Published on March 31, 2023 by Sridhar Shivaram

The bank run that resulted in the collapse of Silicon Valley Bank (SVB) derailed the US financial system. SVB, the Santa Clara, California-based bank that served the tech sector, was the largest US-based lender to fail since the 2008 global financial crisis and the second biggest to fail ever. While the regulatory authorities and lenders of last resort have announced that the nation will guarantee all SVB’s deposit payments, its downfall has unnerved other banks’ customers, denting confidence in other financial institutions as well.

The collapse: what happened at SVB?

Incorporated in 1983, Silicon Valley Bank catered to tech firms, providing funding/venture capital (VC) to early-stage startups that the usual lenders would not support. SVB was a funding machine to nearly half of the US’s venture-backed technology and healthcare entities that have gone public over the past two years.

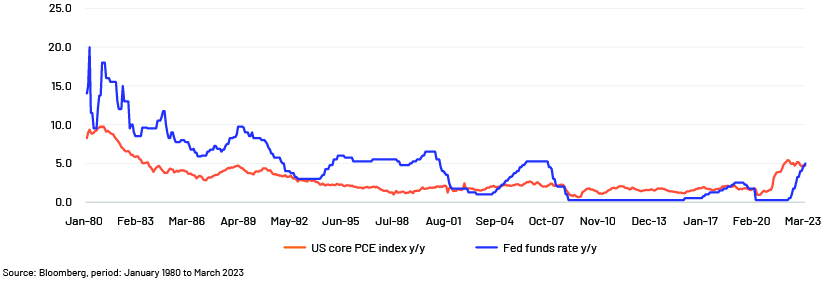

On 10 March 2023, the Federal Deposit Insurance Corporation (FDIC) decided to take charge of SVB, after the banker had attempted to offload reserve assets. The collapse has been defined as the most prominent casualty of the Federal Reserve’s (Fed’s) tightening cycle aimed at curbing inflation. As interest rates surged, not only in the US but across the globe, tech startups had already begun to play safe by withdrawing deposited funds to cushion their working-capital needs. Many of these early-stage entities were not forced into staying with SVB, but the banker demonstrated it was in their best interests to remain in business by backing the CEOs of these startups with attractive personal loans and mortgages.

SVB failed to estimate the size and duration of deposits, the main error that directly impacted its business model, a model that was not well diversified and focused mainly on the VC community. On the deposit side, the bank had grown from USD62bn to USD189bn from 2019 to 2021 as the VC sector was in the limelight and booming amid zero rates, government stimulus to keep the financial system strong on the liquidity front and the strong speculative valuations of many startups. Since a large chunk of their deposits was with early-stage loss-making companies, deposits from existing companies started to reduce, but this was usually offset by a new batch of companies coming on board. However, banking activity was sharply curtailed at the start of 2022 owing to higher interest rates or the hawkish mindset of central banks, and deposit outflows started to accelerate around a run rate of 20% annualised from 2H22. SVB’s management did not expect the rapid drop in deposits that accelerated into 2023.

Fifty percent of the venture-backed companies in the US had their money in SVB. Amid the turmoil, the bank could not find more depositors to help run its business, so it bought mortgage-backed securities (MBS), an asset class that banks explore when they do not have enough sources to lend them money or attract deposits from. MBS are products akin to bonds and consist of home loans bundled together and other real estate debt obligations bought from banks that issue them. Investors in this asset class receive periodic payments similar to bond coupon payments. Simply put, investors who buy MBS are basically lending money to home buyers. As evident in the subprime mortgage crisis of 2007-08, an MBS is only as sound as the mortgages that back it. An MBS may be a mortgage-related security or a mortgage pass-through. MBS are volatile assets, whereas deposits are fixed obligations for the bank.

SVB’s deposits were primarily non-FDIC-insured and commercial, which is why it could not afford to lose depositor confidence. On 8 March 2023, management planned to restructure its securities and raise USD2.25bn in capital to cover the loss from offloading USD26bn in debentures, a part of its available-for-sale portfolio. Investors were perplexed as to why the entity planned to sell the securities, since management had been stating they had alternate sources of liquidity.

Management could not sufficiently explain why capital of USD2.25bn was being raised. This could not be justified by the need to face uncertainty or pressure on net interest margins and potential credit losses as their loan customers found it more difficult to survive in a higher-interest-rate environment. However, the bank disclosed that deposit outflows were persistent and unlikely to end soon. This led investors to another concern – whether the bank would have to offload other securities in its portfolio, part of the held-to-maturity category, at even bigger losses. Amid this turmoil, the bank’s stock price plummeted about 60%, way more than estimated (15-20%) by the bank and underwriters. VC firms advised the companies to exit their deposits immediately, resulting in a run on the bank that forced the FDIC to step in.

SVB’s situation spilled over to the US financial sector. Its problems coincided with those of Silvergate Capital Corp., and the twin shockwaves had a ripple effect on the banking sector, pushing stocks down further.

The banks have still not learnt lessons from the 2008 financial crisis. SVB may have avoided this situation if it had maintained proper liquidity standards by holding more cash and short-term securities instead of keeping its investment portfolio made up mostly of longer-tenor bonds at low rates.

Fed not diverted by SVB imploding, easing fear of contagion

To protect the US economy, the Fed decided to provide aid to all depositors, announcing it would make additional funding available to depository institutions to ensure the banks affected have the liquidity support needed to pay off and meet the needs of all depositors. In its effort to support businesses and households, the board announced on 12 March that it would support the victims of the financial calamity. The additional funding would be made available via a new bank term funding programme (BTFP), providing loans with a duration of up to one year to banks, credit unions, savings associations and other eligible depository institutions, pledging Treasuries, agency borrowings and MBS, and other qualifying assets as collateral. The assets will be valued at par. The BTFP will be an additional source of liquidity against high-quality securities, eliminating an institution's need to quickly sell those securities at times of stress. With approval of the Treasury Secretary, the department will provide up to USD25bn from the Exchange Stabilization Fund as a foundation for the BTFP.

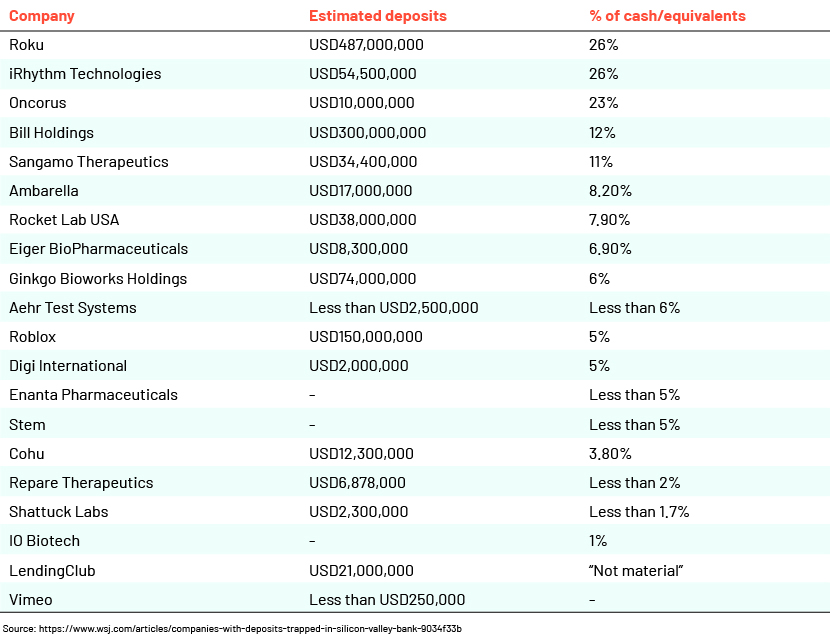

When SVB collapsed following a run on deposits, many of its customers required compensation. Stocks of Roku Inc., a US-based manufacturer of hardware digital media players, fell sharply on 10 March after its disclosure that approximately USD487m, or 26% of its USD1.9bn cash position, was held at SVB. Those funds were locked in when the bank failed, but the company’s concerns were eased by the Fed announcing the following Sunday that it would make whole SVB’s uninsured depositors.

The major question now is whether this move would derail the Fed’s aggressive tightening since March 2022 that aims to bring inflation back to the original 2% target.

The Fed’s tightening cycle has so far not been good enough for issuers in the fixed income markets or the overall economy. Sustained resistance b the labour market and household consumption has triggered expectations of a deep recession, prolonging inflationary pressures. Fed Chair Powell’s latest comments and interest rate regime have upped the tightening game, likely to further alter market expectations across asset classes.

Powell admitted that inflation is a major concern and far more complicated than what the markets and the governor himself had been factoring in. Market participants’ approach to “being more informed than the Fed” has been seasoned by the pre-pandemic lessons, specifically those of 2019, when the Fed had to derail the rate-hiking cycle following market perceptions; this was eventually readjusted to an opposite reality.

The reality now that the terminal rate could be far higher than the levels expected earlier, given the data releases, confirms the January 2023 theme that “markets are premature in pricing in the Fed’s leniency”; the rate could be much higher than 4.3% estimated two months ago. The latest FOMC projections held on to the dot plot of 5.2% and an average of 5.1%, unlike the counterparts, i.e., the riskier assets still believe the Fed will eventually relent. Powell’s latest statements clearly indicate that history cautions against premature loosening and that the Fed will stay on course until inflation is reined in.

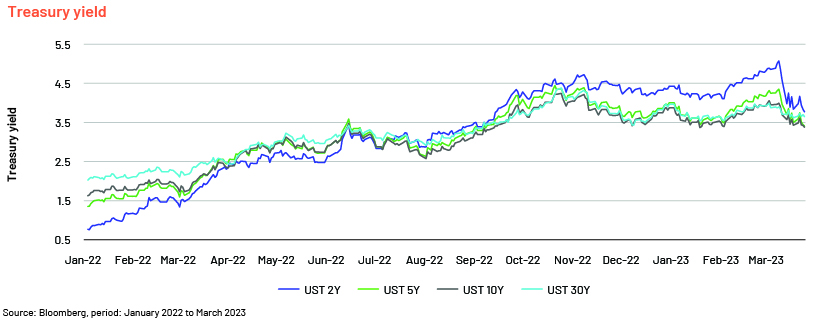

The Fed began its tightening cycle in March 2022. It has since has raised rates by 450 basis points (bps), taking the terminal rate to 4.50-4.75%, with the latest meeting in February effecting a 25bps hike. This marked the Fed’s eighth consecutive rate hike, bringing the rate much deeper into restrictive territory, which the markets also believe is above 3%. The Fed reiterated it will not be changing its plan to reduce the size of its balance sheet (this was first disclosed in May 2022). As a function of this, rates have risen rapidly across the economy, although with a lag. While the labour market remains tight, other parts of the economy have begun to slow, further opening the way to a recession.

Fed officials indicated at the 22-23 March meeting that combatting inflation may necessitate just one more rate hike this year but less easing in 2024 than most thought appropriate just three months ago. They raised the rate by 25bps, as widely priced in by the markets, bringing the terminal rate to 4.75%-5.00%, the second straight hike of this size following the 50bps increase in December and the four consecutive 75bps hikes before that. A dot plot of the forecasts depicts a 5.1% median estimate for year-end 2023, stable since the last update in December, while projections for 2024 rise to 4.3% from 4.1%. Chair Powell specifically clarified that the US banking system is “sound and resilient”, but the recent turmoil is likely to result in tighter credit situations for businesses and households, creating further problems for economic activity. He removed references to inflation having cooled, reiterating that it “remains elevated”. On the statements front, the FOMC continues with the pace of balance-sheet runoff, also referred to as quantitative tightening, maintaining the monthly caps of USD60bn for Treasuries and USD35bn for MBS.

However, based on the recent events in the financial sector, we could see the Fed’s tightening cycle and the current interest rate regime being side-tracked. This could have positive and negative implications on the market. A positive implication is that the rate-hiking cycle could slow significantly or pause, with the Fed focusing on providing liquidity to aid the financial sector, giving fixed income issuers an opportunity to raise funds across tenors at cheaper rates. A negative implication is that the Fed’s path towards reining in inflation may be suspended. This may have a long-term impact on the economy, as the Fed might get back on track with its tightening cycle and raise rates with possibly larger margins. Despite the widespread market volatility due to the recent turmoil in the banking sector, inflation remains well above the Fed’s 2% target, particularly in the most troubled service sector, with the macroeconomic situation also remaining stagnant. Market participants believe this suggests the Fed may not suspend its tightening cycle in its effort to maintain price and financial stability. The inflation print for February shows core consumer prices accelerating to 0.5% over the month, while retail sales rose 0.5%, depicting underlying strength in the economic data.

The committee also reiterated that the recent turmoil in the banking sector would tighten credit conditions. Since the degree and extent of this is uncertain, future policy decisions are deemed to be data-dependent. The monetary authority’s median forecast of the terminal rate for year-end 2023 remains unchanged, implying room for another 25bps rate hike this year. Powell also stated that no rate cuts are likely this year as inflation remains hot and the labour market tight.

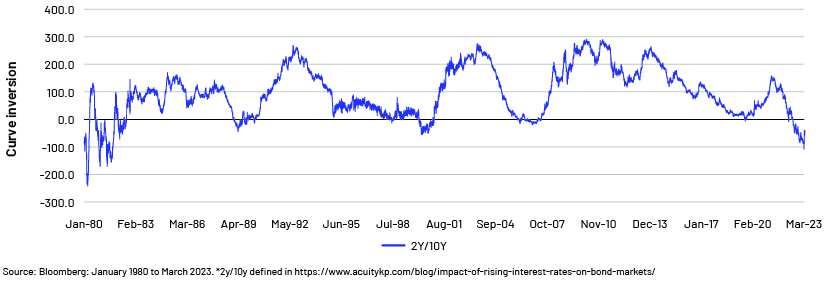

Considering all factors, the markets expect a recession in 2Q23; the prediction indicator (also known as the 2y-10y inverted curve*) first materialised a year ago and has stayed inverted since 5 July 2022, reaching levels last seen in the Volcker era in the 1980s (c.-109bps). The tightening credit conditions could deepen, generating slack in the labour market, gradually cooling core PCE inflation.

Markets are sceptical about the FOMC’s estimates over the past 15 months, but feel the authority is becoming realistic. Tightening remains key to curbing high inflation, but some of the Fed’s task will be performed by the tightening credit conditions amid the turmoil in the US banking system, paving the way for a recession. The current inflation number is far too entrenched to warrant rate cuts over the coming 12 months. More monetary concerns are likely to emerge, with easing unlikely before 2Q24 despite the possible recession.

The turmoil in the banking sector has mildly altered the Fed’s mindset towards policy decisions, but the inflation fight is yet to be won. At the March 2023 meeting, the Fed clearly pencilled in a rate hike and stated that the US banking system remains resilient and sound, with strong capital and liquidity. Its ultimate goal is to curb inflation amid the ongoing turmoil. It provided support to the stressed banks in a timely manner and will continue to do so, as required.

What is clear from the Fed’s latest meeting is that the banking crisis has not reduced inflationary pressure. The inflation trajectory has in fact been scaled higher. However, the Fed’s hawkishness seems scaled down somewhat, indicated by the absence of guidance for rates higher than the 5.1% terminal rate. Given the uncertainty surrounding the actual impact of the crisis on bank lending conditions, if financial conditions do not tighten enough, the Fed may pull back even this slight easing.

What does this imply for the capital markets?

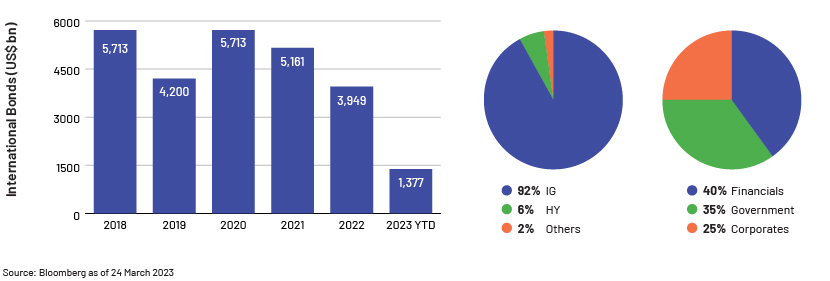

Markets have enjoyed strong tailwinds since the global financial crisis in 2007-08. Interest rates have remained low, valuations have continued to rise and credit availability has remained high for almost two decades. Even in 2020, after activity halted briefly during the early months of the pandemic, markets came to life in the second half. In almost every aspect, 2021 was a defining and exceptional year for fixed income markets but not a trend breaker. Markets continued to rally, flooded with ample liquidity provided by the central banks.

