Published on November 27, 2018 by Lakshmi Krishna and Harsha Krishnakumar

A 2018 study by Constellation Research1 expects companies’ budgets for investing in Artificial Intelligence (AI) to continue to rise by more than 50% annually for the next four to five years. The financial services industry is certainly not looking away, adopting advanced technologies as it strives to meet challenges in terms of time and cost, drawing insights from data and providing a more meaningful customer journey. Prominent examples of these include robo-advisors, chatbots and AI-driven portfolio and risk management that have ushered in a new era of innovation in so far fairly unchartered territories.

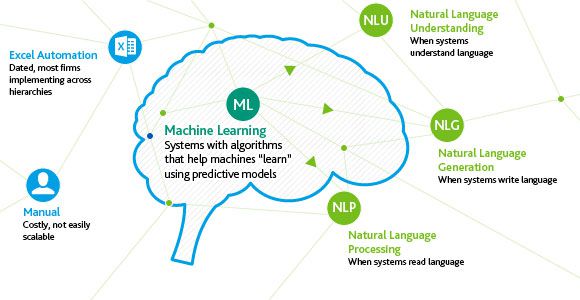

This changing landscape compels firms to see technology no longer as a passive participant but as a change driver that can learn and adapt to the needs of an organization. However, before we get ahead of ourselves, perhaps an important starting point would be to look at the range of options that are relevant for asset managers.

NLG, NLP and NLU ensure that reports and documents produced suit the target audience. The technologies analyze, interpret and evaluate what the report is meant for and the audience that will read it, and accordingly tweak the language to personalize content.

An interesting area that has opened its doors to Machine Learning (ML) is content writing, particularly Fund Commentary. From data insights to summaries, human-like content (generated by machines) has overcome the constraints faced by many asset managers and fund marketers. ML empowers firms by providing faster turnaround, seamlessly sifting through tons of financial data and writing factual content like never before.

To summarize, its application in fund marketing and its ability to empower clients lead us to explore the potential of NLG.

What is NLG?

Simply put, Natural Language Generation (NLG) generates narratives using data-driven decision making. Such narratives summarize and explain input data in an easily comprehensible manner. With the increasing need to understand data better, NLG communicates content in an anthropomorphic manner, customizable to target audiences almost instantly! By plugging into various data environments, NLG elevates client reporting to the next level. For example, it can convert a routine data report to a standardized report with insights promoting customer engagement. In an emerging trend noted by Gartner, NLG will be a standard feature of 90% of modern business intelligence and analytics platforms by 2019,2. That said, it is imperative to also understand the role of NLG within the realm of ML.

How NLG works

While trying to understand what makes this wonderful subset of AI useful, we need to look at two elements:

-

The working model

-

What NLG can do for your business

The working model

An NLG model typically works around structured data. Once the data is in the required standard format, scenarios are analyzed and rules are subsequently defined to decipher the raw data. Here, instead of an analyst examining data, NLG builds insights from the quantitative data, transforming it into a clear and crisp narrative. While it may seem straightforward, the real challenge lies in elegantly setting up the rules and the timeliness of deployment.

Acuity Knowledge Partners leverages NLG technology to produce c.4,000 credit issuer reports covering local governments.

With NLG, did you know you could

-

Generate large-scale narratives from data-driven reports?

-

Generate narratives in multiple languages?

-

Integrate with your reporting and BI tools to produce crisp narratives and insights?

-

Generate more accurate reports with faster time to market?

What NLG can do for your business

In financial services, fund marketers routinely turn to technology to have fund performance commentaries, earnings reports, due diligence questionnaires (DDQs) and client reports completed on time, often due to resource constraints. While the idea of automating commentaries isn’t really new, asset managers utilizing NLG can produce reports at a fraction of the effort required for manual authoring. This enables content to be ready during the first few days of a quarter, rather than weeks after receiving the data. With NLG, scalability and frequency come at a very minimal variable cost. This helps asset managers

-

Prepare highly customized and targeted content

-

Stay consistent and compliant, as NLG ensures the reports are uniform, and changes in compliance are easily integrated by tweaking the tool

-

Integrate data source websites like Bloomberg, Reuters, and FactSet to produce reports on an ad hoc basis almost instantly

Watch this space to understand how NLG could be the answer to your fund marketing needs. Fund commentary writing services

Sources

1. https://www.zdnet.com/article/ai-investment-rising-significantly-among-early-adopters/

What's your view?

About the Authors

Lakshmi Krishna has over 6 years of experience in commentary writing, RFP creation/writing, and client reporting. In her current role at Acuity Knowledge Partners, she provides support in fund marketing services for the asset management industry. She holds a Master of Science in Finance from the University of Texas and a Bachelor of Engineering (Information Science and Technology) from Visvesvaraya Technological University.

Harsha Krishnakumar has over 10 years of experience in RFP creation/writing and personal coaching. In his current role at Acuity Knowledge Partners, he provides support in business development and content strategy for fund marketing services. Prior to this, he was part of the Sales Enablement team at JPMorgan. He holds a Master of Business Administration from ICFAI Business School and a Bachelor of Engineering from Bangalore Institute of Technology.

Like the way we think?

Next time we post something new, we'll send it to your inbox