Published on May 5, 2020 by Pankaj Bukalsaria

The COVID-19 pandemic is a black-swan event that no one was prepared for. Its severity and scale have led to drastic responses, including nationwide lockdowns and stringent travel restrictions, and created significant market uncertainty. The aviation, travel and leisure sectors were the sectors immediately affected, closely followed by retail, already struggling due to the rise of ecommerce companies. Low oil prices and a drop in fuel demand made matters worse for energy companies.

While governments are taking fiscal and monetary measures to provide liquidity in the near term, the decrease in consumption, lower production and supply chain disruptions are bound to impact businesses, forcing many of them to restructure or declare bankruptcy.

Corporate leverage is already much higher than it was during the 2008 financial crisis. According to JPMorgan, major corporates have announced new loans and drawn credit lines of USD208bn (as of March 2020). This only includes amounts disclosed by large borrowers; middle-market and private companies are likely to have made more borrowings.

Restructuring advisors to play a key role

As companies face challenges in terms of incremental cash, working capital and liquidity, they are turning to specialist financial advisors to help them weather the crisis and keep their businesses viable. Restructuring advisors are helping them adopt effective liquidity management strategies to ease cash pressure – essential for long-term sustainability.

A senior financial advisor specialising in debt advisory and restructuring recently stated in a Business Insider interview that “Clients of all sizes are asking about liquidity. The single most critical factor that narrows a company's degrees of freedom and available options is a shortfall in liquidity". Another senior advisor commented that "Companies need to protect themselves by reducing whatever costs they can, minimizing costs of operations. You have to draw down bank lines…Cash is going to be king here for a little while until things start to settle”.

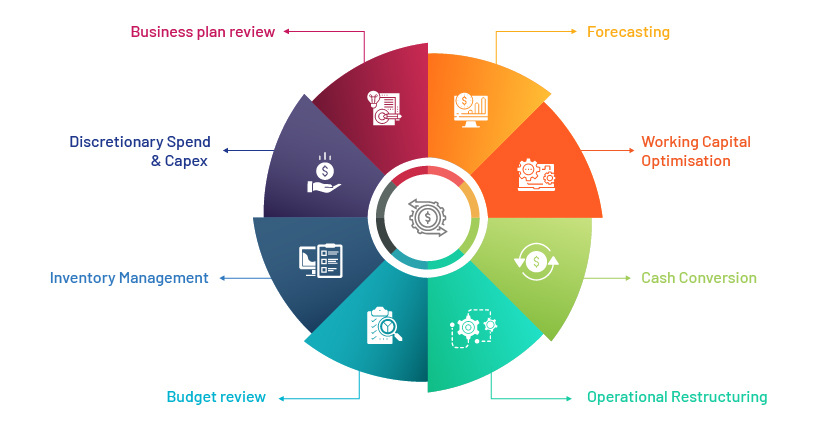

There are normally three stages of restructuring advisory: assessing liquidity, looking for available options, and contingency planning, if required. Restructuring advisors have been helping their clients assess cash flow prudently, analyse business viability and scenarios comprehensively, identify funding alternatives, and evaluate restructuring options, as shown below:

1. How much is required and for how long? – Cash flow assessment

In these uncertain times, short-term and medium-term cash flow forecasting and planning are the first and most important measures for effective liquidity management. It would first involve assessing a company’s current and future cash flow needs as follows:

