Published on April 27, 2020 by Sreenath Kesavan

The US steel industry has been severely impacted by the COVID-19 outbreak as end-market demand has disappeared. The steel mills have reacted by rapidly idling blast furnaces in recent weeks, resulting in a drop in utilisation rates that we believe will only worsen unless the pandemic is brought under control. Demand destruction has resulted in steel prices falling sharply, and the trend is likely to continue. We believe that only companies with strong balance sheets will be able to survive the COVID-19 challenge.

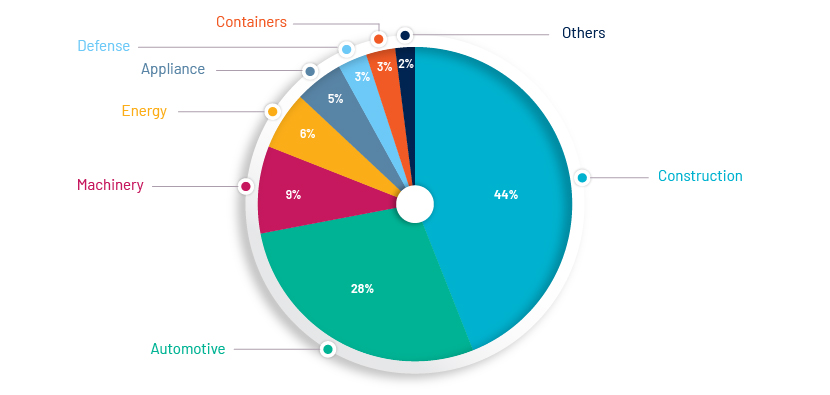

End markets driving steel demand have been impacted. We look at the impact of the COVID-19 outbreak on the steel industry’s end markets below. The construction, automotive and energy sectors account for nearly 80% of end-market demand for steel in the US.

2018 steel shipments by end market

Source: AISI, Acuity Knowledge Partners

Construction spending is likely to be muted. US construction spending fell unexpectedly by 1.3% y/y (vs estimates of positive growth of 0.6%) in February, following record growth of 2.8% y/y in January. Although the Trump administration has called for a USD2tn infrastructure package in response to the coronavirus pandemic, it remains to be seen whether Congress will pass this significant sum after approving an emergency USD2tn coronavirus relief bill in the last week of March.

Auto demand is pointing to a fall. Major US automakers Ford and General Motors (GM) have closed their plants indefinitely due to the virus outbreak. Toyota and Fiat Chrysler Automobiles (FCA) have extended the shutdown of their North American plants until 20 April 2020 and 4 May 2020, respectively. The COVID-19 outbreak in March led to Ford reporting a drop in sales of 12.5% y/y, FCA of 10% y/y and GM of 7% y/y for 1Q20. Toyota North America, Honda and Hyundai saw steeper drops of 37% y/y, 19% y/y and 43% y/y, respectively.

Energy-sector demand likely to take a large hit. Apart from the coronavirus outbreak affecting demand, the US energy industry has also been hit by a supply shock. Oil prices have hit 18-year lows due to increased production by Saudi Arabia and Russia as OPEC and Russia failed to reach an agreement on deeper supply cuts in early March. Russia and Saudi Arabia recently agreed to cut production by c.10 million barrels (MMbl)/day. While this appears to be a substantial production cut, it is not enough to meet demand destruction of c.30MMbl/day due to the coronavirus outbreak. This increased supply has directly hit the US energy industry, rendering any new shale exploration expensive, even as new shale exploration tries to keep output steady in the short term, protected by hedges.

US energy industry set to lose market share built on shale

Source: EIA, Acuity Knowledge Partners

Mill utilisation rates drop to multi-year lows amid idling of blast furnaces. The steel mills have reacted by rapidly idling blast furnaces in recent weeks. A number of flat rolled steel mills (AK Steel, ArcelorMittal and US Steel) catering to the automotive sector have announced idling of blast furnaces, totalling 5m+ short tons (st) per year of crude steel (c.5% of the crude steel produced in the US in 2019). Furthermore, US Steel has announced it will idle its tubular mills in Ohio and Texas (c.51% of its tubular capacity) by end-May. Tubular steelmaker Tenaris has also announced curtailment of most of its US production. As a result, the US steel mill capacity utilisation rate fell to 69% for the week ended 4 April 2020, according to the American Iron and Steel Institute (AISI), a multi-year low. This compares to a peak level of c.80% for most of 2019 and early 2020, prior to the outbreak.

US steel industry’s near-term outlook appears bleak. Demand destruction has also been reflected in benchmark US hot-rolled coil (HRC) spot prices, which plunged to a four-month low of c.USD520/st in early April, down 16% from the year-to-date high of USD618/st on 15 January 2020 (source: Fastmarkets’ Metal Bulletin). Many market participants have reported order cancellations, a precursor to prices falling even further. In such a weak pricing scenario, it would be very hard for US steel companies to break even, let alone make profits. Only companies generating free cash flow; have positive cash balances, extended credit lines, and flexible production schedules; and have entered into long-term contracts would be able to survive.

Adapting to the new normal

We believe COVID-19 will have a deep impact on how we do business around the world. Businesses will need to be agile to adapt to this new normal of business as they rethink their strategy for 2020.

Here is where Acuity Knowledge Partners can help you navigate through these challenging times. Our global offices can enable you to handle business demand and uncertainties with ease. Currently, we are helping many of our clients with our understanding of the market to chart their 2020 strategy.

To help our clients navigate both the people and business impact of COVID-19, we have created a dedicated hub containing a variety of topics including our latest thinking, thought leadership content and action oriented guides and best practices.

Sources

https://www.steel.org/industry-data (utilisation rates)

https://www.cnet.com/roadshow/news/car-sales-coronavirus-effects-covid-19-automakers/

https://agmetalminer.com/2020/03/30/could-we-be-on-the-way-to-10-per-barrel-oil/

What's your view?

About the Author

Sreenath Kesavan is part of the Investment Research team at Acuity Knowledge Partners. He has spent more than seven years in his current role covering the U.S. steel industry at Acuity Knowledge Partners and currently supports sell-side clients with research assignments including initiation and thematic reports, economic updates, data research and earnings review. He holds an MBA in Finance from ICFAI University, Dehradun.

Like the way we think?

Next time we post something new, we'll send it to your inbox