Published on February 16, 2023 by Rajeev Sinha

We constantly hear of themes and trends in sustainable investing, including talk of unprecedented traction within the ESG investing space. Do experts and practitioners within the financial services space actually need to assess whether this is a reality or just a carefully constructed narrative?

“Without data, you’re just another person with an opinion,” said W Edwards Deming, so let’s check global ESG investing statistics

Global ESG investing – in numbers and spirit

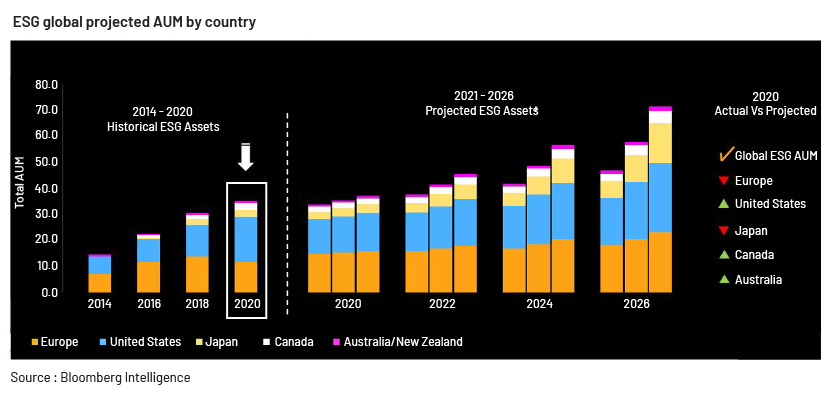

“Environmental, social and governance (ESG) assets are on track to exceed USD50tn by 2025, representing more than a third of the projected USD140.5tn in total global assets under management,” according to a recent report from Bloomberg Intelligence. It also noted that “the world is on track to have a USD1tn ESG ETF market and an USD11tn ESG debt market by 2025. Both ESG ETF and ESG debt would drive growth in ESG investing strategies.”

Experts at Bloomberg Intelligence (BI) state that the pandemic and the global race to net zero carbon emissions were the key drivers that put ESG criteria into orbit – from niche to mainstream to mandatory. It appears that ESG investing has fundamentally reshaped the financial sector, primarily because of enhanced scrutiny by regulatory authorities, markets being more sensitive to ESG-related developments and asset owners (including pension funds, endowments and foundations) considering ESG as key criteria when appointing managers across asset classes.

BI’s report also stated that this exceptional growth is here to stay, as it is “primarily driven by corporates, development projects and central banks focused on the pandemic and green-recovery efforts, and above all, the global push to attain net zero”.

Demand for ESG-focused investment opportunities has outpaced supply

Although global demand for ESG-themed investment products has increased rapidly, many investors still struggle to find relevant investment opportunities that align with their requirements and priorities. Most institutional investors believe investment managers need to do more when it comes to developing new ESG-focused investment products, according to a recent survey by PwC. On the other hand, less than half of the managers surveyed mentioned they are still contemplating launching new ESG-focused investment products. An immediate priority for some of these managers has been to convert existing investment products into ESG ones, leading to demand for ESG-focused investment opportunities surpassing supply.

<Growing need for simplified regulation and transparency on ESG products

Regulations need to be simplified and made consistent to ensure continued and sustainable growth in ESG products, according to leading industry reports. In addition, data used for screening ESG opportunities needs to be transparent and more authentic. A lack of consistent and transparent standards recently has led to instances of regular investment products being labelled ESG, an industry-wide issue within the asset and wealth management space; this is less than ideal on a number of levels.

What could this mean for providers of ESG data, research and analytics?

To start with, this may mean unprecedented demand for reliable and meaningful ESG data, research and analytics from users of data, such as asset and wealth managers, regulators, supranationals, governments and corporates.

We believe this could lead to a spike in sales and marketing activity at ESG data and analytics firms. To create compelling sales collateral, acquire new clients and defend existing business, sales support teams at these firms may see heightened engagement with key stakeholders such as relationship managers, and client service and product partners.

This expected increased level of engagement between sales support teams and the broader organisation would necessitate that ESG firms reimagine their operating models, including their staffing approach to RFP/DDQ operations. Some of the established ESG firms have already set up dedicated RFP and content management teams in global financial hotspots such as New York, London and Singapore over the past year. However, many still rely on their sales, service and product partners to respond to questionnaires on new business and client retention.

We believe that due to rapid growth in business at ESG firms, the current approach of engaging sales, client service and product managers to co-work on questionnaires on new business and client retention may soon become unsustainable. At some stage, these client-facing teams would not have the required bandwidth to engage with new and existing clients in a meaningful way.

How Acuity Knowledge Partners can help

Our Financial Marketing Services (FMS) vertical has more than 12 years of experience in supporting asset managers and other financial institutions with their requests for proposal (RFPs), requests for information (RFIs) and due diligence questionnaire (DDQ) requirements, both in a consultative and collaborative capacity.

Our class-leading RFP services support is backed by a senior layer of subject-matter experts who have spent significant time in the financial services domain responding to ESG-themed questionnaires for our asset management clients and have developed meaningful insights on new and emerging trends impacting the ESG and sustainability space.

Leveraging our more-than-decade-long experience, capital markets pedigree and deep financial-domain knowledge including the ESG space, we believe we are uniquely positioned to extend our proven RFP and content management support to ESG firms and help sales and marketing teams do more.

Sources:

Tags:

What's your view?

About the Author

Rajeev Sinha is part of the Fund Marketing Services practice at Acuity Knowledge Partners. In this role, he is primarily responsible for the management and oversight of dedicated RFP and DDQ teams that work with leading global asset management firms. Rajeev has over 10 years of sales-enablement experience. Prior to joining Acuity, he worked in various roles at J.P. Morgan, including those of a proposal writer and knowledge manager. Rajeev has also worked as an account manager for clients’ dedicated RFP teams at Genpact and Copal Amba. He started his career as a research analyst covering the private equity market at RR Donnelley. Rajeev holds..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox