Published on February 17, 2022 by Vipul Gupta

The COVID-19 pandemic is the most serious challenge facing financial institutions in nearly a century. As the economic fallout spread, retail lending was also impacted and banks found themselves juggling with big priorities such as keeping their distribution channels open amid social-distancing norms, managing customer expectations and ensuring regulatory compliance. In this blog, we discuss how the US retail market was impacted by the pandemic, and its outlook.

Market overview

-

The retail lending market broadly encompasses the mortgage and consumer credit markets. In terms of market share, few major players currently dominate the market. However, with technological advancements and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets.

-

The US retail lending market had total balances outstanding of USD12.2tn in 2020, representing a compound annual growth rate (CAGR) of 1.8% from 2016 to 2020. The mortgage credit segment had total balances outstanding of USD10.4tn, equivalent to c.85% of the market's value.

-

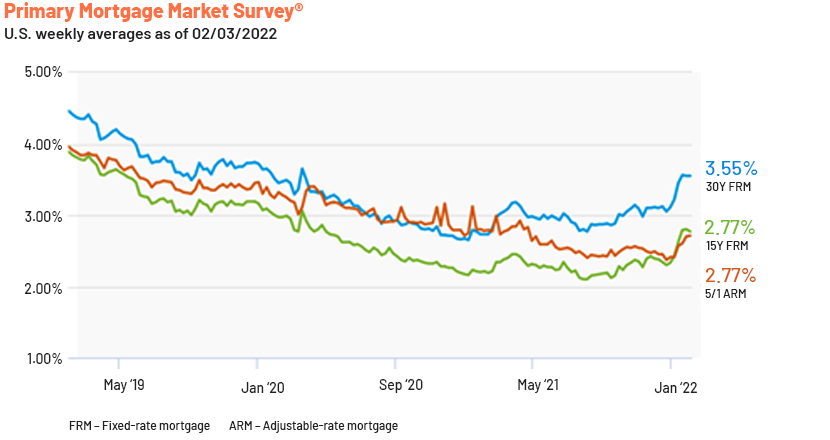

The US saw unprecedented fiscal stimulus in the last two calendar years. The Federal Reserve dropped the benchmark rate to record-low levels, and the mortgage rates hit their lowest level in almost 30 years of 2.68% in December 2020 (for 30Y FRM).

-

Household debt increased by USD1tn to USD15.58tn in 2021, the biggest annual increase since 2007, driven mainly by mortgage debt and auto loans. Home loan originations were at record-high levels in 2020-21 as buyers raced to lock new loans at historic-low interest rates ahead of an expected rate increase in 2022.

-

On the supply side, the housing market has been hamstrung by a lack of supply for some time, even before the pandemic.

-

Low inventory and strong demand pushed new and existing home prices up by more than 10% in 2020 and by around 19% in 2021.

Market outlook

-

Fitch forecasts strong economic growth of 3.9% in the US in 2022 and expects the unemployment rate to continue to trend down, providing favourable conditions for US banks and the retail credit market.

-

To contain inflationary pressure, the US Federal Reserve plans to dial back the extraordinary economic stimulus. On 26 January 2022, it said that it will likely hike interest rates and reaffirmed plans to end its bond purchases from March 2022.

-

Accordingly, mortgage rates are marching to higher ground in 2022, and the advance has already trampled the once-vibrant refinance market. The average rate on the 30Y FRM has increased to 3.55% in February 2022 from a low of 2.68% a year ago.

-

In its most recent Economic and Housing Market Outlook, Freddie Mac expects the 30Y FRM to average 3.6% in 2022, rising as high as 3.7% in the fourth quarter of 2022.

-

Home prices are set to spike 16.4% in 2022 due to persistent supply issues and robust demand, according to leading US house listing site Zillow’s latest forecast (February 2022).

-

Despite this, the home-purchase market remains strong, as mortgage rates are still low by historical standards. Even a jump to 4% by year-end 2022 would still be lower than pre-pandemic levels.

-

The supply crunch and expectations of price and interest rate increases should continue to incentivise individuals to buy a home now rather than waiting for 2023 or later.

-

We, therefore, believe the outlook for the US mortgage industry looks positive overall in the near term. As per some forecasts, US retail banking market is expected to witness a CAGR of 4.49% over the 2021-2026 period, buoyed by economic growth and robust domestic demand.

How Acuity Knowledge Partners can help

We have nearly two decades of experience in helping 400+ banks and financial institutions transform their operating models and cost structures. Within our Lending Services vertical, we launched retail lending support services in September 2021.

Our retail lending solutions help banks optimise their retail banking value chain across origination, processing, underwriting, closing and post-closing activities. We support all retail lending channels including consumer mortgage, credit cards, personal loans and auto loans. Our loan support officers standardise and streamline the end-to-end loan approval, underwriting and servicing processes, aided by tech-enabled platforms, and help identify red flags in loan applications, such as high credit card utilisation, late payments or lack of credit history.

Our retail lending solutions can help banks improve origination productivity and cycle time, manage higher volumes and utilise flexible staffing for one-time projects or spikes in work volumes.

Sources:

https://www.statista.com/statistics/500814/debt-owned-by-consumers-usa-by-type/

https://www.researchandmarkets.com/reports/5350610/retail-lending-in-the-united-states-of-america

https://www.reuters.com/business/us-banks-see-business-lending-driving-2022-growth-2022-02-03/

http://www.freddiemac.com/pmms/

https://www.mordorintelligence.com/industry-reports/us-retail-banking-market

https://edition.cnn.com/2022/02/08/economy/us-household-debt/index.html

Tags:

What's your view?

About the Author

Vipul Gupta has over 16 years of experience in working with leading global organisations in the banking and commercial lending domains. His expertise spans a broad range of credit analysis, financial modelling, portfolio management, leveraged lending, industry coverage and onshore client-facing roles. Vipul holds an MBA in Finance and a bachelor’s in mechanical engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox