Published on September 9, 2020 by Champak Patel

As equity research analysts at Acuity Knowledge Partners, we thrive on analytical discussions to keep improving our fundamental research skills. We like to stay abreast of trends and discuss different sectors, company results and strategies, regulatory and technological changes, macroeconomic and geopolitical factors and now, the pandemic. However, as we moved to a work-from-home format, these discussions took a nosedive. Within two weeks of WFH, we knew that we needed to do something to satisfy the analyst within us.

We launched a virtual stock-market investment competition that we named “Invest Karo Na” (meaning “make investments”) over three months – 1 May to 31 July 2020. Participants were judged on their skill in selecting stocks and generating portfolio returns. India’s primary stock index, the NIFTY 50, was our benchmark; we provided virtual initial capital of INR1m and asked the participants to invest, based on their research. Restrictions on minimum holding periods and maximum weightage of a single stock and announcing winners every two weeks made the competition even more interesting.

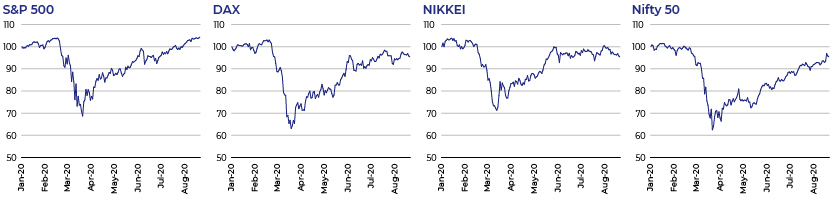

The markets were also fascinating to watch during this time, with a gap wider than ever before between the real economy and stock markets as markets fell globally as lockdowns were imposed. However, we began to see initial signs of a V-shaped recovery. While the economic indicators were telling a different story, the liquidity injections by central banks and, probably, investor’s fear of missing out on the recovery took many global markets to their pre-pandemic levels. India was no different; rather, it was more interesting, due to the India-China tensions.

Performance of major world indices YTD

Note: YTD charts, indexed to 100

Source: nseindia.com, indexes.nikkei.co.jp, dax-indices.com/indices, spglobal.com

The participants performed well amid such market conditions. They generated an average return of 23% within the three months. The top five participants generated a substantial average return of 31%+, an alpha of 12% more than the benchmark. What was interesting to see, though, was the fundamental research process adopted to select these high-performing stocks. Acuity Knowledge Partners has been supporting world-leading investment managers and analysts with fundamental research for years, but seeing investment/stock selection strategies put to practical use was satisfying.

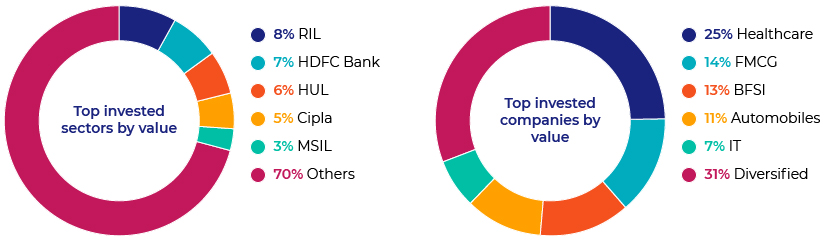

A snapshot of team performance over the investment period

Source: nseindia.com, Acuity Knowledge Partners

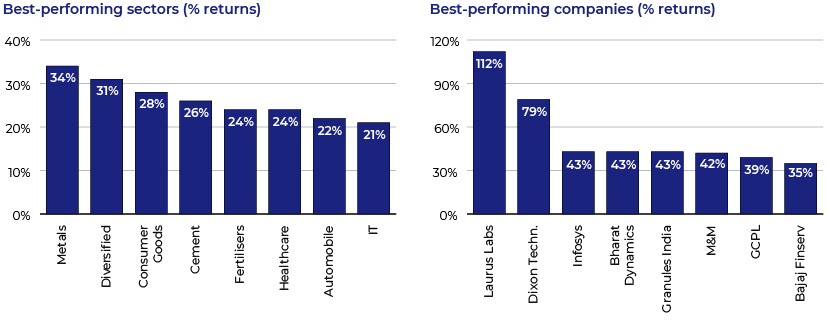

The participants conducted detailed research not only on the markets, but also on the companies and the global situation. They adopted classic investment textbook strategies that had to be flexible given changing market dynamics. This enhanced their skill sets and led to better decision making and more learning for the whole team. Our weekly discussion calls provided a glimpse of several such strategies used:

-

Theme-based – The healthcare sector has been the theme of the global markets since the pandemic began. Several participants invested in stocks in this sector. The top pick was Laurus Labs (ticker: LAURUS.IN) that manufactures and supplies application programming interfaces (APIs) for anti-retroviral products for global pharmaceutical companies. It provided returns of 62% during the period of the competition.

-

Event-driven – On 15 June, we had news of clashes between Indian and Chinese soldiers in the Galwan Valley. Participants expected higher spending by the Indian government to bolster its defence capabilities. The major picks were Bharat Dynamics (ticker: BDL.IN) and HAL (ticker: HNAL.IN), which provided returns of 63% and 34%, respectively, from 15 June to 31 July

-

Growth investing – Several analysts looked for intrinsic value in companies, based on their growth strategies. The top pick was Reliance Industries (ticker: RIL.IN), up 49% during the competition period, driven by multiple investments in the company’s technology platform

-

Value pick – Given that the stocks were heavily beaten down before the competition started, the participants found stocks trading at deep discounts with potential to provide double-digit returns once the situation normalised, e.g., Maruti Suzuki (ticker: MSIL.IN; up 28%) and UltraTech (ticker: UTCEM.IN; up 25%).

-

Top-down – The participants analysed macroeconomic and geopolitical tensions, concluding that several manufacturing companies are looking to shift their production facilities from China. The top portfolio pick using this strategy was Dixon Technologies (ticker: DIXON.IN; up 54%) that deals in contract manufacturing of electronic items.

-

Long-only – The participants resorted to old-fashioned fundamentals-based company research to pick industry leaders and companies likely to contribute to India’s long-term economic growth. The major holding was HDFC Bank (ticker: HDFCB.IN; up 14%).

Note: Best performance is calculated based on the entry into and exit from the stock by a participant and could be different from the three-month investment period return

Source: nseindia.com, Acuity Knowledge Partners

At Acuity Knowledge Partners, our highly qualified and experienced analysts work as an extension of the teams of global investment managers and research analysts. We support our clients to find new investment opportunities and stay abreast of industry, regulatory and technology trends, and evolving company performance. Our teams of fundamental research experts and data experts provide customised solutions by combining alternative data and technology expertise to provide differentiated research insights. With one of the largest pools of investment analysts with higher professional degrees in finance (such as CFA and CPA), we employ and engage the best of minds and technology (e.g., our BEAT suite of tools) to provide significant value to financial firms across the globe.

Tags:

What's your view?

About the Author

Champak Patel is a part of investment research vertical at Acuity Knowledge Partners, Gurgaon. He has over 11 years of total work experience in equity research & advisory, financial modeling, generating stock ideas, writing research reports, and presenting investment themes to fund managers. Currently, he leads various equity research engagements supporting clients across sectors and geographies. Champak is an MBA in Finance from Institute for Technology and Management, Mumbai and a Bachelor of Technology in Chemical Engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox