Published on March 31, 2021 by Mahesh Agrawal

The global energy landscape is undergoing a transformation and could witness radical changes over the next one to two decades. The major factors driving this change are worsening climate change and growing awareness of the ill effects of environmental pollution globally. Technological advancements towards the sustainable and efficient use of energy have been helping countries plan zero- or even negative-emissions policies for the longer term that could be instrumental in achieving targets/commitments related to climate goals. The pandemic has likely slowed or delayed some of these changes, but we see no material adverse effect on cleaning up the energy sector in the medium to long term.

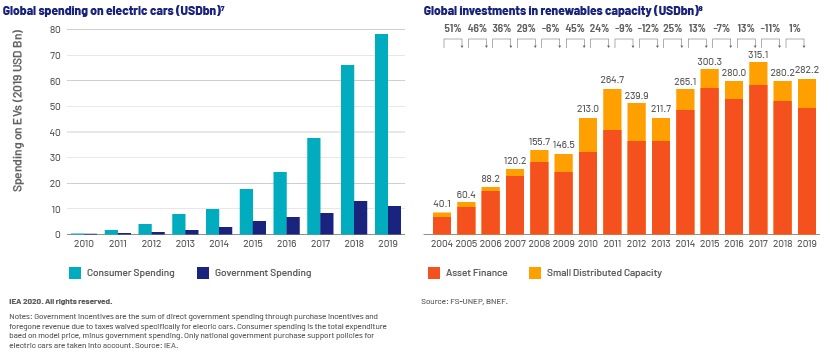

1. Switch to electric vehicles – Most countries are focused on reducing their emission footprint, and switching to electric vehicles is considered to be one of the most viable options for doing so. Although challenges such as low mileage per charge, high initial cost and lack of infrastructure remain, increasing investment in the sector, improving technical efficiency, regulatory policies in favour of the switch and increasing awareness among consumers are likely to help electric vehicles gain traction. Deloitte estimates that the share of electric vehicles in global automobile sales could increase to around 32% by 20301 versus market share of around 4.2% in 20202 . Many automobile manufacturers, including GM3 , Ford4 and VW5 , have set targets to switch a significant part of their current portfolio from petroleum to electric over the next decade, and have made large capital commitments to this end.

2. Switch from coal to gas/renewables – The electricity sector is one of the most polluting globally, accounting for nearly 31% of all manmade emissions6 . The primary reason is large-scale use of coal for electricity generation due to its relatively low cost and the lack of alternatives. However, increasing production of natural gas globally, including shale gas in the US, and technical advancements in renewable energy provide competitive alternatives to coal in the current environment. The Paris Agreement on climate protection further accelerated the switch from coal to achieve the time-bound emissions targets. Many European countries including the UK have targets in place to eliminate the use of coal over the next decade, and emerging economies including China and India have also been investing heavily in cleaner power sources.

3. Cleaner and efficient use of traditional fuels and biofuels – Traditional fuels play a pivotal role in economic development and could be difficult to replace quickly without disturbing the economic balance. However, these fuels can be modernised to meet emissions targets, and many countries appear to be taking steps in that direction. Stricter emission limits on petroleum fuels including petrol/diesel are already in place and could be tightened even further to reduce carbon and nitrogen emissions. Refiners would need to invest in upgrading refining facilities to meet stricter regulatory standards. Biofuels have also been emerging as a fuel of choice given their net near-zero emissions and are being adopted increasingly as a blending component to reduce overall fuel emissions.

4. The increasing cyber threat to energy operations – The interconnectedness of energy infrastructure brings significant efficiency to all energy-related operations and helps automate and manage processes better. However, an unintended consequence of networking is that it exposes these processes to outside interference, namely cyberattack. Energy infrastructure is considered to be critical infrastructure in any country, and an attack could prove to be disastrous. Cyberattacks could be launched to demand ransom, sabotage, or as an act of terrorism or competition. A Deloitte report says that nearly 20% of cyber incidents in 2016 were related to the energy sector in the US9 . Companies in the energy sector need to be prepared to handle these cyberattacks and invest proactively to strengthen their networks.

5. Distributed energy systems – Electricity production has historically been a large-scale business, with a few production plants serving large areas and populations. However, the adoption of renewables is pushing energy production to smaller or individual units. Home solar plants can fuel a single home, while small-scale wind or solar plants can generate electricity for one village or community. While distributed electricity production helps isolate supply-related incidents, it creates more instability in the system, as forecasting energy supply and demand becomes challenging. Open access to energy systems provides consumers with multiple options for power supply, making it very important for companies to build relationships with consumers.

How can energy companies navigate the sector transformation?

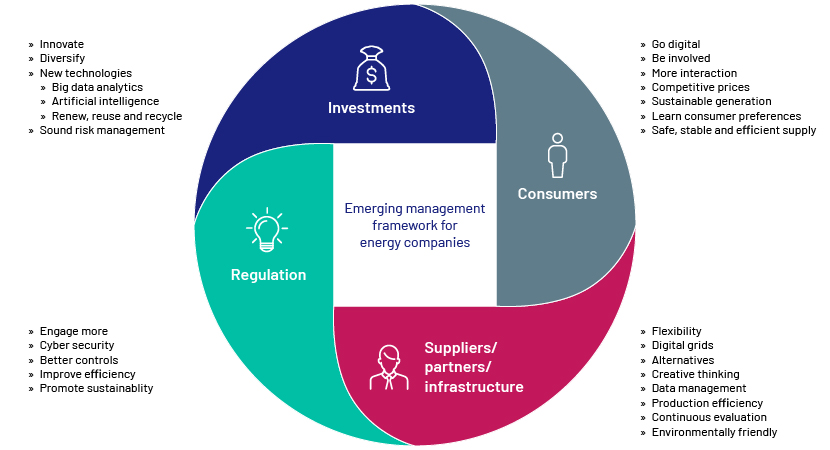

Energy systems are evolving fast, and companies operating in the sector need to adopt new operating models and business strategies to survive and thrive in the changing environment. The energy transformation presents both opportunities and challenges. Success or failure of a business would largely depend on its ability to adapt to new realities. We detail below steps companies could take to better explore these opportunities:

-

Innovate – Companies first need to be a lot more innovative, not only in terms of predicting correctly what consumers want but also in terms of how best to serve them and optimise available resources. Technological innovation has served the sector well over the years in many areas of operation including production cost reduction, better resource exploration, saving on system waste and improved connectivity between energy infrastructure and smart grids. For example, using the Supervisory Control and Data Acquisition (SCADA) system for locating oil reserves helps optimise oil drilling, and enhanced oil recovery (EOR) methods help increase oil recovery from the same wells. Still, there is a lot of scope for improvement, especially in the newer energy areas. For example, the plant load factor of solar and wind power projects have improved over the past decade but are still nowhere close to those of traditional power plants to make them a reliable source of electricity. Better data analytics on wind speed, direction and solar position could help improve the reliability of the system. Other energy sectors also offer opportunities to improve, and companies could explore these to get ahead of the competition.

-

Invest for the future – Investment is necessary not only to maintain the current scale of operations but also to prepare for the future. Investment in improving current operations, newer technologies, data mining and data sciences, artificial intelligence and robotics will go a long way in bridging the gap between where companies are currently and where they need to be in the future. The competitive edge of energy companies would depend much on how quickly and efficiently they can optimise their business models to meet new requirements. The International Renewable Energy Agency estimates that annual investment in renewables needs to increase from around USD300bn/year currently to more than USD800bn/year by 2050 to meet key targets under the global climate goal10 .

-

Diversify – In this rapidly changing environment, companies cannot afford to continue operating in niche segments and risk losing out when newer entrants with new technologies start taking away market share. They need to expand their horizons so they are ready for the change when required. They need to be agile and collaborative on multiple fronts. Traditional business could still be the mainstay of organisations, but companies could use the existing skillsets and technical knowledge to explore new opportunities in emerging sectors and invest appropriately. It is also important to diversify business relationships and partner with service providers, vendors, outsourcing companies and the gig economy to bring more flexibility and creative thinking to projects. Shell, BP and Total are some of the big companies investing heavily in next-generation energy sources, including solar and wind power plants and charging infrastructure.

-

Invest in infrastructure – One of the major risks for organisations in the energy sector is stranded assets. Building infrastructure entails significant investment, and it would be a strain on a company if a particular asset needs to be written down or closed prematurely or, in the worst case, becomes a liability. The best way to counter the problem would be to evaluate the project consistently during its life and make changes as and when necessary. Access to relevant market data and using data science could help the organisation keep track of the changes and make the right decisions. Another option could be to make the infrastructure adaptable if required, without significant investment. For example, a retail petrol outlet could be built in a way that if required, it could be easily converted into a charging outlet.

-

Engage – The transformation could bring radical changes, and companies need to be open about these changes to stakeholders to prepare them for the future. The labour force may need to be reskilled and reallocated to match emerging requirements. Management also needs to guide employees on the direction of the organisation and train them for new tasks and responsibilities. Outside the organisation, it needs to communicate with society about the new possibilities and how these could benefit society. This would not only help the company foster better relationships with consumers but also understand consumer preferences and better predict demand.

-

Digital – Digital technologies have been advancing rapidly, making customer engagement more informative, interactive and fun. Artificial intelligence, the internet of things and cloud-based services make it easier for companies to enhance performance and deliver better results. Going digital could also help improve communication with suppliers and partners to better manage infrastructure. Digitalising electricity or gas networks enables two-way communication between all market participants, helps overcome inefficiencies in the system and prepares companies to respond better to demand/supply variations. Hence, digitalisation could improve the reliability, stability and availability of grids and build a good reputation for the organisation.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners provides expertise for market research on industries, economies and commodities. Our team has a firm grasp of macroeconomic and market concepts, and expertise in technical and quantitative analysis to provide in-depth market insights on relevant topics. We enable clients to manage increasing demand on their teams by providing customised managed services solutions, based on specialised skills and technology, and by delivering operational efficiency, resilience, and significant cost savings.

1 https://www2.deloitte.com/us/en/insights/focus/future-of-mobility/electric-vehicle-trends-2030.html

2 EV-Volumes - The Electric Vehicle World Sales Database (ev-volumes.com)

3 https://www.nbcnews.com/business/autos/gm-go-all-electric-2035-phase-out-gas-diesel-engines-n1256055

5 https://thedriven.io/2019/11/19/volkswagen-commits-97-billion-to-electric-mobility-switch/

6 https://www.c2es.org/content/international-emissions/

7 https://webstore.iea.org/download/direct/3007

8 https://www.fs-unep-centre.org/wp-content/uploads/2020/06/GTR_2020.pdf

10 https://www.irena.org/publications/2020/Nov/Global-Landscape-of-Renewable-Energy-Finance-2020

Tags:

What's your view?

About the Author

Mahesh has over 14 years of experience in commodity and macroeconomic research and has been associated with Acuity Knowledge Partners (Acuity) since September 2012. At Acuity, he supports a leading European investment bank’s commodity research desk in analysing commodity markets, preparing research notes and creating presentations for conferences and client interactions. Mahesh holds a master’s degree in Science (Energy Trading) from the University of Petroleum and Energy Studies, Gurugram, and a Bachelor of Science from Bikaner University, Bikaner.

Like the way we think?

Next time we post something new, we'll send it to your inbox