Published on July 14, 2022 by Abhishek Mukherjee

US IPOs have been increasing since the pandemic, and the IPO market has been the strongest in decades, despite the recession caused by the crisis.

The market was on a downtrend in March and April 2020, when infections were at their peak globally, but quickly recovered when the numbers started reducing.

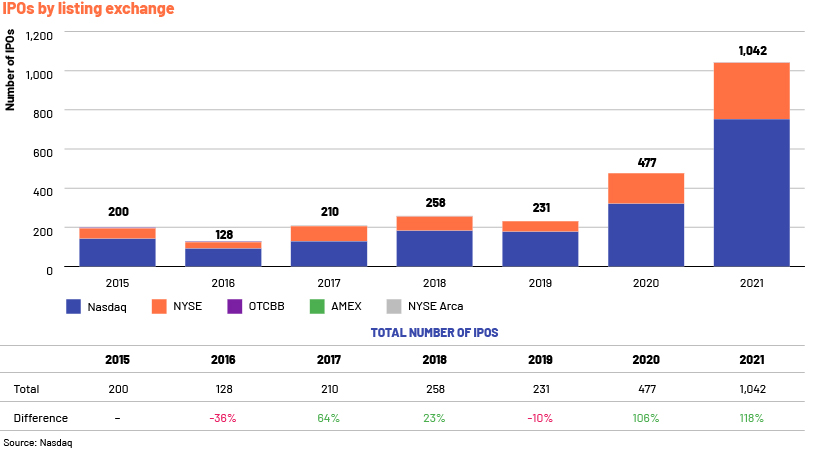

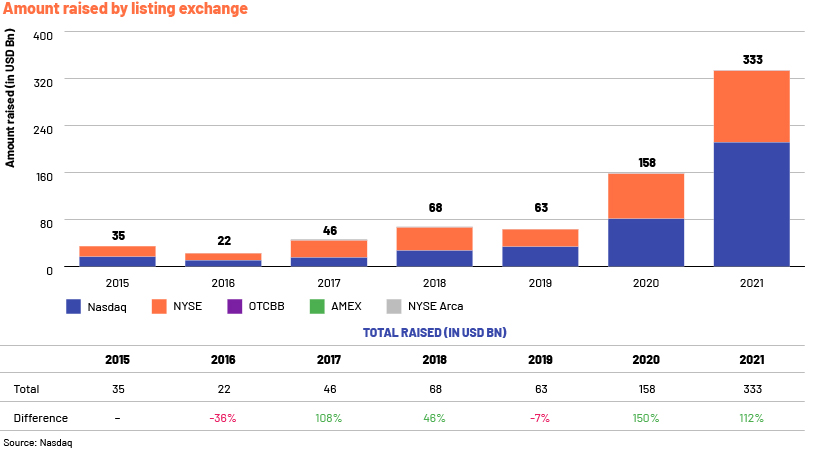

With the economic recovery, the market picked up from May 2020 and ended the year at 477 IPOs, 106% more than in 2019.

Total IPOs and capital raised on listing exchanges since 2015

The US IPO market fared even better in 2021, recording 1,042 IPOs by year-end, 118% more than in 2020 and the most in a single year since 2015.

The Nasdaq led US exchanges in 2021 with 753 IPOs, representing 72% of total IPOs launched that year. This was 136% more than it launched in 2020; total IPOs launched saw an increase of 118% compared to 2020.

IPOs raised USD333bn in 2021, 112% of the amount raised in 2020 but less than the increase in 2020 over 2019. In 2020, IPOs raised 150% more than in 2019 with 106% more IPOs. In 2021, IPOs raised 112% more than in 2020, with 118% more IPOs.

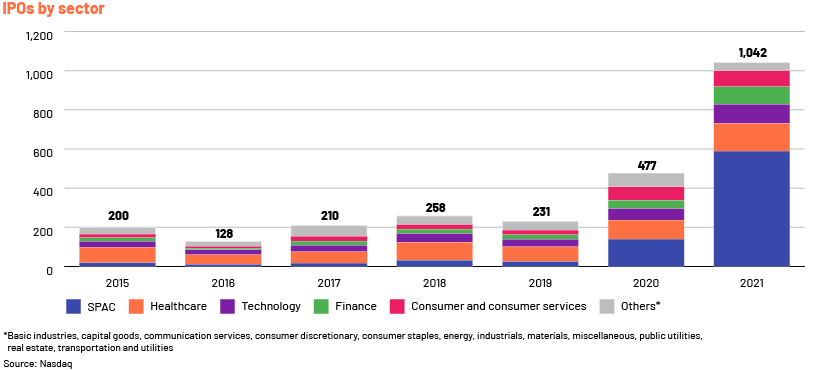

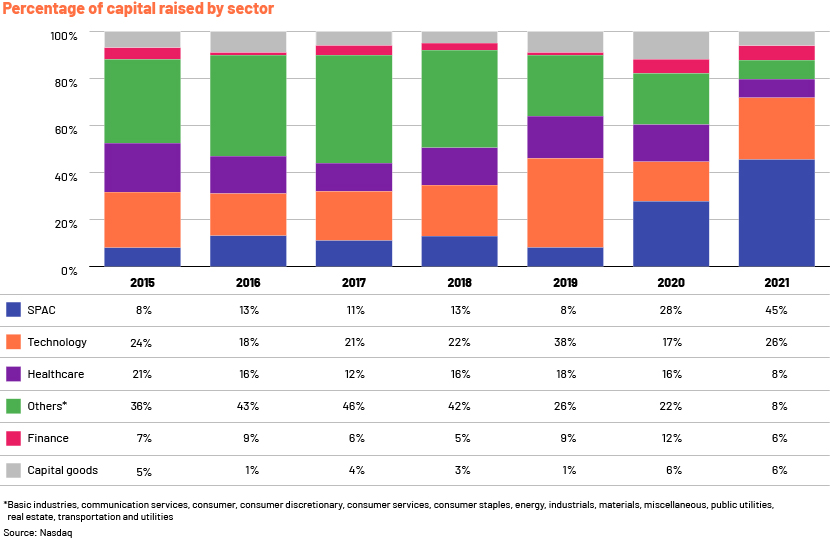

IPOs launched in 2020 and 2021 were mostly through special purpose acquisition companies (SPACs) and not via the traditional route, with healthcare, technology and finance the top-performing sectors.

SPACs dominate the space after the pandemic

SPAC-driven IPOs dominated the space in 2020 and 2021; they broke records in 2020 in terms of volume and capital raised, and this continued in 2021. More than 50% of the 589 US IPOs launched in 2021 were through SPACs. They raised USD149bn, the most raised so far and approximately 45% of the total raised by US IPOs that year.

SPACs are public companies with no business operations; they raise money from investors and then aim to merge with a private company. This is sometimes referred to as a backdoor IPO, because private companies do not follow the normal procedure for filing an IPO. The IPO filing process with a SPAC is faster than the traditional IPO filing process. All these features make this method easier and more attractive for investors seeking a speedy return on investment.

SPACs accounted for the largest share of IPOs in 2021, followed by the healthcare (142 IPOs; 14% of the total) and technology (97; 9%) sectors. In terms of capital raised, the technology sector came second (USD88bn; c.26% of the total capital raised), followed by the healthcare sector (USD28bn; c.8%).

