Published on November 1, 2022 by Gaurav Agrawal and Mukti Sharma

-

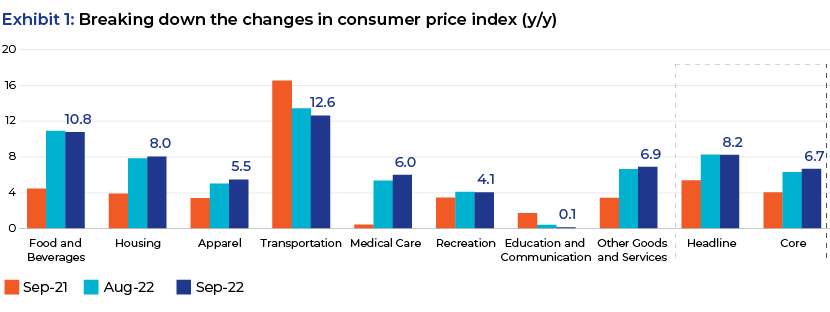

The latest CPI print for the US came in at 8.2%, while the core inflation was recorded at 6.7% - this, despite the sharp pace of rate hikes by the Federal Reserve (Fed), indicates that inflation is sticky as growth slows (US GDP is expected to grow 1.1% in 2023 as per the latest IMF data)

-

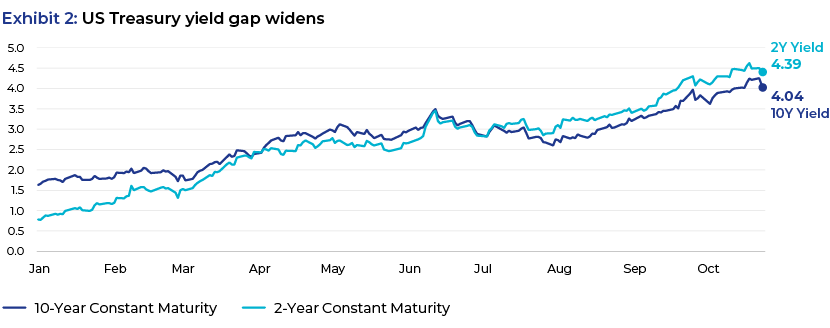

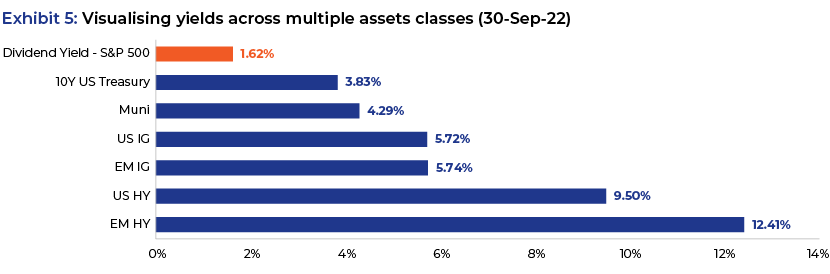

The aggressive rate hikes have resulted in a spike in yields (The 2-year US treasury is yielding 4.39% as of 26 Oct 2022 vs. 0.8% at the start of the year), resulting in attractive risk-reward positions across majority of the fixed income asset classes

-

Despite the volatile macro, geopolitical and inflationary situation, fixed income as an asset class remains attractive. In this environment, high quality government and municipal bonds, followed by Investment Grade (IG) corporates and pockets of High Yield (HY), offer attractive opportunities

Higher rates, higher inflation and higher spreads – Moving beyond the easy money world

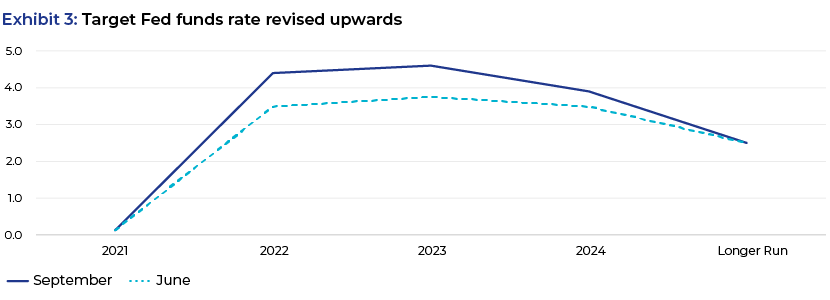

The Fed has so far stuck to its key mandate of controlling the inflation and raised benchmark rates to a range of 3.0-3.25% vs. a 0% floor as of end-2021. At the September FOMC meeting, Fed officials hammered in their hawkish stance by signalling the intention to continue hiking rates until they hit a terminal rate of 4.6% in 2023. However, it is still uncertain if a terminal rate of 4.6% would help in taming the inflation. Although the Fed has raised rates by 300bps this year, inflation still seems to be running hot; as such, there is a high probability of a 75bps rate hike in the next Fed meeting (to be held on 2 Nov 2022), as per market estimates. Additionally, we believe that the Fed would not hesitate to raise the rate to a 5% range if inflation continues to run hot. This would also result in a meaningful probability of a recession in 2023.

Bond yields continue to propel higher in anticipation of further central bank tightening. As of 26 Oct 2022, the 10-year US Treasury yield was at 4.04% after hitting a 10-year high of 4.25% on 24 Oct, while the 2-year yield was at 4.39% after hitting a new 15-year high of 4.62% on 20-Oct.

-

The front end of the yield curve is fully priced for a front-loaded hike cycle. The Fed fund futures are pricing a peak of 4.62% by next May, which is in line with the FOMC dot plot. Two-year Treasury yields are up 102bps to 4.39% since Chair Powell’s hawkish speech at Jackson Hole.

-

Projection for the next few years is not pretty either. In their quarterly updates of estimates, FOMC officials expect the unemployment rate to reach 4.4% by next year, from the current 3.7%. A rise of this magnitude is often accompanied by a recession. Additionally, GDP growth forecast has been reduced to a 0.2% expansion this year, compared with 1.7% seen in June, and to 1.2% in 2023. This follows two consecutive quarters of declining GDP growth.

-

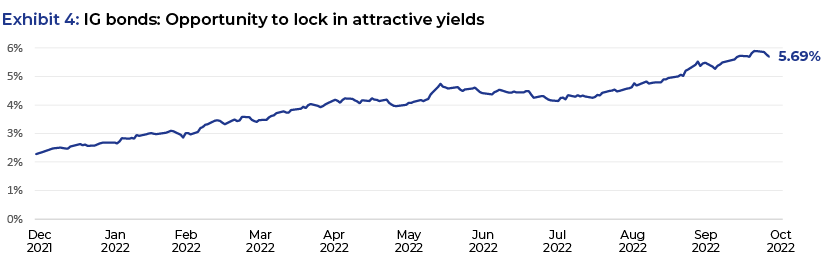

The IG Corporate yields are 5.7% vs. 2.3% as of end-2021. Yields on IG corporate bonds are at a 13-year high of 5.7%, with a positive slope. Yields are high broadly due to the rate hikes, while a positive slope indicates bond investors are compensated fairly for extending the duration. With the increasing probability of a recession, the yields could rise further; however the slope may not steepen much given that the recessionary risk would be priced in as a short-term shock rather than a long-term issue, resulting in a flattening or inverting of the yield curve.

Fixed Income assets to remain in vogue

The fixed income asset classes are secularly yielding over 4% - something that fixed income investors have not seen in over a decade or two. This is in stark contrast to the record negative-yielding debt; treasuries, IG bonds and even HY bonds yielding lower than the S&P500 dividend yield as early as 2021. With global interest rates and credit spreads rising this year and markets already pricing in an aggressive central bank tightening cycle, the risk-reward trade-off for fixed income has become more favourable. In our view, the best approach for investors is to focus on high-quality, short-term cash flows that provide a margin of safety against potential upticks in interest rates. Medium- to longer-term investors can then transition to higher durations once the Fed rate reaches its terminal value of 4.6%.

IG credit should be a go-to asset class: Credit opportunities are surfacing as IG spreads widen. The ICE BofA High Yield index spread fell by 7bps to 4.8% over US Treasuries since a day before the 75bps rate hike announcement on 21 September. During the same timeframe, the spread on the ICE BofA US Investment Grade Index rose 20bps to 1.67%, providing clear evidence that IG corporates can bestow market participants with greater stability in the current times, compared with HY corporates. In case recessionary pressures become more dominant, non-cyclical and defensive sectors could potentially offer a safe haven.

Municipal bonds, although down 12.31% YTD, have seen the worst selling since the 1980s. However, this is unlikely to be the case going forward as the pace of rate hikes is not expected to be as sharp as it was before. This sell-off has resulted in an opportunity that has barely existed in the past two decades. Additionally, the tax-equivalent yield on the broad muni index was 7.5% as of end-Sep 2022 (and for investors in highest-tax bracket), the highest on record since 2009, sa per the Bloomberg Municipal bond index.

How Acuity Knowledge Partners can help

Over the past decade, fixed income investors have been operating on a single mantra – “There is no alternative” – as the yields were very low (negative in some cases), which led to a flow to high-risk assets. However, with the risk-free yields now at 4.4%, we have now got a new mantra – “There are adequate (if not ample) opportunities”. However, with this opportunity set, fundamental credit research of issuers and sectors is very crucial in driving the return profile.

Acuity Knowledge Partners, with its team of 350+ fixed income and credit research analysts specialising in Fixed Income asset classes and sectors coupled with a time-tested collegium process to research helps some of the largest buy- and sell-side clients globally by providing them the much-needed operational flexibility.

Sources

3. September 20-21, 2022 FOMC Meeting

5. Summary of Economic Projections

6. Fed Funds Futures Peak Terminal Rate

7. 10-Year Treasury Yield Projection

8. ICE BofA US High Yield Index Option-Adjusted Spread

8. ICE BofA US High Yield Index Option-Adjusted Spread

9. ICE BofA US Corporate Index Option-Adjusted Spread

10. S&P 500 Investment Grade Corporate Bond Index

12. Consumer Price Index - September 2022

Tags:

What's your view?

About the Authors

Gaurav has over 14 years of experience in investment research and corporate finance, with expertise in High Yield corporate and alternate investing strategies. He currently provides research and analytical support in fixed income investments in the developed markets to one of the largest alternate asset manager, globally. He has wide experience in fundamental credit research, target identification, due diligence support, portfolio monitoring (mainly high yield debt) and equity investments in various sectors from developed markets. Gaurav has extensively worked on relative valuation and peer analysis; creation and updating operating/financial models; industry and macro research. He holds a PGDM (equivalent to MBA) from IMT Nagpur.

Mukti has been a part of Acuity’s investment research team for over 3 years. She currently supports a large alternate asset manager and is the primary point of contact for Asia Pacific region. Mukti provides fundamental credit research and analytical support to the client in the developed markets in APAC. Mukti holds a PGDM in financial markets from the National Institute of Financial Management.

Like the way we think?

Next time we post something new, we'll send it to your inbox