Published on April 12, 2022 by Jeetendra Prakash, CFA

The stringent sanctions imposed on Russia have resulted in a large void in the energy market – a gap other suppliers will likely struggle to fill. Irrespective of the outcome of the war, these sanctions would make structural changes, resulting in a new normal for the global energy market.

Russia’s significance:

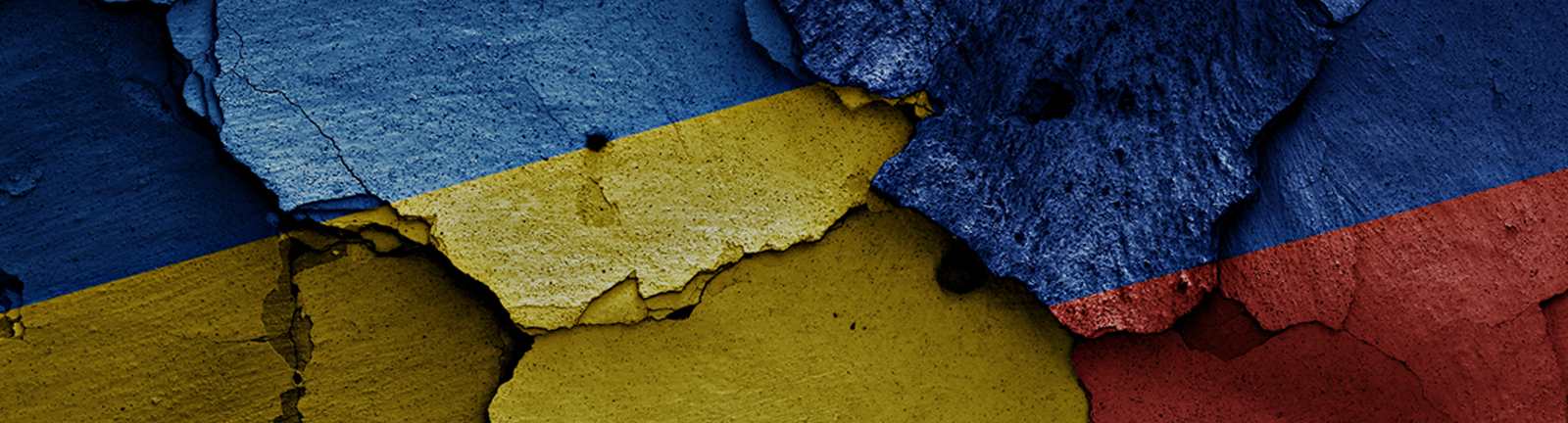

Russia is the second-largest oil producer and the largest exporter of oil and oil products in the world.

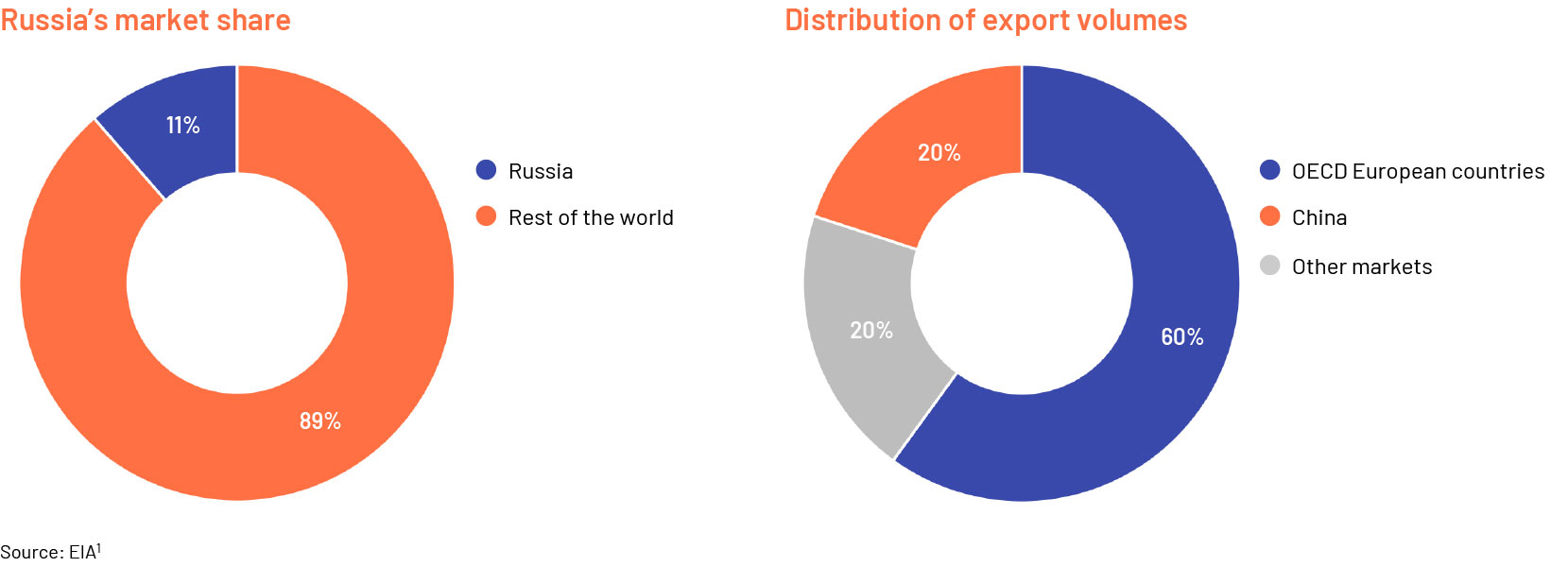

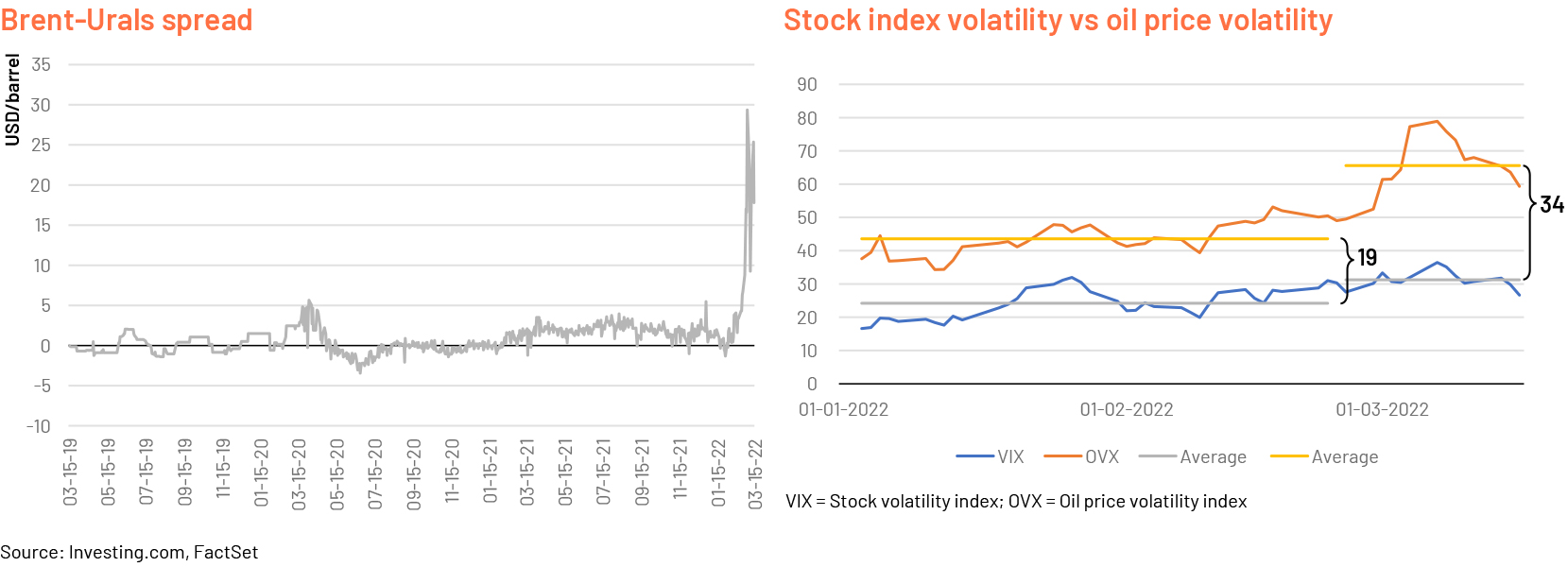

Western sanctions have in the past been carefully crafted to allow the energy trade to continue unhindered. Even after the fall of the Soviet Union, energy flows to Europe continued. However, given the severity of Russia’s current actions against Ukraine, all countries have made a coordinated effort to intensify sanctions. Removing Russia’s banking system from the SWIFT payments network and the US’s explicit ban of Russian energy imports have had a direct bearing on Russia’s energy sector. We covered the sanctions on Russia in greater detail in our previous blog. The EU has managed to ensure the energy sector is left out of the sanctions, but this does not seem to matter currently, as shipping and insurance companies are staying away from Russian cargoes given the high risk. European companies also face strong moral suasion against transporting Russian cargoes. This has resulted in the price discount of Urals to Brent expanding to c.USD20/barrel from historical levels of USD1-2/barrel. Given Russia’s standing in the crude oil market, any development on the Russia-Ukraine front would have a magnified impact on crude prices and volatility (see the chart below).

Quantifying the impact

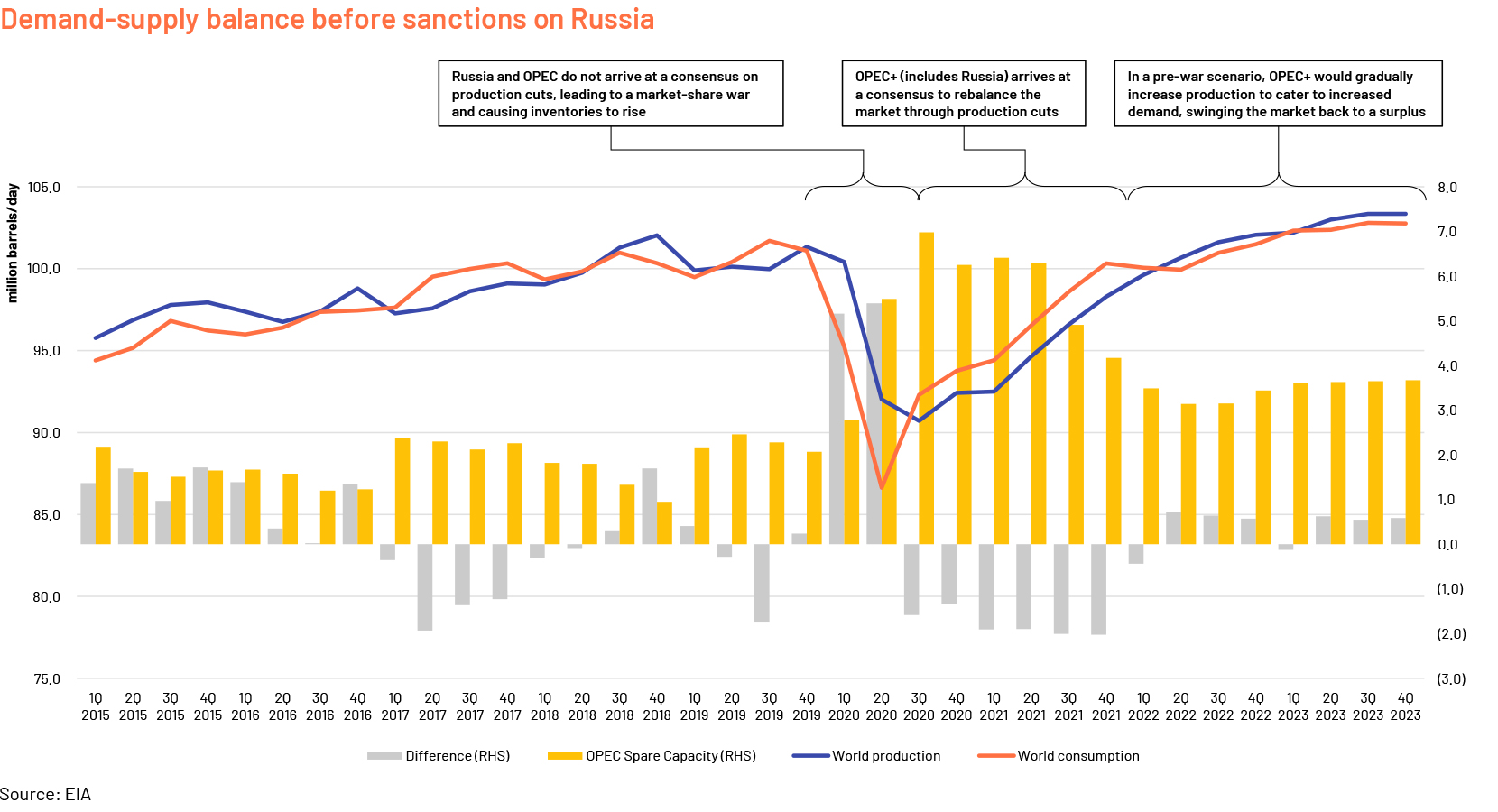

The EIA estimated a 3.7% y/y increase in global oil demand in 2022, driven by improving economic activity. This comes at a time when OPEC+ (OPEC, Russia and other oil producers) has lowered oil output, leading to a sustained shortfall in oil output for the last c.20 months. This was done to rebalance the market after the inventory build-up at the start of the pandemic.

As demand increased, OPEC+ would ease supply curbs, leading to the market swinging back to a surplus. The surplus would also be driven by higher US output. Note that Russia alone was to contribute more than 20% of the incremental demand in 2022. However, with Russian production taken off, the market is suddenly witnessing a deficit of 7-8% of 2022E global demand.

Filling the gap:

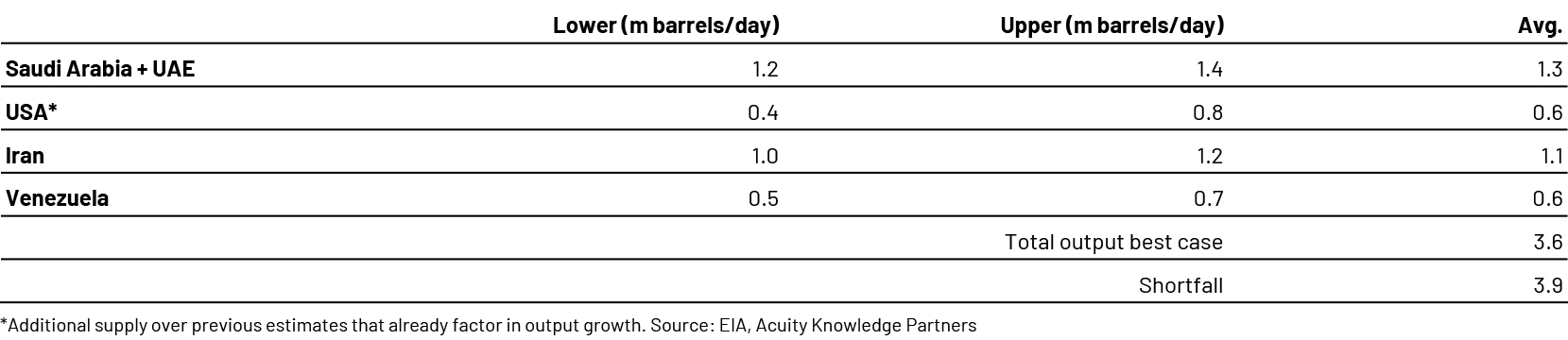

Russia’s export volumes of 7-8m barrels/day (including oil products) are at stake. The table below illustrates how much of the shortfall can be bridged by other oil suppliers, based on current spare capacity.

The geopolitics:

The table above represents the best-case scenario, as each of these suppliers would have to enter difficult negotiations with the US before any increase in output is implemented.

The US would have to exercise extreme care in its effort to gain support from the Middle East. In a bid to revive the Iran nuclear deal, the Biden administration took steps such as removing the Iran-backed rebel group, the Houthis, from its list of terrorist organisations and not supporting Saudi Arabia in its fight in Yemen. This has soured relationships between the two Gulf kingdoms and the US. In the case of Iran, while such steps were taken to incentivise Iran to come to the negotiating table, Iran continues to side with Russia.

The US’s attempt to reach out to Saudi Arabia and the UAE in the past week was unsuccessful, and at an OPEC+ meeting in early March, Saudi Arabia and the UAE decided not to increase supplies beyond the previously agreed levels. We note that Saudi Arabia and the UAE are two of OPEC’s reliable suppliers whose spare capacity can be brought to market without delay.

The US reopened diplomatic talks with Venezuela, but Venezuela is also a key Russian ally crippled by stringent Western sanctions led by the US. Venezuela is unlikely to heed the US’s request unless it receives tangible benefits.

The range depicted in the table illustrates the possible output increase, based on our estimates. However, reaching the higher end of the range would take time, as these producers have been operating well below their capacity for more than two years. Infrastructure bottlenecks are exacerbated in Iran and Venezuela owing to years of underinvestment and sanctions on the oil and gas sector.

As an immediate measure, the US and other large nations agreed to release 60m barrels from their strategic reserves, but this failed to allay market fears, as the inventory potentially accounts for less than two weeks of Russian imports.

The outlook:

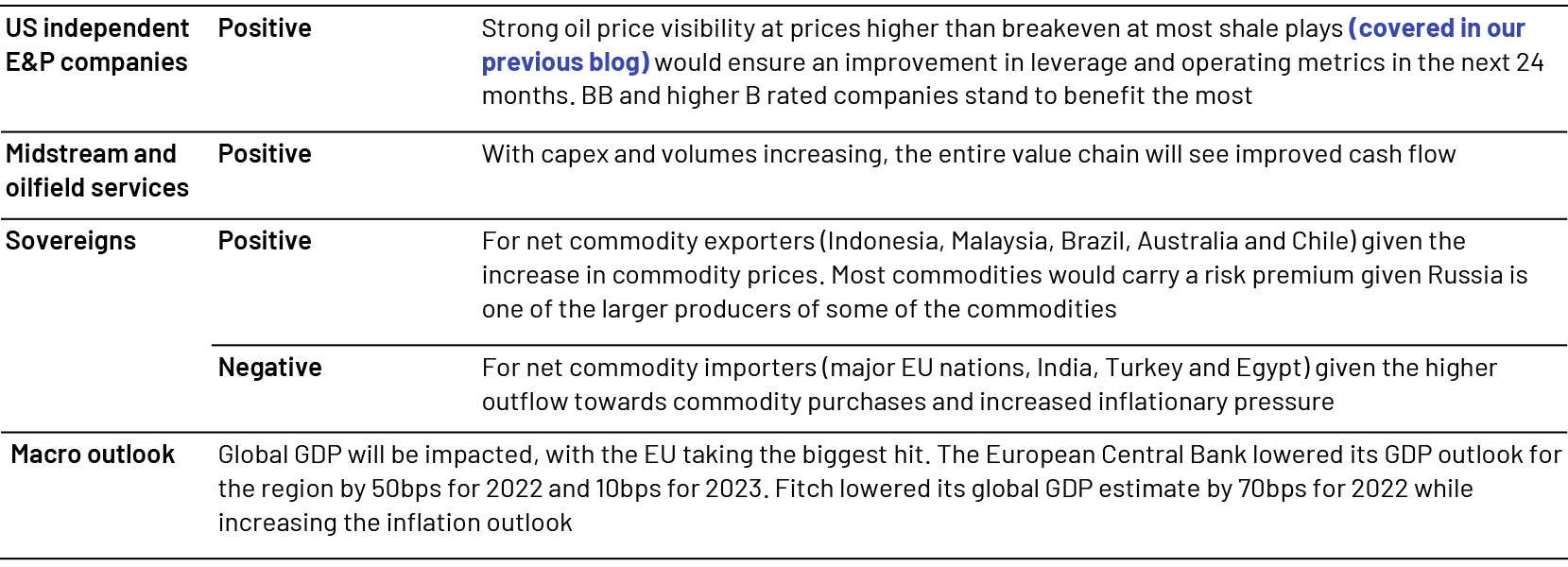

As Russia’s crude supply diminishes from the market, the supply deficit would widen. Even if all Gulf nations agree to beef up output, Russian supplies would not be fully replaced. In addition, the cushion of spare capacity would be exhausted, resulting in any small change on the supply side having a magnified impact, commanding a higher risk premium.

OPEC+’s concerted supply cuts, coupled with the uptick in demand over the past two quarters, have steadied crude oil prices at over USD95-100/barrel. The worst-case scenario (currently the most probable outcome as things stand) would be that none of the larger producers agree to enhance output. As such, we are looking at a scenario of USD100/barrel as the floor, with higher volatility and upside depending on geopolitical developments.

In the run-up to the Russia-Ukraine war, most economies were seeing lower real discretionary income levels due to higher inflation. At USD100/barrel, prices are c.40% higher than aggregate levels seen for most of 2021. As the supply side is unlikely to provide any relief, we foresee demand destruction/reduction as the more likely outcome for the market to reach equilibrium.

At the same time, it would be interesting to see how long oil buyers stay away from the deeply discounted Russian oil – the only factor likely to bring relief to the oil market.

Sector-specific credit impact:

Sources:

Tags:

What's your view?

About the Author

Jeetendra Prakash has close to 15 years of work experience in investment research, with a focus on oil and gas and real estate. He currently supports a large US-based hedge fund. The process involves credit research of high-yield and investment grade credits for different strategies. In addition, he is also actively involved in training and quality control of deliverables. He holds an MBA and is also a CFA charter holder.

Like the way we think?

Next time we post something new, we'll send it to your inbox