Published on March 10, 2020 by Sunil Chippalakatti and Swati Gera

The UK amended its anti-money laundering (AML) framework on 10 January 2020, enforcing Money Laundering and Terrorist Financing (Amendment) Regulations 2019. The following are the high-level changes it makes to comply with standards set by the Financial Action Task Force (FATF) and the EU’s Fifth Anti-Money Laundering Directive (5 AMLD).

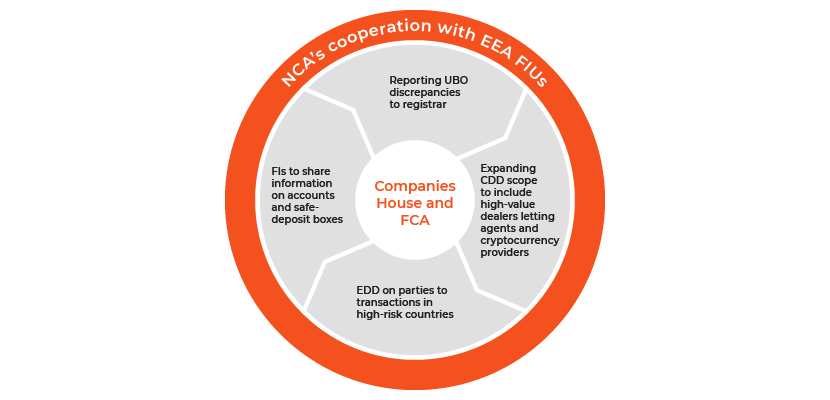

Key changes re-defining the AML landscape

Source: Acuity Knowledge Partners

The key changes are as follows:

1. Expanding the scope of due diligence to high-value dealers, digital-currency providers and auditors and tax advisors

2. Enhancing due diligence on all parties to high-risk-country transactions

3. Reporting discrepancies in details on ultimate beneficial owners (UBOs) to registrar (Companies House)

4. Financial institutions to share information about accounts and safe-deposit boxes

5. Increasing the National Criminal Agency’s (NCA’s) cooperation with European Economic Area Financial Intelligence Units (EEA FIUs)

Detailed guidelines on these changes are outlined below:

1. Expansion of definition of a regulated entity

-

All market participants: They are now required to perform due diligence on all parties involved in transaction(s) crossing the EUR10,000 threshold

-

Letting agents: They are now required to report monthly rents received in excess of EUR10,000

-

Crypto asset exchange providers and custodian wallet providers: All new businesses that will have activities in the UK are required to be registered with the Financial Conduct Authority (FCA). All existing businesses are to comply with the registration requirements by end-2020.

-

Auditors and tax advisors: The definition of a tax advisor is extended to those who provide material aid or assistance on tax matters (includes third-party data/service providers)

2. Customer due diligence:

-

Amendments to Regulation 33: Enhanced due diligence on high-risk-country transactions Increased scope of enhanced customer due diligence (CDD) on all parties (payees or beneficiaries) to transactions in a high-risk third country, as identified by the European Commission, compared to only the payee party in previous guidelines. Enhanced due diligence measures taken by a financial institution must include the following:

-

intended nature of the business relationship

-

source of funds and source of wealth of the customer and of the customer’s beneficial owner

-

reasons for the transactions

-

approval of senior management for establishing or continuing the business relationship

-

enhanced monitoring of the business relationship by increasing the number and timing of controls applied, and selecting patterns of transactions that need further examination

-

3. Amendments to Regulation 30 A: Reporting discrepancies to the registrar (Companies House)

-

The institution must continue to report to the registrar (Companies House) any discrepancy between information sourced by the institution and information filed by the customer with the registrar (Companies House) on the customer’s beneficial ownership

4. Requests for information about accounts and safe-deposit boxes:

The UK is to establish a centralised automated mechanism to identify natural and legal persons that hold or control bank accounts, payment accounts or safe deposits held by credit institutions within the UK.

-

Each credit institution and provider of safe custody services must ensure the provision of information [such as name, date of birth, international bank account number (IBAN) and address of the holder(s) or beneficial owner(s)] requested by law enforcement authorities or the Gambling Commission by establishing and maintaining systems that enable institutions to respond

5. Amendment to Schedule 6A: NCA cooperation with EEA FIUs: The NCA is to increase its cooperation with foreign FIUs. This is to ensure smooth cooperation after the UK leaves the EU. The amendment requires the NCA to provide the following:

-

A prompt response, assigning a point of contact

-

Relevant documentation/information

-

A request order for missing documentation/information

These amendments to the regulations, including the drive for greater transparency, widening the scope of AML regulation, increased cooperation and information sharing between national authorities, and scrutiny of business relationships in high-risk jurisdictions reflect a paradigm shift in the AML requirement, focusing on securing the financial system against being misused for money laundering and terrorist financing.

Need to comply? Here is how Acuity Knowledge Partners can help

We at Acuity Knowledge Partners leverage the four “pillars” – people, data, processes and technology – to support our clients in their fight against financial crime. Key support areas are as follows:

-

Due diligence review: We support our clients in on-boarding, remediation and trigger-initiated due diligence review of their customers and vendors. We follow a four-pronged methodology – Extract-Populate-Investigate-Calculate Risk (EPIC) to perform due diligence. To this end, we have a tool built in-house – the Due Diligence Automated Reporting Tool (DART) – that helps us reduce turnaround time and provide customised reports

-

AML reviews: We support our clients in strengthening their AML frameworks by

-

Analysing the comprehensiveness and effectiveness of rules implemented for identification of suspicious activities

-

Performing a 360-degree analysis of all transactions that breach the defined thresholds

-

We provide our clients with customised managed solutions, leveraging data from Bureau van Dijk (BVD), our data partner, and the support of our Technology and Data Science Teams.

Sources:

1. https://www.legislation.gov.uk/uksi/ 2019/1511/made

2. https://www.legislation.gov.uk/uksi/ 2017/692/contents/made

4. https://www.fca.org.uk/firms/financial-crime/money-laundering-regulations

5. https://www.fca.org.uk/firms/financial-crime/cryptoassets-aml-ctf-regime

What's your view?

About the Authors

Sunil Chippalakatti has 13 years of experience in Anti Money Laundering (AML) and KYC due diligence, having previously worked for JPMorgan India and Tata Consultancy Services. His expertise spans across the risk and compliance, focusing on transition, set up and managing KYC and AML/CFT operations. At Acuity Knowledge Partners, he manages two due diligence engagements. Sunil has done MBA from M P Birla Institute of Management, Bangalore

Swati Gera has 5 years of experience in Anti Money Laundering (AML) Analytics and Compliance reporting, having previously worked for Infosys. Her expertise spans across the risk and compliance sector, focusing on AML and know your customer (KYC). At Acuity Knowledge Partners she is responsible for KYC/AML support to Compliance Services. Swati has done her engineering from Lingayas University, Faridabad.

Like the way we think?

Next time we post something new, we'll send it to your inbox