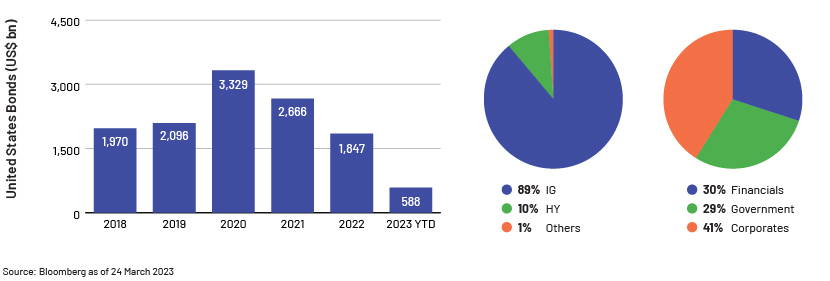

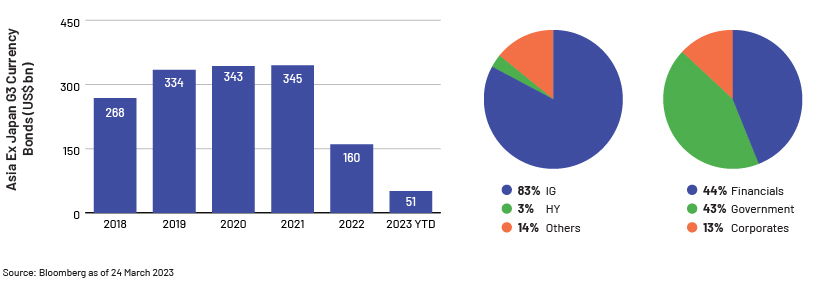

The monetary authorities started to rein in inflation in 1H22 by sharply raising rates, nearly matching the record pace in 2021 and pausing markets. The mood was disturbed in early summer. Banks began to pull back, unwilling or unable to lend. Deal volumes across major markets, namely international dollar, US Corporate Bonds and Asia Ex-Japan G3 (USD, EUR and JPY), plummeted, performance declined and valuations were dampened sharply across certain sectors.

The year 2022 did not attract issuance volumes on the primary-market front, but liability management transactions became a key theme for the period, providing the issuers with an opportunity to tap troubled markets so as to optimise their capital structure, benefit from restructurin their debt maturity profiles and make their investors confident they were rich in liquidity, enabling them to early redeem debt obligations.

Liability management transactions are techniques and procedures used by capital market issuers with the objective of buying back, altering the terms of their outstanding debt or debt management in their balance sheet. These techniques include tender offers (fixed-price method or modified Dutch auction method) made by an issuer to purchase all or a portion of the outstanding bonds from investors for cash. There are also exchange offers, where an issuer decides to repurchase the outstanding bonds in exchange for new bonds with different terms/covenants, and consent solicitation – a proposal to amend the terms of an existing debt or open-market repurchases, typically based on private negotiations. Some issuers also make use of opportunities where these techniques can be combined in order to maximise the success of the exercise. This is mainly to achieve deleveraging efficiency, defer near-term maturities, avoid stress covenant testing and avoid high redemption costs on “out-of-the-money” convertible bonds.

At the start of 2023, sovereigns and financials tried to contribute to the volumes and bring back the momentum, backed by strong order books and investor participation in certain paper. Longer-dated tenors regained investor attention amid the volatility in Treasuries. The early move in the markets showed how issuers engaged primarily in borrowing and lending, and capex-driven and project financing adapt to the interest rate regime to survive.

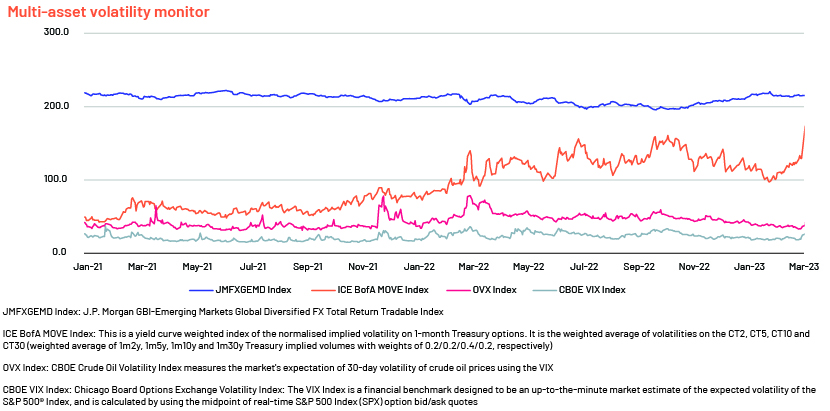

SVB’s collapse sent jitters across major asset classes in the financial markets. The major US banks index fell by c.18% in the seven trading sessions before 13 March 2023, while smaller regional banks plummeted by c.25%. With investors panicking, bank share prices started falling sharply across regions. Broader equity indices were relatively resilient, with the S&P 500 index falling by close to 8% from its peak in February and erasing all its gains year to date, although still leading the market at up by 8% from the lows in October 2022.

On the rates side, the 10-year Treasury yield moved from almost 4% to 3.5% in three days while the policy-sensitive two-year note fell over 100bps from 5.0% to just below the 4% mark as expectations for the Fed’s terminal rate shifted substantially. With the prevalent market behaviour, participants priced in a lower terminal rate and early rate cuts, with 4% at year-end 2023 against consensus of 5.5% only days earlier.

What lies ahead

The Fed’s move is consistent with what markets priced in earlier, indicating that the extent of ring-fencing of troubled banks and the safety nets for access to liquidity would be enough to continue to focus on fighting inflation. The Summary of Economic Projections (SEP) signals another rate hike. Higher rates for longer dovetails with market expectations of no consideration of rate cuts until 2Q24.

Markets are in a trap amid one of the biggest monetary policy tightening cycles in history; it is unavoidable that this brings heightened challenges for the economy in general, with considerable grief specifically for those who remain highly leveraged. Markets will face headwinds and a slew of challenges for some time. The risk of recession is real and has been heightened by recent events across the globe. The good news is that markets are almost over the peak in inflation and both core and headline prints are likely to rebound sharply in 2023. Interest rates are volatile but closer to the peak and before too long, this will likely read through to rate cuts and a recovery in economic activity by 2024. With the spike in volatility and heightened uncertainty in early to mid-March 2023, it is prudent to let things cool down in the immediate short term. The much better valuations seen in government debt securities in 2022 and early 2023 have been partially reversed, while equity markets/riskier assets have proved to be sound and resilient. Therefore, markets are somewhat content to hold on to cash and liquid instruments while waiting for opportunities in longer-duration paper and equities amid weakness.

How Acuity Knowledge Partners can help

We are a leading provider of high-value research, analytics and business intelligence to the financial services sector. We support over 400 financial institutions and consulting companies through our specialist workforce of more than 5,200+ analysts and delivery experts across our global delivery network. We provide bespoke support to capital markets (CM) teams of investment banks and advisory firms across the world through a wide range of solutions for corporate CM, financial institutions group (FIG) CM, sovereign, supranationals and agencies (SSA) CM and sustainable CM teams. Our team of CM experts regularly track macroeconomic factors affecting the markets and provide end-to-end support, from deal origination to execution, including the most intricate financial analysis and after-market support. The CM team also provides assistance with covenant analysis on different types of debt products by actively monitoring and capturing the covenants being incorporated by issuers in the offering circular, interpreting the ultimate purpose of the investments and how far they will benefit investors, and helping issuers raise funds.

Sources:

-

https://www.acuitykp.com/blog/impact-of-rising-interest-rates-on-bond-markets/

-

https://momentum.co.uk/media/8265/silicon-valley-bank-collapse_march-2023.pdf

-

https://www.shipemd.com/assets/files/4n/ship_investment_notes_bank_4751-003.pdf

-

https://www.newyorkfed.org/medialibrary/media/research/staff_reports/sr957.pdf

-

https://www.ocbc.com/iwov-resources/sg/ocbc/gbc/pdf/fx%20outlook/20ncident.pdf

Tags:

What's your view?

About the Author

Sridhar has been working with Acuity’s Global Capital Markets (GCM) team for over 4 years. He is currently supporting the GCM team of a major European investment bank and has demonstrated his proficiency in comprehending the Investment Grade and High Yield bond markets across the United States, Asia and EMEA. Prior to joining Acuity, Sridhar was working with an Indian mid-size investment bank where he was responsible for providing assistance to Investment Advisory and DCM Origination and Sales teams in their fund raising initiatives. Sridhar holds a Post Graduate Diploma in Management, specializing in Finance from New Delhi Institute of Management. He is also passionate about the equity markets,..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox