Published on July 16, 2020 by Ritika Sharma

A “black swan” event. That’s what it is. The suddenness and severity of the COVID-19-related slowdown are unprecedented. The outbreak has been and continues to be a major concern for businesses across the globe. The biggest challenge now is business continuity.

Revenue for the 30m small businesses in the US has dried up, and many businesses have had to lay off employees. Small and midsize businesses (SMBs) play a vital role in the US economy and account for around 44% of US economic activity.

On 27 March 2020, the US federal government signed the Coronavirus Aid, Relief, and Economic Security (CARES) Act into law – a large coronavirus relief bill aimed at supporting small businesses amid the current pandemic.

One of the bill’s measures is the Paycheck Protection Program, or PPP. The PPP provides loans designed to give a direct incentive for small businesses to keep their workers on the payroll amid the crisis. This programme accounts for USD349bn of the USD2tn COVID-19 rescue package. The US Small Business Administration (SBA) government agency offered each small business a forgivable loan of up to USD10m to cover payroll and certain overhead costs.

More than 1,800 banks and other traditional institutions, credit unions and farm credit system institutions are participating in the programme. Businesses impacted by the crisis from 15 February to 30 June 2020 are eligible for one PPP loan.

Highlights of the PPP

-

All small businesses – including non-profit organisations, veterans organisations, tribal business concerns, sole proprietorships, self-employed individuals, and independent contractors – with 500 or fewer employees can apply. Businesses in certain industries with more than 500 employees may apply if they meet the applicable SBA employee-based size standards

-

The loan has a maturity of two years and an interest rate of 1%

-

No loan repayment required for the first six months

-

No collateral or personal guarantees required

-

No fees

-

The loan covers expenses for eight weeks starting from the loan origination date (if the obligations began before 15 February 2020)

-

The loan can be forgiven and essentially be turned into a non-taxable grant

-

No prepayment penalties or fees

The SBA will forgive loans if all employees are kept on the payroll for about 10 weeks and the money is used for payroll, rent, mortgage interest, or utility payments. Payroll costs were capped at USD100,000 on an annualised basis for each employee. Due to the likely high subscription, not more than 25% of the forgiven amount is expected to be for non-payroll costs.

The SBA emergency loan fund had over 3m applications. The loan was processed by 4,664 lenders across the US for about 1,525,000 companies, contractors and sole traders to keep them afloat amid the crisis. The SBA announced that all of the USD349bn allocated for PPP loans had been used up as of 16 April 2020; however, pay-outs were lagging, raising concern among those whose loans have yet to be approved.

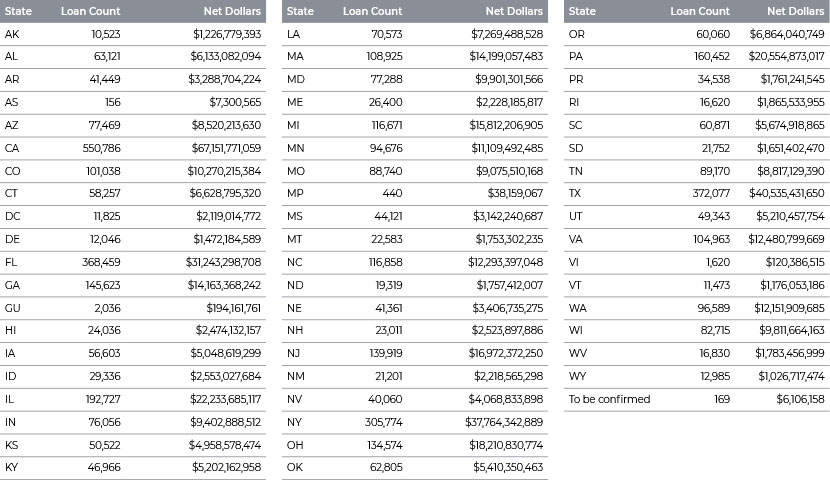

*** Data as of 13 April 2020

The three biggest state economies – California, Texas and New York – accounted for 23% of the loans, i.e., more than USD82bn. Meanwhile, businesses in a number of small, rural states that have avoided the brunt of the outbreak took home a disproportionate share of the pie.

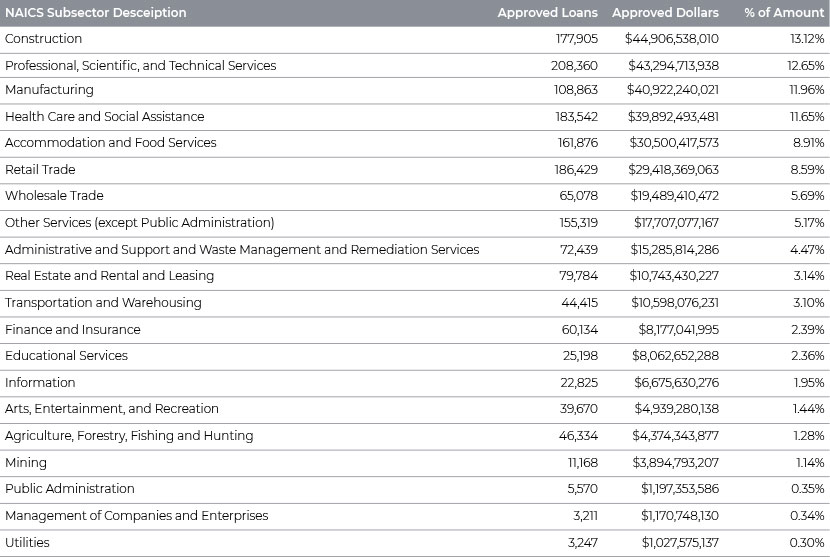

The construction industry is one of the main industries receiving a bulk of the funds – 13.1% of the total – while companies worst hit by the crisis – those in the accommodation and food services sectors – received about 9% of the pot.

***Approvals through 16 April 2020

PPP: Round 2

The federal PPP was so popular that the funds were disbursed in just two weeks. Consequently, many business owners were left unfunded. Therefore, additional funding of USD310bn was approved for the PPP.

One important provision of the new funding measure is that USD30bn was set aside specifically for community lenders, small banks and credit unions. An additional USD30bn will be allocated for midsize banks and credit unions. It is quite possible that the community banks and smaller credit unions may still be processing loans after the large banks tap the USD250bn they have access to.

It was predicted that the additional funds would be allocated far more quickly than the first round, as the pipeline of applicants was full; however, it is end of June and there is more than USD128bn still unallocated for small businesses.

As of 20 June 2020, 4.6m loans had been granted via the two rounds of the PPP for a total loan value of USD515bn.

Changing guidance may also have kept some businesses on the side-lines. The SBA and Treasury have issued new or updated guidance about a dozen times since the programme was introduced on forgiveness, audits, eligibility and other aspects. In addition, small businesses unsure about what the future holds may not have considered taking such a loan a worthy endeavour.

For business owners who have secured funding, the PPP has proven to be a financial lifeline for weathering the economic downturn.

Loan size of second round

***Approvals through 20 June 2020

Grey areas of the PPP

-

Messy rollout

-

Banks’ concern about whether due diligence has been conducted and likely fraud/default

-

Lending limits

-

Non-SBA partners were largely non-starters

-

Systems have been overloaded

PPP Flexibility Act of 2020

The PPP Flexibility Act of 2020, signed into law by President Trump on 5 June 2020, amends the PPP to give borrowers more flexibility in terms of how and when loan funds are spent while retaining the possibility of full forgiveness.

Key takeaways

-

The PPP Flexibility Act amends the PPP to give borrowers more time to spend loan funds and still obtain forgiveness

-

Borrowers now have 24 weeks to spend loan proceeds, up from 8 weeks

-

The Act also reduces mandatory payroll spending from 75% to 60%

-

The two new exceptions let borrowers obtain full forgiveness even without fully restoring their workforce

-

Time to pay off the loan has been extended to five years from the original two

-

The Act now allows businesses to delay paying payroll taxes even if they have taken a PPP loan

Risk of fraud

The risk of fraud and exploitation emerges, as borrowers may seek PPP loans under different business names, ones that were not actually operating before the crisis. For example, Staveley, a resident of Andover, Massachusetts, was accused of claiming that he and his business partner needed to pay employees at businesses affected by the crisis, when in reality, these businesses were not operating before the pandemic and had no employees on the payroll. Such fraudulent behaviour has implications for the borrower as well as the lender.

Acuity Knowledge Partners’ lending practice

We have been supporting clients in verifying and analysing loan/proposal documents. Our service also includes analysing an applicant’s payroll costs using the information provided in conjunction with company sales. We can also assist lenders with due diligence and monitoring to assess loan forgiveness applications.

Sources:

https://home.treasury.gov/system/files/136/PPP--Fact-Sheet.pdf

https://www.vistage.com/research-center/business-financials/20200331-cares-act/

https://www.insurancejournal.com/news/national/2020/04/17/565287.htm

https://www.investopedia.com/paycheck-protection-program-flexibility-act-of-2020-an-overview-4846944

What's your view?

About the Author

Ritika Sharma has over a decade of experience in credit analysis. Her area of expertise is analysing financial statements of new and existing corporate borrowers to determine their financial strength and creditworthiness in line with bank’s risk policy. Currently, she supports the commercial underwriting team of a US-based bank, focusing on gathering, analysing and evaluating risk exposure data through appropriate risk documentation. She holds an MBA in Finance from Kurukshetra University.

Comments

17-Jul-2020 10:07:58 am

Good work Ritika, through information provided. This program definitely help not only SMEs also people working there to survive in this critical economic situation.

Like the way we think?

Next time we post something new, we'll send it to your inbox