Published on November 5, 2020 by Trishan Ravihansa

With the world moving towards increased digitalisation, the need for e-agriculture is felt more than ever. E-agriculture enriches farmers with data, increases yield and efficiency and improves food distribution with the help of new technologies. Access to real-time statistics of their farms, market conditions and weather forecasts enables farmers to manage their harvests in a sustainable and profitable manner. As consumers show increased interest in healthy foods, farmers can make available data relating to chemical use in food production.

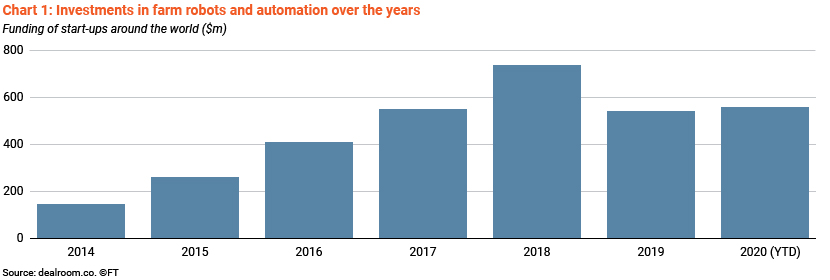

Modern farming technology is used from checking soil moisture levels in the field to forecasting weather through tools such as sensors, cameras, GPS, microphones, accelerometers, gyroscopes, drones and unmanned aerial vehicles. Process-automating technology, such as harvesting robots and automated irrigation systems, is also available. Investment in automation and agricultural robots has increased (see Chart 1) due to concerns over labour shortages amid the coronavirus pandemic.

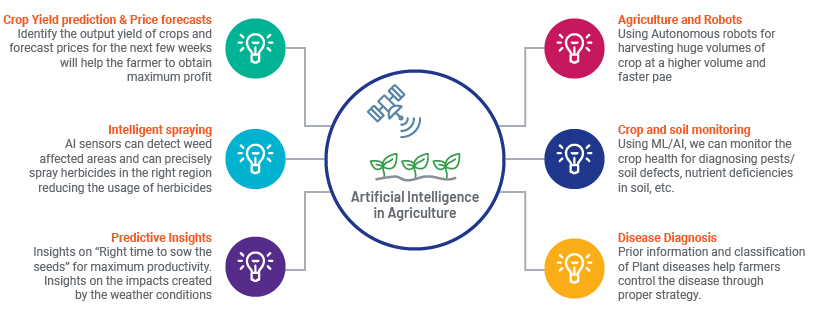

Use of the internet of things (IoT) and artificial intelligence (AI) in agriculture to optimise output

Modern farms are now able to ensure crops and soil receive exactly what is required, through the use of remote sensors located in the fields (that monitor light, humidity, temperature, soil moisture and crop health), automated irrigation systems, unmanned aerial vehicles, drones and satellites. Site-specific application senable farmers to maintain their farms at optimum levels. The collated data is then used to feed into AI systems to build algorithms such as image-recognition algorithms to classify plants and detect pests and diseases, and for predictive analysis in terms of yield and weather conditions. Agricultural robots driven by AI are also deployed at various stages of production. The most advanced AI-enabled farms are able to produce over 20 times more food per acre, using c.90% less water, than traditional fields.

Technological development has also made precision livestock farming possible, optimising animal production by, for example, recognising sick animals and separating them from other animals, and feeding them properly.

How agri-tech companies are financed, and the unique risks inherent in their business

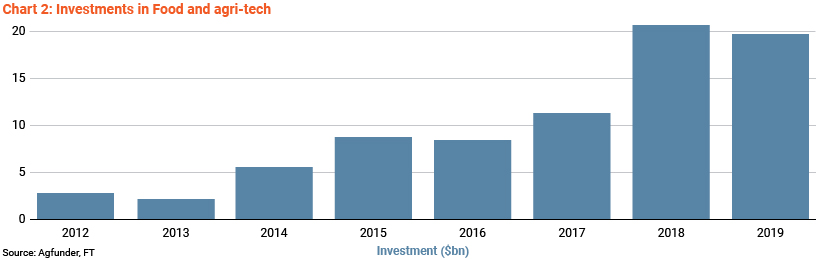

Long-term financial support is necessary for agri-tech companies to carry on their research and development (R&D). Most of these companies are start-ups and are, therefore, mostly funded by angel investors, private equity firms and venture capital funds. They also benefit from government grants and credit. According to online equity investment platform AgFunder, global investment in agricultural and food technology has increased rapidly recently, but dipped by c.5% to USD19.8bnin 2019, primarily due to a decline in investment in food delivery services (see Chart 2)

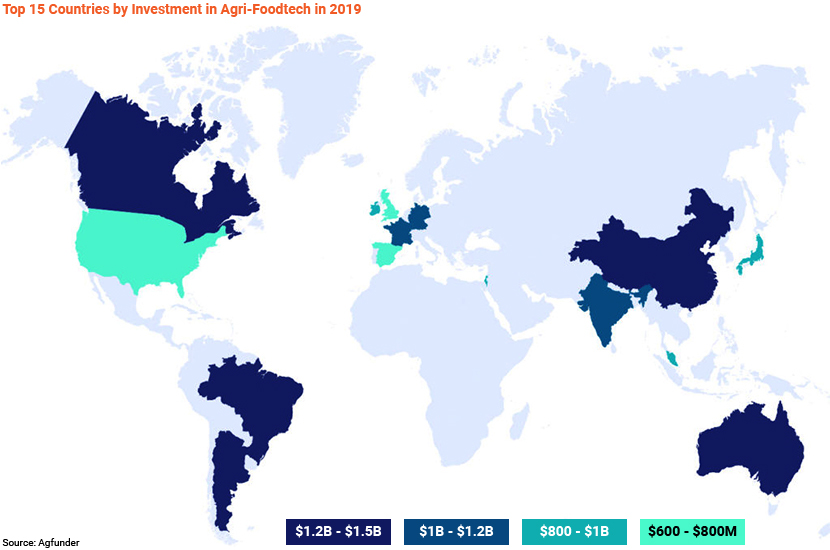

Bank lending is not that common for agri-tech companies, due to the lack of historical performance records and the inability of these companies to provide collateral. The nature of these companies require spatient capital to fund their R&D and other operations. However, the positive impact of agri-tech companies on mitigating climate change has increased the importance of investing in them globally, as shown in the following world map. Therefore, the creditworthiness of these companies needs to be looked at through a new lens and credit facilities provided to them. Banks could include agri-tech company-specific covenants in facility agreements such as business plans, technical feasibility reports, financial models, progress reports and forecast financial ratios. Other considerations may include checking the availability of manufacturing capabilities in a particular country or elsewhere in the world. For agri-tech start-ups to be successful, strong collaboration with governments and farmers is critical to ensure the technology remains affordable and accessible.

How Acuity Knowledge Partners can help

We offer bespoke quantitative and technology-powered solutions and boast a large pool of experts and extensive research analytics covering the agriculture sector. We provide data science solutions by leveraging a pragmatic four-pillar framework covering data acquisition, data preparation, data analysis and reporting and insights. We conduct agri-tech-specific credit appraisals, risk-level assessments by using bespoke credit scoring models, and holistic credit appraisals to assess the creditworthiness of a borrower. We enhance such credit appraisals with data analytics insights that make credit assessments more realistic. We also offer post-lending solutions such as automated tools for covenant monitoring and covenant-monitoring dashboards that provide an overview of outstanding facilities.

References:

https://www.researchgate.net/publication/340664302_E-AGRICULTURE_IN_ACTION_BIG_DATA_FOR_AGRICULTURE

https://medium.com/trends-in-data-science/data-science-in-agriculture-bd172cf5cdb9

https://www.dhs.gov/sites/default/files/publications/2018%20AEP_Threats_to_Precision_Agriculture.pdf

https://www.ft.com/content/88360cd4-5731-11ea-abe5-8e03987b7b20

https://news.crunchbase.com/news/agtech-sector-blooms-as-more-dollars-and-startups-rush-in/

https://www.adb.org/sites/default/files/publication/579766/adbi-wp1115.pdf

https://www.adb.org/sites/default/files/publication/455116/adbi-wp872.pdf

https://blog.marketresearch.com/smart-farming-the-future-of-agriculture-technology

What's your view?

About the Author

Trishan is a Senior Associate attached to the Commercial Lending division at Acuity Knowledge Partners. He is currently part of the Commodities, Food & Agriculture sector undertaking covenant monitoring and validation, financial spreading and performing risk raters for a leading European based bank. Prior to Acuity Knowledge Partners, he was a management trainee attached to the Financial Reporting division of a Sri Lankan bank. He also gained exposure from a global audit firm in spheres of corporate taxation and transaction services related advisory.

He is a passed finalist of the Chartered Institute of Management Accountants (UK) and currently studying for Chartered Financial Analyst Level II examination.

Like the way we think?

Next time we post something new, we'll send it to your inbox