a. Reviewing and updating assumptions, business plans, and budgets

b. Decelerating the cash-burn rate

c. Modelling downside and worst-case scenarios

d. Budgeting and updating cash flow projection for the next three to six months

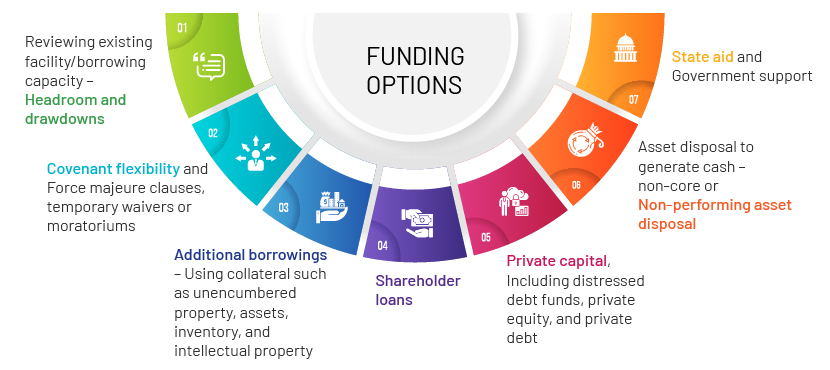

2. What are the options? – Funding assessment and alternatives

Despite prudent cash flow management, companies may breach covenants. They may also miss servicing debt obligations or making interest payments. Thus, in a rapidly deteriorating cash scenario, restructuring advisors help explore liquidity options to ensure the health of the balance sheet.

a. Reviewing existing facility/borrowing capacity – headroom and drawdowns

b. Covenant flexibility and force majeure clauses, temporary waivers or moratoriums

c. Additional borrowings – using collateral such as unencumbered property, assets, inventory, and intellectual property

d. Shareholder loans

e. Private capital, including distressed debt funds, private equity, and private debt

f. Asset disposal to generate cash – non-core or non-performing asset disposal

g. State aid and government support

3. Contingency planning – Restructuring alternatives

Finally, the increasing operational and financial challenges given the recessionary economic conditions may require advisors to assess business viability and prepare for financial restructuring. Advisors work on contingency plans in terms of restructuring alternatives, to preserve and recover any value, and to plan a rescue and revival, or exit.

Some options to consider and evaluate:

a. Out-of-court restructuring of liabilities with creditors

b. Distressed M&A, and divestiture of companies and divisions to protect value

c. Initiating bankruptcy and insolvency to protect the business

d. Complete sale or liquidation if future business viability is uncertain

Restructuring advisors expected to get busy as situation worsens and defaults increase

Wall Street expects this economic crisis to be worse than the last recession. A number of bankruptcies are expected, with more firms being unable to pay back their debt due to government-ordered lockdowns. According to a Moody’s Investor Services report, the number of distressed companies (with ratings of B3 Negative and lower) soared past the 2009 level (291 companies) to a new high of 311 companies, (110 added in March alone), indicating an expected rise in defaults that may ultimately result in restructuring or bankruptcy. Moody’s baseline default forecast is for the US spec-grade default rate to end-March 2021 at 14.4%.

Businesses would need specialised advisors and restructuring specialists to guide them through this difficult situation; many have already started partnering with investment banks and advisors.

Acuity Knowledge Partners works with leading investment banks and corporate finance advisors on restructuring and special-situation projects and mandates. Our almost two decades of experience mean that we even supported investment banking clients through the 2008 financial crisis. Our specialised teams of restructuring experts are equipped to support all aspects of restructuring and debt advisory, including liquidity management, creditor advisory, insolvency and reorganisation support, distressed assets support and other turnaround activities. For more details on our restructuring and debt advisory click here.

Adapting to the new normal

We believe COVID-19 will have a deep impact on how we do business around the world. Businesses will need to be agile to adapt to this new normal of business as they rethink their strategy for 2020

Here is where Acuity Knowledge Partners can help you navigate through these challenging times. Our global offices can enable you to handle business demand and uncertainties with ease. Currently, we are helping many of our clients with our understanding of the market to chart their 2020 strategy.

To help our clients navigate both the people and business impact of COVID-19, we have created a dedicated hub containing a variety of topics including our latest thinking, thought leadership content and action oriented guides and best practices

Sources:

-

Press Releases

Tags:

What's your view?

About the Author

Pankaj has over fifteen years of experience in investment banking. He oversees multiple client engagements on front office research and analytics support across Corporate Finance / M&A, Capital markets including Islamic products, and Restructuring & Debt advisory. He has significant experience in working on Oil & Gas, Metals & Mining, Fintech and FIG sectors. A significant aspect of his work involves white boarding client requirements, proposing solutions and onboarding and managing client relationships across the globe, with focus on the Middle East, Africa and Asia. Prior to Acuity, he worked with UBS IB offshore team in India, where he led the set up and transition of Global Energy team..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox