Published on February 7, 2020 by Narendra Mendru

Surveillance is defined as “attentive observation, as to oversee and direct someone or something”. Similarly, trade surveillance, in general terms, is about closely observing proprietary or client trades so as to spot and investigate a suspicious trading pattern.

However, the non-technical definition of the phrase perhaps does not really convey the broader picture of the function. Therefore, in the context of the financial sector, trade surveillance can be defined as the process of monitoring and investigating an organisation’s trading activity that directly or indirectly involves the practices of market abuse or market manipulation that could lead to legal litigation, criminal charges, and even business closure.

Trading in the securities markets has evolved both technologically and geographically, from “open outcry” to “high-frequency trading”, where traders use powerful algorithms to place their orders automatically, in microseconds. As trading in the capital/securities markets has evolved, traders have found new ways to manipulate prices, eventually resulting in losing investor confidence and damaging market integrity. The obvious aftermath is regulators finding it necessary to protect investor interests and enhance market integrity by implementing stringent controls and regulations to govern financial institutions.

Challenges in trade surveillance

Having a robust or holistic trade surveillance process in place has become challenging recently. It requires that businesses build a wide range of models to effectively detect market abuse events. The challenges include the following:

-

Monitoring trades across global markets

-

Monitoring pre-trade communications

-

Identifying intent and stimulus behind market manipulation

-

Inferior and/or static model designs leading to the output of a large number of false positives

-

Complying with complex and far-reaching regulations

-

Movement from laggards to early adopters in buy-side firms

-

Indefinite controls in place for unregulated markets

-

Lack of immediate expertise to gauge the psychological state of traders

How to create a competent and effective trade surveillance environment

We believe the best way to overcome these challenges is to devise a strategic plan of action and follow it one step at a time.

Broader coverage

Buy-side and sell-side firms have expanded their geographical presence through technology. They have also increased their trading in products such as exotic derivatives, swaps and other over-the-counter (OTC) products on different trading platforms, including electronic communication networks, high-frequency trading and dark pools. At this pace of expansion, it is crucial that firms expand coverage of trade data across markets, as this helps generate better alerts. Trade surveillance vendors have also been investing in direct data feeds for the equities, derivatives and options markets, and focusing on integrating derivatives and underlying financial instrument data as quickly and efficiently as possible. Hence, firms must choose their vendors wisely, preferably those that can ensure optimal integration of in-house data and external trading data, such as trades on different platforms.

Integration across compliance disciplines

The regulators expect firms to have an understanding of risks on a holistic, enterprise-wide basis, as well as at the desk level. Integration between departments (Compliance, Strategy, Technology and Business) and between surveillance units, such as trade surveillance and electronic communication surveillance, would enable better identification of issues than if conducted on a standalone basis. Usage levels of multiple communication channels and trading technologies continue to increase, requiring a far more sophisticated level of timely investigation of suspicious trading activity by integrating findings from different sources. The integration of electronic communications and trades into a single application would contribute significantly to reducing the time required to conduct investigations. Firms should, therefore, invest in high-end technology that can integrate a trader’s electronic communications and trades.

Analysing behavioural patterns

All participants in the financial markets trade to earn profit. Market manipulation, however, is driven by greed and fear. Earning profits is in itself not harmful, but malicious intent harms the market, resulting in an artificial pricing situation and inequality as the price mechanism is distorted. We believe it is always better to suppress the bad intent proactively than to just identify the manipulation after the event Analysis of a trader’s behaviour relating to trades could help firms identify the hidden threats that parameter-based models cannot. Firms, therefore, need to seek an integrated solution – one that combines parameter-based models with behavioural patterns to improve effectiveness, while reducing the cost of compliance.

Surveillance models need to be reviewed

Surveillance models should not be static. They need to be improved continuously. Firms need to have a formal review procedure, involving both compliance and business processes, to ensure they have adequate mechanisms and protections in place. A failure in model design, mainly the improper setting of thresholds, could result in a large number of false positives. To reduce this, firms should review their models regularly, improving the thresholds using new-age scientific approaches (involving machine learning, data science tools and artificial intelligence).

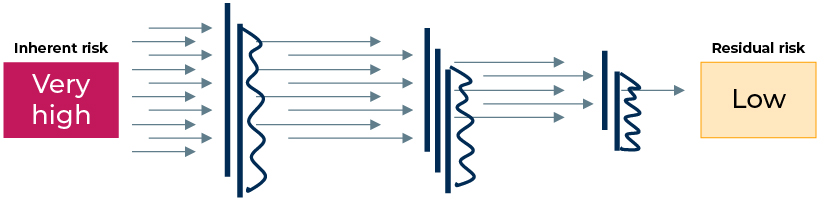

Regulators are becoming more advanced and dynamic in their monitoring

The regulators continue to implement advanced surveillance techniques and expect the firms they regulate to keep abreast of these. “Sampling” trading activity or individuals is not viewed as a comprehensive approach. Firms need to take a holistic approach to negating the risks in managing a function in a traditional manner.

Source: mckinsey.com

|

1) Models are built into the applications , as per the regulators’ requirements |

4) Alerts are analysed based on facts and intellectual processes |

7) The Compliance Advisory Team investigates and analyses the escalated alerts |

|

2) Data from the markets and the firm on executed trades is collated and entered on the applications (SMARTS, Actimize or BTCA) |

5) All processed alerts go through secondary quality checks for sanity and accuracy |

8) An alert is closed out, based on the specified rationale, if not a true alert |

|

3) The application generates alerts as per the models defined in the application |

6) Any anomaly is escalated to the Compliance Advisory Team |

9) A suspicious transaction report is sent to the regulators to report a true alert |

Surveillance programmes must focus on OTC products

Generally, OTC products are not effectively monitored and do not have standard pricing information, unlike exchange-traded products. However, this is no longer an excuse for not monitoring OTC instruments. The regulators recommend taking a more proactive approach, as they also focus more on such instruments. OTC products, especially fixed income and forex instruments, can be monitored, but requires ongoing innovation and subject-matter expertise. Firms should recognise that any attempt, whether successful or not, to manipulate markets or conduct other types of market abuse is subject to regulatory action. Do your programmes detect attempted manipulation and abuse?

Enhancing buy-side surveillance capabilities

Buy-side firms generally lag sell-side ones in terms of sophistication and coverage, although they are aware it is imperative to increase their focus on trade surveillance.

Therefore, having a separate compliance management team to oversee the trade surveillance process is critical. It would help an organisation streamline the processes with efficient technologies and educate their traders on the importance of adhering to regulations.

Source: ezofficeinventory.com

Front-office experts on surveillance

Firms now hire individuals with quantitative backgrounds and an understanding of how trades work in the real environment to man their front and middle offices. Such individuals would also be aware of the complex psychology of manipulators.

Conclusion

As behaviours evolve with technological changes in markets, firms need to stay one step ahead of potential market threats. Innovative and more efficient automated solutions would enable them to manage trade surveillance effectively in order to prevent market abuse and mitigate reputational risk.

How Acuity knowledge partners can help

Acuity knowledge partners will help buy-side and sell side firms leverage our expertise in trade surveillance. Our objective is to provide clients with scalable, cost effective solutions to eliminate risk and increase service quality. We also understand the significance of building an efficient and dynamic trade surveillance environment. We also make constant efforts to stay relevant to regulatory changes.

What's your view?

About the Author

Narendra Mendru has 5 years of experience in Trade surveillance. He worked with various firms, including Bank of America and HSBC. In his current role, He is working as delivery lead with Acuity knowledge partners and supports clients as SME in trade surveillance. He holds MBA degree, specialized in finance from MATS Institute of Management, Bangalore.

Comments

21-Feb-2020 08:00:43 am

Naren you have proved once again you go by concepts, tried and tested. This is so flawless and the content presented in a very professional manner. Well Done.

Like the way we think?

Next time we post something new, we'll send it to your inbox