Published on March 18, 2025 by Mukesh Tripathi

Net interest margins across the global banking sector are expected to narrow as deposit costs remain elevated. As interest rates decrease, banks will likely need to reassess their strategies for generating non-interest income to sustain profitability.

With falling interest rates, loan demand is expected to rise, increasing borrowing activity. Both retail and corporate borrowers are expected to contribute to this growth, particularly with a boost in debt issuance and a potential resurgence in mergers and acquisitions (M&A), which would further fuel demand.

Regarding deposits, even with declining interest rates, the cost of funding may not decrease at the same pace. Deposit betas are likely to be lower than in a typical downward rate cycle. This is due to ongoing demand for liquidity from banks and depositors’ reluctance to accept lower rates, which may continue to intensify competition for deposits.

Non-interest income

The pressure on net interest margins is expected to highlight the importance of generating more non-interest income as a sustainable revenue source. We identify the following areas as strong opportunities for banks to enhance non-interest income growth in the coming years.

Gain from securities portfolios: Banks have in recent years faced losses from their securities portfolios due to rising bond yields, driven by aggressive interest rate hikes by central banks to combat inflation. These higher yields led to unrealised losses on fixed-rate bonds, placing financial strain on banks and contributing to institutional failures. However, as inflation stabilises and central banks begin easing interest rates, bond yields are expected to fall, leading to price appreciation in existing bond portfolios.

This shift is expected to impact banks' profitability positively by generating gains as bond prices rise. Additionally, this could strengthen balance sheets, improving capital adequacy ratios by delivering real growth in shareholders’ equity and reducing financial stress. While the overall outlook for bond portfolios is positive, the magnitude and timing of these gains will depend on the pace of rate cuts and any unforeseen economic disruptions.

Investment banking fees:

All key segments in investment banking are expected to grow in 2025, as the cost of capital is anticipated to decline and as markets adjust to potential policy changes.

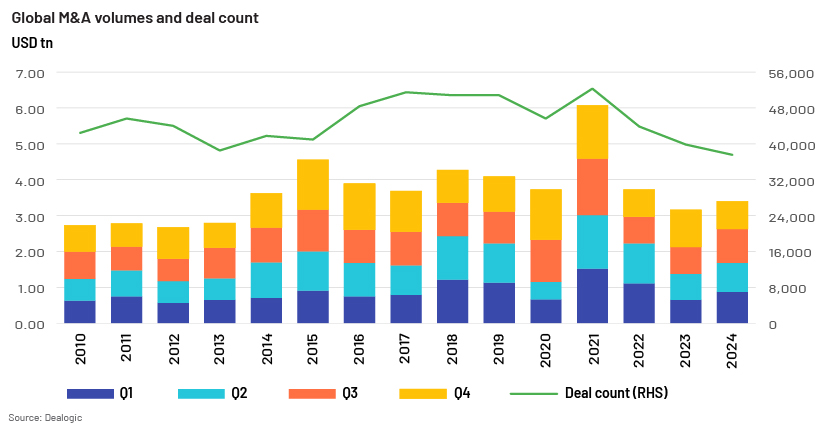

Global M&A activity (in value terms) saw an 8% increase in 2024 compared to the 10-year low in 2023, with revenue growth at a higher rate of 11%, according to Dealogic. We expect this positive momentum to continue as central banks in the US and Europe begin lowering interest rates and political stability improves following a record number of elections globally. Furthermore, companies are increasingly pursuing acquisitions in technology and innovation-driven sectors, especially in areas such as artificial intelligence (AI), cloud computing, cybersecurity and automation. As digital transformation accelerates, many organisations will likely seek acquisitions to close technology gaps, enhance operational efficiency and strengthen their competitive advantage. The sectors they operate in are expected to remain key drivers of M&A activity leading to an uptick in non-interest income generated.

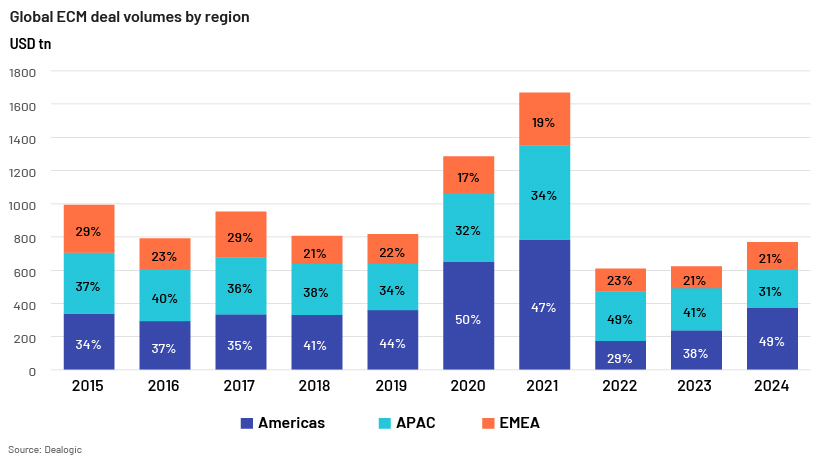

Equity issuance, especially in high-growth sectors such as technology and green energy, is projected to rise amid a favourable environment of lower interest rates, improved economic stability and continued innovation, particularly in areas such as AI and other transformative technologies. The decline in interest rates has driven higher equity valuations, encouraging promoters and private equity firms to capitalise on the opportunity to take their private companies public, allowing them to exit their stakes at attractive valuations. However, despite these favourable conditions, market volatility and geopolitical risks remain significant challenges that could dampen the pace and volume of equity offerings.

Global equity capital markets (ECM) deal volumes (in value terms) grew by 20% in 2024, reflecting a recovery in investor sentiment and increased capital-raising activity. However, revenue growth generated from ECM deal volumes lagged, increasing by approximately 9%, as competition among underwriters and pricing pressure dampened profitability. Notably, ECM volumes declined in regions such as China and Latin America, in line with broader economic slowdowns and regulatory headwinds affecting these economies.

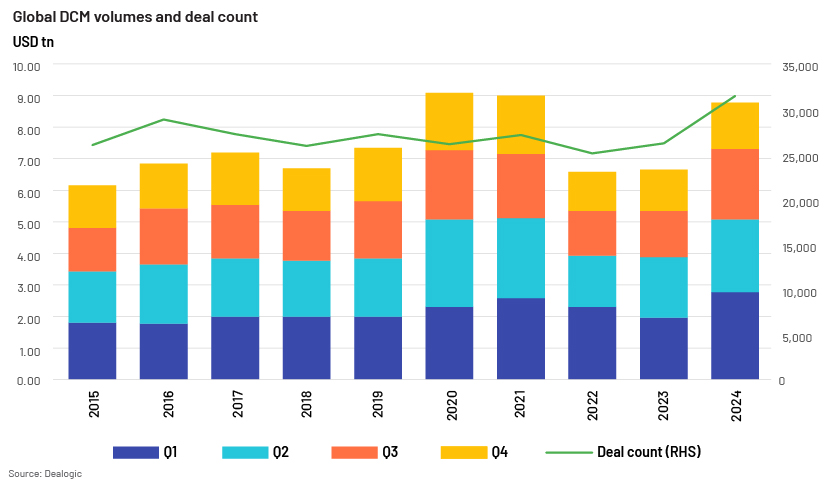

Global debt capital markets (DCM) deal volumes (in value terms) are expected to grow due to the pressure on issuers to refinance nearly USD6tn in maturities in 2025. Additionally, companies may issue fresh debt if interest rates decrease. DCM volumes were up by 30% in 2024, nearing the peak levels of 2020 and 2021. In terms of deal count, it was a record year.

Refinancing fees:

As interest rates decline, retail borrowers are expected to increasingly seek opportunities to refinance their existing loans at lower rates. Refinancing typically involves upfront fees ranging from 2% to 5% of the loan amount, covering costs such as application fees, appraisal fees, closing fees, and other associated charges. As a result, banks are likely to see a significant increase in the share of refinancing fees within their overall non-interest income, particularly if many borrowers take advantage of lower rates to reduce their debt-servicing costs.

Additionally, as borrowers look to refinance, lenders may benefit from an increase in loan volume and additional services tied to refinancing, such as mortgage insurance or home equity loans. Refinancing could become an important revenue stream for banks, particularly in an environment of declining interest rates where demand for such products is likely to rise.

Other non-interest income segments, such as fees from asset management and wealth management, are expected to continue growing at a steady pace, as in previous years, due to growth in capital markets.

The outlook for global equities and fixed income, currencies and commodities (FICC) revenue in 2025 presents a mixed but cautious scenario, shaped by macroeconomic factors and market conditions. Equities are expected to experience moderate growth, although heightened volatility is likely, as central banks remain vigilant on inflation and interest rates. Despite potential headwinds from geopolitical tensions, growth in corporate earnings offers support. In FICC sales and trading, revenue prospects will likely be influenced by interest rate dynamics and inflation expectations. With central banks continuing to ease key policy rates, bond trading revenue is projected to stay elevated, particularly in developed markets. Currency and commodity trading volumes may remain volatile, driven by fluctuations in global supply chains, possible tariffs leading to currency depreciation and changing commodity prices. Overall, while equity markets face some challenges, the FICC space is expected to benefit from higher volatility and trading volumes, especially in fixed income and currencies. However, competition and regulatory changes could impact margins and profitability.

Conclusion

Net interest margins are expected to face pressure due to elevated deposit costs and a decline in interest rates. However, rising loan demand, particularly from retail and corporate borrowers, would fuel an increase in borrowing activity and debt issuance. In response to these pressures, non-interest income will likely become a key driver of growth. Gains from securities portfolios are expected as falling bond yields lead to price appreciation, improving profitability and capital adequacy. Investment banking is set to experience growth, particularly in M&A, equity issuance and debt capital markets as lower capital costs and economic stability encourage corporate activity. Refinancing fees are anticipated to increase as borrowers take advantage of lower rates to reduce debt-servicing costs. In FICC markets, revenue is expected to benefit from heightened volatility and increased trading activity, although regulatory changes and competition could impact profitability. Overall, while challenges remain, strategic focus on non-interest income and active management of market volatility will be key for banks.

How Acuity Knowledge Partners can help

We provide research on industry- and country-specific topics to global organisations and research houses and help them make sound decisions. We support our clients in a wide range of areas, including M&A, investment research, industry profiling, financial analysis, thematic research and macroeconomic and FX research. Acuity Knowledge Partners also help clients build databases and provide regular sector coverage. Each output is customised, based on the client’s requirement. By leveraging dedicated teams of experienced analysts at our offshore delivery centres, our clients benefit in terms of operational efficiency and cost optimisation

Sources:

Tags:

What's your view?

About the Author

Mukesh has over 18 years of experience in investment research, delivery, and project management. He leads offshore research teams for bulge bracket investment banks, operating out of Acuity’s multiple South Asia delivery centers, including those in Bangalore, Gurgaon, and Beijing. In addition, he co-manages the Projects and Transitions team and is responsible for initiating new equity research projects, trials, pilots, and recruitment, ensuring smooth progression from the scoping stage of a new engagement to its inception and until it reaches a steady state. Before joining Acuity, he worked with IGATE (a part of the Capgemini Group) as part of the Investment Banking Research Team for a New York-based investment..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox