Published on January 17, 2022 by Ankit Mehrotra

Climate change – code red for humanity

Climate change poses the biggest risk to our world today. The recently released Sixth Assessment Report of the Intergovernmental Panel on Climate Change (IPCC) estimates that the planet will hit the critical warming limit of 1.5°C by 2040. The implications of this are very grave – atmospheric concentrations of greenhouse gases (GHGs) are increasing and water levels are rising. While this spells impending doom, it also provides an opportunity to leapfrog to a low-carbon economy. However, it would the require collective will and innovation to make this transition, and all stakeholders in the global ecosystem would need to commit to change.

Global commitment to fight climate change

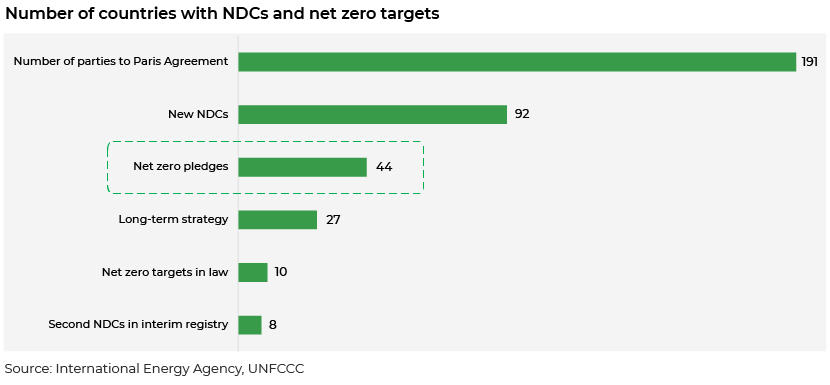

The Paris Agreement (COP 21) 2015 was a major landmark in the global mission towards reducing carbon emissions. COP 21 targeted reducing emissions to limit global warming to well below 2°C. The agreement also resolved to take action to limit it to 1.5°C. It involved the declaration of nationally determined contributions (NDCs). NDCs are long-term goals and commitments by member nations to minimise their carbon footprint. Many countries have pledged to reduce their emissions to “net zero” by 2050. Net zero refers to the balance between emissions produced and removed from the atmosphere through carbon sinks.

In the run-up to the UN Climate Change Conference (COP 26) in Glasgow in November 2021, 44 countries had made net zero pledges and 92 countries had put forward new or updated NDCs to the UN Framework Convention on Climate Change (UNFCCC).

The UN has also created a framework of 17 measurable Sustainable Development Goals (SDGs) to be achieved by 2030. These SDGs target holistic development, where environmental protection, social inclusion and economic development are valued equally. They envisage extensive collaboration between the Organisation for Economic Co-operation and Development (OECD) and middle- and low-income economies.

“Transition finance” – a key catalyst for a sustainable future

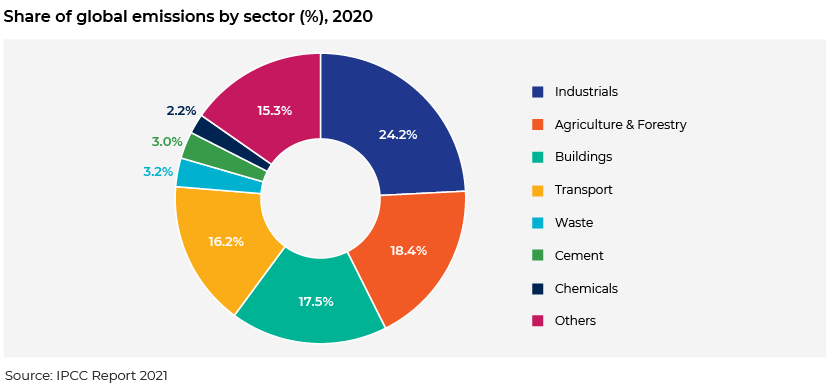

Achieving these ambitious climate targets would entail a massive transformation of the global economy. This would involve investment in the next generation of clean technologies, reorienting supply chains and reimagining businesses processes. All this will require substantial capital. It is estimated that there is an annual funding gap of USD2.5-3.5tn required to finance this transition.

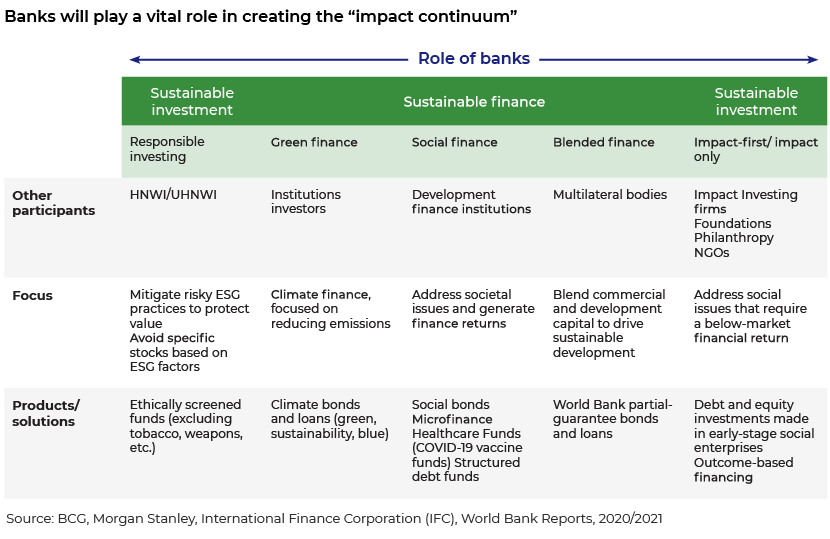

Banks would play a multi-faceted role in driving this transformation by means of the following:

-

-

Environmental, social and governance (ESG) advisory: Global banks are working with their clients to create “decarbonisation pathways” for transition towards a low-carbon business model. These pathways will primarily be for banks’ clients operating in sectors that have historically been high emitters.

-

Product innovation: Banks are creatively reimagining their portfolios of sustainable products. In addition to popular products such as “green bonds”, they are developing other innovative products for climate finance. For example, “blue bonds” aim to raise finance for a sustainable ocean economy, covering aquaculture, fishing, port infrastructure and deep-sea mining.

-

Financial intermediation: In their classical role as intermediaries, banks are connecting investors who want to create an ESG impact, i.e., asset managers, sovereign wealth funds and philanthropic foundations with communities/borrowers on the ground, where capital is needed the most.

-

Avoiding “greenwashing”: Banks would have to play a major role in ensuring that transition finance creates a sustainable impact and is not merely a relabelling of products. To this end, marquee financial institutions such as the Bank of America, Wells Fargo, Morgan Stanley, J.P. Morgan Chase and Standard Chartered bank have announced they would divest from financing fossil fuel and coal projects.

-

Conclusion

For ESG principles to be effectively embedded in investment and financing processes and for banks to create a meaningful environmental and social impact, the following are essential:

-

-

-

A common taxonomy

-

Uniform ESG reporting and disclosure standards

-

Consistent and measurable data

-

Standard and integrated criteria for assessing ESG risks and scores

-

-

EU taxonomy for sustainable economic activities – the International Capital Market Association (ICMA) principles on green bonds and the Task Force on Climate-related Financial Disclosures (TCFD) – has laid down common reporting standards. However, there is room for improvement. As regulations are streamlined and more banks become active participants in the global drive towards a sustainable future, we can expect ESG reporting to become more standardised, with regional nuances making them more dynamic.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners is the preferred partner for sustainable finance solutions. We provide comprehensive thought leadership and specialised ESG research solutions. We also enable investment banks and advisory firms establish and grow their sustainable finance practices by providing a wide range of customised analysis and support.

Tags:

What's your view?

About the Author

Consulting and Research. At Acuity Knowledge Partners, he has led sector and product-specialist pilot teams in Renewable Energy and Environmental Finance, Syndicated Loans - Capital Markets, Sustainable finance, Restructuring, Debt Advisory, Strategy, Corporate Development and M&A Coverage. With McKinsey and Ernst & Young, he has worked on client engagements related to market entry strategy and competitive positioning. Ankit holds an MBA with a dual specialization in Finance and Marketing from Lal Bahadur Shastri Institute of Management and earned his B.Com (Hons.) from Delhi University.

Like the way we think?

Next time we post something new, we'll send it to your inbox