Published on July 25, 2023 by Sreehari Tamaraparani

For over a decade now, the financial services sector and especially the global payments landscape has been slowly evolving, thanks to the advancements being made on the technological front. From the rise of mobile payments to the proliferation of cryptocurrency, technology has fundamentally altered the way we pay for goods and services.

While the traditional banking institutions were somewhat cautious about adopting these new technologies before 2020, the pandemic certainly accelerated the transformation of the sector as whole, with digitalisation playing a key role in daily life. We are moving towards non-physical buying channels, i.e., online platforms, as a result of which payment methods are becoming more digital or cashless.

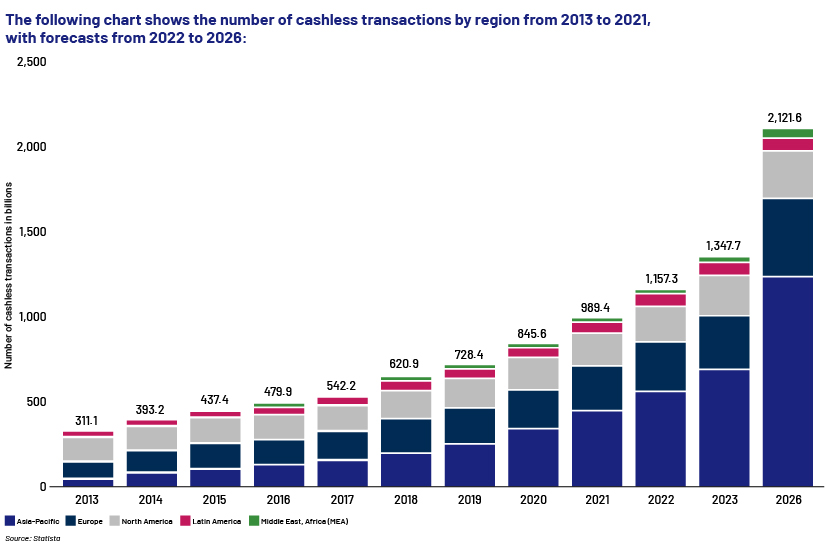

Non-cash/cashless transactions conducted in Asia Pacific in 2021 amounted to c.USD440bn, according to Statista. Europe and North America followed, with USD254.6bn and USD204.4bn in transactions, respectively. Cashless transactions globally are expected to cross the USD2tn mark by 2026.

Source: Statista

Most cashless payments are via credit and debit cards, credit transfers and direct debit. However, with the rapid technological advancements after the pandemic, many fintech firms, in collaboration with major banks, have developed a variety of alternatives. One such alternative to the traditional non-cash payment methods is Pay by Bank, underpinned by the concept of open banking. In this blog post, we aim to explore both these concepts and their impact on the future of payments and banking.

What is open banking?

Open banking is a financial concept that refers to the practice of sharing financial information and data between banks and other financial institutions through open application programming interfaces (APIs). Open APIs allow third-party developers to create applications and services that can access bank data and provide new financial services to customers. It is important to note that in open banking, customer data is shared with third-party providers only with customer authorisation. It is not a means for banks to sell customer data.

The main goal of open banking is to promote competition and innovation in the financial services sector by making it easier for customers to switch between financial service providers and access new and innovative financial products and services. By enabling data sharing between banks and third-party providers, customers can benefit from a wider range of financial products and services that are tailored to their individual needs.

What is Pay by Bank?

Pay by Bank is a payment method that allows customers to make payments directly from their bank accounts, without the need for a credit or debit card. Pay by Bank is also known as "bank transfers" or "bank-to-bank payments”.

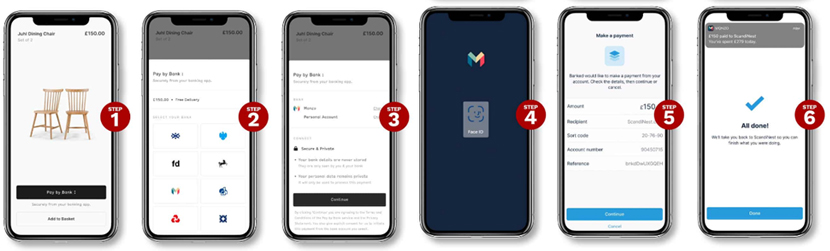

Pay by Bank works by using open banking APIs to securely connect a customer's bank account to a merchant's payment system. When the customer selects the Pay by Bank option at checkout, they are redirected to their bank's online banking platform, where they can log in and authorise the payment. The payment is then transferred directly from the customer's bank account to the merchant's account.

The following images show what the Pay by Bank feature looks like and how it works (set up by Banked for a UK online merchant):

Pay by Bank is currently available in several countries, including the UK, where it is offered by a number of banks and fintech payment providers. As open banking and real-time payments continue to gain popularity, Pay by Bank is likely to become an increasingly popular payment method for online and mobile commerce.

