Published on October 13, 2020 by Shubha Kamath

Introduction:

The life sciences sector has not attracted as much attention from the average Joe as it has since the start of the coronavirus pandemic. The last epidemic that even came close to wreaking such havoc was the Spanish flu of 1919 – over 100 years ago. The world has, naturally, turned towards big pharma to provide hope of a potential cure. Over 165 pre-clinical and clinical trials for a vaccine are currently in progress.

The road to recovery for this crisis, unlike those for the most recent crises, is mired in uncertainty, and the pioneering life sciences companies are as uncertain about their future as we are.

Macroeconomics:

The world economy is forecast to contract by 4.9% (according to the IMF’s June 2020 update), with some of the erstwhile drivers of global growth (India and China) seeing significant dips in performance. The impact on low-income households is also disproportionately significant and is expected to wipe out substantial progress made towards eliminating income inequality since the 1990s. With several protectionist policies in force in the major economies at the start of the year, the pandemic has come as a further blow to proponents of globalisation. Yet, it remains more crucial than ever to ensure multilateral cooperation on several fronts. Many of the hard-hit emerging economies need liquidity assistance and external relief to bridge the shortfall in funding to fight the crisis. Apart from this, the global supply chain needs a major overhaul to achieve pre-pandemic efficiencies.

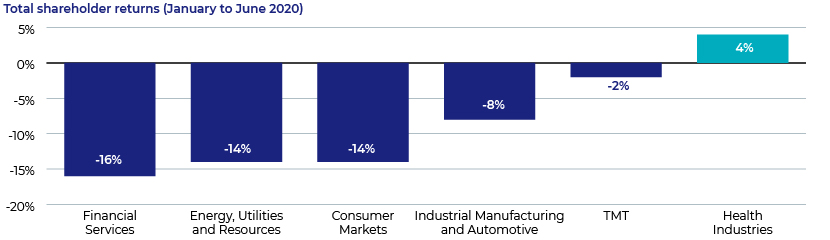

In terms of investor confidence, the life sciences sector enjoyed a unique run in the first half of 2020, outperforming other major sectors with regard to total shareholder returns:

Source: S&P Capital IQ, PwC analysis

Additionally, a number of macroeconomic developments globally have created a perfect storm of sorts that companies could take advantage of to pursue a well-thought-out acquisition strategy:

-

Record-low interest rates

-

Dry powder for both strategic and sponsor-backed acquisitions

-

Banks warming up to lending to financially sound companies

-

Bankruptcies and insolvencies of weaker players in various sectors likely paving the way for greater consolidation

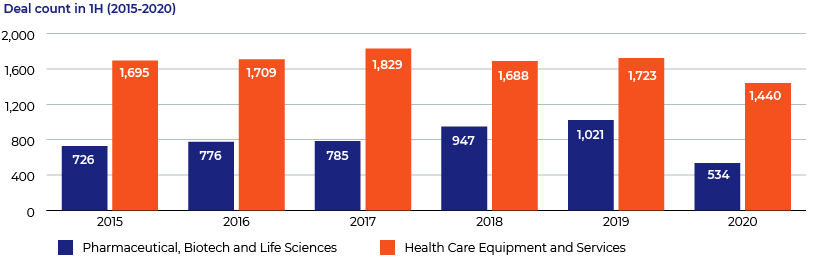

Source: S&P Capital IQ

Paradigm shift in healthcare consumption habits:

The life sciences and healthcare services sectors have been working at breakneck speed to deliver a cure and contain the spread of the virus since March. Yet, the industry itself has witnessed significant demographic changes in consumption patterns that would affect the long-term strategies of several key players. Consumer healthcare/over-the-counter (OTC) divisions have been propping up cash flow since the early days of the outbreak, but consumers have shown an unprecedented inclination towards accepting new digital habits. Patients have become more concerned with personal health issues and are more digitally engaged with their afflictions. The number of telemedicine consultations has also seen a significant increase globally.

New and innovative therapies have gained traction, and statements by the US Food and Drug Administration (FDA) regarding approval of such therapies have been received positively by pharma executives. For instance, former FDA Commissioner Scott Gottlieb recently suggested that 10-20 cell and gene therapies (CGTs) could be approved by 2025.

The sector may also be impacted by general changes in policy that usually follow such life-altering crises. For instance, after the 2008 recession, weaker economies enacted laws that lowered prices of pharmaceutical products and imposed greater restrictions on reimbursements. Governments may be less supportive of new therapies in future, although this may provide some benefit to specific patient groups.

Source: S&P Capital IQ

What happens to deal-making trends in the aftermath of a major crisis:

Companies generally try to avoid fire sales when a crisis hits. This is reflected in the deal multiples during the year that remain at pre-crisis levels. However, in the year following a crisis, the urgency to make deals is evident, and discounts can be found in transactions across sectors. A McKinsey study shows that following the dot-com bubble burst in 2002, average EBITDA multiples (across industries) stayed high (11.8x) but shrank the following year (10.4x). In 2008, multiples remained high at 13.1x and dropped to 10.6x in 2009.

What will kick-start M&A in the “new normal”:

-

Dry powder: As mentioned above, companies sitting on excess cash reserves had time to carefully assess investment and growth opportunities during the lockdowns. Big pharma has over USD150bn of dry powder to pursue high-growth opportunities and would keep a keen eye on developments in the novel therapeutics space to bridge gaps in the pipeline. Additionally, cash-rich private equity (PE) firms may be looking at opportunities as companies look to divest non-core assets

-

Fewer alternatives to utilise cash: Cash-rich companies, especially in the life sciences and technology sectors, tend to return cash to shareholders in the form of buybacks. However, in the present climate, this is unlikely to be a viable option. As a consequence, companies have more cash to scour for profitable inorganic growth opportunities

Recipe for successful pharma M&A in the “new normal”:

The immediate instinct of most executives would be to focus on recovering lost revenue in the short term. However, as highlighted above, when deal making picks up after the crisis, there should be enough bargain opportunities available in the market that can create sustainable value for shareholders.

A recent survey by PwC of over 900 CFOs pointed at M&A being a core lever to executing a recovery strategy. Therefore, it is extra important for pharma companies to adopt a through-the-cycle approach to valuation, for the following reasons:

-

Benefits of scale: One of the major focus areas for inorganic growth is attaining cost synergies. These can be attained only by using an end-to-end assessment aimed at unlocking potential value, instead of merely focusing M&A strategy on short-term gains. The pharmaceutical gig is an expensive one, and it takes years of effort and several million dollars of investment to have a promising candidate. It is imperative that companies use M&A as a way to cut costs in this cumbersome journey and in doing so, add value for shareholders.

-

Revamping portfolio: The life sciences sector is unique in terms of the challenges it faces on the intellectual property front. Patent expiries and loss of exclusivity can be detrimental unless management is proactive in filling these gaps in the pipeline. (For example, TevaPharmaceuticals’ loss of exclusivity on Copaxone still sends shivers down the spines of those of us who follow the sector.) As highlighted in the previous point, drug development is years in the making and, quite often, the inorganic route is the way to go. This involves not only specialty prescription pharma acquisitions, but also looking to balance this high-growth opportunity with investments in OTC segments to maintain sustainability of cash flow in the long term.

The major M&A trends we expect to see in the short to medium term are highlighted below:

-

For healthcare service companies – altering business model due to digitalisation: If there is one trend the pandemic has acted as a catalyst for, it is the disruption caused in the model of physician-patient consultation. While patients have traditionally been inclined to visit a doctor in person, social-distancing norms and lockdowns have shown the ease of transition to digital means. This has happened without any adverse impact on the level of care provided, and is likely to become a long-term trend. First movers in this space would have a substantial opportunity to capitalise on the market

-

For medtech companies – consolidation in sectors that suffered during the lockdowns: Sub-sectors of the medical device sector, such as dentistry and orthopaedics, have suffered due to the ban on elective procedures during the first half of the year. M&A in this sector will likely pick up and lead to market consolidation as weaker players are gobbled up by more resilient businesses

-

Opportunities to create value are also likely in sub-sectors directly linked to coronavirus treatment and diagnostics. Erstwhile niche firms are now at the forefront, and companies with sound fundamentals will likely be sought after by bigger players

-

-

For pharma and biotech – expect a shift to specialty pharma and divestments in the OTC space: While OTC businesses have helped big pharma companies tide over much of the effect of the pandemic-induced lockdowns due to the “toilet-paper hoarding” syndrome, a number of companies are likely to look at high-growth opportunities in the specialty pharma sector. Prime targets of JVs and acquisition agreements would be the small to medium-size biotech companies engaged directly in the discovery of treatments/vaccines for the novel coronavirus

-

Investments in other breakthrough therapies such as gene therapy and oncology should continue to attract interest, with R&D expertise the key driver

-

The above points should drive home the message that a well-thought-out M&A strategy could be crucial for long-term success in this watershed year. Executives would need to rearm and reassess their strategy and identify specific themes and deal-screening criteria. They may choose to plug gaps in the commercial pipeline, expand in new geographies to enhance supply-chain capabilities or identify opportunities in the era of digitalisation. Either way, corporate development teams would be well advised to take a proactive approach and secure board commitment on expansion plans.

This will be crucial to thriving in the “new normal”.

How Acuity Knowledge Partners can help?

Acuity Knowledge Partners provides multi-sector expertise in areas of financial analytics and advisory services, with the life sciences sector as one of the major areas of focus. As a leading provider of research and valuation services to clients globally, we are uniquely positioned help identify value-unlocking opportunities in the pharma and biotech sector for a range of financial institutions comprising investment banks and sponsors. With domain knowledge and exceptional track record of timely service, we have partnered with clients to help scale up their sector coverage, drive down costs, and offer out of the box solutions with round the clock access to a talented analyst pool.

Sources:

https://www.pwc.com/gx/en/services/deals/trends.html

S&P Capital IQ

https://pharmanewsintel.com/news/biotech-to-be-extremely-active-in-2020-mergers-and-acquisitions

What's your view?

About the Author

Shubha Kamath has over 6+ years of experience working across different value chain in the Investment Banking domain. Currently, supports Consumer and retail team for a U.S. based mid-market Investment Bank, in Bangalore. She has good exposure working through the deal life cycle, including deal origination to deal execution. She has experience working on different pitchbooks, evaluating business dynamics and CIMs. She has extensive knowledge in financial modelling and capital structure analysis. Prior to joining Acuity, she was part of sell side research team of Crisil Ltd. She holds a Master’s degree in Business Administration in Finance.

Like the way we think?

Next time we post something new, we'll send it to your inbox