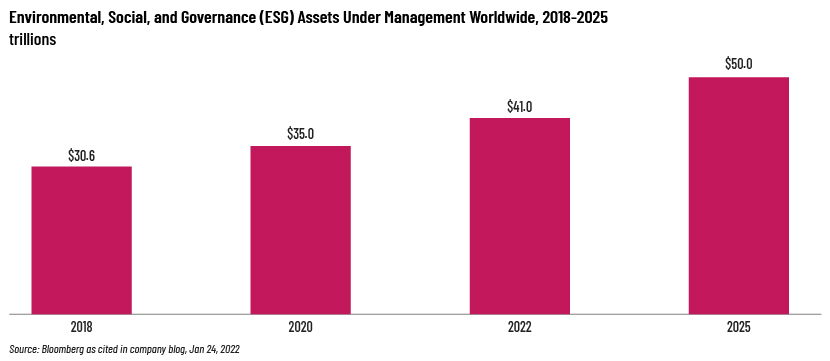

According to PwC’s Asset and Wealth Management Revolution 2022 report, asset managers worldwide are expected to increase their ESG-related AuM to anywhere between USD24.4tn (low case) and USD47.6tn (best case) by 2026. With a projected CAGR of 12.9%, ESG assets are on track to make up 21.5% of total global assets in less than five years. Growth in ESG investments may be faster than growth in the investment sector as a whole.

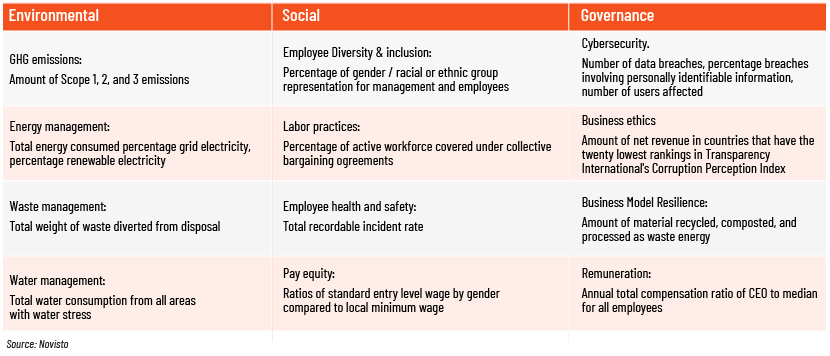

As interest in ESG criteria grows, investors need a way to conclusively assess a company’s ESG performance. This has led to an increase in the number of ESG rating agencies such as Sustainalytics, MSCI and FTSE ESG, which rate companies based on their ESG performance and provide this information to their clients. These ESG assessments are designed to help investors identify and understand ESG risks that relate financially to a company. Companies that score well on ESG metrics are likely to be better at anticipating risks and opportunities, inclined to long-term strategic thinking and focused on creating long-term value. Like other business metrics, ESG metrics are used to assess the performance and risks of a company’s operations. These metrics can come from standards, frameworks or regulations that require specific information. ESG metrics can be both quantitative and qualitative.

The following table lists examples of ESG metrics:

Companies with high ESG factors have lower costs of debt and equity and tend to outperform the market over the medium (3-5 years) and long (5-10 years) term, according to Deutsche Bank research. On the other hand, the consequences of a bad classification can be significant. If a company receives a poor rating from an ESG data provider, investors may consider its stock as an unsustainable asset and leave it out of their investment portfolio.

There is widespread understanding that sustainability and profitability can coexist. The move to a greener world creates new business opportunities and redistributes capital flows. ESG scores are important for companies to attract investors and manage risk. A strong ESG proposition helps companies enter new markets and expand in existing ones. This improves return on investment by allocating capital to more promising and sustainable opportunities. Climate and ESG considerations would inevitably be at the heart of investment as the wealth landscape changes.

How Acuity Knowledge Partners can help

We provide customised ESG support solutions for private equity clients, covering sector- and country-specific reporting, marketing support, ESG risk analysis and opportunities. We support client teams and advisory through a top-down, bottom-up or combined approach. Our ESG support solutions include building a reporting process, developing frameworks, pitching new ideas to integrate developments, writing reports and preparing marketing collateral. We support asset managers, investment banks, commercial and regional banks, venture capital firms, think tanks and specialist advisory firms.

References:

-

What is Sustainability? How Sustainabilities Work, Benefits, and Example (investopedia.com)

-

Global Asset Management Industry Must Transform to Thrive Amidst Changing Macroeconomics (bcg.com)

-

Sustainability And Profitability: Why They Can And Should Go Hand In Hand (forbes.com)

-

ESG Ratings: do they add value? How to get prepared? (deloitte.com)

-

How Millennials and Gen Z Are Driving Growth Behind ESG | Nasdaq

-

Millennials__Gen_Z__and_the_Rising_Demand_for_Corporate_Social_Responsibility.pdf (ctfassets.net)

-

Understanding ESG Metrics: Definition and Examples | Novisto

-

Rise of Responsible Investing – The Economic Times (indiatimes.com)

-

12 Worst ESG Companies | Stocks to Avoid (theimpactinvestor.com)

-

What is an ESG Score and How Important is It for Companies? (techtarget.com)

-

ESG Ratings & sustainability info for Accenture Ltd. | ESG Investing (csrhub.com)

-

ESG Ratings & sustainability info for Alpha Metallurgical Resources Inc | ESG Investing (csrhub.com)

What's your view?

About the Author

Sandip has over 6 years of experience in the financial services industry. His expertise includes investment commentary, portfolio analysis and project management. Part of the Acuity FMS team, Sandip is responsible for writing fund commentary across asset classes and strategies. He collaborates with various teams and provides insight into thought leadership articles and investor communication documents. He holds an MBA in Finance from Bharatiya Vidya Bhavan Institute of Management Science, Kolkata.

Like the way we think?

Next time we post something new, we'll send it to your inbox