Published on February 19, 2021 by Sudhir Shetty

Trade finance encompasses a number of financial instruments/products that facilitate global trade and commerce among multiple parties, such as export credit agencies, exporters, importers, shipping agents, customs agents and banks.

The global trade finance market is expected to grow to c.USD56bn at an estimated CAGR of 3.8% from 2019 to 2026, according to alliedmarketresearch.com. The adoption of technologies such as optical character recognition, radio frequency identification, blockchain and digitisation of trade documents is expected to drive this growth.

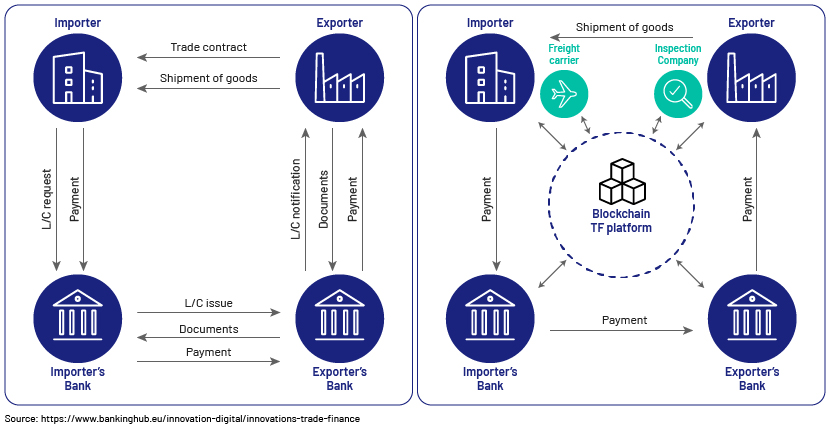

Letter-of-credit transactions have traditionally involved cumbersome paperwork, and stakeholders were affected severely during the COVID-19-related lockdowns due to inordinate delays. Banks across the globe have also been struggling with legacy systems that have negatively impacted the industry, resulting in both reduced trade finance volumes for banks and inadequate liquidity for companies.

Banks and technology companies have been exploring ways to automate the trade finance process for the past two decades. Blockchain technology, which functions on a distributed ledger technology (DLT), has the potential to enable efficient digital transactions for all stakeholders in an international trade transaction. DLT enables peer-to-peer transactions and offers transparency to stakeholders and real-time access to information, ensuring seamless flow of the trade finance process.

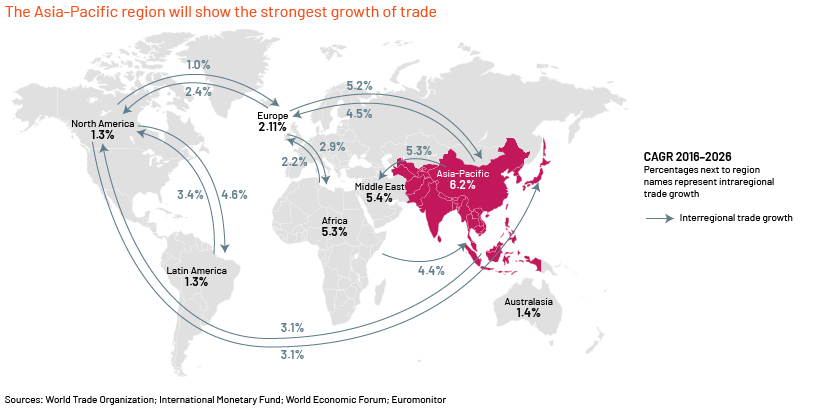

Asia Pacific – the new growth market

While the EU contributed EUR4.1tn and the US EUR3.7tn to global trade worth EUR27.6tn in 2019, global banks are identifying opportunities presented by emerging economies in the trade finance segment. Both Europe and the Americas are expected to register growth in trade of 2% and 1%, respectively, until 2026, as business in these geographies has matured over the years. The uncertainty caused by Brexit is also likely to have a negative impact on trading volumes between these geographies. However, the integration of digitalisation with the trade finance cycle is expected to improve the growth rates of both the US and the EU in the coming years.

The share of global trade using documentary credit has declined to c.15% currently from c.50% in the 1970s, according to research by Bain & Company in collaboration with HSBC, due to the preference for open-account trading for the following reasons:

-

Higher bank transaction costs that cut into the already thin margins of commodity trading companies

-

Well-established trading partners not making it essential that banks engage in risk mitigation

-

The need to process multiple documents, resulting in inordinate delays and inconvenience

We expect Asia Pacific (APAC) to lead growth in documentary trade finance in the coming years, as the region’s markets have greater perceived risks due to either buyers or sellers not fulfilling their obligations. High-volume shipments involving energy products, chemicals and grain are facilitated by letters of credit in APAC, presenting a significant opportunity for banks.

Blockchain technology is estimated to add USD2bn to the existing USD8bn in bank revenue annually to the global trade finance segment by 2026, according to research by Bain & Company in collaboration with HSBC.

The shape of post-pandemic digitalisation initiatives

Tech companies such as Bolero, Wave, Contour, TradeSun Inc. and GT Nexus Inc. are offering digital solutions ranging from digital payment guarantees and electronic bills of lading to optical character recognition and artificial intelligence. Businesses are realising the importance of adopting such technologies, especially in the wake of the COVID-19-induced global economic slowdown.

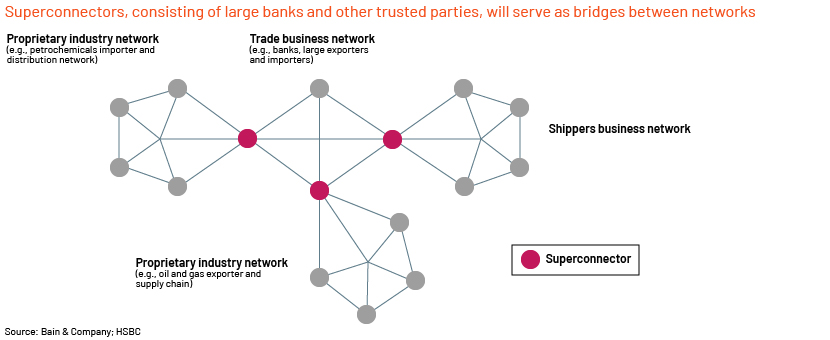

Large banks, along with government agencies and large corporations, could also facilitate the digitalisation process by acting as super-connectors, linking the various private networks involved in the global trade finance cycle. For instance, super-connectors have helped shipping companies track the flow of merchandise and customs documents, and oil and gas companies track data related to the movement of oil consignments from producer to refiner. Banks, on the other hand, could provide data related to financing and collateral. By being enablers in the super-connector network, banks would also have access to a significant amount of information that would help mitigate risks involved in the trade finance cycle.

Exodus in commodity trade finance

Commodity trade finance has traditionally been considered to be one of the safest business segments for banks, as finance is provided with the traded commodities as security. However, owing to pressure from large trading companies and changing capital requirements under Basel regulations, banks have had to offer unsecured and cash flow-based finance with covenant-light features in recent years to remain competitive. The COVID-19 pandemic worsened the situation, and many reputed commodity traders went bankrupt due to alleged malpractice, coupled with thin operating margins (0-2%). As a result of such losses, ABN Amro Bank NV decided to shut its trade finance operations completely, while other banks such as Société Générale SA, BNP Paribas, Natixis, ANZ and Rabobank have discontinued certain geographical trade finance operations. The exit of ABN Amro Bank has left a deep void of USD21bn in the commodity trade finance space.

ING Group NV and Deutsche Bank are exploring opportunities in this segment by revisiting the trade finance processes; this will likely mitigate the abovementioned risks and help provide finance to commodity traders. A sustained revival in commodity prices in 2021, along with the participation of banks and institutional investors, could enable commodity trade finance to gain traction.

How Acuity Knowledge Partners can help

Leveraging its two decades of experience in delivering high-value research, analytics and technology solutions, Acuity Knowledge Partners (Acuity) has built a robust and sustainable ecosystem of people, process and technology.

Acuity has strong credentials as a strategic partner to commercial banks, supporting them across the spectrum of trade finance operations – from request initiation to tracking payments – with its expert credit team ensuring in-depth credit analysis and continuous portfolio monitoring. All our services are assisted by our proprietary suite of solutions – Business Excellence and Automation Tools (BEAT) – which offer AI-/ML-integrated domain-specific contextual technology that can help in the digitalisation of trade finance activities.

Sources:

Rebooting a Digital Solution to Trade Finance: Bain & Company + HSBC

https://www.alliedmarketresearch.com/trade-finance-market

https://www.bankinghub.eu/innovation-digital/innovations-trade-finance

What's your view?

About the Author

Sudhir has over 15 years of experience working with leading global organizations in the credit-rating and commercial-lending domains. Currently, he is part of a commercial-lending team that works with a large Canadian Bank supporting their alternate finance team. Prior to this, he supported the commercial-lending teams of a large European banks and was responsible for communicating with the origination teams, writing annual and interim credit reviews, responding to risk queries and performing post-credit-sanction formalities. Prior to joining Acuity, Sudhir worked for a leading rating company and supported the US public-finance domain, both in his individual capacity and in the capacity of a team lead. Sudhir holds a Master in..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox