Published on February 14, 2023 by Shubha Kamath

The ESG market was set for a great start to 2022, with high expectations of crossing the highs in 2021. The Russia-Ukraine war changed the outlook and pushed up energy prices. This caused volatility in the market amid record-high inflation, which governments tried to cool through interest rate hikes. ESG bonds, like the rest of the bond market, felt the heat of high borrowing costs. However, ESG bonds were well placed and fell modestly compared to the other debt classes. Amid slower interest rate hikes and inflation subsidies in the US, ESG bonds are set to recover in 2023.

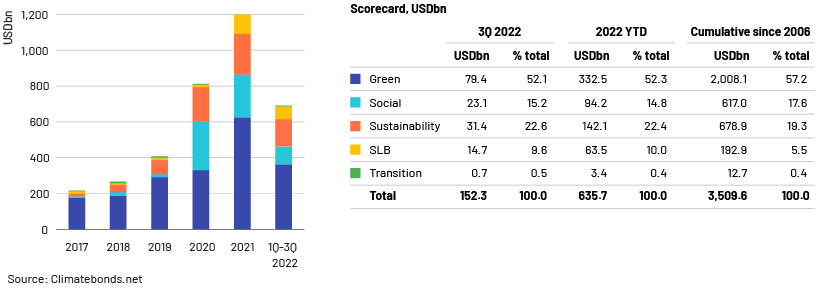

ESG financing has become a large part of capital markets and gained momentum in the past two to three years to become a USD3,510bn market.

Geopolitical and macroeconomic factors have contributed to a drop in debt issuance across the board. Green, social, sustainability, sustainability-linked (SLB) and transition (GSS+) bond volumes reached USD152bn in 3Q 2022, a decline of 35% compared to 2Q 2022 and a decline of 45% compared to 3Q 2021. The volume of green bonds, which accounted for more than 52% of all deals, fell a modest 13% year on year. Major issuance was in Europe, the Middle East and Africa (EMEA), with Germany adding 18%, followed by the Americas and Asia Pacific adding 11%. Year-to-date volumes of GSS+ debt had reached USD635bn by the end of 3Q 2022.

Green bonds saw the most activity among ESG products, due to their established framework. Green bonds are also said to benefit issuers and lenders financially. On the supply end, a recent study conducted by the Climate Bonds Initiative revealed that issuers enjoy a pricing benefit, which means a bond is issued at a higher price than a vanilla bond. “Greenium”, a new concept, refers to a premium paid on green bonds. This does not signify a loss for investors, as it was proved that the premium paid to issuers was recovered in the secondary market, with the bid-offer spread being tighter than that for vanilla bonds.

With the ESG debt market on the rise, concerns around quality and greenwashing have increased. The number of ESG-related regulations is increasing, to avoid greenwashing and regulate the use of proceeds. This resulted in the US Executive Order on Supply Chains, the Digital Operational Resilience Act (DORA), New York State’s Proposed Guidance and the EU Supply Chain Act. The Biden administration aims to start ESG investment and deploy clean energy, as announced through the Inflation Reduction Act. This may call for further regulations and debt restructuring.

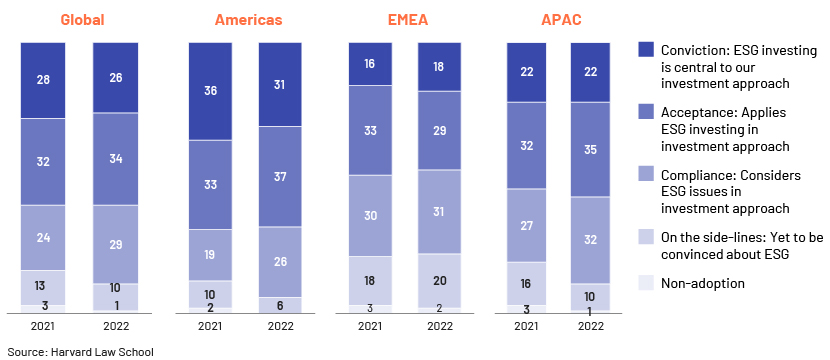

Demand, combined with regulatory pressure for countries to achieve sustainability goals, has resulted in in integrating ESG factors in the investment process. The number of non-users of ESG factors in the investment approach has dropped significantly globally.

The energy crisis, driven by the Russia-Ukraine war, revealed the high dependence of economies on Russian fossil fuels. Europe imported 45% of its gas, 44% of its coal and 25% of its oil from Russia. The crisis has called for transitioning from fossil fuel to renewable energy, which also helps meet sustainability goals. The EU’s REPowerEU proposal outlines sourcing 45% of its energy mix from renewables and increasing efficiency in existing channels to save 13% of energy consumption. In the US, the Biden administration passed the landmark Inflation Reduction Act that allocates USD369bn towards clean energy, decarbonisation and clean energy tax credits. It aims to reduce carbon emissions by up to 40% by 2030.

