Published on November 15, 2019 by Ankita Mohanty

The world, in a quest to redeem itself from its old mistakes, is pinning its hopes on electric vehicles (EVs). The transportation sector has contributed significantly to CO2 emissions. While its share is reducing, it is still responsible for about 20% of global CO2 emissions. With EVs becoming viable, the world may solve a small part of its problems related to poisonous gases.

EVs have become popular not only because of the problem of CO2 emissions, but also due to the fact that internal combustion engine vehicles (ICEs) use fossil fuels, a finite energy source, whose prices have increased over the years. EVs are likely to render ICEs obsolete, saving the world substantial expense. We, therefore, believe the emergence of EVs opens up significant opportunities for stakeholders.

Market scope

The EV industry opens up a number of opportunities across the value chain for many developing and developed economies. Countries such as India and China, with their large markets, have welcomed automotive manufacturers and original equipment manufacturers (OEMs). China has become the world’s largest EV market, and India, committed to going completely green by 2030, is offering a number of incentives for manufacturers. Europe and the US already have well-developed EV markets that are seeing continued growth. The number of opportunities open apply not only to automotive manufacturers or investors but also to those involved in developing infrastructure and user-friendly software in the fields of navigation, automation, and smart utilities. Opportunities are also plentiful in the fields of battery recycling and manufacturing. We believe entrepreneurs and investors should ride this wave while costs are low and benefits are significant.

However, to capitalize on these opportunities, the EV industry needs to overcome a string of challenges, and to effect a paradigm shift in the market in terms of mass adoption, it would need to show the economic benefits of EVs.

Opportunities disguised as challenges

Given the amount of research and development (R&D) being conducted, the industry’s future in a few pioneering nations looks bright for the coming years, but how far it will reduce global pollution, the reason for its existence, remains to be seen. The success of EVs hinges on their popularity not only in developed nations but also in developing and underdeveloped nations, where the questions of pricing and infrastructure availability arise.

Lower battery prices key to achieving price parity with ICEs

The EV market is at a nascent stage, and research indicates that cost parity between EVs and ICEs will be achieved only by 2025. Car buyers generally do not consider CO2 emissions or the environmental impact of fossil fuels as the main factors influencing their decisions, but we believe that if cost parity is achieved, these factors will play a larger role.

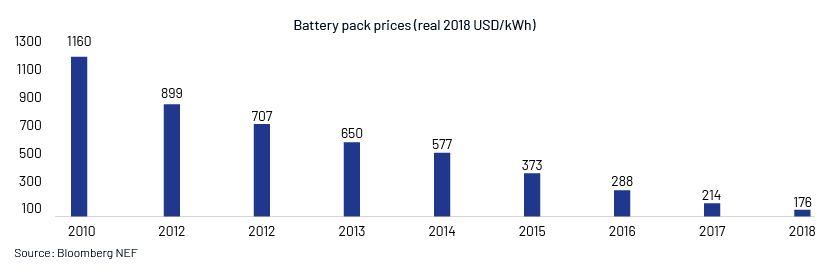

The main reason for this disparity is the cost of making an EV, versus that of making a conventional vehicle, with batteries accounting for the bulk of the cost. For EVs to succeed, the focus would have to be on R&D of battery technology, in terms of fast charging, recycling, and reducing cost so that they are affordable for middle-income groups. This focus on R&D is already set, and battery prices decreased by a significant 50% between 2014 and 2016. EV batteries cost around USD350/kWh in 2016, but Tesla cut their cost by USD100, reducing their price to USD250/kWh in the same year. The trend continued as more automotive manufacturers entered the EV market, and the average price fell to USD176/kWh in 2018. The graph below shows the results of a Bloomberg survey on EV battery prices.

Figure 1: Battery pack prices, 2010-18

We believe that if this trend continues, price parity could easily be achieved by 2025, with battery prices falling to USD100/kWh, making EVs attractive.

Improved infrastructure is critical for acceptance

Another major pain point restricting the acceptance of EVs is their limited driving range and the lack of adequate charging infrastructure. An EV, on average, can travel up to 100 miles on a single recharge, insufficient while traveling long distances. Even if the necessary charging facilities are in place, it takes time for a battery to recharge. Battery backup needs to increase to 200-250 miles, on average, to make EVs attractive, and charging time needs to be reduced considerably, without raising the prices of EVs.

A few models, such as Tesla’s Model S 85 and Tesla’s Model 3, can travel more than 250 miles on a single charge and require less charging time, but EVs are likely to become attractive to the mass market only when mid-range and low-end vehicles also offer the same benefits. We believe this opens up an excellent opportunity for existing EV manufacturers (such as Nissan, Ford, Honda, and Fiat) and newer entrants (such as Tata and Toyota) to overcome these hurdles and become leading manufacturers in the EV industry. It also opens the door for non-automotive companies such as ABB to provide the much-needed technology to reduce charging time considerably. ABB also installs and maintains charging infrastructure.

Government support is necessary for the long-term success of EVs

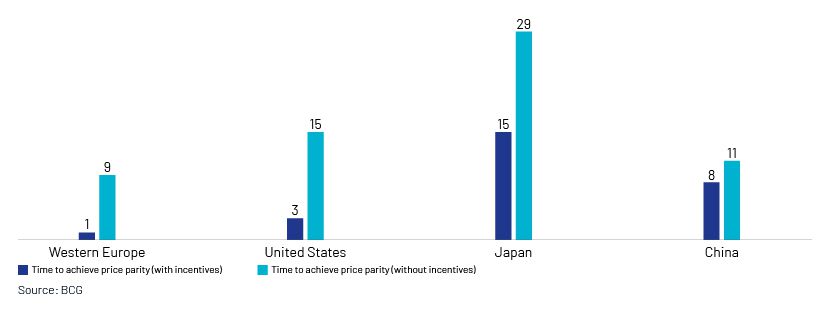

Government policies and incentives play a vital role in all industries, and the EV industry is no different. Tax incentives, for example, help companies achieve price parity with ICEs and could positively impact demand for EVs. Measures such as free battery-charging points, discounted toll charges, and charging facilities near workplaces would also further bolster demand for EVs. Europe is a classic example, with the governments of Sweden and Denmark providing tax rebates of up to 40% on EVs. Other European countries, such as the Netherlands and Norway, provide free parking and charging for EVs. EVs and ICEs in Europe are almost at price parity, indicating that favorable government policies are vital for growth of the EV industry. A study conducted by the Boston Consulting Group (BCG) suggests that with the help of state-sponsored incentives, buyers of EVs in Western markets could break even in one to five years.

Figure1: Time (in years) to achieve price parity between EVs and ICE vehicles

In Conclusion

To succeed in this new, changing environment, automotive manufactures, OEMs, and investors will need to have a 360° view of the regulatory policies, consumer sentiment, and competition in this field. This opens the door for consulting firms. Consulting firms that offer full-fledged research and analysis could become an essential part of the value chain, not just for new entrants but for established players as well. We have a strong understanding of the automotive and renewable-energy industries; this, combined with our in-depth research and analysis, enables us to offer one-stop solutions to help companies across the EV industry’s value chain understand the social, political, and economic landscape of both, the automobile and EV industries.

Sources

A Behind the Scenes Take on Lithium-ion Battery Prices

BU-1003: Electric Vehicle (EV)

50% DROP IN BATTERY PRICES IN 3 YEARS

A Behind the Scenes Take on Lithium-ion Battery Prices

Electric Car Price Tag Shrinks Along With Battery Cost

Electric Car Gold Rush: The Auto Industry Charges Into China

Denmark is killing Tesla and other electric cars

What's your view?

About the Author

Ankita Mohanty has over four years of experience in secondary research, database management, report writing, company profiling and data analysis. At Acuity, she works for a client in the mining and metals industry, with special focus on analyzing ‘iron ore’ as a commodity across CIS countries, Middle East and China. Prior to Acuity, she worked with Universal Data Solution, SNP Infra Research and Infoedge India Ltd. Ankita is a B. Tech from Biju Patnaik University.

Comments

24-Nov-2019 02:30:35 am

Great work Ankita... Congratulations! Can you please make me understand how battery pack prices are calculated, USD 176/unit is high. How many km/unit a normal ev car can run? Thanks!

Like the way we think?

Next time we post something new, we'll send it to your inbox