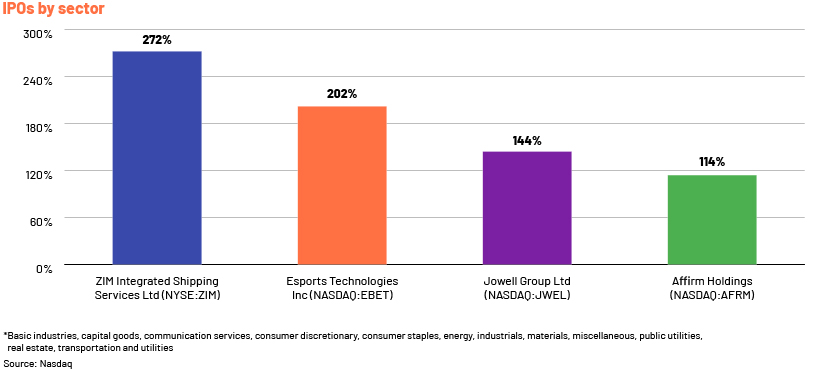

Some of the best-performing IPOs in 2021

The graph above shows the four top-performing IPOs in 2021, based on IPO pricing, as of 28 December 2021. The value of ZIM Integrated shares increased steadily over the year, and the YTD performance was +272%. On the other hand, Esports Technologies saw a large jump in the share price during its first few days of trading. It was active in acquiring companies and launching new products since its IPO, resulting in a YTD performance of +202%. Jowell Group and Affirm Holdings also saw a steady increase in share prices, having beaten revenue estimates. Affirm Holdings announced a partnership with Amazon.com, boosting its share price performance.

Although it is extremely difficult to predict a stock market’s performance, we believe the performance of some of the top-performing IPOs in the past two years indicates a similar result in 2022. This is likely one of the main factors prompting other private companies to launch IPOs.

Conclusion

IPOs performed exceptionally in 2021. Although expectations for IPO market performance in 2022 are mixed, we believe the market will not disappoint and will perform better than in 2021. IPOs raised more than USD300bn last year, and a number of renowned companies in the technology, healthcare and financial sectors are set to launch IPOs in 2022. We believe the technology and healthcare sectors will lead the deal table this year, considering the significant demand.

There may, however, also be some hesitancy in the IPO market this year. The constant waves of infections have caused economic uncertainty and although the past two years saw good performance, they were defined by market disruption. Tensions between Russia and Ukraine add to this uncertainty and may affect the global economy, resulting in many companies delaying IPO plans this year. Overall, we expect the IPO market to exceed 2020 results but believe it is highly unlikely to surpass the 2021 results.

IPOs through SPACs should increase, as this route is faster than the traditional IPO route for private companies, making it very attractive for investors. In addition, SPACs are now backed by most investors across sectors, as evidenced by the increase in the number of IPOs via SPACs. The SEC has recently sought to make SPAC disclosure and liability rules more stringent. This is because of the disconnect between the large amount of information companies are required to provide for a traditional IPO and the few disclosures required from SPACs. The new rules would reduce risk for retail investors, as they require more information be provided when filing an IPO through a SPAC. This would, however, increase the time taken to file an IPO through a SPAC and could affect the number of IPOs filed this way.

How Acuity Knowledge Partners can help

We are experienced in supporting investment banks in the US, Europe and Asia Pacific with our M&A, capital markets, restructuring and sustainable finance solutions. We have years of experience in providing end-to-end support to ECM advisors and helping onshore teams on live transactions and regular work streams related to IPOs, FPOs, PIPE, rights, convertible and other equity offerings.

Sources:

https://www.nasdaq.com/market-activity/ipos

https://www.nasdaq.com/market-activity/stocks/screener

https://www.statista.com/statistics/1178249/spac-ipo-usa/

https://www.statista.com/statistics/1178273/size-spac-ipo-usa/

https://www.cnbc.com/2021/12/09/sec-chair-gensler-seeks-tougher-spac-disclosure-liability-rules.html

https://markets.businessinsider.com/news/stocks/5-best-performing-ipos-in-2021-1031068763

Tags:

What's your view?

About the Author

Abhishek has more than 7 years of experience and for the past three years he has supported a mid-market investment bank based out of the U.S. Abhishek specializes in the Technology & Services industry and has M&A experience. He actively participates in the training and development of team members.

Abhishek formerly held the position of U.S. Tax Consultant at Deloitte Tax India Private Ltd. before joining Acuity. He has a Post Graduate Diploma in Management (Finance) from Institute of Management Technology, Hyderabad, India.

Like the way we think?

Next time we post something new, we'll send it to your inbox