Pay by Bank – a promising payment option for both merchants and consumers

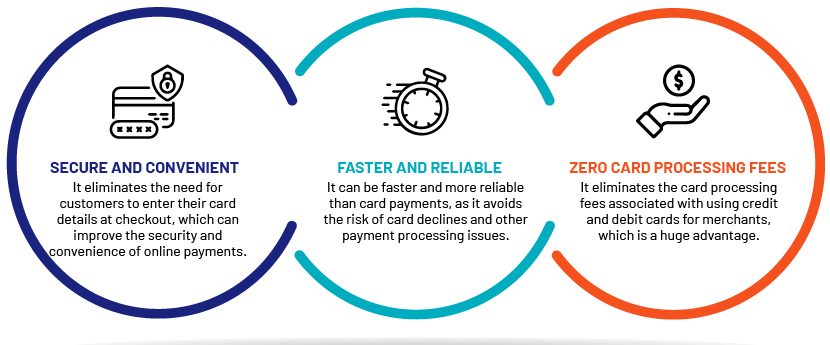

The future of Pay by Bank looks very promising. Typically, merchants/businesses pay anywhere between 2.87% and 4.35% of each transaction as card processing fees. Pay by Bank is essentially free. With merchants incurring no card processing fees with Pay by Bank, this payment method is increasingly being adopted. Merchants have significant incentive to push Pay by Bank as the main payment option, as they do not lose out on their profit margins via processing fees. The following are the main advantages of Pay by Bank over traditional card payments:

For consumers, the Pay by Bank option represents convenience while transacting online. Many do not save their credit/debit card details with third parties because they feel it is risky to save card data on these platforms or simply find it a hassle to pull out their cards and enter the details required to complete a transaction. For such consumers, Pay by Bank is an easy payment option. Many may also not have access to credit cards owing to bad credit scores or because they feel strongly against using credit cards. This payment method is an excellent option for such individuals.

Pay by Bank – the road ahead

As a result of these advantages for both merchants and consumers, the adoption of Pay by Bank in the UK and the European Union is increasing. It was expected to start being used in the US retail space in 2023, meaning this option would only gain in adoption.

However, many consumers may not adopt this option, preferring to use their credit cards. This may be out of habit, due to the ability to earn reward points or, for some, out of necessity. Regardless, with the world going cashless and adopting new-age digital payments, we believe it is inevitable that Pay by Bank will become one of the leading propositions for banks to sell to their customers.

With the foundations already laid by many banks, fintech firms and the Open Banking Implementation Entity in the UK through their standard and guidelines for implementation, it is safe to say that open banking and Pay by Bank are set to explode in other markets. Statista expects the number of open banking users to reach 132.2m globally by 2024, at an annual growth rate of nearly 50%.

Pay by Bank – complementary to legacy payment methods?

With major banks such as Bank of America partnering with fintech firm Banked Ltd and J.P. Morgan partnering with Mastercard to implement their Pay by Bank products, other competitor banks have no option but to adopt this new-age digital payment technology and build their own product or risk losing their share of customers.

Banks must not view Pay by Bank as a product that may cannibalise other payment products such as direct debits, automated clearing house (ACH) payments or other real-time payments, but rather as complementing these legacy payment methods.

Banks must also consider the fact that in some jurisdictions, open banking will allow retailers to share consumer data with banks. In this age where data is considered more valuable than gold, this could be a game changer for banking institutions.

The role of proposal teams

Proposal and bid management teams within commercial banks would play a pivotal role in commercialising these new innovations. It is one thing to innovate and create these new payment solutions, but it is a different ball game when it comes to convincing clients and selling these products and generating revenue. The following are areas in which proposal teams can add value and create the desired impact.

In conclusion, proposal teams have the potential to play a significant role in how well Pay by Bank fares in the global payments market. By being agile and customer-focused and by effectively communicating the bank's value proposition that aligns with evolving customer needs and concerns, proposal teams can help drive growth and innovation in the Pay by Bank and open banking space.

How Acuity Knowledge Partners can help

Our Financial Marketing Services (FMS) unit has more than 15 years of experience in supporting major commercial banks and other financial institutions globally with their requests for proposal (RFPs), requests for information (RFIs) and due diligence questionnaire (DDQ) requirements, both in a consultative and collaborative capacity.

Our class-leading RFP services support is backed by a senior layer of subject-matter experts who have spent a significant amount of time in the commercial banking domain responding to RFPs and have developed meaningful insights on new and emerging trends such as Pay by Bank and open banking that impact the entire treasury services space. Our teams are adept at developing bespoke content on complex solutions for RFPs and have the required experience to drive growth and add value to our commercial banking clients.

Leveraging our more-than-decade-long experience, commercial banking pedigree and deep financial-domain knowledge, we believe we are uniquely positioned to extend our proven RFP and content management support to commercial banking proposal teams so they could do more. Our commercial banking clients can expect a partnership that offers a true “plug and play” service able to deliver meaningful outcomes and an enhanced return on investment in people, processes and technology.

Sources:

-

https://www.statista.com/statistics/265767/number-of-cashless-transactions-worldwide-by-region/

-

https://www.valuepenguin.com/what-credit-card-processing-fees-costs

Tags:

What's your view?

About the Author

Sreehari Tamaraparani is a Assistant Director within the Fund Marketing Services line of business at Acuity Knowledge Partners.

Sreehari has 10 years of sales enablement experience with team management, writing compelling business proposals and content management within the financial services industry. Prior to joining Acuity, he worked at J.P. Morgan as an RFP Writer within the Investor Services line of business. Prior to his stint at J.P. Morgan, Sreehari worked as a Proposal Manager for Bank of America Merrill Lynch within the Global Transaction Services line of business.

Sreehari holds a Bachelor of Commerce from Bangalore University, India and a Post Graduate Certificate in International Business from..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox