Published on January 15, 2019 by Kartikeya Arora

The merger between three public-sector general insurance companies, National Insurance Company Ltd, United India Insurance Company Ltd, and Oriental Insurance Company Ltd, which currently have a combined market share of ~26%*, will form the largest non-life insurance company in India. This merger will eventually reduce competition, thereby providing support to the sector's overall profitability. With only three general insurance companies, namely ICICI Lombard General Insurance Company Ltd, New India Assurance Company Ltd, and General Insurance Corporation of India (GIC, which is a reinsurer), currently being publicly listed in India, the listing of this mammoth merged entity is very likely to evoke interest from the global investment community, complemented by the expectations of robust growth in the Indian insurance sector.

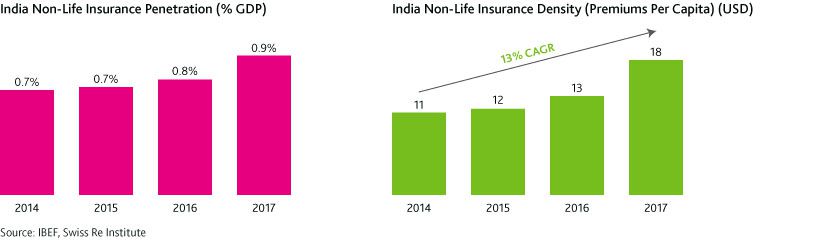

Continued economic expansion, along with a sustained increase in household savings, has enabled the Indian non-life insurance industry to register double-digit growth in premiums over the last decade. Despite growing at a CAGR of ~15% between March 2008 to March 2018, public-sector general insurance companies have lost significant market share to private players, with the gross underwriting market share of public-sector general insurers declining to ~45% in FY18 from ~60% ten years ago. Regulatory reforms, such as the relaxing of restrictions on foreign ownership, along with the effective utilization of strong brands by private insurers have contributed to this decline in market share.

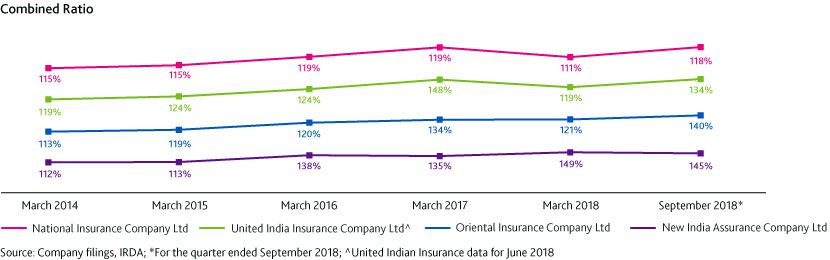

Public-sector general insurance companies have lagged behind their private-sector peers, not just while capturing new business, but also in terms of operational efficiency and financial discipline, where they have displayed worrisome trends, with low solvency margins, a lack of underwriting profitability, and poor capital adequacy. Public-sector general insurers have struggled to maintain the solvency margins prescribed by Insurance Regulatory and Development Authority (IRDA). Solvency margins basically indicate the extra capital insurance companies are required to hold in order to meet unforeseen exigencies. Barring New India Assurance Company Ltd (which was listed recently), public-sector general insurance companies, namely United India Insurance Company Ltd, Oriental Insurance Company Ltd, and National Insurance Company Ltd, have consistently struggled to maintain the IRDA’s mandated 1.5x solvency margin.

*Apr-Oct 2018 market share, based on gross direct premiums

The combined ratio, a measure of profitability for public-sector general insurers, has been consistently above 100% for these companies, thereby indicating underwriting losses.

While there are significant operational hiccups that need to be managed, such as the standardization of IT platforms across the three companies, industry participants believe this merger will bring positive sector-level changes, with improved underwriting discipline, better risk profiling, higher solvency margins, and relatively stronger capital adequacy ratios.

How Acuity Knowledge Partners can help

Indian insurance firms raised around USD6.7bn through public issues in 2017. Regulatory support, such as the increase in the FDI Limit (changed to 49% from 24% in 2016), along with improvements in sector-specific operational and financial metrics, should put the Indian insurance space on investors’ radars and fuel further investments in the sector.

Our research analysts combine cross-domain expertise with data management to assist both, buy-side investment managers and sell-side investment banks in identifying significant investment opportunities with multiple tailwinds, such as the one that is currently emerging in the Indian general insurance domain.

Sources:

- Insurance Regulatory and Development Authority of India (IRDA)

- India Brand Equity Foundation (IBEF)

- Company disclosures

- https://www.moneycontrol.com/news/business/companies/ey-to-advise-on-merger-of-3-psu-general-insurers-3295601.html

- https://www.moneycontrol.com/news/business/why-modi-govt-is-racing-against-time-in-its-mega-psu-insurers-merger-bid-3297711.html

- https://www.moneycontrol.com/news/business/economy/exclusive-psu-insurance-merger-not-top-priority-to-be-pushed-to-q2fy20-2820841.html

- https://economictimes.indiatimes.com/industry/banking/finance/insure/will-the-merger-of-3-general-insurers-make-the-new-entity-more-competitive/articleshow/63901793.cms

- https://www.livemint.com/Money/kNd6fZURO4Uzs6iPYJYH6L/How-will-the-merger-of-public-sector-general-insurers-impact.html

Tags:

What's your view?

About the Author

Kartikeya Arora has over 4 years of experience in research and advisory, financial modeling and report writing. During his two and a half year tenure at Acuity Knowledge Partners, Kartikeya has worked in both equity and credit domains, covering companies primarily located in North America and Asia. He is currently working with the Investment Research team tracking the Asian Insurance space.

Like the way we think?

Next time we post something new, we'll send it to your inbox