Published on March 14, 2024 by Ranul Perera

Primer – A frontrunner in effective debt management

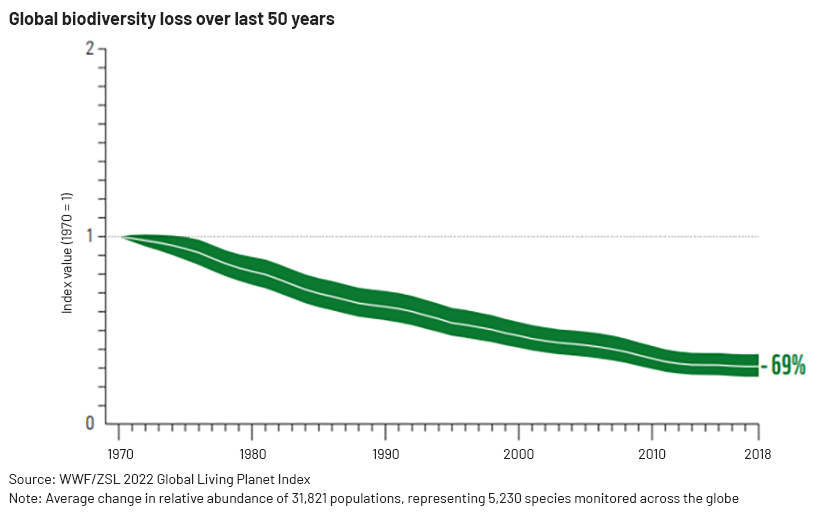

The United Nations Development Programme estimates that more than 50 impoverished nations are at risk of default, including 28 of the world’s top 50 most climate-vulnerable countries. These nations are home to half of the global population living in extreme poverty. To ease the mounting debt burden, governments have set their sights on a sustainable solution – debt-for-nature swaps (DNSs).

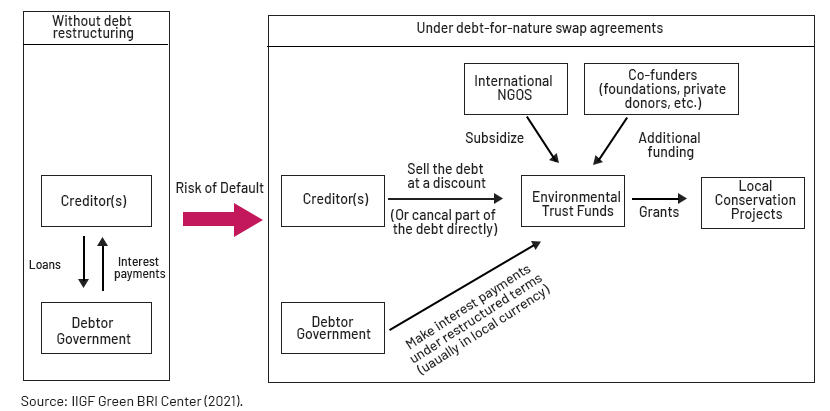

DNSs are financial arrangements where debt that is owed is partially or fully forgiven in exchange for investments in environmental conservation.

DNSs involve a degree of debt restructuring, where the creditor sells a part or all of the outstanding debt at a discounted rate to environmental trust funds managed by international non-governmental organisations (NGOs) or donor countries. Instead of servicing the debt under a bilateral agreement with the creditor, the debtor would now pay interest to the trust funds that mobilise the proceeds for investment in local conservation projects.

DNSs are not new, but this new wave of substantially larger deals may be part of the solution to debt distress and a way of directing additional resources to combat climate change and ensure environmental conservation.

Debt management and counteracting the climate crisis – a win-win for stakeholders and exponents

The swaps reduce the debt burden while bolstering climate resilience, accentuating its appeal as a sought-after and burgeoning method of sustainable financing. As climate concerns rise, governments and ESG-oriented investors emphasise the need to implement sustainable financing initiatives.

DNSs incentivise investments in environmental rehabilitation, prompting debtor governments to shift attention to natural endowments and local biodiversity to combat climate change. Investments linked to a DNS could include the following:

-

Reforestation efforts

-

Mangrove plantation

-

Restrictions on overfishing

-

Subsidies for renewable energy production

-

Transition to electric mobility

-

Waste management

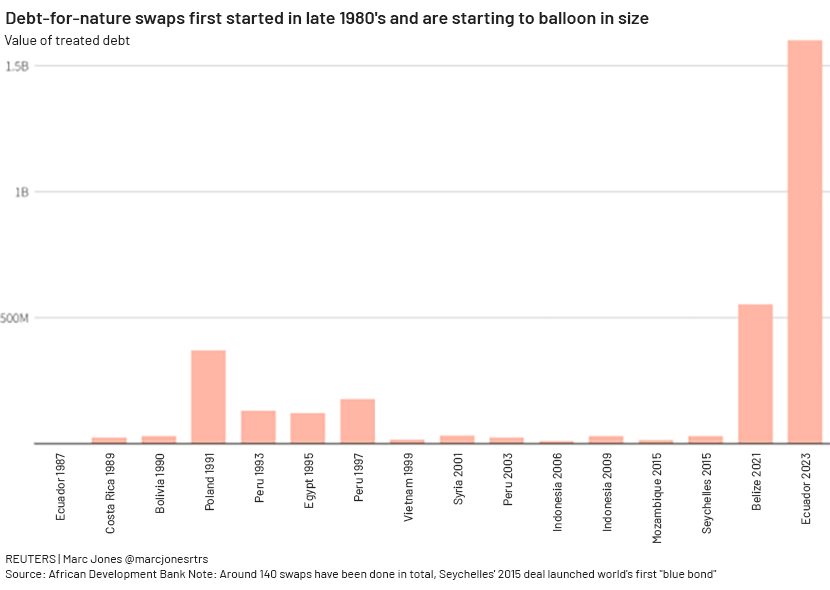

The appeal of DNSs has risen since they was first employed in 1987, reaching a total market value of USD3.7bn by the end of 2022, according to Reuters, which cited data published by the African Development Bank. Pursuant to the United Nations Development Programme, since the inception of DNSs, the total value of debt restructured under its auspices amounted to USD2.6bn over 1985-2015, of which USD1.2bn was used to fund development or nature-related projects.

Prominent examples in recent history include the following:

Ecuador: In May 2023, the government of Ecuador negotiated a DNS deal worth USD1.6bn, encompassing USD1.1bn of forgone debt repayments and USD0.5bn channelled into safeguarding the Galapagos National Park, the Galapagos Marine Reserve and the new Hermandad Marine Reserve, which together cover a total of 198,000 square marine kilometres.

Belize: The country signed a DNS in 2021 to protect its coral reef and reduce its debt level by more than 10% of GDP. According to Forbes, the deal led to USD4.0m of annual sustainable financing for conservation and pledged to protect 30% of Belize’s waters, in addition to other measures.

Poland: In 1991-92, the government of Poland launched a large- scale DNS intended to ease the country's indebtedness and other global environmental problems concurrently, swapping 10% of debt (potentially up to USD3.3bn) in bilateral agreements with key creditors in return for pledging to institute the Polish EcoFund, which was obliged to provide grants for projects in Poland addressing transboundary air pollution via sulphur and nitrogen oxides, pollution and eutrophication of the Baltic Sea, global climate-change gases, biological diversity, waste management and the reclamation of contaminated soil.

Meanwhile, many governments around the world are deliberating the feasibility of DNSs, especially those in the developing world that face pressure from mounting debt. Reuters reported that officials in Sri Lanka have been discussing a tentative deal up to USD1bn, while Cape Verde is nearing finalising a swap estimated at USD200m.

Obstacles to overcome

DNSs, like any other financial product, have inherent pitfalls and risks, including the following:

Finalising a DNS can be cumbersome, especially if the level of debt that needs to be restructured is substantial. Moreover, it involves multiple transactions with numerous parties, namely the principal debtor, creditor, NGOs and donors, in several stages, including its preparation, negotiation and implementation; the process could take two to four years to complete.

DNSs are also contingent on a debtor government’s ability to fulfil the terms of environmental conservation in exchange for debt relief. Governance issues, such as mismanagement and corruption, could impede the overall execution of DNSs and deter investor confidence.

It is common practice in DNSs to use local currency to service the swap. Therefore, a devaluation of the local currency or inflation could reduce the real cash value and investment in conservation commitments.

Conclusion

DNSs are considered to be somewhat of a niche area but have been growing in popularity recently given their association with environmental conservation and easing debt burdens. The deals signed by developing nations such as Ecuador and Belize illustrate the viability and positive outcomes of DNSs. A large number of vital ecosystems remain under threat, and as governments, particularly in the developing world, strive to responsibly stabilise their debt-to-GDP ratios, DNSs will likely gravitate to the forefront of sustainable financing.

How Acuity Knowledge Partners can help

Our more than two decades of investment expertise and bespoke research capabilities in supporting global financial institutions across fixed income asset classes position us well to partner with buy- and sell-side institutions to support their research teams to take advantage of this opportunity.

References:

-

Insight: Bankers bet billions on new wave of debt-for-nature deals | Reuters

-

EU's powerful lending arm eyes first 'debt-for-nature' swap | Reuters

-

Sri Lanka becomes latest country to consider debt-for-nature swaps – Green Central Banking

-

A new wave of debt swaps for climate or nature | United Nations Development Programme (undp.org)

-

Debt-for-nature swaps | Poland | Global law firm | Norton Rose Fulbright

What's your view?

About the Author

Ranul is an associate within the Lending Services Division of Acuity Knowledge Partners. He is a member of the Working Capital Solutions team in Colombo, engaging in credit reviews, quarterly portfolio reviews, risk ratings and financial spreading for a prominent European Bank. Prior to his current stint in Acuity, Ranul was employed as a compliance intern at one of Sri Lanka’s largest non-bank financial institutions. He holds a Bachelor’s Degree in Banking, Finance and Financial Risk Management from Victoria University, Melbourne.

Like the way we think?

Next time we post something new, we'll send it to your inbox