Published on March 15, 2022 by Priyadarshini Elumalai and Srianindhya Padakanla

With companies forced to adopt remote working options amid the pandemic, demand for digital transformation has stimulated growth and competition and fostered innovation and digitalization of front- and back-end functions.

This has led to looking for technology-driven alternatives to mitigate risk and improve controls, cost and efficiency.

The compliance function, for example, now has access to a number of automated solutions such as the following:

-

Client-onboarding platforms

-

Applications to check the credibility of counterparties

-

Solutions to distinguish and disclose suspicious transactions

Resulting in

-

Delivering transparency and managing investments quickly

-

Adhering to guidelines using quality data and powerful mechanisms

-

Promptly recognizing and rectifying breaches with intuitive tools before they become violations

-

Adopting rules that accurately interpret the investment guidelines

The following are some of the main drivers of technology impacting trading and compliance activities;

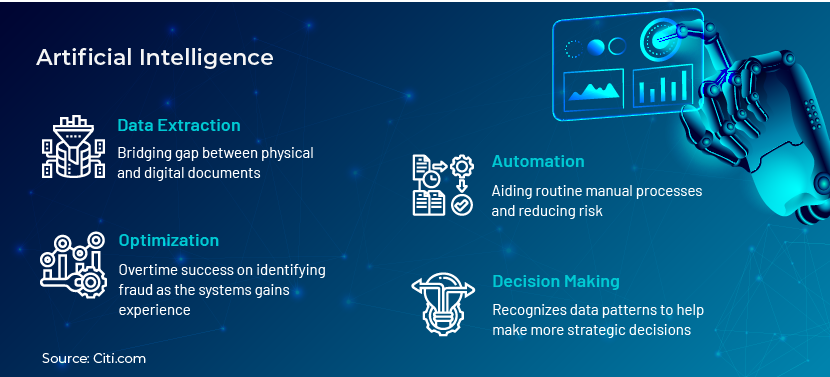

1. Artificial intelligence (AI)

Investment firms were driven to new-age technology and exploring the benefits of AI with its patterned programs and procedures in their effort to provide a better service faster. This paradigm shift also improves security measures.

AI’s ability to process large amounts of data rapidly and accurately can transform compliance activities. Compliance officers spend a considerable amount of time on reading and reviewing investment and regulatory documents to interpret guidelines and restrictions.

AI-powered systems help transform large numbers of complex documents into concise and easy-to-understand formats. It could also be used to collate compliance requirements from different regulatory sites and alert users of changes.

AI-enhanced algorithms are used in the trading function to execute orders through automated and pre-programmed trading instructions, based on variables such as quantity and price.

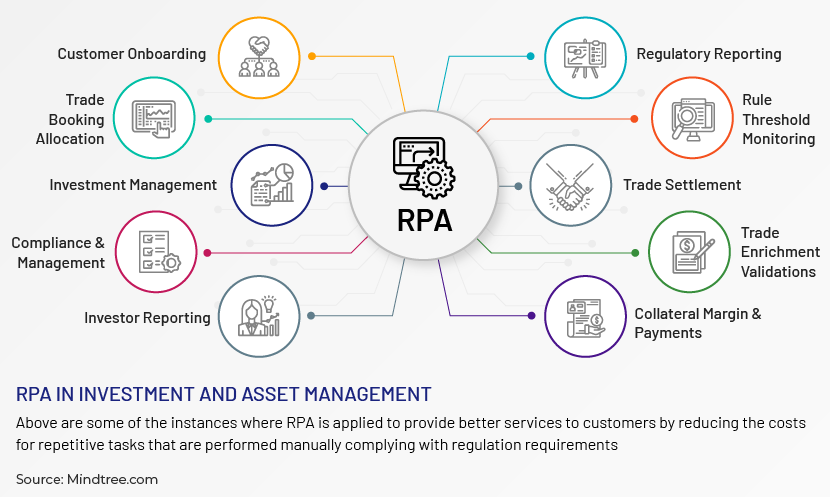

2.Robotic process automation (RPA)

RPA is the software used to manage high-volume repetitive tasks – such as addressing queries, making calculations, maintaining records and performing automated transactions – that previously required human intervention.

RPA cannot, however, replace or replicate human cognitive functions or critical thinking.

If that is the case, why opt for RPA?

a) RPA can be used to process transactions, trigger responses and communicate with other digital systems

b) It increases accuracy by eliminating human error, reducing costs and potential losses due to using erroneous data

c) It is a non-invasive technology that does not affect existing IT infrastructure or other applications

d) RPA improves the quality of individual processes, increases productivity and enhances customer satisfaction

Compliance officers perform judgment-based tasks that involve large numbers of standard, repetitive and false alerts. RPA-embedded solutions with cognitive capabilities can perform such tasks rapidly, speeding up the review process.

They can also help collect data from regulatory/law agencies (such as the Securities and Exchange Commission and Foreign Account Tax Compliance Act) to speed up the investor onboarding process.

Collecting and consolidating data from multiple sources is one of the many tasks the compliance function performs on a daily basis. This is onerous, prone to manual error and at times monotonous. RPA automates such tasks, enabling accelerated and accurate analysis.

3.Blockchain

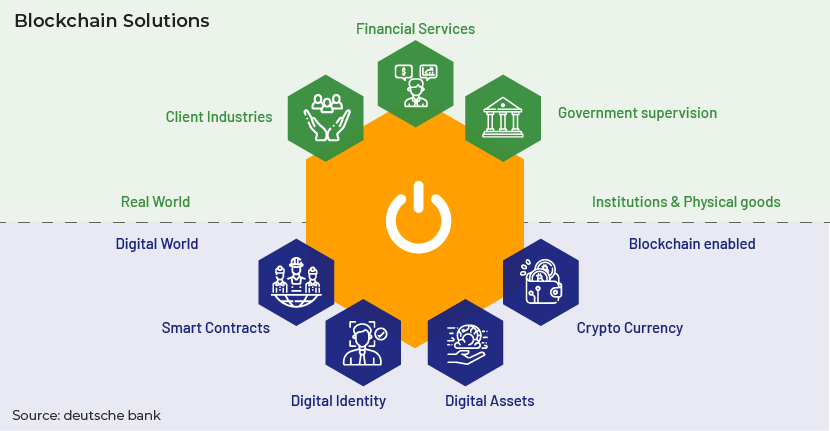

Blockchain is a backend database that maintains a distributed ledger, helps move transactions without the assistance of intermediaries and validates the transactions. The use of a digital ledger makes it difficult or impossible to change, hack into or cheat the system.

By adopting this technology, financial institutions could eliminate the step of third-party verification, reducing processing time. Since blockchain keeps track of all transactions transparently, these institutions could settle the transactions directly on blockchain without relying on custodial services.

For instance, blockchain can increase accuracy and facilitate instant settlement by eliminating intermediaries involved in trading such as brokers. It also helps manage portfolios and record investment constraints according to client specifications.

It identifies anti-money laundering by generating unique ID information and enabling an effortless transfer of documents while safeguarding the privacy of the information. This facilitates automated customer onboarding using limited resources.

Portfolio managers and investors will be able to record and manage real-time assets and investments using this distributed ledger, spending minimal time on performance reports/statements.

As data on a blockchain cannot be tampered with/altered, an audit trail is maintained for investors to ensure compliance.

Conclusion

The financial industry, together with compliance processes, is clearly heading towards digital transformation and automation. This evolution would not only simplify the handling of compliance-related daily tasks but also make these processes more efficient and secure. By integrating advanced technologies, organizations can enhance guideline compliance, ensuring adherence to regulatory requirements while optimizing risk management and operational efficiency.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners is a pioneer in providing investment services offering. We understand our clients’ products and the regulations associated with them.

We create tailor-made dynamic functions with a robust, responsive and proficient control framework and process delivery. We have a highly experienced tool-agnostic team that can provide support in investment compliance, trade surveillance and corporate, forensic and crime compliance. These services are supported by our proprietary suite of Business Excellence and Automation Tools (BEAT), which offer domain-specific contextual technology.

Our teams of experts have a unique combination of skill sets. They have extensive experience in order management/compliance systems such as Bloomberg AIM, Ion’s Latent Zero Sentinel, Charles River Database (CRIMS), LDC, ThinkFolio and BlackRock’s Aladdin, BTCA and SMARTS.

Sources:

https://www.sciencedaily.com/terms/artificial_intelligence.htm

https://onlinedegrees.sandiego.edu/artificial-intelligence-finance/

https://consoltech.com/blog/it-issues-in-financial-services/

https://datafloq.com/read/how-rpa-finance-changing-way-business-operates/9263

https://www.artificial-solutions.com/chatbots

https://microsoft.github.io/botframework-solutions/overview/virtual-assistant-solution/

https://youteam.io/blog/10-use-cases-of-blockchain-technology-in-banking/

Tags:

What's your view?

About the Authors

Priyadarshini has 4.5 years of experience in Investment Compliance and Collateralized loan obligations, having worked with State Street Corporation prior joining Acuity. At Acuity Knowledge Partners she is part of the Investment Compliance team and specializes in post and pre trade monitoring. Priya holds a Masters of Business Administration degree from Pondicherry University.

Srianindhya has 6 years of experience in Investment Compliance, having worked with State Street Global Advisors prior joining Acuity. At Acuity Knowledge Partners she is part of the Investment Compliance team and specializes in post and pre trade monitoring. Srianindhya holds a Masters of Business Administration degree from Mysore University.

Like the way we think?

Next time we post something new, we'll send it to your inbox