Published on October 20, 2020 by Laura Rajapakse

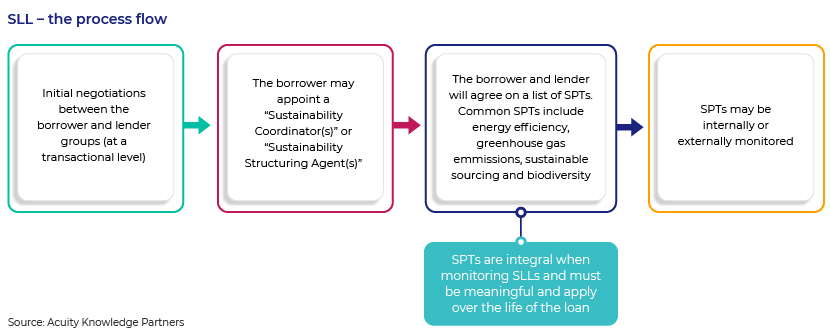

A new lending concept has emerged over the past three years – sustainability-linked loans (SLLs). These aim to facilitate and support environmentally and socially sustainable economic activity and growth. What differentiates SLLs from other loan products in the market is their link to sustainability – the pricing is linked to a borrower's performance against pre-determined sustainability targets (SPTs). In the event the borrower meets all the targets, the lending margin will decrease, translating into an economic benefit in terms of reduced finance expenses for the borrower.

Journey from green loans to SLLs

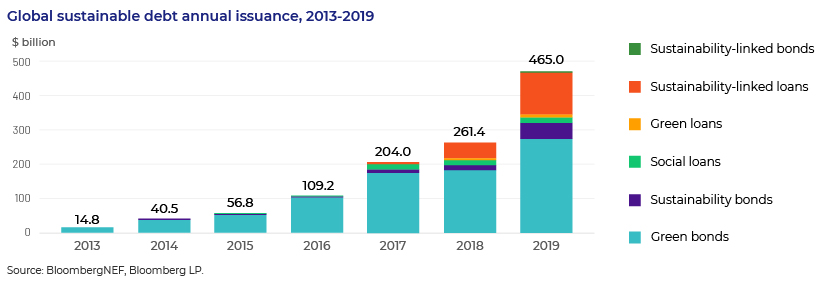

The use of SLLs grew with the Loan Markets Association’s (LMA’s) introduction of SLL Principles in 1H2019, subsequent to the Green Loan Principles (GLPs) it published in April 2018. The main difference between the previously published GLPs and the SLL Principles is the use of proceeds. Whereas the proceeds from SLLs can be used for general corporate financing but with the interest tied to sustainability KPIs, proceeds from green loans must be targeted at specific projects (with the rate of interest not contingent on any sustainability metric).

For instance, in Europe, the Taxonomy Regulation was established in June 2020, setting a framework to facilitate sustainable investment. The UK government, despite Brexit, is committed to matching the EU Commission’s sustainable growth strategy, and will retain the taxonomy framework, including its high-level environmental objectives.

Institutional commitment to ESG drives demand for SLLs across industries

In these changing times, companies are compelled to incorporate ESG factors in their business strategies; failure to do so may result in being exposed to risks such as reputational damage and poor financial performance

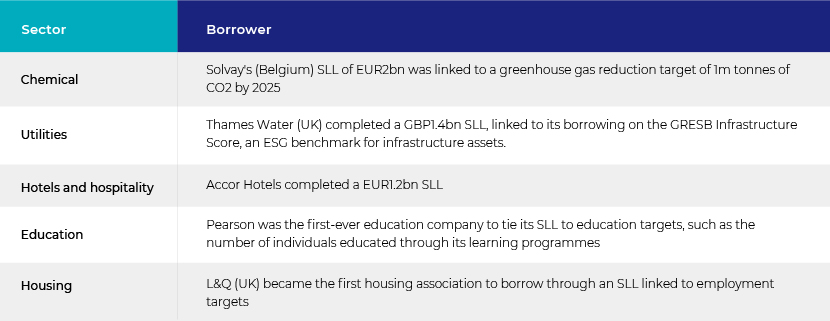

The first company to borrow though an SLL was Philips in 2017; the interest on its EUR1bn loan was linked to an ESG rating from an independent firm. The largest commodities SLL was signed in July 2019 by Chinese commodities trader COFCO International with ING, BBVA and Rabobank for USD2.1bn. The company subsequently increased the facilities to USD2.3bn, with the participation of 21 international banks. The latest SlL to be signed was in September 2020 for EUR650m between Enerjisa Uretim, the leading power generation company in Turkey, and seven banks; this is the largest SLL in Turkey so far. Given below are examples of SLL borrowers from various industries.

Lenders becoming greener by facilitating growth of SLL financing

In September 2020, 130 global banks committed to and signed up for the principles, under which they would bring their strategies in line with the Paris Agreement on climate change. They committed to setting a minimum of three long-term targets, while having to assess the negative and positive impacts on their balance sheets. Globally, banks and lenders use ESG ratings and data to identify lower-risk borrowers and meet sustainable financing goals. By participating in SLLs, banks and lenders can demonstrate their effort and commitment in this area and highlight their performance against their own ESG goals. Through providing SLLs, lenders show their alignment with their corporate customers’ ESG objectives, helping them achieve the following:

-

Expansion and diversification of the lending profile through the structured means of SLLs and improving their sustainability credentials

-

Offering their clients access to flexible and lower cost of capital through the incentive of achieving ESG performance, reducing a borrower’s overall cost of debt

How Acuity Knowledge Partners can help

We have a large pool of lending experts with significant experience in diverse sectors. We are, therefore, able to help lenders assess a borrower’s ESG standing in conventional terms, such as by incorporating ESG covenants and providing related monitoring support, drafting credit proposals inclusive of ESG status/risk analysis and incorporating ESG factors in credit ratings to arrive at better pricing and promote green lending. We also provide data science initiatives, including extracting ESG data, deriving insightful trends based on sentiment and maintaining meaningful databases.

References:

https://www.lsta.org/content/sustainability-linked-loan-principles-sllp

https://www.reuters.com/article/growth-in-sustainability-linked-loans-bo-idUSL2N27615Y

https://www.spglobal.com/marketintelligence/en/news-insights/trending/ogTMPV1VWGymqVfNOd4OQw2

What's your view?

About the Author

Laura is a Delivery Manager of the Commercial Lending team at Acuity Knowledge Partners. She was previously attached to the corporate finance team of a leading local apparel company for 7+ years. She holds a BBA (International Business and Management) from Northwood University, USA and MBA (Finance) from Cardiff Metropolitan University, UK.

Like the way we think?

Next time we post something new, we'll send it to your inbox