Published on October 14, 2020 by Prasanna Kumar

The impact of shareholder activism on corporate decisions has increased significantly in recent years. Actively managed funds/hedge fund managers/institutional investors seeking alpha on their investments are pushing corporates to implement strategies that, at times, are not in line with the corporate mission/values.

Who is an activist investor?

Investopedia defines an activist investor as “an individual or group that purchases large numbers of a public company's shares and/or tries to obtain seats on the company's board to effect a significant change within the company”.

Usually, an activist investor invests in a business and then takes action that increases the stock price. The investor would subsequently exit the stock with a significant profit, which would not have been the case if the action was not taken. Types of such action include asking the company to cut costs, reduce capex, restructure/divest non-core assets and pay higher dividends. Such action would increase the company’s margins in the short run, increasing its stock price, but hurt its long-term prospects.

How do they identify target companies?

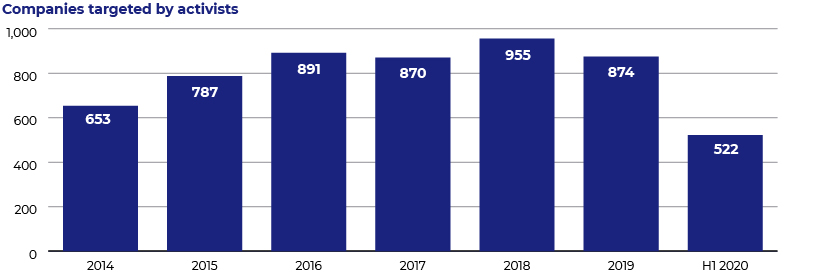

The following chart provides a historical representation of the number of companies targeted by activists.

*2020 refers to data for 1H 2020

Source: https://www.activistinsight.com/

Activist investors explore opportunities for value creation. There are multiple areas of value creation, but they consider the following four broad categories:

-

Financial value creation: An activist investor targets companies with higher levels of cash and liquid securities and low or no borrowing. They campaign for returning unused cash to shareholders explicitly (via a dividend) or implicitly (via a share repurchase)

-

Strategic value creation: An activist investor targets companies with non-core businesses and which may be valued either higher or lower than the intrinsic value. They campaign to divest assets and unlock value

-

Operational value creation: An activist investor targets companies that are inefficiently run, meaning those that are not up to date either technologically or operationally

-

Regulation and governance: An activist investor targets companies with corporate governance issues or lapses. They campaign, for example, for changes in board structure, management compensation, and separation of roles of chairman and CEO

Types of campaigns by activist investors

Activist investors adopt a number of strategies in their campaigns. Their approach and actions may be mild, such as negotiating with management, but could also be aggressive, such as pursuing litigation. We discuss below a few types of campaigns/approaches:

-

Proposing resolutions: Proposing resolutions at board meetings to address and influence areas such as corporate policies and practices, executive compensation, operations and corporate behavior

-

Proxy voting: Activist shareholders may try to persuade other investors to use their proxy votes to promote changes in management and board composition

-

Hedge fund activism: May use borrowed money in an aggressive strategy to effect a notable change in corporate strategy or financial structure, or major board or management changes

-

Mass media: May resort to negative publicity campaigns to draw public attention to shareholder concerns to put enough pressure on management to agree to shareholder demands

-

Litigation: In the worst-case scenario, activist investors could initiate legal action against management on matters including but not restricted to social and environmental factors

Reasons for an increase in shareholder activism

Activists have been able to generate returns in excess of benchmarks and attract more capital. More return on an investment attracts higher inflows, increasing the war chest. The following graph depicts the capital attraction cycle:

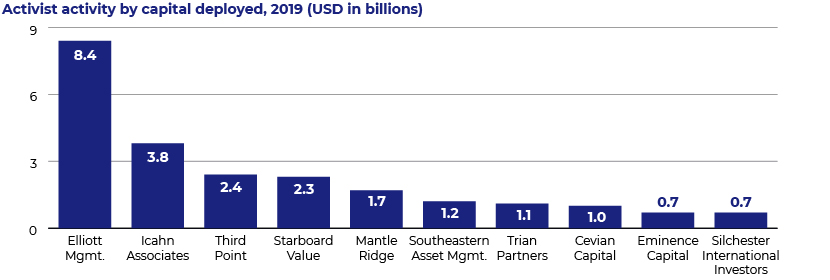

Who are the top activists?

Opportunity for investment banks

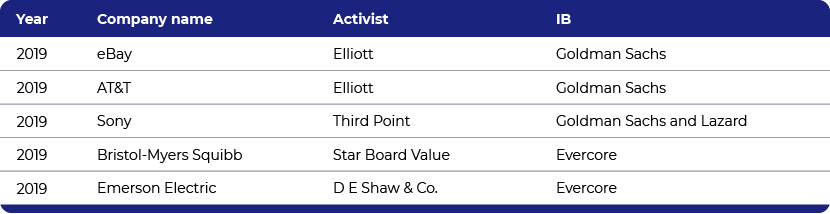

Many investment banks (IBs) provide shareholder advisory services to defend corporates. This particular field has been dominated by a few bulge-bracket firms such as Goldman Sachs and Morgan Stanley for a while. These firms naturally focus on large corporates, presenting a significant opportunity for mid-market IB firms to target mid-size to small corporates. Such companies usually do not have the required infrastructure or resources to deal with activists. Therefore, they hire IBs for a fee.

IBs advise these companies’ management or boards on effective investor engagement strategies – how to build strong and productive relationships with institutional investors. The services also include drafting press releases, analysing costs and preparing a defensive strategy to counter activists’ demands. The advisory team prepares a comprehensive financial analysis of the client by peer-benchmarking operational metrics, analysing SG&A costs, taking a critical view of capex and analysing shareholder voting trends.

Once an IB defends a corporate, the trust built would result in a long-term relationship, leading to follow-up business in other areas of investment banking.

Goldman Sachs ranked #1 in the shareholder activism space in 2019, followed by Morgan Stanley. Lazard and Evercore also featured among the top 10, according to global provider of financial market data Refinitiv.

Global expansion

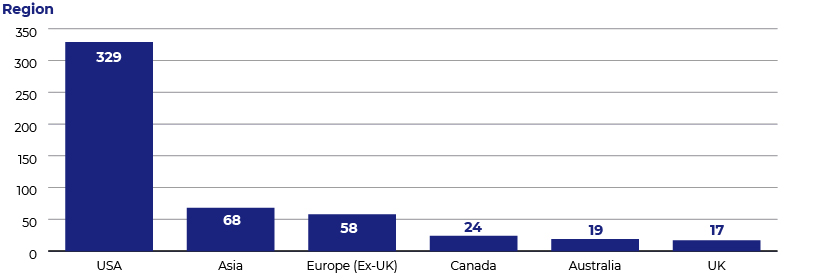

Activist investors have historically been common in the US, but their numbers in Europe, and of late in Japan, are increasing. IBs, having developed strong skills in dealing with activists in the US, are better equipped to deal with those elsewhere as well.

The following chart depicts the number of companies targeted by activist investors by region in 1H 2020:

Source: https://www.activistinsight.com/

What about the other side of the table?

There is also an opportunity on the other side of the table – to advise institutional investors/hedge fund managers. A few IBs have done so in the past, but the majority advise only corporate clients and not activist investors. Houlihan Lokey mentions in the list of services it provides that for certain highly selective transactions, it may assist activist shareholders in terms of providing analytical and strategic support. IBs are well aware that corporates or boards will find it very difficult to work with IBs that previously worked with activist investors. Some IBs such as Greenhill and JP Morgan are even vocal about not representing activist hedge funds.

Recent examples

Activist investor Starboard Value LP picked up a significant stake in Mednax Inc., a healthcare service provider, in December 2019. It pushed the board to either full or partial sale of the company. In July 2020, Mednax announced leadership and board transitions. Moelis and Barclays served Mednax as financial advisors.

Jana Partners, an activist hedge fund, acquired a nearly 9% stake in Whole Foods, an organic food grocer, in April 2017. The hedge fund was looking to shake up upper management. Whole Foods’ CEO hired Evercore to defend itself against the activist investor. Eventually, Amazon acquired Whole Foods in June 2017, and Evercore advised Whole Foods on the sale process.

Outlook

With the large number of cases of shareholder activism, there is increasing opportunity for bulge-bracket and mid-market IBs to defend corporates.

This advisory service is largely relationship-driven, similar to any other M&A deal. An experienced managing director or director of an investment banking division with a strong relationship with a company’s management or board members would lead the engagement. Data sourcing, number crunching, data analysis and first-cut pitch material would be prepared by investment banking analysts/associates/VPs.

Acuity Knowledge Partners offers onshore IBs in the US and Europe M&A-, debt- and equity-related solutions and shareholder activism solutions. We have dedicated shareholder activism support teams to help clients with in-depth research and data analysis so that our clients can focus on pitching and negotiation.

Sources:

https://www.investopedia.com/terms/a/activist-investor.asp

https://www.eurekahedge.com/Research/News/825/Shareholder-Activism

https://www.activistinsight.com/research/ActivistInsight_H12020Stats.pdf

https://www.activistinsight.com/research/_AIHYR_2020.pdf

https://www.reuters.com/article/us-goldman-sachs-activists/goldman-ranks-as-top-activism-defense-firm-beating-morgan-stanley-idUSKBN20T2O1/

https://www.nasdaq.com/articles/starboard-picks-stake-in-mednax-calls-for-cos-sale-wsj-2019-12-10

https://www.hl.com/services/corporate-finance/board-advisory-services/

https://www.greenhill.com/en/business/transactions/activist-shareholder-response

Tags:

What's your view?

About the Author

Prasanna Kumar has over 16 years of experience in global capital markets –Investment Banking and Investment Research. His responsibilities include managing one of the IB engagements and relationship, coordinating with staffers and bankers on new initiatives and services, soliciting feedback, working with teams to identify and improve efficiencies and productivity, training team members on complex and value-added analysis, and implementing industry best practices in the Acuity team for IB Analytics.

Prior to taking up the dedicated role with the account in 2014, Prasanna was working as part of Projects and Transition team gained experience in business development and equity research (financial modeling, report writing, relative..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox