Published on May 9, 2023 by Ankit Kumar

As the banking crisis unfolds, it does not remain limited to the US but is spreading to all of Europe and will likely impact every country even if the banks concerned do not have direct relationships with them.

All past global economic/financial crises began in the US and spread across the world within a few months. How many of us know that the US Federal Reserve (Fed) printed USD3tn in just three and a half months in mid-2020? This increased the Fed’s balance sheet size by c.72% (to USD7.2tn) in just a few months. So basically, the government bought more bonds, which in turn pulled down the interest rates and eventually increased money flow in the economy to support businesses and individuals to help revive the economy. This strategy – referred to technically as quantitative easing – was essentially meant to support the US economy to fight the impact of the pandemic. This raises two important questions: (1) Why do other countries not also print money to ease their economies? It is because doing so would result in hyperinflation, such as in Zimbabwe (from 2007 to 2009). (2) How could one country’s quantitative easing negatively impact the rest of the world? Again, the answer is simple – it is because of the US dollar’s dominance in global trade and financial settlements.

In early 2021, excess liquidity in the market and the ultra-low interest rate environment, coupled with trillions of dollars of printed money, resulted in a financial market bubble. The Ukraine-Russia conflict began in early 2022, disrupting supply chains, increasing energy prices across the globe and leading to a spike in inflation in the US, UK and Europe. To control inflation, the Fed started raising the interest rate – from a low of 0.25-0.50% before 1Q FY22 to 4.25-4.50% by end-FY’22. It is currently at 4.75-5.00% (1Q FY23) and is expected to peak to 5.50-6.00% later this year. European countries, already facing high inflation due to a shortage of gas and high energy costs, soaring food prices and supply-chain disruption, had to increase interest rates (currently 3.00-3.75%) because of the US’s aggressive rate hikes, to curb inflation.

This is the background to the banking crisis that started in early 2023, triggered by the collapse of Silicon Valley Bank, Signature Bank and First Republic Bank in the US, followed by Credit Suisse in Europe. The issues with Credit Suisse were very different from those of its US counterparts, but all this was caused by a deterioration in market sentiment that dampened consumer confidence.

While most central banks are now busy re-designing their financial strategies to control contagion risk and help their economies recover, how do we identify their credit risk?

-

Liquidity risk:

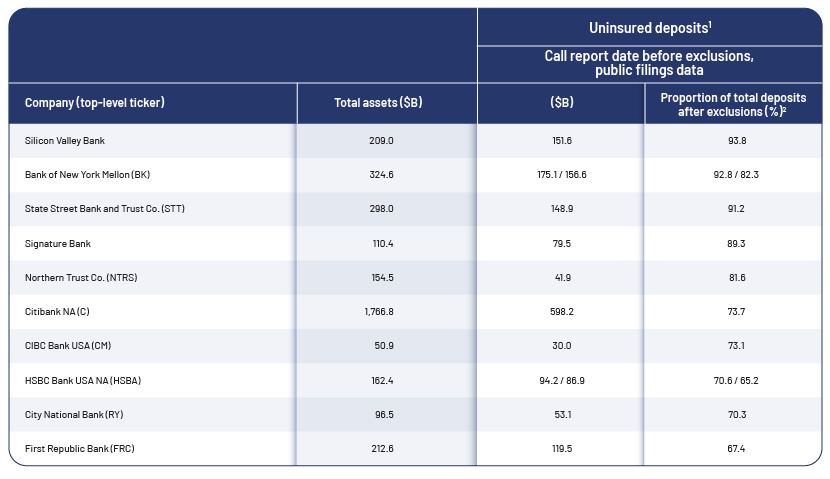

Banks, especially those with smaller balance sheets and regional banks, are currently facing heightened liquidity risk due to deposit outflow. Because of rising interest rates, banks that rely mainly on customer deposits could see a sudden increase in outflows, as investors will pursue high-yielding instruments. It is, therefore, crucial to study banks’ funding profiles, including deposit concentration, the share of commercial and retail deposits, and market funding. Another very important factor to consider is the proportion of uninsured deposits to total deposits. The following table illustrates this:

Source: S&P Global Market

But the downside is that more and more investors are now pulling money out from regional banks that support small businesses and putting it into larger banks; thus, millions of dollars are being poured into money-market funds, and this could potentially create another bubble.

-

Interest rate risk:

Banks generally use hedging tools such as derivates and swaps to minimise their sensitivity to this risk. Look for hedging strategies and how banks measure this risk. It is also important to assess the non-traded interest rate risk, which could result in balance sheet mismatch. Balance sheet risk arises when assets and liabilities are written and rates are priced over different tenors, leading to exposure to different interest rates.

-

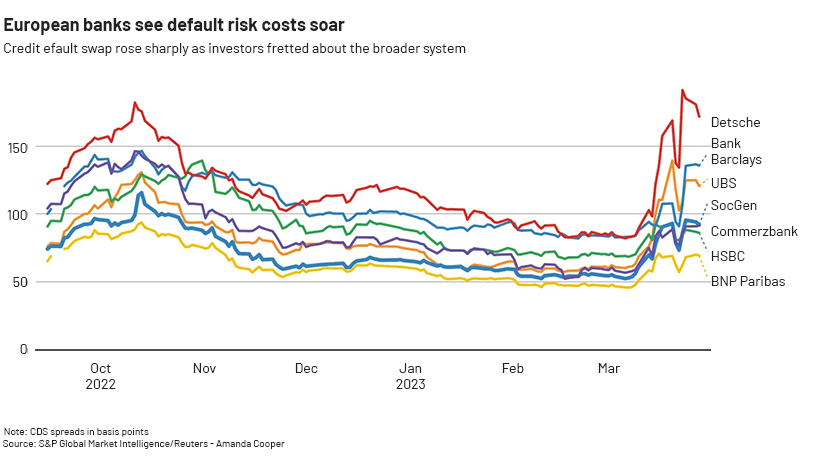

Credit default swaps (CDS):

Because of negative market sentiment, governance issues and systemic risk, CDS of most US banks, especially regional banks, have increased. European banks are also feeling the heat. One example is Deutsche Bank, whose CDS surged to more than a four-year high by the end of 1Q FY23, although the bank remains profitable and has good fundamentals.

-

Asset quality:

Important indicators are non-performing loans to gross loans, concentration risk in the loan portfolio and exposure to vulnerable sectors such as real estate – commercial and residential, IT and SMEs. A bank’s investment portfolio is also an important part of its balance sheet, so it is crucial to analyse the proportion of available-for-sale and held-to-maturity securities.

-

Earnings:

Because of high volatility in interest rates, banks are exposed to lower margins. While the high interest rate environment would benefit banks’ earnings profiles to a certain extent, it would also pressure profitability through higher costs of funding and narrowing net interest margins.

-

An important indicator is Common Equity Tier 1 (CET-1) capital and its excess buffer over the minimum regulatory requirement (according to Basel III norms, the CET-1 ratio should be at least 4.5%). In addition, because of the high interest rate environment, banks have reported huge unrealised losses on their investment securities, so it is imperative to measure the impact of these on the capital position.

Apart from these measures, the Fed also conducts an independent stress testing of large US banks to assess the impact of adverse economic scenarios on them. In 2023 testing, the Fed will include a severe recession with heightened stress in both commercial and residential real estate markets and corporate debt markets to assess how well capitalised larger banks are. Although the report for 2023 is not published yet, the 2022 report indicated that large banks have an adequate capital cushion to absorb losses (aggregate actual CET-1 ratio was 12.4% vs stressed CET-1 ratio of 9.7% vs minimum regulatory requirement of 4.5%).

So, are we in a recession? Technically, it is difficult to confirm this, but the current US Treasury yield curve is inverted (i.e., the longer the maturity of bonds, the lower the yield), which to some extent predicts or indicates a recession. However, we should also look at the economy as a whole, including other factors such as inflation, the unemployment rate and wage growth before reaching a conclusion.

The objective of this study was to understand the root cause of the banking crisis and how we can monitor and understand further development in this space.

How Acuity Knowledge Partners can help

We provide bespoke research to commercial and regional banks across the globe for managing credit risk associated with financial institutions. We work as a first line of defence for our clients by closely monitoring the performance of banks, insurance companies, securities and broker firms, global asset managers, hedge funds, pension funds, etc. Our subject-matter experts identify key risks and challenges associated with the current macroeconomic environment, sovereign risk and geopolitical pressures.

References:

-

https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

-

https://www.forbes.com/advisor/investing/fed-funds-rate-history/

-

https://www.ecb.europa.eu/press/pr/date/2023/html/ecb.mp230316~aad5249f30.en.html

-

https://www.federalreserve.gov/publications/files/2022-dfast-results-20220623.pdf

-

https://www.federalreserve.gov/publications/2023-Stress-Test-Scenarios.htm#:

What's your view?

About the Author

Ankit has over 12 years of experience in credit research and has been associated with Acuity Knowledge Partners (Acuity) since September 2011. At Acuity, he supports the second-largest Dutch bank’s financial institutions portfolio, in addition to supporting multiple other banks assisted by Acuity’s Lending Services division. He has extensive experience in preparing credit reviews for banks, insurance companies, pension funds, asset managers and securities firms. Ankit holds a master’s in Business Administration from IMT Ghaziabad, a master’s in Financial Analysis from ICFAI University and a Bachelor of Commerce (Honours) from University of Delhi.

Like the way we think?

Next time we post something new, we'll send it to your inbox