Published on March 19, 2024 by Akshay Verma

Global markets have witnessed two major financial market collapses in the past 15 years. After the pandemic, the world economy has faced market volatility, near-zero interest rates, the Russia-Ukraine war, rising inflation and consecutive interest rate hikes. Such extreme market conditions make it very challenging for investment committees to generate consistent positive returns on their portfolios. Active decision making and frequent rebalancing have become the need of the hour. Investment committees meet infrequently, and critical investment decisions need to be made within a short period of time amid such volatility. This has led to the increased role of the outsourced chief investment officer (OCIO), mandated to act swiftly and in line with changing market environments. Additionally, strategies like Private Equity Outsourcing are gaining prominence, offering institutional investors access to specialist expertise to navigate complex investment landscapes effectively.

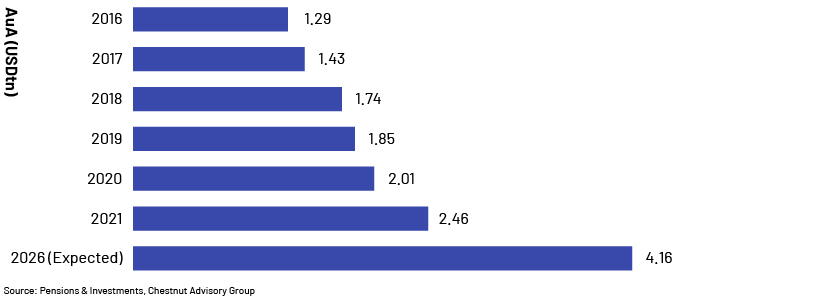

The role of the OCIO became part of the asset management space in 1980 and has grown in scope since then. Global assets under advisement (AuA) grew 90% from 2016 to 2021, according to the Chestnut Advisory Group. Despite this rapid expansion, not everything was positive in 2022; Charles Skorina & Co. noted a significant dip in AuA due to the Nasdaq's 33% loss in value, along with declines in the Russell 3000 and the Dow Jones.

“The growing complexity of assets, requirement to adjust to uncertainties and volatile markets, access to experts, and shrinking investment management costs will increase demand for OCIOs,” according to Capgemini. Both Cerulli Associates’ OCIO Survey 2022 and Capgemini’s Wealth Management Top Trends 2023 expect healthy demand for OCIO services in the coming years.

Forces driving the importance of the OCIO role

The pandemic prompted institutional investors to recognise their discomfort and lack of effective structure for managing investments in a volatile, complex and fast-moving financial landscape, especially within the confines of the traditional consulting model. The conventional practice of holding quarterly investment committee meetings to approve all portfolio allocation changes was challenged.

Forces driving the importance of the role:

1. Strong governance framework to mitigate risk: Constantly changing market environments necessitates frequent rebalancing and smart tactical adjustments. A participant in the OCIO study elaborated on the connection between the increasing intricacies of the investment landscape and . Several market participants reported that OCIOs provided them with a strong governance framework and proper risk management. “Many plan sponsors are not in the investment business, and the OCIO model lets them outsource that responsibility to a full-time investment advisor, which may provide outcomes and allows them to focus on their area of specialisation,” says Steve Cummings, Global Head of Investments at Aon. The delegated OCIO provider accepts the fiduciary responsibilities in writing and is mandated by the respective regulatory authority. This helps the plan sponsor significantly reduce their fiduciary risks, although they still need to fulfil some of them. A streamlined decision-making process amid volatility, such as the pandemic, helps an organisation minimise risks due to delayed decision making. The participant mentioned that conventional governance was stress-tested significantly in 2022 and that failure to rebalance early resulted in substantial loss. Those who did rebalance fared well. Hence, focus on quick rebalancing is a discipline most OCIOs adopt.

2. One size does not fit all: Different demographics require different approaches. Asset allocation for a plan of an average of 35 years will differ from that for a plan of an average of 55 years. At the outset, the OCIO provider will sit with the sponsor’s investment committee to understand the client’s goals, objectives, risk tolerance and constraints. The provider would then map the client’s unique investment journey in accordance with these and capital markets expectations.

3. Lack of investment expertise: Many organisations are now moving towards adding complex asset classes, such as alternative investments, to their portfolios, targeting better risk-adjusted returns. However, these investments require an in-depth understanding and minimum fund size to participate in the asset class. OCIOs can provide smaller organisations with the necessary expertise and access to alternative investments through investment vehicles such as commingled funds and separately managed accounts.

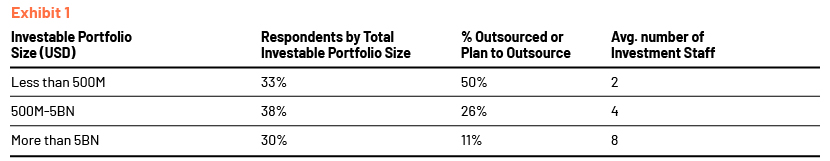

Exhibit 1 suggests that smaller portfolios with a few investment staff prefer to have an OCIO in charge of their investment mandates (according to the 2022 OCIO survey by xx).

4. Right blend of active vs passive strategies: Research published by Brinson, Hood & Beebower in 1980s suggested that the main driver of investment value is active management, not security selection or market timing. This increased demand for funds that provided active management; demand continued to increase among actively managed funds until the global financial crisis that led to a sharp drop in investment value. Following this, a number of asset managers adopted a blend of active and passive management. Several OCIO providers use active strategies when markets are inefficient and passive strategies when they are efficient enough.

5. Growth in OCIO search consultants: Another factor accounting for increased demand for OCIOs industry is the ease of hiring OCIOs. The increase in the number of OCIO search consultants has reduced the burden on investment committees of hiring the right service provider. As specialists in OCIO search, these consultants add significant value to the search process through their detailed analysis and in-depth due diligence.

6. Transparent fee structure: Most OCIO service providers used to provide an all-inclusive fee, but search consultants have now requested that they break this down into components, for increased transparency. This has also enabled a reduction in fees over time.

Full vs partial discretion

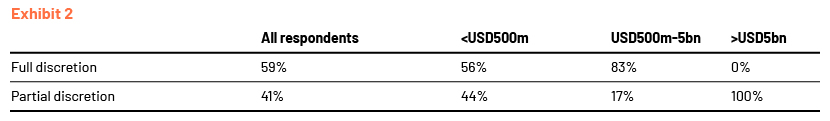

Plan sponsors should consider what benefits are most important to them; this would determine whether the organisation needs full or partial discretion. An organisation with a strong investment team and robust investment structure could choose partial discretion or a traditional consulting model. However, a smaller organisation would need the investment experience and expertise of an OCIO provider. If it is to manage their investments itself, it would need a dedicated investment team and setup, which could cost a couple of billion of dollars. Portfolios with less than USD5bn tend to choose full discretion, according to OCIO 2022. This suggests that smaller portfolios with fewer investment staff require a fully delegated investment plan, as Exhibits 1 and 2 show:

How Acuity Knowledge Partners can help

We have been providing specialised financial marketing services, including RFP drafting, content management, digital marketing assistance, creative designing, SEO and Google Analytics to a world-leading OCIO company for more than a decade.

Our support to this company remains unrivalled, as evidenced by its impressive performance metrics. With a highly knowledgeable team, we consistently deliver more than 60 RFP drafts annually, with an acceptance rate exceeding 80% in countries such as the US and Canada. We bring a wealth of expertise to the realm of digital marketing. We perform a multitude of tasks on a quarterly basis, including creating 690+ assets for campaigns, 6,900+ content updates, content publishing, document revisions, 450+ marketing collateral enhancements, and performance report updates, in addition to crafting and updating 150+ blog posts. We also play a pivotal role in establishing and promoting the OCIO company’s online brand presence through tailored channels, SEO strategies, and Google Analytics. Our specialist team conducts thorough analyses of site errors, web crawls and audits on more than 1,200 documents annually.

Our financial marketing services extend to a diverse range of sectors for OCIO clients, including healthcare, education, insurance, foundations, endowments, corporate and public pension plans, and retirement plans.

Tags:

What's your view?

About the Author

Akshay has a total experience of 12 years and has been working with OCIO clients for the last 6 years. He has done his post-graduation in Finance and Marketing and completed CFA Level 2. Akshay has keen interest in capital markets and the asset management industry.

Like the way we think?

Next time we post something new, we'll send it to your inbox