Published on July 30, 2024 by Prasanna Kumar

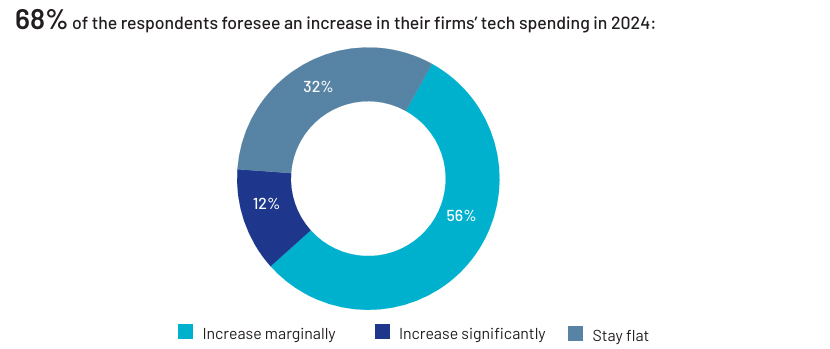

68% of the respondents agree that investment banking and advisory firms’ tech spending will increase in 2024. Majority of the firms have technology roadmaps targeting productivity and efficiency.

Technological advancements and innovations have altered the way investment banking firms operate.

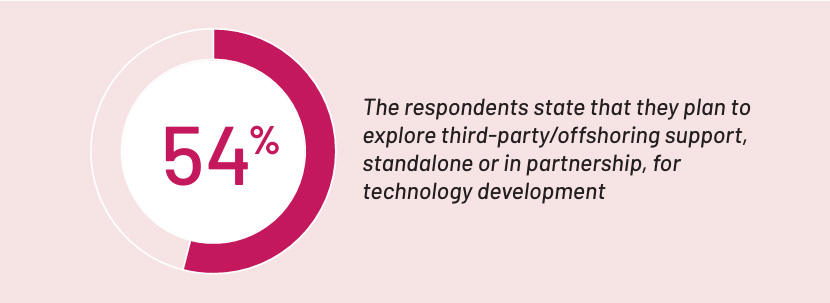

To address and keep pace with evolving market dynamics, investment banks and advisory firms are formulating digital transformation strategies. Digital tools and platforms are being increasingly leveraged by investment banking and advisory firms to evaluate global markets, revisit and review their portfolios, enter new economies and capture cross-border deal opportunities. Our survey results also brings forth the focus on technology adoption and related spending to implement productivity-enhancement and/or automation tools.

Based on the survey results and in line with the sector’s focus, we believe that the following will be priorities in a firm’s technology journey:

-

Streamlining the deal-origination process and improving deal-flow management

-

Advanced deal sourcing and identifying relevant clients

-

Efficient client reach-out and relationship management (CRM)

-

Re-engineering/redesigning the workflow management and reporting process

-

Automating the client-facing process, including client onboarding and document processing

Tags:

What's your view?

About the Author

Prasanna Kumar has over 16 years of experience in global capital markets –Investment Banking and Investment Research. His responsibilities include managing one of the IB engagements and relationship, coordinating with staffers and bankers on new initiatives and services, soliciting feedback, working with teams to identify and improve efficiencies and productivity, training team members on complex and value-added analysis, and implementing industry best practices in the Acuity team for IB Analytics.

Prior to taking up the dedicated role with the account in 2014, Prasanna was working as part of Projects and Transition team gained experience in business development and equity research (financial modeling, report writing, relative..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox