Published on May 10, 2024 by Rabin Thakur

The energy transition and how to finance it

The “energy transition” broadly refers to the global shift in the energy sector from the use of fossil-based energy systems to non-fossil and newer forms of energy that are considered to be cleaner. For the uninitiated, these include renewables such as solar and wind, biomass, energy storage in lithium batteries and green hydrogen.

The need for an energy transition

The main requirement is to meet the ambitious target under the Paris Agreement of limiting the annual increase in global temperature to 1.5° Celsius. The Intergovernmental Panel for Climate Change (IPCC), a UN body tasked with advancing scientific knowledge around climate change, suggested that emissions arising out of burning fossil fuels must be halved within the next decade to limit global warming to 1.5° Celsius[1].

A fundamental question in the field of energy generation and consumption relates how bad fossil fuels are or could be. A UN Climate Action article suggests that fossil fuels including coal, gas and oil account for nearly 75% of global greenhouse gas emissions, the primary reason for global warming[2].

Challenges faced in transitioning to clean energy

Despite awareness of the impact of fossil fuels, the transition to cleaner energy sources has faced multiple challenges.

Energy security is the biggest challenge to transitioning, especially for developing countries, due to the erratic nature of non-fossil energy generation and ever-increasing demand owing to growing economies and populations.

Policies and the regulatory environment also provide little support in enforcing the use of non-fossil fuels and phasing out fossil fuels. At the global level, however, the 2023 United Nations Climate Change Conference (COP28) saw an important breakthrough when the need to “phase down” (but not phase out) use of fossil fuels was first accepted[3].

The lack of input materials to develop infrastructure for harnessing renewable energy and eliminating status quo bias (relating to the traditional use of fossil fuels for energy generation) are additional challenges.

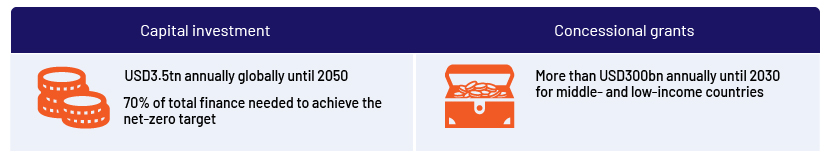

One of the most important challenges is how to finance the energy transition. The International Monetary Fund (IMF) stipulates that achieving net zero by 2050 – a requisite for limiting the annual increase in global temperature to 1.5° Celsius – requires USD5tn in investment annually by 2030[4]. To put this in perspective, private equity capital invested globally in 2022 was USD2.2tn[5]. Even if all the private equity capital were to be invested only for achieving net zero, it would meet only half the requirement.

However, global investment in clean energy suggests that the response is gathering pace. It has continued to increase since 2017, according to the International Energy Agency (IEA); it crossed USD1.6tn in 2022 from a nearly static level of c.USD1.1tn from 2015 to 2018. It is estimated at c.USD1.7tn in 2023[6].

How is the energy transition being financed?

Two broad forms of financial inflows are required for transitioning to clean energy – capital investments and concessional grants – according to the Energy Transition Coalition (ETC).

To accumulate capital, a supportive policy and regulatory environment is needed, in addition to a sustainable energy finance community with the right financial instruments. Policymakers and governments as well as financial institutions, insurers and developers all have unique and important roles to play, and they need to have a clear vision of what they can do to unlock more investment in clean energy.

Blended finance:

Blended finance combines development finance with philanthropic funds to catalyse private capital inflows to emerging economies, mitigate risks and create a lower blended cost. This addresses concerns of private investors relating to market and project risks. Blended finance has contributed USD140bn to achieving the UN’s Sustainable Development Goals in developing countries[7].

Sustainable and green bonds:

A sustainable bond is a bond issued by a government or a financial institution. Its proceeds are allocated exclusively to projects that promote sustainability and climate action. By 2018, almost USD500bn in green bond issuance was initiated by government and institutional issuers, bringing the global climate bond market value to nearly USD1.5tn[8].

Guarantee mechanism:

As with any infrastructure project, clean energy projects need to be financially bankable. These guarantees are typically provided by an independent third party to protect the project from insolvency and revenue loss. Guarantees reduce investor and funding risk, helping to leverage clean energy for project growth with investor and lender participation[9].

Insurance:

Insurance companies play an important role in the energy-transition finance equation by hedging project risks, providing an easy route to project finance. Big insurers have not only invested in the energy transition but have also successfully implemented projects[10].

How Acuity Knowledge Partners can help

We are a leading service provider of a range of services in the ESG and sustainability domain. We serve clients in a variety of sectors and in areas such as private equity, venture capital, asset management and investment banking. We support funds reporting under Articles 8 and 9 of the Sustainable Finance Disclosure Regulation and provide end-to-end research support to green/impact funds with strategies aligned to meet global-warming targets under the Paris Agreement.

Source

-

[1] ClientEarth Communications: Fossil fuels and climate change

-

[4] IMF: World Needs More Policy Ambition, Private Funds, and Innovation to Meet Climate Goals

-

[7] Four tools for increasing sustainable energy finance | World Economic Forum (weforum.org)

-

[8] Four tools for increasing sustainable energy finance | World Economic Forum (weforum.org)

-

[9] Four tools for increasing sustainable energy finance | World Economic Forum (weforum.org)

-

[10] Four tools for increasing sustainable energy finance | World Economic Forum (weforum.org)

Tags:

What's your view?

About the Author

At Acuity, Rabin is overseeing multiple ESG engagements which includes research, analysis and reporting assignments for clients in the US and Europe. Overall, Rabin holds an experience of ~11 years which is spread across various areas of client management and interface within the domain of ESG and Sustainability. Rabin holds a post-graduate diploma in Sustainable Management from Indian Institute of Management, Lucknow

Like the way we think?

Next time we post something new, we'll send it to your inbox