Published on March 2, 2021 by Benjamin Tharmaratnam

To support the global move towards a greener future, lenders are increasingly seeking ways to promote environmentally friendly means of lending, such as the provision of green mortgages. Green mortgages are extended to new buildings that meet stipulated environmental standards and/or to buildings to be renovated to reduce their environmental impact and make them more eco-friendly.

Increasing popularity of green mortgages globally

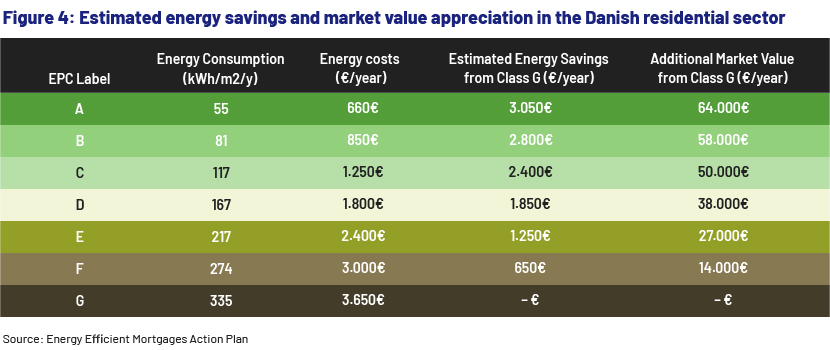

The cost of borrowing on green mortgages is directly proportional to the energy efficiency and performance of the property against which the mortgage is being provided. Thus, owning a home that is more energy-efficient would make repayments more affordable. Green buildings (LEED1 certified buildings) reduce CO2 emission by 34%, and consume 25% less energy and 11% less water, according to a review by the US Department of Energy.

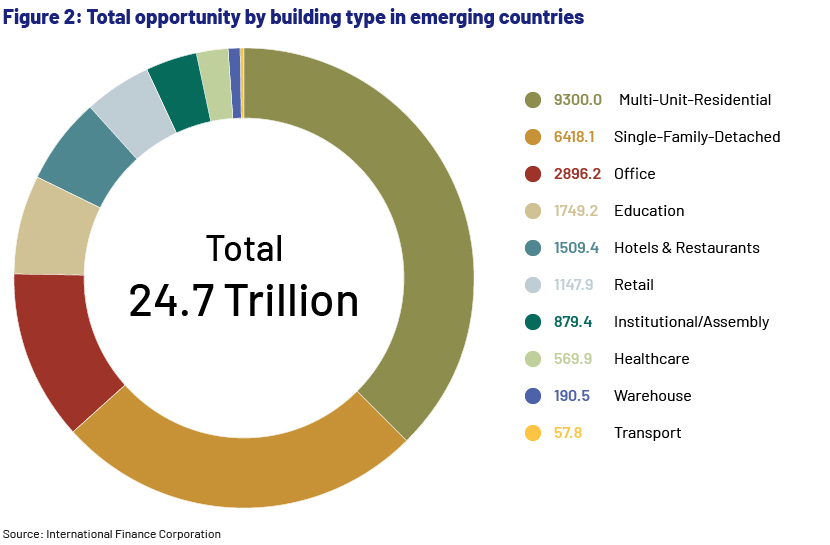

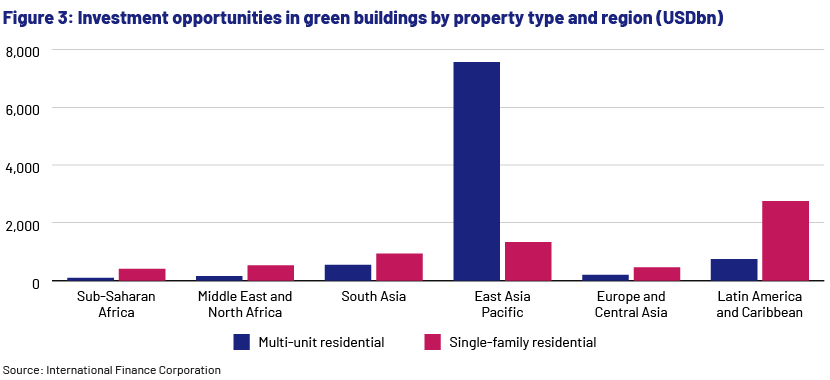

Residential and office buildings account for about 17.5% of global greenhouse gas emissions, according to a recent Our World in Data report. The International Finance Corporation expects investment opportunities in green buildings in emerging markets2 to reach USD24.7tn by 2030, and the global green residential market to grow at a CAGR of 10.9% from 2018 to 2023.

Government involvement in promoting green mortgages

Subsequent to releasing the European Green Deal3 , the European Union has set a number of assertive goals, for instance, “no greenhouse emissions” by 2050. The Europe Regional Network of the World Green Building Council estimates that Europe would have to renovate 23,000 homes a day until 2050 to meet its climate target by 2050. This has led the European Union to incentivise green mortgages.

The UK implemented the Clean Growth Strategy subsequent to the EU strategies. In January 2021, the government proposed rigorous energy efficiency standards for homes and offices, for example, new homes to be more energy-efficient and “zero-carbon ready” by 2025, and existing homes to be improved significantly to make them warmer and reduce energy bills.

The US government has also initiated strategies such as providing tax credits for energy-efficient homes. Fannie Mae, Freddie Mac and the Federal Housing Administration have initiated a number of programmes to encourage green home buyers. Fannie Mae’s Green Reward Program offers a lower interest rate, a free Energy and Water Audit Report and up to 5% additional loan proceeds for refinance, acquisition, supplemental and second supplemental loans.

The role of banks

To support the green revolution, financial institutions are offering either lower interest rates or higher loans for green mortgages. The main goal of the EU’s Energy-efficient Mortgages Action Plan (EeMAP)4 is to develop a green mortgage for the European market that encourages energy efficiency. In June 2018, 37 European banks, including major banks such as BNP Paribas, ING Bank and Nordea Bank, launched a new energy-efficiency mortgage pilot scheme.

Green mortgages in the UK entered the mainstream market in 2018, although some smaller firms had been offering these mortgages for a while before that. The Bank of England has launched a range of green products in 2021, following criticism of British banks for their slow response to global warming. In October 2020, Barclays Bank raised GBP400m through green bonds for renovating residential properties.

In addition to financial covenants such as the loan-to-value and cover ratios, borrowers need to comply with the green covenants imposed by banks, such as providing disclosure on how loan proceeds have been allocated, compliance with energy rating standards and reducing greenhouse gas emissions.

Research by the Energy-efficiency Data Protocol and Portal (EeDaPP) initiative on the Italian market found a significant negative correlation between energy efficiency and the probability of mortgage default. Research by the University of North Carolina found that the default risk on energy-efficient homes is, on average, 32% lower than on other homes. We believe that lower default risk and the trend towards green building present banks a significant opportunity to participate in the green mortgage market.

How Acuity Knowledge Partners can help

We assist commercial banks in the different stages of the lending process. Our strong team of experts analyse risk profiles and monitor borrowers’ compliance with covenants. Our Commercial Banking team is experienced in adapting to the evolving green mortgage market and analysing new covenants in green mortgages.

Footnotes

1Leadership in Energy and Environmental Design (LEED) is an internationally recognised green building certification system that provides third-party verification that a building or community was designed and built using strategies aimed at improving performance across all metrics that matter the most: energy savings, water efficiency, CO2 emission reduction, improved indoor environmental quality, and stewardship of resources and sensitivity to their impacts.

2 Emerging markets include sub-Saharan Africa, the Middle East and North Africa, South Asia, East Asia Pacific, Europe and Central Asia, and Latin America and the Caribbean.

3 The European Green Deal is a set of policy initiatives undertaken by the European Commission with the overarching aim of making Europe climate-neutral by 2050.

4The EeMAP is a market-led initiative focused on the design and delivery of an “energy-efficient mortgage”, intended to incentivise and channel private capital into energy-efficiency investments. This is a project funded by the European Union.

sources

3. https://open.library.ubc.ca/cIRcle/collections/graduateresearch/42591/items/1.0078390

5. https://www.moneygeek.com/mortgage/resources/green-mortgages/

6. https://ourworldindata.org/emissions-by-sector

8. https://www.pnnl.gov/main/publications/external/technical_reports/PNNL-19369.pdf

9. https://www.usgbc.org/sites/default/files/2020-03/LEED-and-Multifamily-Incentives-March-2020.pdf

12. https://eemap.energyefficientmortgages.eu/wp-content/uploads/EeDaPP_D57_27Aug20.pdf

13. https://www.imt.org/wp-content/uploads/2018/02/IMT_UNC_HomeEEMortgageRisksfinal.pdf

14. https://www.mondaq.com/asset-finance/961236/green-loans

16. https://www.ft.com/content/2c3d00f5-6db3-4a00-9275-636eb6ff70fc

https://www.gov.uk/government/news/rigorous-new-targets-for-green-building-revolution

Tags:

What's your view?

About the Author

Benjamin is an Analyst attached to the Commercial Lending division at Acuity Knowledge Partners. He is currently part of the Real Estate Finance undertaking covenant monitoring and validation, financial spreading and performing risk analysis for a leading European based bank. He is a passed finalist of the Chartered Institute of Management Accountants (UK) and is currently studying for a Bachelor’s degree in Accounting from the University of Sri Jayewardenepura.

Like the way we think?

Next time we post something new, we'll send it to your inbox