Published on September 20, 2023 by Sachith Vijayaraghavan and Gautam Prakash Singh

Introduction

With the implementation of the Markets in Crypto Assets (MiCA) regulation, the European Union (EU) took a big step forward in the world of cryptocurrencies. The regulation is a first-of-its-kind initiative that intends to bring the cryptocurrency market under the control of financial authorities. It will ensure transparency, compliance and investor protection. This blog examines the main aspects of the regulation, its potential benefits and challenges, and how compliance can help businesses succeed in this evolving environment.

The MiCA regulation is a comprehensive framework created to control activities and services associated with crypto assets within the EU. It substitutes individual legislation from member nations with a set of guidelines, giving crypto-asset service providers and token issuers clarity and assurance.

The individual national regulatory agencies will be responsible for enforcing the law, and the European Banking Authority (EBA) and the European Securities and Markets Authority (ESMA) will have the authority to supervise and conduct investigations. The introduction of the MiCA regulation in 2024 would be a key step forward in determining the direction of cryptocurrency legislation.

Objectives and coverage

The regulation’s key objectives include consolidating regulations, setting clear rules for service providers and token issuers, and providing regulatory oversight where existing financial regulations fall short. It covers a broad range of crypto activities, including the issuance and trading of cryptocurrencies, and provision of custodial services and payment services using cryptocurrencies. It encompasses issuers of utility tokens, asset-referenced tokens and stablecoins, as well as service providers such as trading venues and crypto-asset wallets.

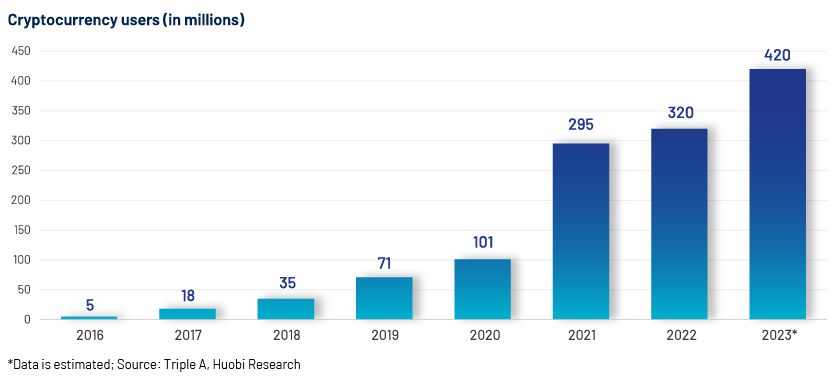

There are an estimated 420m cryptocurrency users worldwide as of 2023. This number is expected to grow in the coming years, with wider adoption of digital assets. The MiCA regulation prioritises investor protection by increasing transparency and establishing a robust framework for issuers and service providers. This comprehensive approach safeguards investors, preserves financial stability and simultaneously fosters innovation and attractiveness within the crypto-asset sector.

Benefits of MiCA

The MiCA regulation offers several potential benefits that contribute to the growth and stability of the cryptocurrency market:

-

Increased consumer protection: The regulation mandates businesses offering cryptocurrency services to provide clear and accurate information about associated risks to consumers, safeguarding them from fraud and scams.

-

Enhanced market transparency: By requiring registration with financial regulators and compliance with anti-money laundering regulations, MiCA improves transparency, making it more challenging for criminals to exploit cryptocurrencies for illicit activities.

-

Fostering innovation: MiCA's technology-neutral approach ensures that innovation within the cryptocurrency market remains unhindered. Businesses could continue to develop new products and services tailored to consumer needs, promoting ongoing growth and advancements.

Challenges for MiCA

While MiCA brings numerous advantages, it also encounters certain challenges that need to be addressed:

-

Enforcement: As MiCA will be enforced by national regulators across the EU, differences in approaches and enforcement levels may cause confusion and uncertainty for businesses providing cryptocurrency services.

-

Compliance costs: Compliance with MiCA entails costs that may be passed on to consumers. This could hinder access to cryptocurrencies.

-

Technical complexity: MiCA's intricate requirements may present challenges for businesses aiming to comply fully, leading to delays in the launch of new products and services.

How can compliance help?

Organisations offering crypto services can reap several benefits from compliance:

-

Reduced risk of fines and penalties: Complying with MiCA reduces the likelihood of fines and penalties from regulators.

-

Customer trust: Consumer trust grows when businesses adhere to regulations, translating into improved sales and market share.

-

Reputation: Compliant organisations are perceived as responsible and trustworthy, leading to an improved brand reputation and attracting new investors.

A compliance team would play a crucial role in assisting an organisation to comply with MiCA by providing comprehensive support and guidance. It offers valuable assistance in several ways, such as providing the necessary guidance and support on MiCA requirements, conducting thorough risk assessments to identify potential compliance issues and developing and implementing effective compliance policies and procedures. The team would also diligently monitor an organisation's compliance with MiCA requirements and ensure a prompt and effective response to regulatory inquiries.

By leveraging the expertise of a compliance team, organisations offering crypto services could effectively mitigate the risk of fines and penalties, foster increased customer trust and enhance their overall reputation in the market. A well-functioning compliance team acts as a protective shield, safeguarding your organisation from potential financial and reputational risks while ensuring adherence to regulatory requirements.

How Acuity Knowledge Partners can help

We are a trusted firm specialising in compliance services. We offer invaluable support to organisations seeking to achieve and maintain compliance in the crypto space. We offer regulatory guidance, helping them navigate the specific requirements and obligations outlined in cryptocurrency regulations. We stay up to date with the latest regulatory developments to provide accurate and timely advice to our clients.

We assist in the development and implementation of robust compliance policies and procedures tailored to the crypto industry. These frameworks ensure that organisations have clear guidelines in place to adhere to regulatory requirements, reducing the risk of fines and penalties.

Our compliance-monitoring services help organisations maintain adherence to crypto regulations. We actively monitor compliance activities, identify deviations and provide prompt corrective measures, ensuring continued compliance.

With our expertise in compliance, organisations can confidently navigate the evolving landscape of crypto regulations, enhance their reputation and mitigate potential compliance risks. Our tailored solutions and comprehensive support enable businesses to achieve and sustain compliance in the dynamic crypto industry.

Reference:

What's your view?

About the Authors

Sachith Vijayaraghavan has 8 years of experience in compliance and has completed 8 years with Acuity Knowledge Partners. His expertise spans across the risk and compliance sector, focusing on compliance reviews of marketing/advertising materials and Email Surveillance. At Acuity Knowledge Partners he is part of the central compliance team and specializing in marketing material review. Sachith is an MBA from Bharathiyar University.

Gautam has 10+ years of experience in Corporate Compliance and Trade n E Communication Surveillance . He has previously worked with Bank of America and NatWest Markets. He has a vast experience and knowledge in Financial Market products, Derivatives products, Stock Markets, Equity and Fixed Income products. At Acuity Knowledge Partners he is part of the Corporate and Forensic Compliance team and specializes in Trade and E-Comm Surveillance. Gautam is an MBA graduate from Chandigarh Engineering College, Chandigarh .

Like the way we think?

Next time we post something new, we'll send it to your inbox