Published on April 24, 2023 by Asha Jagadishwaran and Annu Liss Anto

Introduction

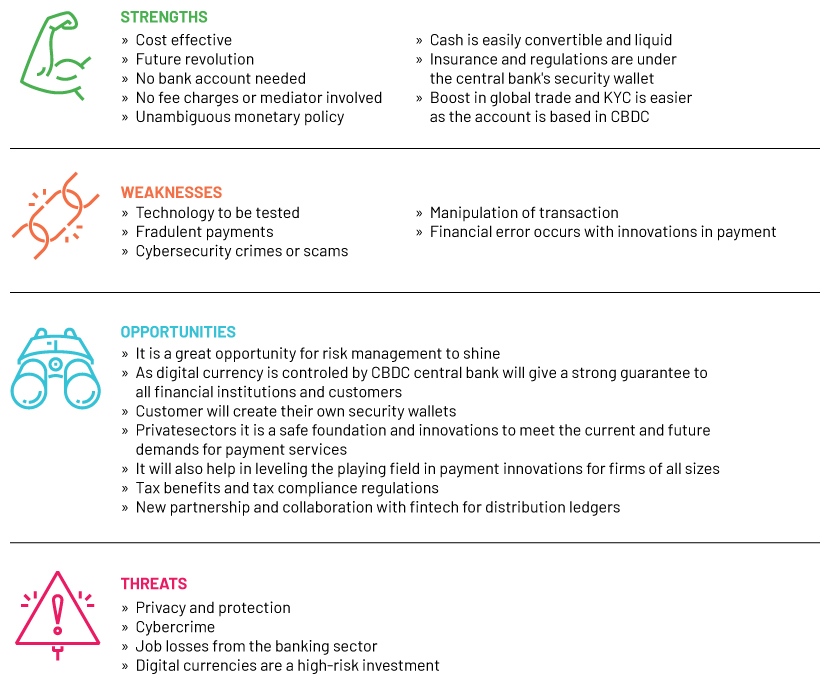

Digital currency is an electronic or digital form of currency that reduces the number of a consumer’s daily physical transactions. Financial institutions aim to develop advanced technology to revolutionise this space. Most central banks have released their own digital currency for use by the wider economy, with significant implications and policies for legacy payments, known as a central bank digital currency (CBDC). A CBDC is regulated by central banks that control monetary policies and regulations and monitor potential threats. Instead of printing currency, the central banks would create digital currency that can be used widely to make transfers and transactions easier. Understanding what digital money and its infinite possibilities is in both the physical and digital markets is critical. This blog also covers what is expected of the currency, a SWOT analysis of its use and the role of compliance.

Key information

Digital money will soon play a large role in our lives:

-

Businesses, government organisations and individuals globally will soon recognise digital currency as legal tender.

-

It has significant potential to generate interest and profits, which would only increase as more governments get involved in promoting its use.

-

Digital services are more convenient when paying a premium and making a claim, and dealing with sales proceeds where information and the system gives us a suitable plan.

-

It makes it easier to set up a trading account and offers financial security globally.

-

Legal measures would need to be enforced to secure investments and profits ensuring minimal complexity to make its use attractive. Regulations differ between countries – some are receptive to its use while others are passive or completely opposed to it.

What we expect

Digital currency is likely to be the future of the financial sector. Digital currencies can be used by individual businesses and financial institutions for a variety of purposes, including interbank transactions:

-

We expect digital currency to increase demand for financial instruments that enable peer-to-peer transactions without an intermediary

-

It may accelerate the move to the metaverse

-

Technological advancements would continue to evolve and mature in the financial sector and risk management

-

Digital currency may move towards new assets and non-fungible tokens

-

It would help the private sector and competition globally

-

As digital currency is centralised, governments could guarantee deposits to protect customers from the currency losing face value

-

It may revolutionise the banking sector and financial services, and make business transactions faster

-

We expect insurers to formulate different approaches to covering virtual money-related risks. They may provide coverage for digital assets in terms of custody plans in terms of crimes such as theft or hacking

Relevance of compliance

Financial compliance plays a significant role in reducing system risk and financial crime. To safeguard investors and ensure markets are effective, transparent and fair, compliance in digital-currency platforms would need to meet essential regulatory objectives. A lack of regulation in this space could encourage hackers and money launderers, harming investors. All five primary responsibilities of the compliance department – prevention, identification, detection and monitoring, advising and resolution – would come into play as the world moves towards digital currencies. They would determine the risks investors face, offer guidance on how to handle and prevent breaches, implementing a control system to safeguard customers and businesses from risk.

Conclusion:

Digital money will likely soon play a vital role. The numerous opportunities it presents makes it even more important to regulate its use and ensure security and transparency. Digital money has revolutionised global markets, but potential threats and cyberattacks remain a concern for both investors and customers.

How Acuity Knowledge Partners can help

We are an influential player in the global market, providing compliance knowledge and a range of services including the following:

-

Validating databases to check for errors in transactions

-

Eliminating discrepancies between single transactions or different currencies

-

Checking documents entered digitally to ensure they are legal and follow the stipulated regulations

-

Checking transactions at the front and back end to ensure data integrity

-

Analysing whether the customer is at high risk

-

Conducting due diligence to avoid deception and reputational harm as a result of the digital transactions

-

Ensuring effective and more efficient consumer protection

-

Compliance and risk management to ensure statistical validity of models and compliance with applicable law and emerging industry best practices

-

Formulating model development plans to address problems encountered during the validation process

References:

Tags:

What's your view?

About the Authors

Asha Jagadishwaran has 14 years of work experience, with expertise in electronic communication surveillance. Prior to joining Acuity Knowledge Partners (Acuity), she worked with the Internal Compliance and Supply Chain team at Honeywell Technology Solutions. At Acuity, she is an integral part of the Corporate and Forensic Compliance team. She holds a master’s degree in Human Resource Management, specialising in Finance, from Tilak Maharashtra Vidyapeeth - Pune

Annu Liss Anto has over 1 year of experience in Corporate and Forensic Compliance at Acuity Knowledge Partners and is engaged in electronic communication surveillance. She holds a master’s degree in Business Administration, specialising in International Finance and Accounting, from Jain University, Bengaluru.

Like the way we think?

Next time we post something new, we'll send it to your inbox