Published on June 7, 2022 by Abubakar Siddeeqh

Introduction:

A Fund House or an asset management company is the company that manages funds, the job of the fund house is to invest pooled funds of retail and institutional investors in equity, fixed income or other such securities in line with the stated investment objective of the fund. Fund Administration refers to back office operations, which includes but not limited to Fund Accounting, financial reporting, net asset value calculation, capital calls, investor communications and other functions that are being carried out in support of the investment fund. In recent times, the fund administrators have been plagued with both operational and growth challenges, firms have adapted well to innovation and development by managing their operations more effectively and not giving in to the pressures of managing multi-asset portfolios. Through the alignment of technology, firms can now offer their asset management customers with a wide array of services.

Fund Administration: The Current Scenario:

Asset managers, have begun to reduce their impeding workload by delegating and employing the help of fund administrators in providing support in middle office and back office operations, outsourcing of the work has helped fund administrators in expanding their business horizon by implementing the latest tech innovations and technical support systems. Fund administrators are now able to work with real-time fund accounting data, they are able to take on mission critical roles and are able to pinpoint out inaccuracies. Majority of Fund houses are now able to deliver robust data analytics, segmentation, and have placed precedence of upgraded IT infrastructure. They have built a fully scalable operating model to ensure 24 hours business continuity across all time zones hence broadening their investment horizon. Furthermore, Fund administrators have evolved their channels of communication to provide for seamless flow of processes. Innovative workflow technology and robotics process automation coupled with the efficient use of AI systems have further upskilled the fund administrators to tackle emerging hurdles and deliver on more value.

Dominant Trends in the Fund Administration Space:

1) Acceleration in M&A activity in industry

-

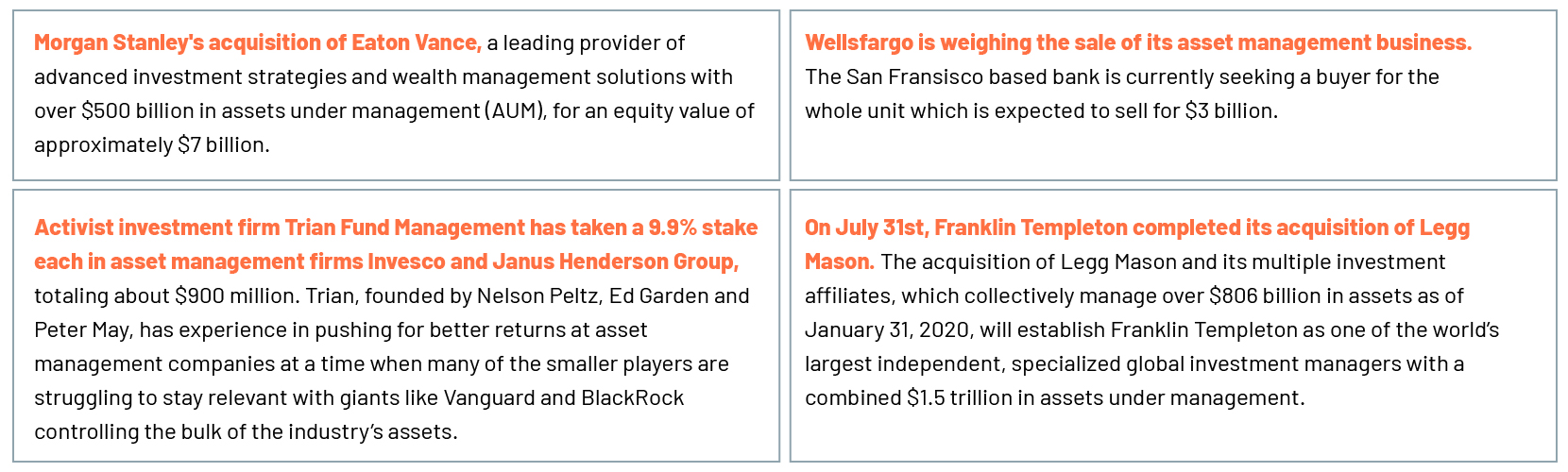

With the increasing expense pressures experienced during the onset of the pandemic, M&A activity has gained prominence in the fund industry. Competitors are consolidating with the hopes of creating a comprehensive business model to sustain & remain well positioned. Some players will need to realize cost synergies quickly to defend profitability; while others need look into more structural changes to their cost base to ensure that costs that have been taken out, remain out.

Some prominent deals in this space

2) Robo-advisory with increasing interest picking up in the ETF space

-

-

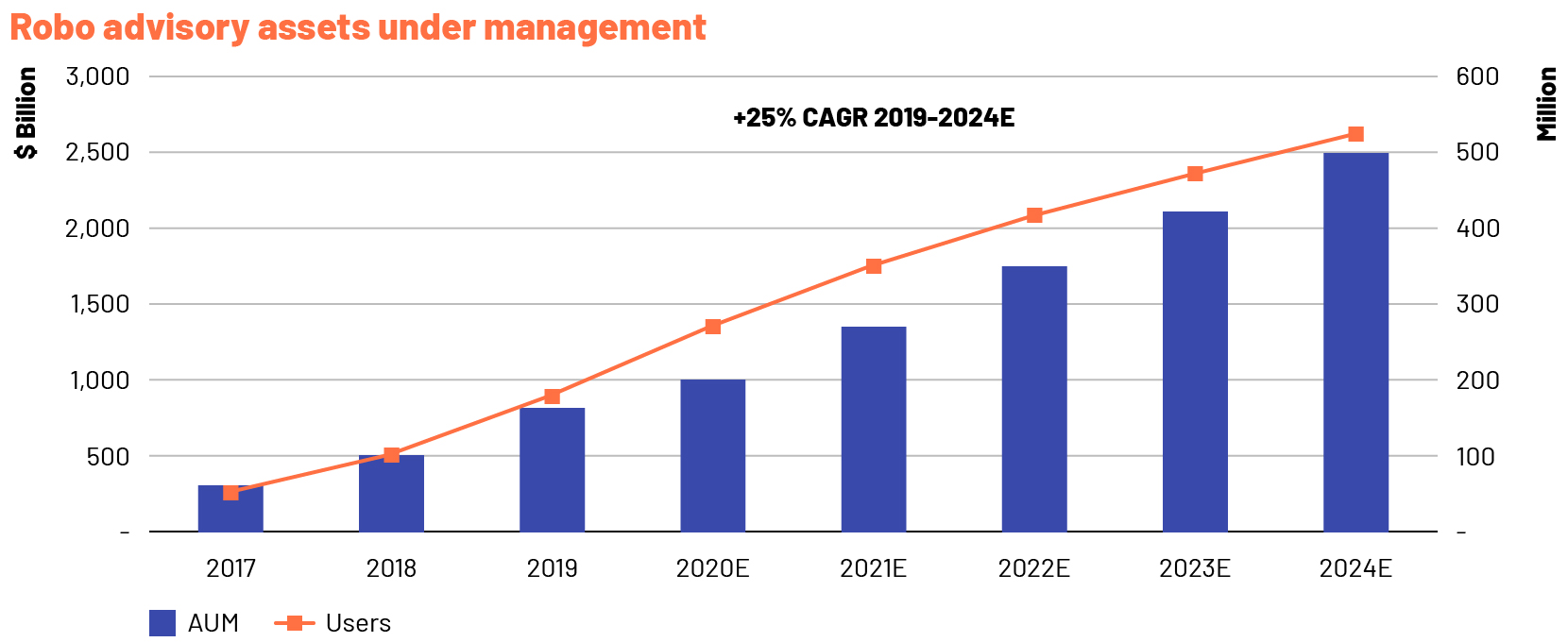

The signups for robo-advisory services have surged since the pandemic with independent robo-advisers Wealthfront and Betterment both reporting double-digital increases in account openings since the market sell-off began. Account sign-ups were up 68% for Wealthfront, while Betterment reported a first-quarter increase in account openings of 25% compared with the prior-year period. Meanwhile, TD Ameritrade saw new-account openings for its automated investing platform jump 150% from the same period a year ago.Total AUM of robo advisors globally is expected to surge to $2.49 trillion by 2024, up from $827 billion in 2019, according to Statista.

-

-

ETFs are being looked upon as versatile tools for investments & interest has been picking up this investment space. From an Asian market perspective; retail investors in Asia are only beginning to embrace ETFs, lagging their global counterparts. Asian investors are comfortable with active products, used to higher returns and less sensitive to active-management fees than their counterparts in the U.S. and Europe, where efficient markets

may provide less alpha-generating opportunities. Asia-Pacific institutional investors including insurance, sovereign-wealth and pension funds are increasingly turning to ETFs to lower costs and diversify across asset classes and geographies. Rule-based and factor-based strategies, commonly referred to as smart beta, are gaining popularity across the region.

-

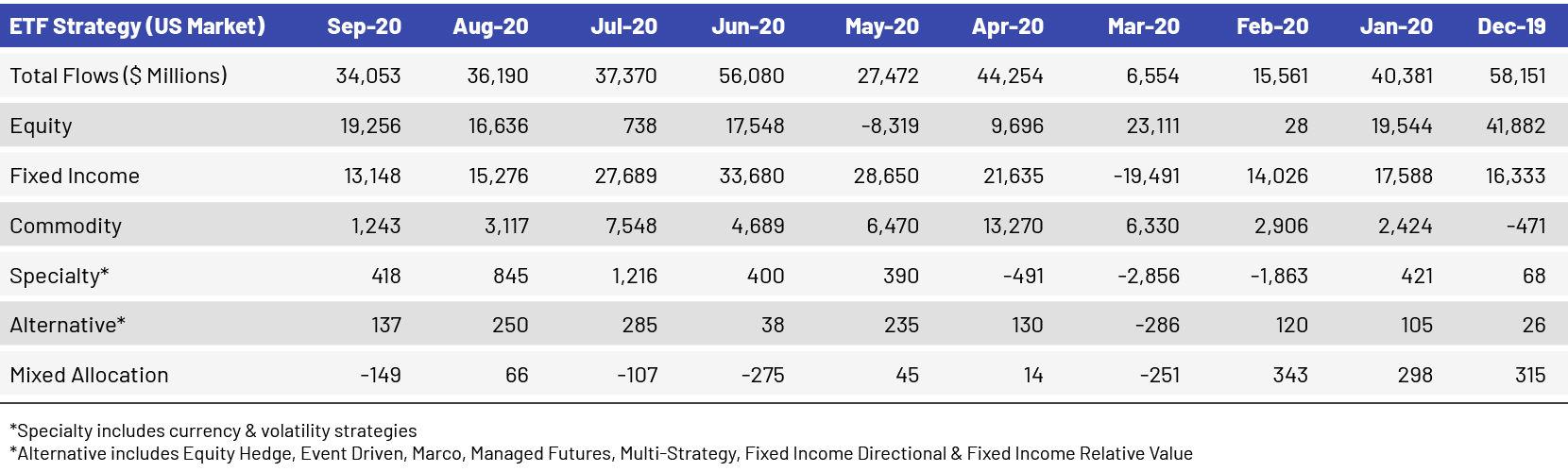

Fund flows have picked up in the ETF space post pandemic stress in March; the below is a compilation reinstating activity gathering pace with respect to fund flows from US markets standpoint –

3) The pandemic has accelerated ESG investment trends in the industry

-

According to Blackrock data, 88 percent of sustainable funds in their analysis outperformed their non-sustainable counterparts in the period 1 January to 30 April 2020. Meanwhile, Morningstar reported 51 of their 57 sustainable indices outperformed broad market counterparts in the first quarter of the year. The amount of money flowing into ESG funds rose by 72% in Q2 2020, accounting for $71m of new investments with Europe accounting for the majority of the allocations, according to Morningstar.

-

Currently 2,706 sustainable funds available which meet the ESG criteria. This is while there were 125 new funds launched in the global market over Q2, with 107 of those being launched in Europe.

-

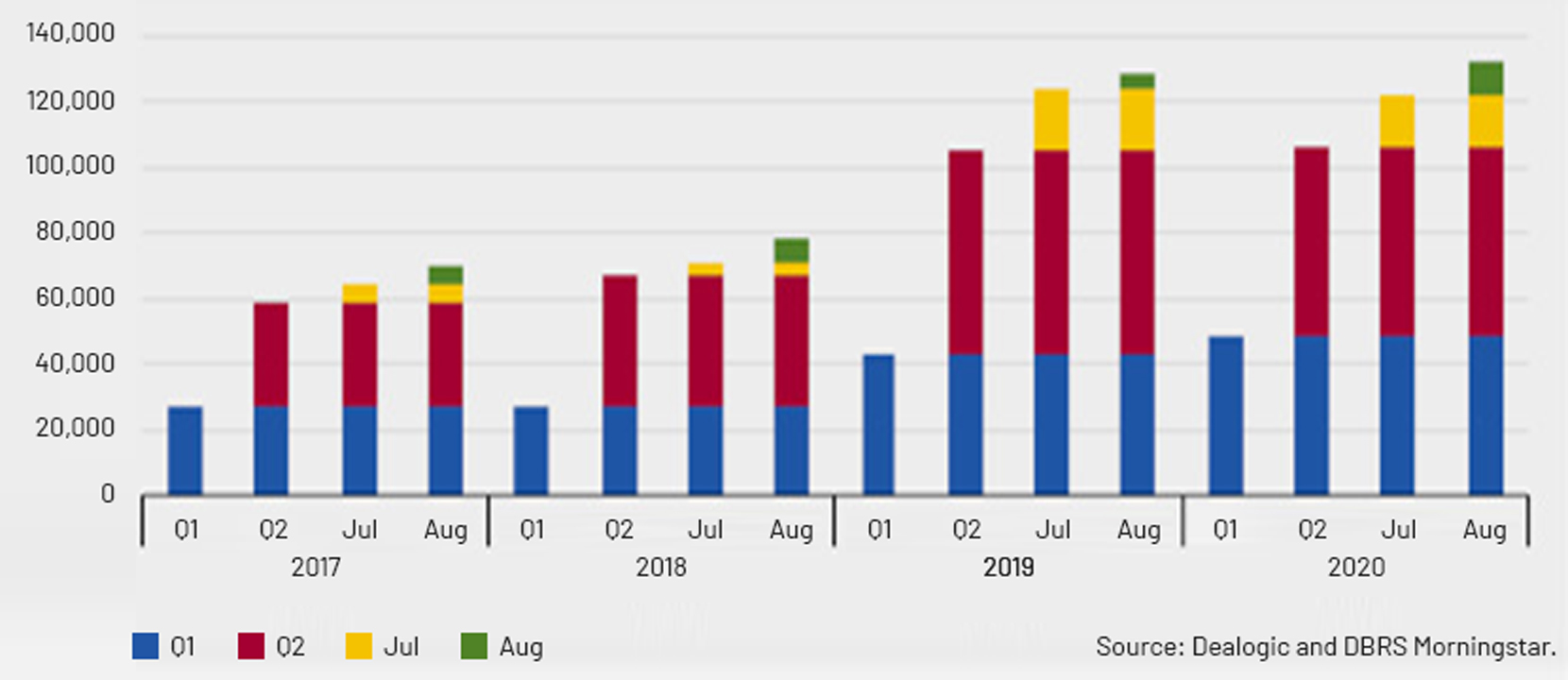

Looking at issue data closely; Covid-19 looks to drive green bond issuance as shift to sustainability intensifies. In addition to this; social bonds are emerging as a prominent sustainable product with supranational institutions and national development agencies driving issuance volumes, echoing the fast-rising growth of green bonds in recent years, as Covid-19 fuels the rise of bonds seeking to support healthcare, employment and housing amid the pandemic crisis.

-

Green bond issuance so far during 2020 has exceeded that of the same period in 2019, despite a temporary slowdown during the height of Covid-19, and is on track for a record year. Corporate green bonds tend to offer yields up to 0.02pc lower than comparable non-green bonds, according to investment research firm MSCI, reflecting the sheer amount of demand for green bonds relative to supply. In the secondary markets, green bonds outperform equivalents, according to CBI’s research.

4) Cumulative Issuance of Green Bonds over the past 3 years (in € mn)

Technology Emphasis

-

Leading fund houses have not only digitized their administration platforms they're increasingly weaving seamless and granular data insights into the full length of their value chains. It is imperative to point out that having technology to gather data is not enough but also human expertise to interrogate and assimilate it in the right way in order to extract the desired results. The emphasis of good technology infrastructure has come into sharp focus more so in recent years with the increasing demand for information from regulators as well as investors.

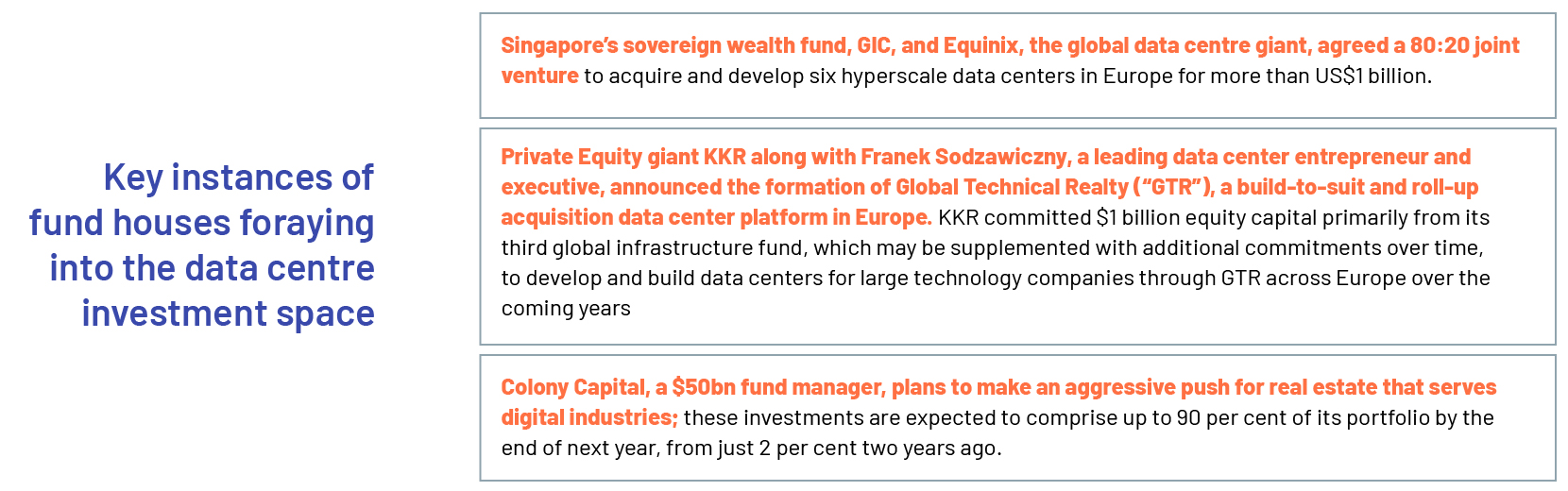

Growing incidences of some major fund houses foraying into the data center investment space. Data centers are high on the list for investors who are increasingly turning to alternatives in the hunt for asset diversification and enhanced risk-adjusted returns.

5) Outsourcing

-

The COVID-19 pandemic and related uptick in remote working – whereby managers have already had to implement the systems and infrastructure necessary to support out of office operations – should help simplify and further accelerate the trend towards outsourcing of non-investment management functions, such as regulatory compliance and reporting duties, affording managers greater time and flexibility to focus on the core business of generating returns for investors.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners is a leading global provider of portfolio operations, risk analytics, Investment and performance reporting and middle-office support. We offer support in Portfolio Strategy and construction, portfolio operations, portfolio analytics and reporting, data management and technology, middle office operations, fund accounting, shadow accounting and many more. We understand our clients’ products and the regulations associated with them. Our experts keep track of evolving regulatory frameworks and assist our clients in complying with them.

“The author wants to acknowledge contributions from Nikita Sushil and Gokul Sridhar”

Tags:

What's your view?

About the Author

Abubakar Siddeeqh has nearly 18 years of work experience. He has been associated with Acuity for the last 9 years and is currently part of the Specialized Solutions ex DTS department managing multiple teams and clients. Prior to Acuity he was associated with Societe Generale (Socgen) for 6 years and has worked in various roles in fund admin services. Prior to Socgen he was associated with Butterfield fulcrum fund services and JP Morgan chase. He holds Master of business administration (finance) degree from VTU and has delivered multiple lectures at different Indian Institute of Management’s(IIM’s) across India.

Like the way we think?

Next time we post something new, we'll send it to your inbox