Published on January 10, 2024 by Amit Tripathi

Introduction

The oil and gas sector has made substantial contributions to economies but is facing a most profound challenge due to rapid climate change and as countries adopt clean-energy technologies to achieve net zero emissions.

The sector has seen troughs and peaks in the past 50 years, changing its outlook. Among the major challenges it has faced are the US shale boom, the digital revolution and the Paris Climate Accords, which kept creating supply-demand imbalances in the market. For instance, the US shale boom led to an oil supply glut, reducing the price of oil. With rising concerns over future demand and climate change, the sector finds itself in a delicate situation.

Geopolitics – for example, wars and sanctions – have always played a significant role. The Russia-Ukraine war created headroom for suppliers as Russia faced sanctions on its oil exports. This led to some countries ceasing purchases while others resorted to panic buying. Oil prices spiked to a 14-year high, to USD140 a barrel, on 7 March 2022.

The gradual shift away from oil

As countries started looking for alternative energies and found them to be future-proof, major economies such as the US, China and Europe began to actively shift away from fossil fuels.

Renewable energy has achieved total market share in a number of developed and developing nations. For instance, Costa Rica produces 98% of its electricity from renewable sources, and Sweden has reached its target of generating 50% of its electricity requirement from renewable sources eight years ahead of schedule.

Developed countries are also taking bold steps to achieve net zero emissions. As in the US, renewable energy is the fastest-growing source of energy. In the first half of 2022, 24% of the US’s electricity requirement was produced using renewable sources, according to an Energy Information Administration (EIA) report. China is emerging as the global leader in renewable energy. It is set to double its renewable energy capacity and produce 1,200GW of energy using wind and solar power by 2025, according to The Global Energy Monitor.

Of the major oil-producing countries, Saudi Arabia is gradually shifting away from fossil fuels by investing more in clean technologies. Project NEOM is one of its biggest investments in renewables.

Do we really need oil?

Absolutely. We daily use products made of oil or manufactured using petrochemicals derived from crude oil:

-

Automobiles – Polymers are used for making vehicles and body parts, including dashboards, speedometer dials, steering wheels, lock handles and armrests

-

Daily utilities – Washroom utilities such as toothbrushes, buckets and mugs. In addition, refrigerators, plastic bottles and kitchen utensils; also belts and shoes (the foam in sneakers is manufactured using petrochemicals, which are also used for single-use plastics)

-

Infrastructure – Road construction, pipes, electricity cables, etc.

All the fibre and plastic we use daily are made of petrochemicals.

Global oil consumption reached c.97.3m barrels per day in 2022, according to a Statista report. Most of the world’s oil is used by the transport sector in the form of petrol/diesel. Motor gasoline use averaged about 8.8Mbpd in the US in 2021.

However, the International Energy Agency (IEA) estimates in its report Oil 2023 that consumption of oil will decline for the first time in history by 2026 and almost halt by 2028. It expects annual demand to decline to 0.4mbpd by 2028 from 2.4mbpd in 2023. In particular, oil used in the form of petrol/diesel is set to decline after 2026 due to the increased adoption of electric vehicles and growth of alternative sources such as biofuels that improve efficiency and reduce the consumption of fossil fuels.

Overall growth in the oil market is supported by the petrochemicals and aviation sectors. It is reported that chemical feedstock would account for 2.3mbpd or c.40% of total growth in oil demand from 2022 to 2028 and the use of jet fuel would increase at an average of 150kb/d a year over 2024-28.

Oil versus renewables: what the future holds

Investment in clean energy is outpacing other investment in the oil sector and increasing its market share, according to the IEA report. About USD2.8tn is expected to be invested in energy globally in 2023; more than USD1.7tn of this will be in clean technologies – including renewables, electric vehicles (EVs), nuclear power, grids, storage, low-emission fuels, efficiency improvements and heat pumps.

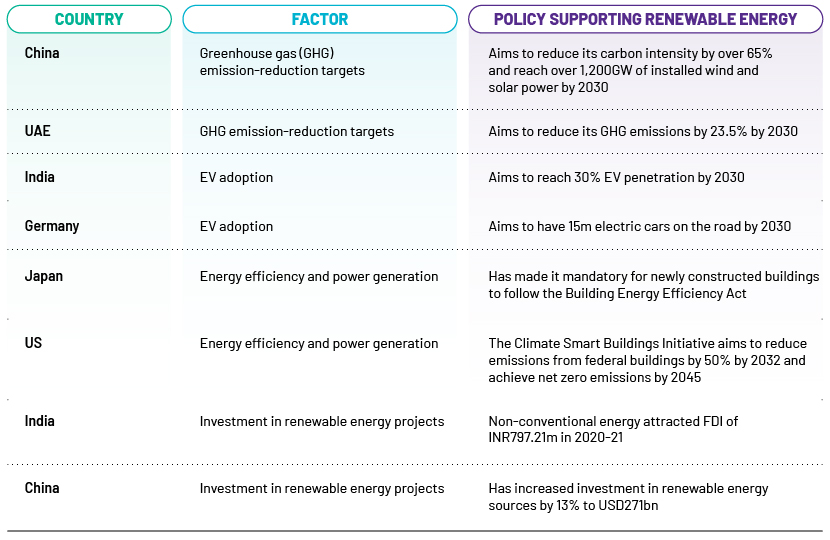

Climate-action policy on the four major factors, i.e., GHG emission-reduction targets, growth of EV adoption, investment in renewables, and energy efficiency and power generation, reflects the potential dominance of the share of renewable energy in the future:

Conclusion

Pressure from environmental groups, the Paris Accords and increased awareness have prompted a number of countries to invest in clean-energy technologies.

Asian countries such as India, China and Indonesia, with large oil and gas assets and heavily reliant on fossil fuels, are taking steps to reduce GHG emissions and investing in renewable technologies in phases, although net zero emissions are likely difficult to achieve.

With growing adoption of EVs and policies and targets supporting renewable energy, this source has substantial growth potential, and consumption of oil in the form of petrol/diesel would reduce sharply. However, growth of the oil market would remain supported by the petrochemicals and aviation sectors, and it will likely take a long time for renewable energy to capture the large market share held by fossil fuels.

How Acuity Knowledge Partners can help

We conduct deep-dive assessment of the sector and provide best-in-class market analysis based on current trends and risks to help clients identify market opportunities, customers and competitors.

References:

-

https://www3.weforum.org/docs/Future_Oil_Demand_Scenarios.pdf

-

https://www.statista.com/statistics/265239/global-oil-consumption-in-barrels-per-day/

-

https://www.eia.gov/energyexplained/oil-and-petroleum-products/use-of-oil.php

-

https://www.iea.org/news/growth-in-global-oil-demand-is-set-to-slow-significantly-by-2028

-

https://www.iea.org/news/clean-energy-investment-is-extending-its-lead-over-fossil-fuels

What's your view?

About the Author

Amit has close to 5 years of experience working across oil and gas value chain. He has varied experience working on various strategic research projects involving market intelligence, competitive intelligence, industry benchmarking and market entry strategy. At Acuity Knowledge Partners, Amit is supporting a major client in various strategic research projects. He holds a MBA degree in Oil and Gas Management from University of Petroleum and Energy Studies.

Like the way we think?

Next time we post something new, we'll send it to your inbox