Published on March 30, 2023 by Koundinya Nedunuri

The metaverse has been positioned as the successor state to the internet, also known as Web 3.0, as well as a platform for human leisure, labour and existence. When one aims to replicate reality in a metaverse, one needs to consider the existence of a thriving economy. This article discusses recent developments and opportunities in payments across the metaverse.

Banks’ current payment solutions do not achieve the interoperability of the metaverse. Transacting traditional money requires a vast infrastructure of banks and regulators to act as custodians, intermediaries and clearing houses. Hence, financial institutions need to explore unique solutions in payment services that could achieve the interoperability and ease required for making payments in the metaverse. Cryptocurrencies such as Bitcoin or Ether could be the solution to all the problems a regular payment system causes. Users can buy, sell and trade across all wallets (PayPal cannot send money directly to Venmo), and there would be no intermediaries taking custody. Users also do not need a bank account and sellers do not need to negotiate, register or sign deals with crypto rails. We explore details on payments in the metaverse below.

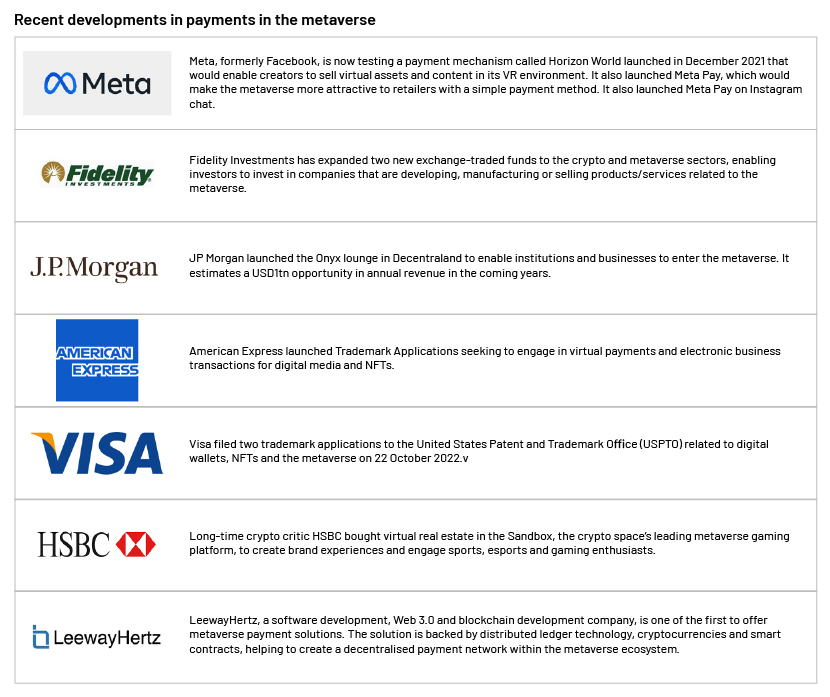

Before the metaverse craze, payment giants had begun exploring payment methods needed by the metaverse. Facebook launched cryptocurrency project Libra in June 2019, before it even changed its name to Meta. It aims to be a new decentralised blockchain, low-volatility cryptocurrency and smart contract platform. In 2016, Alipay launched VR Pay. The user selects the product on the mobile virtual reality (VR) platform or VR app to place an order, confirms the purchase, enters the payment link, selects Alipay and clicks to confirm the payment.

Payments in the metaverse

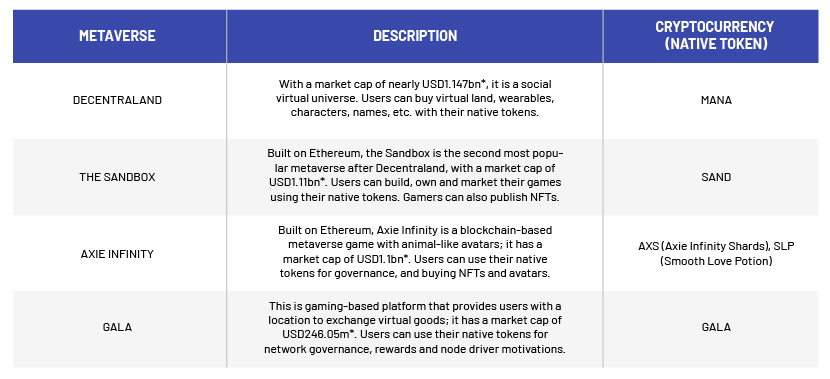

The metaverse has already taken shape, with a number of platforms built on different blockchains with features such as smart contracts for virtual land, native cryptocurrencies and non-fungible token (NFT) trade. The following are examples of such platforms and their respective cryptocurrencies:

*Market cap as of 15 March 2023; Source: Blockworks and Coinbase websites

Virtual assets such as NFTs and in-game currencies in gaming are increasingly using cryptocurrency for payment. Cryptocurrencies are less fragmented than today’s in-game currencies such as Robux and COD points, support two-way exchange (from USD to BIT and back) and are interoperable; for example, the same currency used in Decentraland can be used in Axie Infinity.

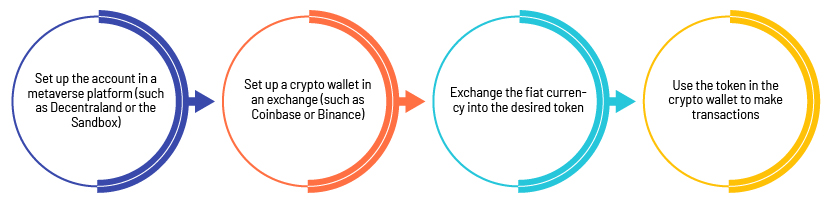

As we can see, each metaverse platform has its own cryptocurrency, native token or in-game currency. Players use this for trading, network governance, etc.; these are different for different platforms. A user takes the following steps to make payments on a metaverse platform:

Although cryptocurrencies are the most popular payment method in the metaverse, there is still room for fiat currency and traditional payment methods.

For example, in-game microtransactions on online gaming platforms are a big business, with games such as Fortnite making billions of dollars each year from selling digital goods to their players. These transactions are usually made with fiat currency. There are two types of fiat-based transactions: the first uses central processors such as PayPal and major credit card networks, and the second uses a virtual currency one can buy with fiat currency, such as FIFA coins on EA Sports FIFA.

Payment with cryptocurrency does not come with the benefits of a smooth process, such as one-click payments and the familiarity of traditional payment methods. By combining the security and ownership of crypto and the smooth processes of traditional payment methods, the metaverse could be more accessible to the market.

Embracing the metaverse payment sector</

strong>Recent developments, potential problems and their solutions indicate payments in the metaverse are still at a nascent stage. They need to mature, along with hardware requirements, smart contract-based businesses and regulatory issues. That said, it is good investment to ride the Web 3.0 wave, as its advent is inevitable. Finance companies need to develop cryptocurrency capabilities and invest in their in-house blockchain platforms to ensure all the parts involved in the entry to the metaverse are properly running, ensuring interoperability and speed.

Business leaders should start identifying how to create payment functionality in a world beyond traditional currency and crypto. There are several ways in which companies can brace for this change; the adoption by Ingenico is one example. It has started to share the risk of acquirers by shifting its model to a mix of lower one-time costs and recurring fees for ongoing service, software and maintenance. This ensures the longevity of their technology in the fast-changing world, by being more agile and avoiding large integration costs through introducing Android-based terminals. Other ways to ride the Web 3.0 wave is by investing to develop cryptocurrency capabilities and identifying gaps in the offerings of cryptocurrency payments such as introducing BNPL or one-click payment facilities.

The possibilities are endless with the metaverse still in a nascent stage, but the time to act is now!

How Acuity Knowledge Partners can help

We have been providing strategic research support in the digital transformation journey to diverse stakeholders in the technology sector – tech corporates, tech advisory firms and tech-focused investors – for nearly two decades. Our unique approach, combining process, people and technology, delivers faster results and drives excellence for our clients. A number of them leverage our proprietary suite of business excellence tools and offerings to unlock new levers of business growth and unmatched returns on investment. We help clients keep abreast of developments around metaverse payments in real time, providing bespoke research required by strategy teams such as market and competitive intelligence and providing the required investment research.

Sources:

-

A guide to payments in the metaverse, Digital Journal, Mar 2022

-

The metaverse and payments: 5 new developments, CUinsight, Apr 2022

-

HSBC Buys Virtual Land in The Sandbox's Metaverse – Crypto Briefing

-

Meta eyes Instagram payments as a gateway to metaverse – The Financial Revolutionist (thefr.com)

-

How Payment Methods Will Work in the Metaverse (pagbrasil.com)

-

Decentraland (MANA) Price, Charts, and News | Coinbase: mana crypto, mana price, mana coin

-

The Sandbox Price (SAND), Market Cap, Price Today & Chart History – Blockworks

-

Axie Infinity Price (AXS), Market Cap, Price Today & Chart History – Blockworks

-

GALA Price (GALA), Market Cap, Price Today & Chart History – Blockworks

-

Visa Files Trademark Applications for Crypto Wallets, NFTs and the Metaverse (coindesk.com)

Tags:

What's your view?

About the Author

Koundinya is a Delivery lead at acuity with 7 years of work experience. He has exposure to roles in strategy and business consulting for various startups, and is adept in competitor benchmarking, Industry study & market sizing. He is currently working with top payment industry clients to support their central strategy departments. Koundinya has completed his B.Tech in Civil Engineering from IIT Guwahati in 2016 with a minor degree in Product design.

Like the way we think?

Next time we post something new, we'll send it to your inbox