Published on June 11, 2018 by Irisha Boruah

Cryptocurrencies have come a long way in the past year and a half from being a safe-haven investment to being labeled as a bubble. The digital-currency market has received renewed global attention recently and investment experts are wondering whether cryptocurrencies are still worth dealing in.

What is a cryptocurrency?

A cryptocurrency is a digital or electronic currency that uses a peer-to-peer network to facilitate secure and verified financial transactions through cryptographic encryptions. Built on a technology called blockchain, cryptocurrencies use a public ledger system that stores details of all confirmed transactions, including creation of the token. Most cryptocurrencies are decentralized in nature, which means a cryptocurrency is not controlled by a single entity, as opposed to centralized electronic money and central banking systems.

Crypto-overconfidence – Why it happened the way it happened

(1) Retail investors drove the cryptocurrency market to new highs in 2017

Market capitalization of all cryptocurrencies increased more than 3,000% to over USD600bn in 2017, as per data from CoinMarketCap. Retail investors rushed to buy digital currencies in the first half of 2017, following a series of global events such as US President Trump’s threat to tax remittances to Mexico, hyperinflation in Venezuela, and Japan’s official recognition of bitcoin as legal tender, resulting in explosive market growth.

Owing to unprecedented growth in cryptocurrencies, many investment specialists like Warren Buffett and Ray Dalio frequently voiced concerns about the potential formation of a bubble. However, a stream of favorable events – like the Bitcoin Cash network’s completion of a hard fork (a software upgrade in blockchain) and the launch of bitcoin futures contracts on the Chicago Mercantile Exchange (CME) and Nasdaq – helped keep investor confidence intact for the rest of the year.

Most institutional investors chose to stay away from the 2017 crypto mania. However, the digital-currency market saw robust investment toward the end of the year from a small group of institutional investors, mostly led by hedge funds, accelerating growth in the sector.

(2) Sharp price correction kept investors away in Q1 2018

The combined market capitalization of cryptocurrencies dropped by over 50% to around USD250bn in Q1 2018, as per CoinMarketCap data. Digital currencies suffered extensive losses as retail investors fled the crypto space, seeking safe havens in gold and other precious metals. Reports of a regulatory crackdown in Asia and the ban on cryptocurrency-related advertisements, followed by the ban on credit purchases of cryptocurrencies by major banks deflated prior investor confidence.

Revival in April 2018 – Cryptocurrency prices receive attention from institutional investors

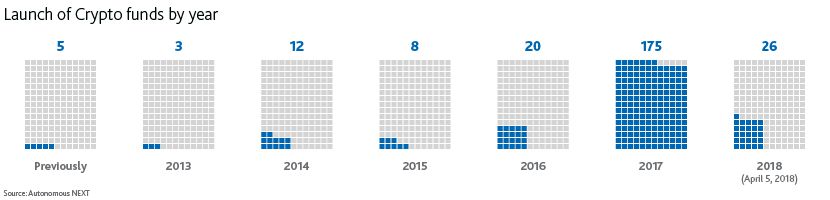

Despite a stagnant market, a group of thrill-seeking institutional investors has kept pouring money into the crypto space in 2018. As per Autonomous NEXT, 26 crypto funds have been launched so far this year. Several investment giants like George Soros and the Rothschild and Rockefeller families began crypto trading, following a theory that cryptocurrency prices had bottomed out. Buoyed by a 30% gain in bitcoin prices in April, many pension funds, mutual funds and investment companies like Barclays and Morgan Stanley are also eyeing crypto investments. As per a Thomson Reuters survey, around 20% of 400 surveyed finance firms are planning to launch crypto trading within the next 12 months. This rapid inflow of long-term institutional money could play an important role in sustaining the value of the cryptocurrency market, and in imparting a formal structure.

The following are a few factors that could further drive institutional money into the cryptocurrency market:

Development of a regulatory framework

Strong corporate governance, financial reporting and disclosure policies, etc. would assure capital protection and help avoid money laundering, fraud and financial scams

Regulatory oversight of products, trading mechanism and investment channels would further organize the market for institutional investors

An untapped market with exponential growth potential

Many industry players believe that in terms of long-term returns, 3 to 4 years in the cryptocurrency market is comparable to 30 to 40 years in traditional markets, making it a perfect strategic investment avenue for institutional investors

Institutional investor concentration is low in the cryptocurrency market; hence, early movers may establish dominance

Innovation and technology development

Ongoing development of products, platforms and technology that address limitations of the cryptocurrency market (such as cybersecurity issues, high transaction fees, data mining difficulties, and lack of a valuation mechanism) would be another major trigger for institutional investors

Wider adoption of blockchain technology

Blockchain is gaining wide acceptance across different sectors; hedge funds, VC and PE firms are also investing in projects, startups and companies developing blockchain

ICOs, tokens, indexes and crypto funds focused on blockchain development are also receiving institutional investor attention

Conclusion

The cryptocurrency market is a relatively small part of the trading industry, but with increasing attention from institutional investors, this niche segment is rapidly expanding its bases to go mainstream. Clarity on the regulatory front, wider acceptance and adoption of blockchain technology and cryptocurrencies, and the introduction of disruptive products and technology could go a long way in driving such investors with long-term capital commitments to join the space. However, to enter or penetrate deeper into the cryptocurrency space, investors require a sound understanding of cryptocurrencies. According to a recent survey by Context Summits, nearly half of the more than 400 institutional investors do not know what cryptocurrencies are. This could definitely slow their investments in this space.

Acuity Knowledge Partners has extensive experience in providing high-value research and analytics solutions to world-renowned asset managers, private equity and venture capital firms, and consulting companies. With dedicated teams of highly qualified analysts, Acuity Knowledge Partnersprovides exclusive business research solutions, including market and competitive intelligence, sector-focused research, business content, corporate communications, media monitoring services and editorial and presentation support, to help organizations capitalize on opportunities in today’s ever-changing global business environment.

Disclaimer:

This is the view of an individual contributor to Acuity Knowledge Partners Blog and should not be construed as a commentary from Moody’s Investors Service, the rating agency of Moody’s Corporation.

Tags:

What's your view?

About the Author

Irisha Boruah has over 7 years of experience in consulting and research. At Acuity Knowledge Partners as a part of the Business Research, Consulting and Content practice; She supports multiple clients across industries in areas such as media monitoring, content creation, validation, index and market research. Previously, she worked with Dion Global Solutions, supporting clients on business and equity research. Irisha holds B.Com (Hons.) from Calcutta University and Masters in Business from Bangalore University.

Like the way we think?

Next time we post something new, we'll send it to your inbox