Published on December 22, 2021 by Ambarish Srivastava

In the private equity and venture capital (PE&VC) space, 2021 was a sort of “template” year, when long-term trends continued after leaving behind the concerns initially faced amid the pandemic in early 2020. Based on recent developments, we have compiled a summary of private equity and venture capital trends that are likely to impact the sector in 2022 and beyond.

Special purpose acquisition companies (SPACs) are here to stay

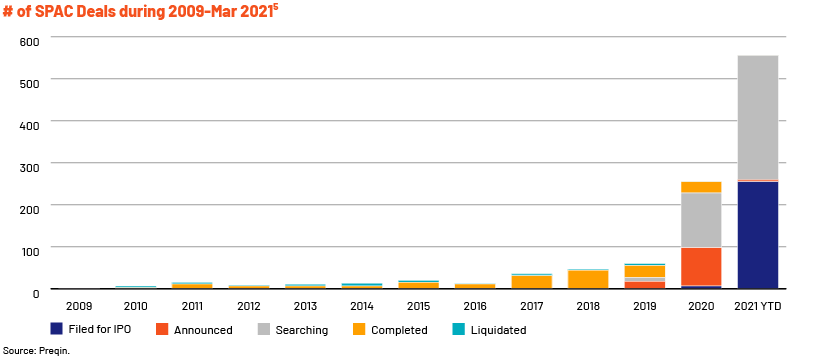

SPACs have picked up strongly for PE in the past two years, as highlighted in our blog1 published in April 2021. SPACs have emerged as a strong exit consideration for the PE industry, leading to a number of associated events. Competition has increased2 , and SPAC sponsors are looking for debt financing following the easing of other routes such as private investment in public equity (PIPE) and other equity proceeds3 . Supported by all manner of financing, the number of SPACs formed in 2022 is bound to exceed the number of SPACs formed in all the previous years combined. We expect SPACs to remain strong as “a viable additional exit route”4 in the next few years.

There is speculation that SPACs could become an important aspect of PE firms' business in the next decade, subject to their performance in the near term6 . However, professionals such as Phil Ingle of Morgan Stanley believe SPACs may be experiencing some fatigue7 .

Holding period has risen but is now stable

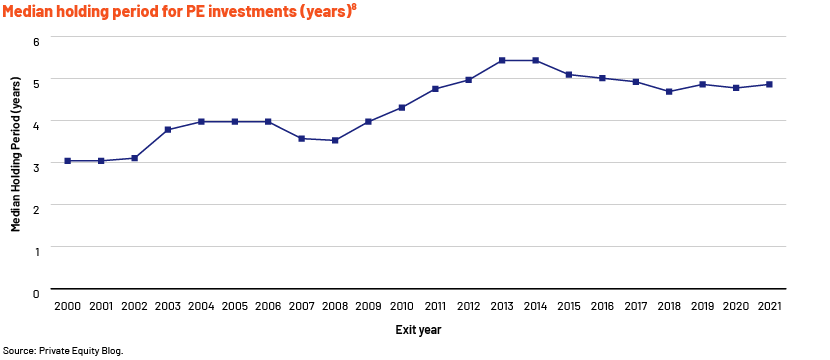

The average holding period increased to more than five years in 2014 from less than four years during the financial crisis of 2008, as exits were challenging.

The holding period now seems stable at 4.8-4.9 years for a fourth year in a row. In fact, the pandemic seems to have had little impact on this. Different sources provide different numbers for the years (e.g., Preqin puts it at 5.9 years for 20149 while PitchBook puts it at 6.2 years10 ). PitchBook puts it at 4.9 years in 201911</sup and 202112</sup , which is more or less stable and a drop from the peak.

Unless a strong trigger comes into play, the holding period is likely to remain at around five years in 2022.

Rise in decacorns

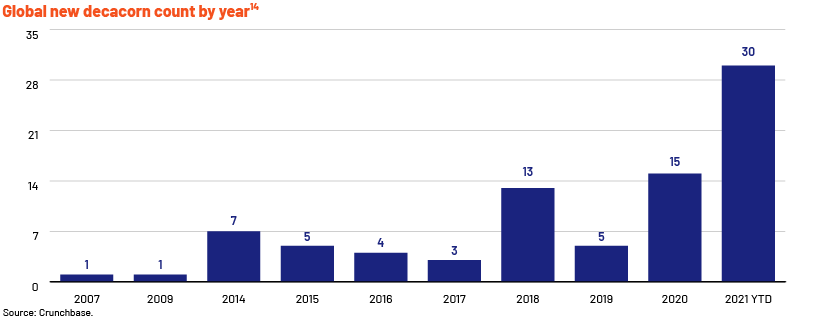

Forget unicorns. Valuations are rising as investors chase a limited number of promising companies, and the age of decacorns – those with valuations of USD10bn or above – has arrived. By November 2021, the number of decacorns had doubled from that in 2020. Many of these decacorns have also been able to maintain their valuations after their IPOs – most of the 31 decacorns that went public since Facebook’s IPO are trading above their highest private valuations13 .

So where are we headed? The initial decacorns were Facebook (2007) and Alibaba (2009); their valuations were rare until 2014, when seven other companies joined their exclusive club. Since 2007, 84 firms have become decacorns.

Extrapolating this high number, we can expect more firms to join this club, based on the following factors: (1) of the 1,000 unicorns currently in operation, c.90 have valuations of USD5-10bn15 , (2) investor appetite for high-growth companies is growing and supply of such companies is limited and (3) the PE&VC sector is flush with substantial funds and its dry powder is at the highest ever.

Digital acceleration likely to continue and go beyond fintech

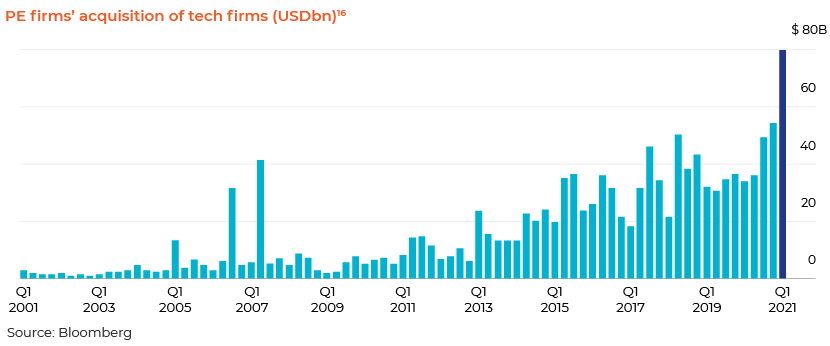

PE&VC firms’ interest in technology is at a high level and rising. The pandemic highlighted this, but the acceleration, as Bloomberg identified it, is for the long term.

PE firms’ acquisition of tech firms16

Investors are focusing on tech businesses as they see consumers keenly adopting disruptive technologies and becoming digitally savvy and conscious of obtaining value for money17 .

As the chart shows, PE&VC managers’ focus on tech has been increasing in the past decade. Crunchbase identified 127 such deals in 2020, including high-profile deals relating to RealPage (acquired by Thoma Bravo, USD10.2bn), Ancestry (Blackstone Group, USD4.7bn) and Pluralsight (Vista Equity Partners, USD3.5bn)18 .

Based on the interest, it is safe to say that tech deals are bound to grow, especially since technology is seen as a disruptor as well as a solution. For example, PE&VC firms are becoming interested in agtech –technology adoption in the agriculture sector – as a solution for the supply chain issues encountered during the pandemic. PitchBook estimates USD2.1bn in venture funding for agtech in 2Q 2021, far more than that received in 4Q 202019 .

Environmental, social and governance (ESG) considerations

We highlighted PE&VC managers’ increasing focus on ESG factors in a blog20 last year in terms of investors and regulators asking for ESG-related criteria to be met, more asset managers adopting ESG standards and making them part of their strategy rather than just initiatives and the shortage of ESG-related talent. These trends have continued, with additional themes emerging as more and more managers and investors gain awareness.

-

The practice of greenwashing (Eton Bridge estimates that up to 40% of green claims made by companies it reviewed are potentially misleading) may be in decline as ESG considerations become more homogenous and the space becomes aware of this practice. The decline may eventually lead to more credibility around ESG matters .

MSCI feels that ESG regulations are at a crossroads and is watching closely for any sign of convergence among the existing 34 regulatory bodies and standards. It believes that if more standards are adopted, it could make the space more fragmented and confusing .

How Acuity Knowledge Partners can help

In addition to monitoring PE trends emerging due to recent developments in the operating environment, we endeavour to continue checking the pulse of the PE&VC space. To this end, we rolled out a survey to identify the mood and sentiments of PE&VC professionals worldwide. We shall share the results shortly.

Sources

1https://acuitykp.com/blog/can-spacs-attract-private-equity/

2SPACs Bring More Opportunity — And Competition — To The Private Equity World – Crunchbase News

3Debt financing gains traction as SPAC space matures — Lexology

4https://www.preqin.com/insights/research/blogs/how-are-spacs-affecting-private-equity

5How Are SPACs Affecting Private Equity? (preqin.com)

6https://www.lexology.com/library/detail.aspx?g=1f48e7cc-d255-447d-9ddb-d491858a246e

7Interest in SPAC mergers declining — SpaceNews

9https://docs.preqin.com/newsletters/pe/Preqin-PESL-May-15-Buyout-Holding-Periods.pdf

12https://pitchbook.com/news/articles/private-equity-venture-capital-carried-interest-profits

13https://news.crunchbase.com/news/decacorn-startups-2021-global-record-data-charts/

17https://www.mckinsey.com/featured-insights

18SPACs Bring More Opportunity — And Competition — To The Private Equity World – Crunchbase News

19https://pitchbook.com/news/reports/q2-2021-emerging-tech-research-agtech

20https://acuitykp.com/blog/esg-trends-in-private-equity/

Tags:

What's your view?

About the Author

Ambarish has about 19 years of experience in business research, analysis and consulting. He is engaged in leading deep-dive strategic projects, due-diligence support, issue-focused trend analysis and similar assignments for our Private Markets clients. His previous experience includes tenures with startups, the Big Four and consulting organisations, where he focused on industry studies, price forecasting, company analysis, macroeconomic studies and other strategic engagements.

Like the way we think?

Next time we post something new, we'll send it to your inbox