Published on September 22, 2021 by Anurag and Nikhil Gupta

Innovation has changed significantly the way we work, shop and pay for goods. Sellers and buyers do not lean towards using hard cash any longer, enabling growth in contactless payment platforms such as Google Pay, PhonePe and Paytm. Payments can also be made with mobile phones at advanced cash registers. Another payment option gaining popularity is bitcoin (a type of cryptocurrency).

What are cryptocurrencies?

Cryptocurrencies are computerised money maintained by a decentralised system that, in turn, is maintained by cryptography and based on blockchain technology with built-in security. Blockchain shows how exchanges are recorded into "squares" and are time-stamped.

What are bitcoins?

Unlike paper cash, the use of which is constrained by national banks or specialist financial organisations, bitcoins are made and held electronically on computers. Bitcoin is a type of cryptocurrency that uses peer-to-peer technology for monetary transactions between individuals or organisations.

It is generally viewed as the first and most valued digital money that focuses on open methods for trade, consolidates decentralised control and ensures client anonymity and record-keeping through a blockchain. With increasing supply, bitcoin is the world’s largest cryptocurrency today.

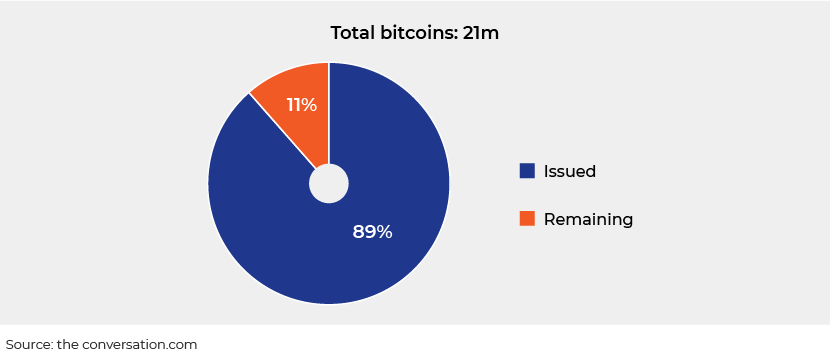

This 11% cut-off is hard-coded into the bitcoin convention and cannot be changed. It creates a false shortage that guarantees the expansion of computerised cash over the long run.

The origin of bitcoin

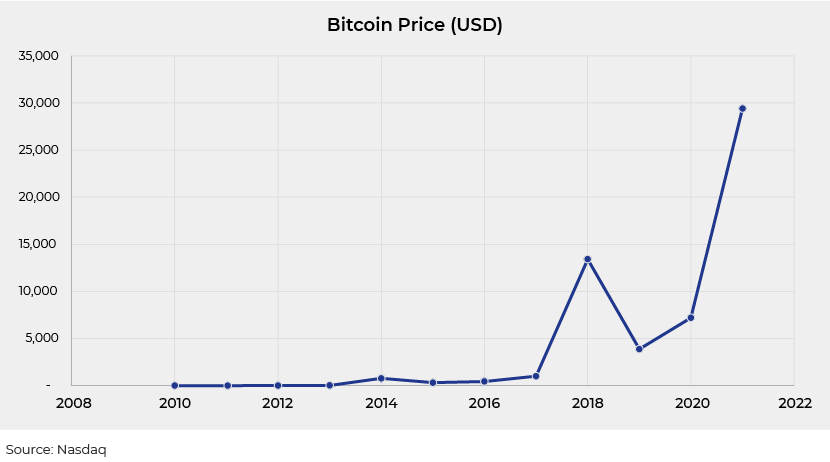

The concept was first presented in 2008 in a white paper by Satoshi Nakamoto, the pseudonymous name of the individual or individuals who developed it. In mid-2009, Nakamoto delivered bitcoin to the public, and a group of zealous allies started trading and mining the cash. Bitcoin's value surpassed USD1,000 in January 2017, just before reaching a peak thereafter.

Determining the price of bitcoin

The price of bitcoin is driven by the market in which it is exchanged. The cost is determined by how much somebody will pay for it. The market sets the price as it would for commodities such as gold, oil, sugar or grain. Like any market, bitcoin depends on principles of market interest, i.e., the higher the interest, the higher the volume, and vice versa.

Current scenario

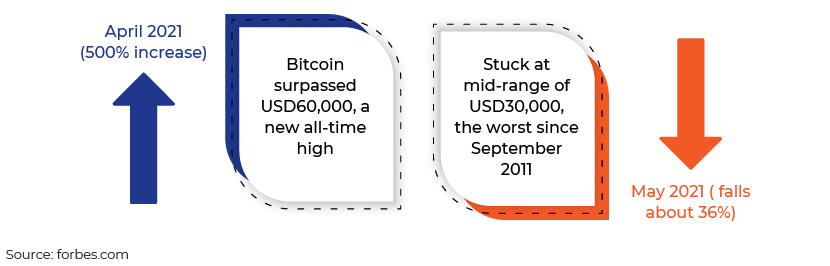

Bitcoin was valued at more than USD19,000 by end-2017; it tumbled to almost USD3,000 just a year later and reached a high of more than USD61,000 by March 2021. It is typically volatile, and values have remained high since its introduction, but it has been on a rollercoaster in recent months.

Bitcoin has proved to be volatile, struggling to meet the expectations of many top investors. It suffered significantly from Elon Musk’s announcement that Tesla no longer accepted it as a form of payment, and from China not allowing its citizens to use cryptocurrencies for financial transactions.

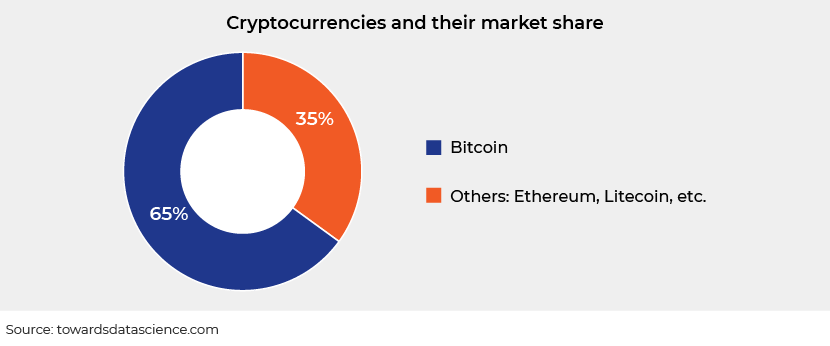

However, bitcoin has surpassed its rivals and currently represents 65% of total cryptocurrency market cap.

Bitcoin’s story as a resource class has changed fundamentally from Nakamoto's unique vision. It is currently viewed as a “store of significant worth”, with holders selecting overwhelmingly to adopt buy-and-hold strategies (HODL) rather than going through with transactions.

As bitcoin is still in its early stages, there are a number of issues, starting with there not being guidelines on using it. Crypto tokens are not made to be managed, the main reason being that it is difficult for nations to authorise their use. Countries such as Saudi Arabia, Algeria and Bolivia have banned the use of digital currencies, and nations such as Japan, the US, India, Germany, Canada, Malta, the Netherlands, Vietnam and Russia still consider the use of these unlawful.

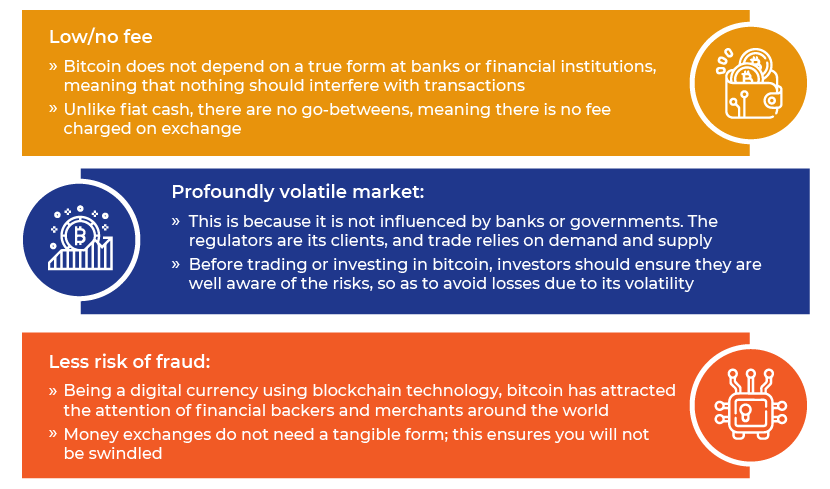

We believe, however, that the value of bitcoin will recover and generate profit for investors in it. While bullish investors expect satisfactory results, the bears recall its instability. It bounced back in 2020, after a steep fall in 2018. Since mid-March 2020, its value has grown c.800%. The following are likely reasons why its value has risen despite the uncertainty surrounding it:

Conclusion

Many believe cryptocurrencies are the future of transactions, especially as they move towards standardisation and are covered by more extensive regulation. Medical services, transportation and logistics are some of the many areas that would benefit from more extensive blockchain appropriation and execution.

The use of bitcoin, a very lucrative alternative asset class, has expanded significantly over time. Its value may reach c.USD107,484 by end-2021, with a market cap of c.USD1,998bn, according to Finder’s May 2021 panel report.

Central banks across the world are planning to launch their own “bitcoin-inspired” cryptocurrencies, which would be more reliable than the almost unregulated cryptocurrencies such as bitcoin.

Overall, we believe the future of bitcoin is promising, given its increasing popularity among countries, institutions and retail investors. However, an investor would need to keep in mind that it is highly volatile at present and its price is subject to market risk.

How Acuity Knowledge Partners can help

We support global and regional commercial banks and investment banks with constant and granular monitoring of their portfolios. Our analysts (MBAs, chartered accountants, CFAs), working from our delivery centres in India, Sri Lanka and Costa Rica, function as an extension of client teams and provide support on portfolio-monitoring activities in the credit space. This includes financial modelling and valuation, financial spreading, covenant monitoring, extrapolating bankruptcy threshold triggers, providing refined early warning signals (negative news support), credit ratings, customised credit reports, short-term outlook and a host of other value-added research involving art-of-the-craft IT solutions. All credit solutions are customised to reflect a client’s proprietary and differentiated analysis, giving the client a unique sustainable edge.

References:

https://www.aeaweb.org/articles?id=10.1257/jep.29.2.213

https://www.in2013dollars.com/bitcoin-price

Bouri, E., Molnár, P., Azzi, G., Roubaud, D. and Hagfors L.I., 2017. On the hedge and safe haven properties of Bitcoin: Is it really more than a diversifier? Finance Research Letters, 20, pp. 192-198

https://economictimes.indiatimes.com/topic/Bitcoin

http://store.ectap.ro/articole/1306.pdf

https://www.finder.com/cryptocurrency-predictions

What's your view?

About the Authors

Anurag has over 13 years of experience in the financial services and banking domains in managing commercial credit portfolios and writing reports such as thematic credit, credit rating, annual review and counterparty risk reports. His key responsibilities at Acuity include managing a credit portfolio for a US-based regional bank. Prior to joining Acuity in 2019, Anurag worked as a manager with a large US bank.

Nikhil is a credit analyst with 1+ years of experience in financial analysis and covenant monitoring. His key responsibilities with Acuity include financial analysis and covenant monitoring for a regional US bank. Prior to joining Acuity, Nikhil worked as a private equity analyst with an Indian brokerage firm.

Like the way we think?

Next time we post something new, we'll send it to your inbox