Published on January 11, 2022 by Nihal Sinha and Arnab Banerjee

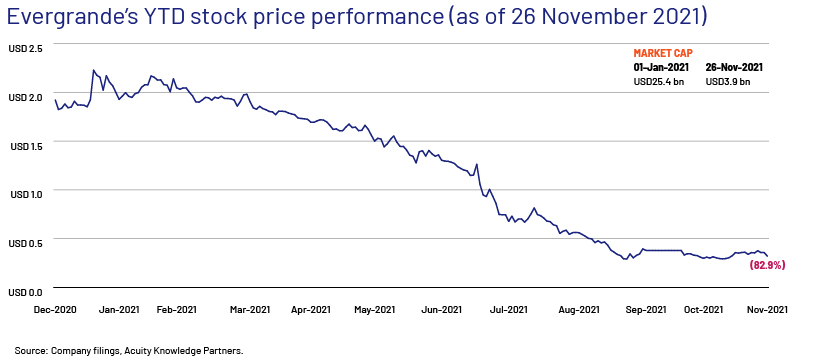

We believe this quotation aptly describes the situation of Chinese property giant Evergrande Group, which has been in the news recently not for its next big project but for its lack of liquidity and interest payment default.

Founded in 1996, Evergrande became the second-largest property developer in China by sales in 2020; it was once the largest real estate company in the world by total assets and the world’s highest-valued real estate brand. Now, however, it is also the world's most indebted real estate developer.

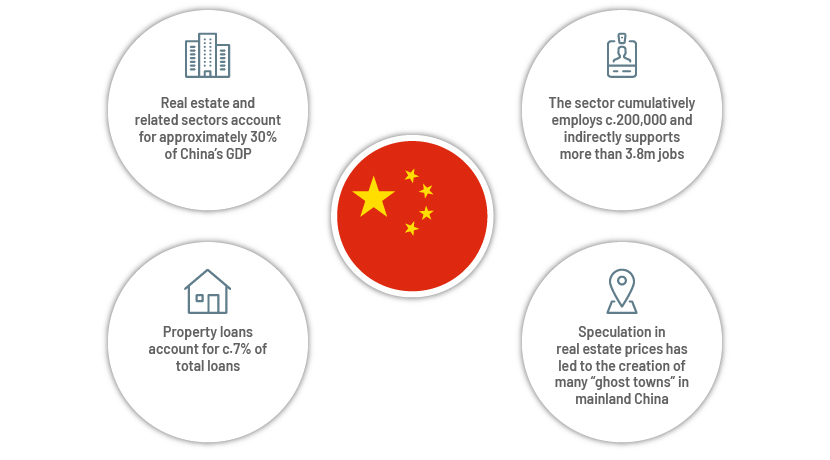

China’s real estate sector

Real estate price speculation has played a big role in China, overstating demand that results in excess supply. This is unsustainable, according to the law of demand and supply, and prices of properties should drop in the future. Moreover, with declining population growth, likely to accelerate in the coming decades, China’s housing demand could see sustained slow growth or decline.

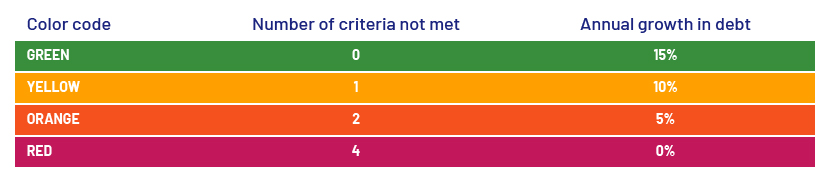

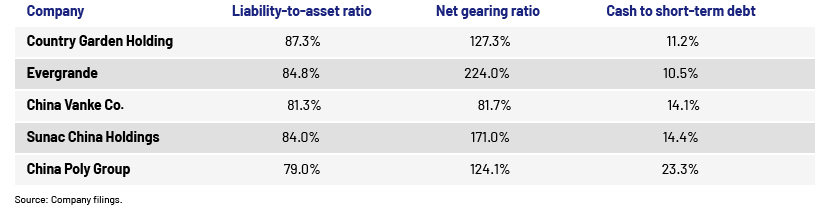

The three red lines

Aimed at deleveraging and improving the financial health of the real estate sector, the government introduced the “three red lines” in August 2020, the final blow to Evergrande’s victory run in the real estate market. Future funding would depend on developers complying with the strict criteria detailed below:

If all criteria are met, a company would fall into the green zone, with allowed annual growth in debt of 15%. If one criterion is not met, the company would fall into the yellow zone, with allowed annual growth in debt of 10%. If two criteria are not met, the company would fall into the orange zone, with allowed annual growth in debt of 5%. If none of the criteria are met, the company would fall into the red zone, with allowed annual growth in debt of 0%.

According to S&P estimates, only 6.3% of its rated developers in China meet all three criteria. A “three red lines” analysis of China’s top real estate companies indicates that all top-five companies (by 2020 revenue) are in the “red” zone.

The Evergrande story

Evergrande made multiple attempts to recover but all failed. According to news reports, it has not been able to find buyers for parts of its electric-vehicle and property services businesses. It also failed at selling off its office tower in Hong Kong, which it purchased for about USD1.6bn in 2015. Its working capital is tied to inventory – mostly incomplete housing projects that were difficult to sell and averaged 3.5 years by 2020. It offered some of the properties to creditors at discounts of as much as 52%, according to Bloomberg, giving a sense of their true market value. The electric-vehicle unit sold shares at a deep discount.

Contagion effect

Evergrande has strategic collaborations with more than 860 well-known companies around the world, and its current situation is likely to affect these business operations. Global investor sentiment may also potentially be impacted if the situation cannot be contained. The cryptocurrency market could also be affected if investors feel the need to liquidate their crypto funds in the wake of this crisis.

All the big names – from Pimco to BlackRock – hold dollar bonds issued by Evergrande. Evergrande had liabilities with 128 banks in 2020. China and Hong Kong contribute significantly to HSBC’s and Standard Chartered Bank’s profits (Hong Kong and mainland China contributed around 84% of HSBC's profits, and Greater China and North Asia accounted for 81% of Standard Chartered Bank’s profits in 2020, according to a Reuters report). HSBC and Standard Chartered Bank are the foreign banks most involved in underwriting syndicated loans for Chinese developers and might experience a second-round impact. HSBC was involved in underwriting 39 outstanding syndicated loans for Chinese developers, and Standard Chartered Bank was involved in 18 deals; these could come under pressure if the wider property sector defaults. JP Morgan estimates a further 11 defaults worth some USD30bn this year across China’s high-yield property sector, translating into a 23% default rate.

This estimate is proving to be accurate, with Evergrande’s rival Fantasia Holdings Group Co. (Fantasia) missing a payment as of 5 October 2021. Fantasia’s stock fell by as much as 52% in Hong Kong following a six-week halt after its surprise default. In October, Chinese firms Fantasia Holdings, Sinic Holdings and China Properties all defaulted on offshore notes. The public USD bond market has been tapped by Chinese real-estate companies for USD274bn in the past five years. This means foreign banks with exposure could lose out on fees if such deals dwindle. It is also worth noting that some USD20bn of Evergrande's debt is owed offshore.

Risk of a more severe crisis

The larger Chinese lenders are state-owned companies, meaning they have significant exposure to the real estate sector as a whole, and if the sector fails to adhere to the requirements, it could trigger a much larger default across the system. Overall sector indicators are not very positive. For instance, according to Bloomberg, Chinese developer Sunac China Holdings has sought “special policy support” from authorities in eastern Shaoxing because operations in the city have become difficult. Thousands of households have made high-yield investments in the sector and are, therefore, at risk of being significantly impacted by this crisis.

What are the chances that the next big crisis can still be avoided?

President Xi Jinping’s likely third term in power is to commence next year; this means it could be politically damaging if his government mismanages the situation and the Evergrande story worsens. The larger Chinese lenders are state-owned companies, as mentioned earlier, and the government could defuse the shock from the Evergrande crisis with their support; but the crisis is unlikely to be eliminated completely. Moreover, China strictly controls the movement of money across its borders, so Chinese and global investors cannot expect to make a sudden exit if they get worried. The People's Bank of China injecting cash into the financial system after 20 September this year helped boost liquidity in the short term and could temporarily ease the concern. In addition, Evergrande met a significant deadline on 10 November for USD148m in coupon payments for bonds due 2022 and 2023.

Conclusion

If Beijing intervenes, supported by the policies in place in mainland China, Evergrande could be saved or the crisis delayed. However, if most real-estate companies in the sector fail to meet the “three red lines” criteria against the backdrop of falling housing demand and declining population growth (demand for residential property in China is entering a phase of sustained decline) and start defaulting, state-owned banks and other foreign institutions with large exposure to the sector would suffer. The defaults could potentially burst the bubble and lead to a grave crisis, although how big a crisis only time would tell.

How Acuity Knowledge Partners can help

We assist investment banks in all stages of investment and with M&A opportunities and financing and public offering advisory. Our strong team of subject-matter experts support a number of bulge-bracket investment banks and boutique investment banking advisory firms across the world. Our Investment Banking team has considerable experience in providing M&A, equity capital market (ECM), debt capital market (DCM) and analytics solutions to clients.

Sources:

https://www.evergrande.com/ir/en/corpinfo.asp

https://www.statista.com/statistics/286277/leading-real-estate-companies-in-china-by-sales-revenue/

https://www.bbc.com/news/business-58579833

https://in.investing.com/news/evergrande-jumps-even-as-its-fate-remains-uncertain-2898349

https://www.ft.com/content/297beae8-7243-4d93-9fac-09e515e82972

https://www.statista.com/statistics/270439/chinas-share-of-global-gross-domestic-product-gdp/

https://www.foxbusiness.com/markets/stock-futures-slide-evergrande-misses-payment

https://www.foxbusiness.com/markets/stock-futures-slide-evergrande-misses-payment

https://indianexpress.com/article/explained/quixplained-china-evergrande-crisis-7532688/

Tags:

What's your view?

About the Authors

Nihal Sinha has joined Acuity in 2020 as an Analyst. Prior to joining Acuity, Nihal worked as an Intern at London Stock Exchange Group

Nihal holds a P.G.D.M (major in Finance & minor in Analytics) from Jagdish Sheth School of Management, Bangalore, India

Arnab Banerjee has ten years of experience in investment banking and equity research. In his current role, he supports a mid-market investment bank based out of the US. Arnab has expertise in areas including M&A, equity capital markets (ECM) and debt capital markets (DCM) and plays an active role in the development and training of team members. Prior to joining Acuity, he worked as Equity Research Analyst at Guggenheim Partners. Arnab holds a Master of Business Administration in Finance from ICFAI Business School, Hyderabad, India.

Like the way we think?

Next time we post something new, we'll send it to your inbox