Amid the crisis, countries continue to build fossil fuel reserves, which in the long run are not a sustainable source. They are simultaneously investing in renewable energy projects that will take a while to commence operations. Renewable energy, previously believed to be expensive, is getting cheaper with technological advancements. In the global power sector alone, quarterly green deals increased by 3% in 3Q 2022. Utilities would become the centre of focus, inviting large investments in power-generation assets and grid upgrades.

The technology sector is the most carbon-intensive, according to the UN, and accounts for 2-3% of global emissions. Data centres use approximately 900 terawatts or 6% of global energy a year. This has alarmed governments and regulators that aim to achieve carbon-neutral goals. End-user devices and peripherals contribute to these emissions. There is growing demand to enhance technology, gain operational efficiency and comply with regulations. Operational efficiency, together with sustainability, could be advantageous in terms of cost saving, financial sustainability and meeting environmental regulations. Leveraging the public cloud instead of using data centres could save up to 80% of energy used. Efforts are underway to make more energy-efficient equipment and reduce the carbon footprint of the supply chain. Digitalisation and optimising user devices and data centres could be a meaningful shift. Together with concerns relating carbon emissions, the need for reliable data sources to measure and monitor carbon footprint is pushing ESG investments.

Amid the volatility and stock prices tumbling in 2022, private equity firms continued to invest in the technology space. These have accumulated large amounts of dry powder and could take the lead in accelerating sustainable deals.

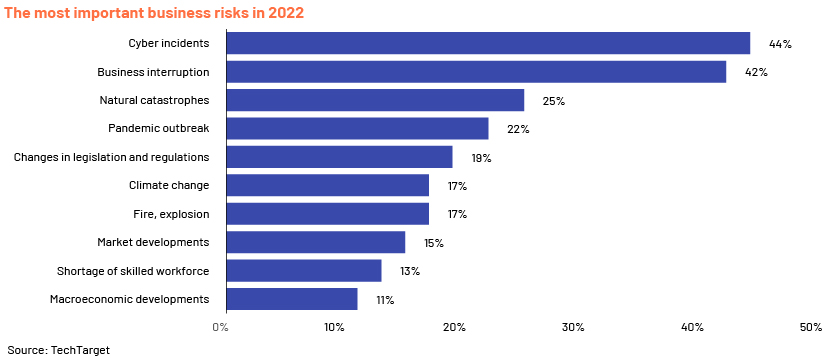

The business risks faced in 2022 prompted ESG investing and a shift in capital to green assets to minimise these risks. Investors and deal makers have realised the impact of sustainable finance and green deals in their flight to quality. Recent trends have also proved how strategies on the ground have moved from traditional investing to more thematic investing. Business disruptions and climate change-related issues accounted for more than 50% of the business risks in 2022. The energy crisis, supply-chain disruptions, climate actions and government’s sustainability related goals would prompt the technology and utilities sectors to grow towards a greener future. Private equity firms may consider investing in sustainable and profitable investments, as green deals create more long-term value and provide higher organic returns. The outlook for sustainable finance deals appears to be positive, although it will likely be a gradual process.

How Acuity Knowledge Partners can help

We help clients expedite the process of data analysis and quality control of ESG bond indices. We apply our technical expertise to create automated templates, generate reports, conduct quality analysis, assess ESG exposure and research issuers using data vendors such as Refinitiv Eikon and Sustainalytics data.

Sources:

https://www.spglobal.com/en/research-insights/articles/daily-update-december-5-2022

https://www.marketsmedia.com/kfw-issues-first-digital-bond-via-clearstreams-d7/

https://viewpoint.pwc.com/dt/gx/en/pwc/esg/external/esg-external.html

ESG Brings Opportunity For Finance (forbes.com)

Tags:

What's your view?

About the Author

Shubha Kamath has over 6+ years of experience working across different value chain in the Investment Banking domain. Currently, supports Consumer and retail team for a U.S. based mid-market Investment Bank, in Bangalore. She has good exposure working through the deal life cycle, including deal origination to deal execution. She has experience working on different pitchbooks, evaluating business dynamics and CIMs. She has extensive knowledge in financial modelling and capital structure analysis. Prior to joining Acuity, she was part of sell side research team of Crisil Ltd. She holds a Master’s degree in Business Administration in Finance.

Like the way we think?

Next time we post something new, we'll send it to your inbox