Published on March 6, 2024 by Krati Chandak

Introduction

The financial world is a complex tapestry of markets, each with its unique role and function. Two integral components of this intricate landscape are the money market and the foreign-exchange (forex) market, which are interconnected powerhouses.

These markets, each with its distinct dynamics, play pivotal roles in facilitating economic transactions, managing risks and shaping the value of currencies. In this blog, we explore how they interact, the advantages of harnessing their synergy and the fascinating data and trends that shape their dynamics.

At the wholesale level, the financial market is involved in substantial volume trades conducted among institutions and experienced traders. This tier caters to intricate transactions that often span major financial entities, including banks, corporations and investment firms.

At the retail level, the financial market encompasses avenues accessible to individual investors and everyday customers. This stratum encompasses investments in money-market mutual funds, carefully chosen by retail investors seeking prudent gains, as well as money-market accounts thoughtfully established by bank customers to efficiently manage their short-term funds while retaining accessibility.

Understanding the money market

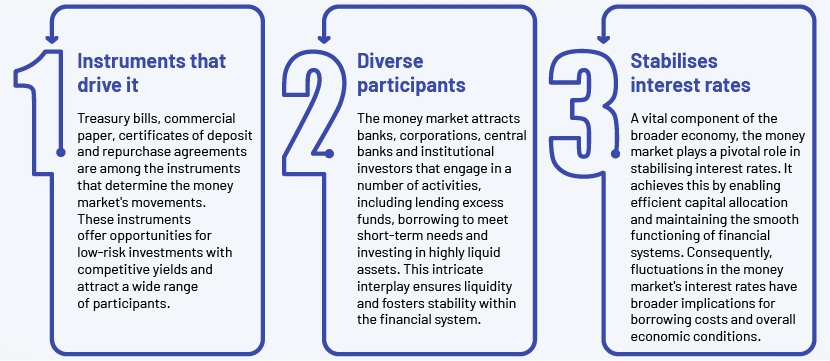

The money market is a vital component of the financial system, where short-term borrowing, lending, buying and selling of financial instruments occur. The primary participants in this market are banks, corporations, government entities and other financial institutions. At its core, the money market acts as a vibrant hub for short-term borrowing and lending. Within this realm, financial instruments with maturities of one year or less are governed by the need for liquidity management.

Key facets of this dynamic market.

Some of the most popular money-market instruments:

-

Treasury bills (T-bills): These instruments are sold at a discount to their face value and mature at par. T-bills are considered to be virtually risk-free, as they are backed by the full faith and credit of the government. They are issued in maturities, such as 4 weeks, 13 weeks and 26 weeks.

-

Commercial paper: These are short-term debt instruments issued by corporations to raise funds for operational needs, such as payroll and inventory management. They are typically unsecured and have maturities ranging from a few days to 270 days. Commercial paper is used mainly by highly creditworthy corporations to meet short-term financing requirements.

-

Certificates of deposit (CDs): These are time deposits offered by banks and financial institutions. They offer a fixed interest rate and have specific maturity dates, ranging from a few weeks to several months. CDs are insured up to a certain limit, making them a secure investment option for individuals seeking modest returns with minimal risk.

-

Repurchase agreements (repos): These involve the sale of securities with an agreement to repurchase them at a predetermined price and date. Repos serve as a short-term funding mechanism for financial institutions, enabling them to raise cash by using securities as collateral.

-

Bankers' acceptances: These are short-term instruments issued by corporations and guaranteed by a bank. They are commonly used in international trade transactions as a form of payment assurance. Bankers' acceptances have fixed maturity dates and are typically sold at a discount.

-

Money-market mutual funds (MMMFs): These are investment vehicles that pool funds from a number of investors and invest the funds in a diversified portfolio of money-market instruments. MMMFs offer investors exposure to money-market instruments without requiring them to directly purchase individual securities. They are designed to provide liquidity and safety while generating competitive yields.

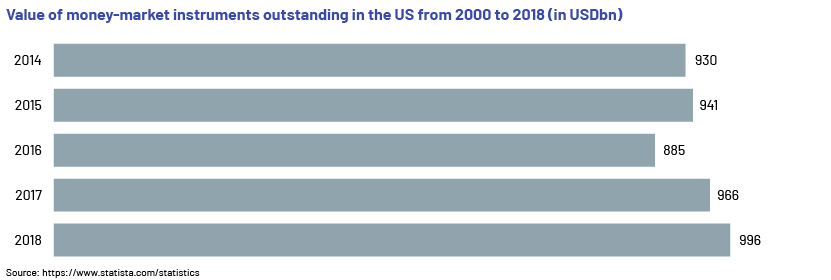

The following chart shows the value of money-market instruments outstanding in the US alone from 2000 to 2018. In 2018, it was approximately USD0.99tn.

Understanding the forex market

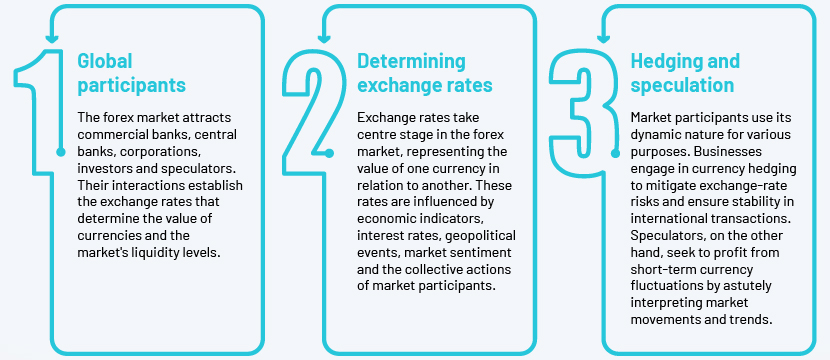

The forex market, on the other hand, is the largest and most liquid financial market globally. It is where currencies are bought and sold, enabling international trade and investment. Market participants range from banks and financial institutions to corporations, governments, speculators and individual traders. The forex market operates 24x5, spanning major financial centres and functioning across time zones.

Its core purpose is to facilitate currency conversion, crucial for cross-border transactions. However, it is also a platform for speculative trading, where market participants can profit from fluctuations in currency exchange rates.

Key drivers

Some of the most popular forex hedging techniques:

-

Forward contracts: These enable locking in an exchange rate for a future date. This helps when an entity knows it will be involved in a foreign-currency transaction and wants to avoid potential fluctuations.

-

Futures contracts: Similar to forward contracts, these involve the obligation to buy or sell a currency at a fixed price on a specified future date. They are traded on exchanges and offer standardised terms.

-

Options: These give the right, but not the obligation, to exchange currencies at a predetermined rate on or before a specific date. They offer more flexibility than forward contracts but come with a cost (the premium).

-

Currency swaps: These involve exchanging a specified amount of one currency for another at an agreed rate on a certain date, and then reversing the exchange at a later date. Swaps are often used for longer-term hedging.

-

Money-market hedging: This technique involves borrowing in one currency, converting it to another and investing the funds in a money-market instrument denominated in the second currency. It is used to hedge against currency risk when the amount and timing of a future transaction are known.

-

Cross-currency hedging: This involves using financial instruments such as options or futures to hedge exposure when dealing with transactions in multiple currencies.

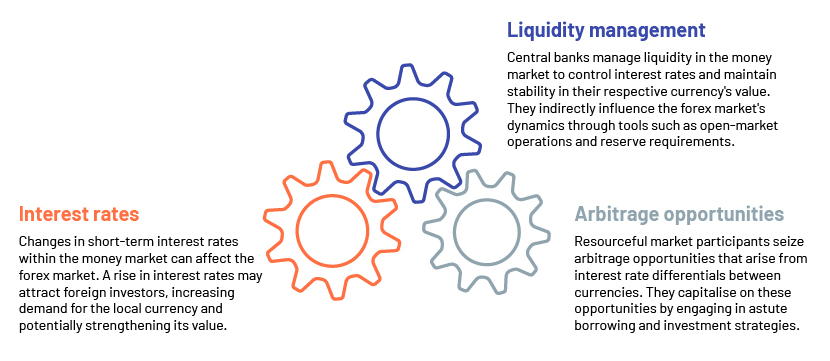

The synergy

The money market and forex market are not isolated entities but interconnected arenas that complement and influence one another. The following provides a glimpse into their interconnectedness:

Learning from the past

The Asian financial crisis of 1997 was a pivotal event that demonstrated the intricate connection between the money market and the forex market. It highlighted how vulnerabilities in one market can have far-reaching consequences for the other and the importance of unlocking the synergy between the two to prevent and mitigate such crises in the future.

Before the crisis, many Asian countries were experiencing rapid economic growth and attracting significant foreign investment. This led to an influx of foreign capital, which was largely invested in the region's money markets. As these markets boomed, interest rates dropped, and governments took on external debt denominated in foreign currencies to finance their projects.

Indonesia, Thailand, Malaysia, South Korea and the Philippines were among the nations that suffered the most from the crisis. Their stock markets, currency exchange rates and prices of other assets fell. GDP saw double-digit declines.

Indonesia's GDP growth contracted to -13.1% in 1998 from 4.7% in 1997, the Philippines’ to -0.5% from 5.2%, Malaysia’s to -7.4% from 7.3% and South Korea’s to -5.1% from 6.2%.

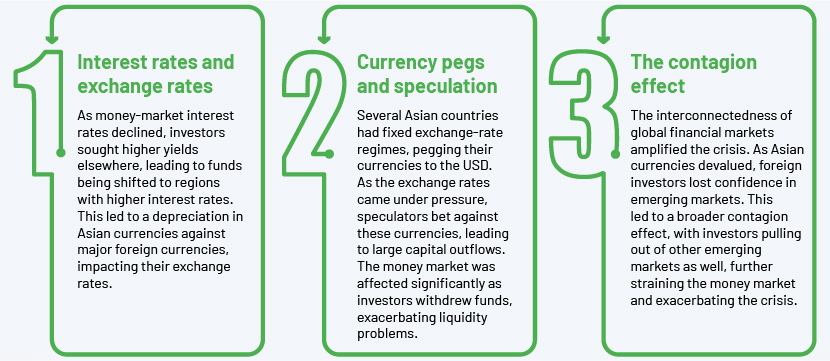

How the crisis affected the synergy between the money market and the forex market

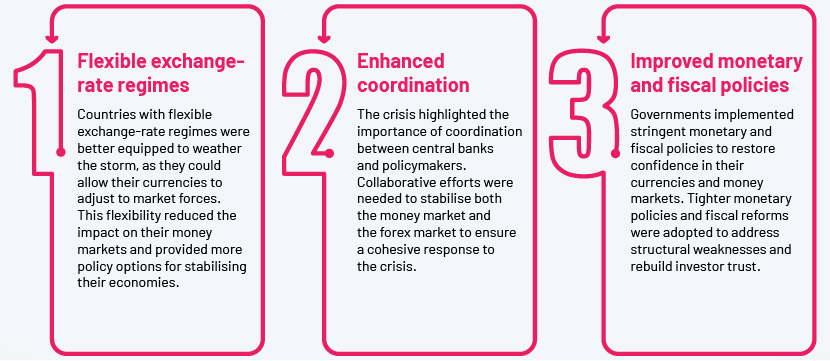

Unlocking the synergy

Conclusion

The Asian financial crisis of 1997 serves as a stark reminder of the synergy between the money market and the forex market. The interconnectedness of interest rates and exchange rates, coupled with currency pegs and speculation, demonstrated the crucial links between the two. Unlocking this synergy requires flexible exchange-rate regimes, enhanced coordination between central banks and policymakers, and improved monetary and fiscal policies. By learning from past crises and promoting a well-balanced relationship between these markets, economies could better weather challenges and foster sustainable growth.

The money market and the forex market are integral components of the global financial system, each with its unique functions and offerings. However, by recognising and unlocking the synergy between them, investors and financial institutions could enhance their decision-making, manage risk and capitalise on lucrative opportunities. Understanding their interconnectedness – whether by employing currency-hedging techniques, capitalising on arbitrage opportunities or optimising liquidity management – would lead to more efficient and profitable financial strategies. As the financial landscape continues to evolve, harnessing this synergy would be critical for market participants.

How Acuity Knowledge Partners can help

We are a leading organisation with extensive treasury experience, dedicated to empowering businesses with comprehensive financial solutions. With a rich legacy spanning more than 15 years, we have honed our expertise in the treasury domain, becoming a trusted partner to companies seeking robust financial management and strategic planning. We understand that effective treasury management is the backbone of any successful enterprise.

Our treasury services encompass a wide range of critical functions, including cash management, liquidity analysis, investment strategies and risk assessment. With a keen eye on market trends and an unwavering commitment to excellence, we tailor our solutions to meet the unique needs of each client, regardless of their industry or size. We believe in fostering long-term partnerships, driven by transparency, reliability and innovation. Our dedication to staying ahead of the curve, coupled with our emphasis on personalised service, has enabled us to build enduring relationships with our diverse clientele.

Whether you are a multinational corporation or a growing startup, we guide you through the complexities of treasury management, enabling you to focus on what matters most – growth and success of your business.

Benefits we offer

-

Expertise and specialised knowledge

-

Subject-matter expertise

-

Resource management including hiring, training and retaining staff

-

Access to an additional pool of resources in the areas of financial analytics, valuation and advisory services

-

-

Cost savings

-

Well-equipped technology partners

-

Risk management and compliance

-

Uncompromised security

-

100% data confidentiality

-

-

Robust process structure and governance

-

Timely delivery of projects with strict adherence to deadlines

-

Progress reports on a daily, weekly, monthly, quarterly and yearly basis

-

Tailor-made process restructuring for improved efficiency and process simplification

-

Easy project management and stakeholder communication

-

-

Competitive edge due to our global presence

Sources:

-

Money Market – Types of Money Market Instruments (coverfox.com)

-

Hedging in the Forex Market: Definition and Strategies (investopedia.com)

Tags:

What's your view?

About the Author

Seasoned treasury professional with 9+ years of expertise in managing financial reporting, risk management, controls, key regulatory changes, cash reconciliation, and process optimization Proficient in stakeholder management, dealing and collaborating with teams and clients across geographies, and leading multi-layer team of 11 executives. Expert in Global Finance Change, Liquidity and Cash Management, regulatory issues and laws, Fund Operations, with hands-on experience in, Bloomberg, TCON, Libor, SOFR, etc.

Like the way we think?

Next time we post something new, we'll send it to your inbox