Published on October 17, 2024 by Shrey Khandelwal

Catastrophe bonds, commonly known as “cat bonds”, are specialised financial tools that shift the risk of natural disasters from insurers and governments to the capital markets. These instruments enable insurance and reinsurance firms to reduce their exposure to catastrophic events such as hurricanes, earthquakes and other natural calamities. By issuing these bonds, companies can secure extra funds following a disaster, easing financial pressure during difficult periods

The concept of cat bonds emerged in the early 1990s, following a series of natural disasters that strained the insurance and reinsurance sector. The first cat bond was issued by the World Bank in 1996

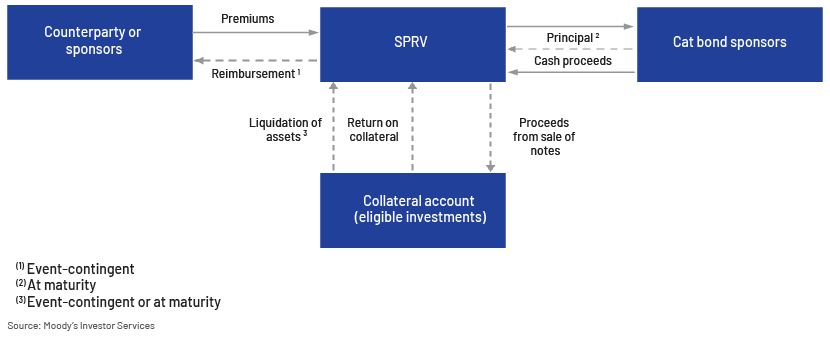

Structure of the cat bonds

In a standard cat bond arrangement, a special-purpose vehicle or insurer (SPV or SPI) forms a reinsurance contract with a sponsor (or counterparty), obtaining premiums from the sponsor in return for offering coverage through the issued securities. The SPV then sells these securities to investors and collects the principal amounts. This principal is placed into a collateral account and is usually invested in high-quality money-market funds

The investor’s coupon, or interest payments, are made up of interest the SPV makes from the collateral and the premiums the sponsor pays.

If a qualifying event occurs that meets the trigger conditions to activate a payout, the SPV liquidates the collateral required to make the payment and reimburses the counterparty according to the terms of the cat bond transaction.

If no trigger event occurs, the collateral is liquidated at the end of the cat bond term and investors are repaid

An example of a cat bond

For example, an insurance company in the US has issued a cat bond. The bond has a USD1,000 face value, matures in two years, and pays an annual interest rate of 7.5%.

An investor who buys the cat bond is bound to receive USD75 each year, and the principal is to be returned at maturity. Issuance of the cat bond raised USD100m in proceeds, which were placed in a special account.

-

The bond is structured so that a payout to the insurance company occurs only if the total natural disaster costs exceed USD300m for the two years. Any remaining funds would be returned to investors at the bond's maturity.

-

During the course of the second year, if a series of natural disasters occurs for a total cost of USD550m, it would activate the payout to the insurance company, and USD100mn would be transferred to the insurance company from the special account.

-

Investors who held a USD1,000 CAT bond earned USD75 in interest in year 1 and lost their principal in year 2. The insurance company reduced its natural disaster costs from USD550m to USD450m by issuing the cat bond.

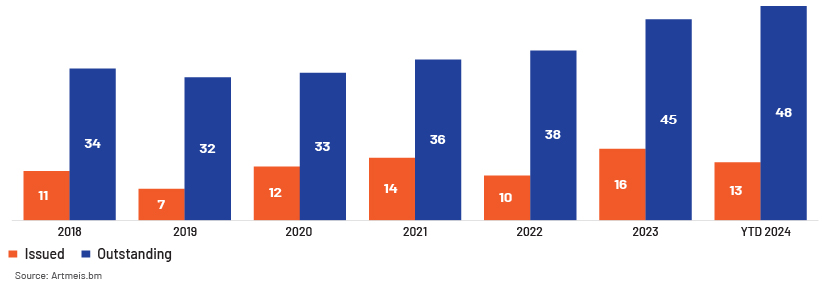

Cat bonds issued/outstanding globally (USDbn)

The Insurance Linked Securities market ended 2023 with a significant increase in cat bond issuance and strong investment returns, primarily because there were no major catastrophic events. This upward trend has persisted, with a new peak in issued bonds and a record number of outstanding bonds in the market

New issuances have experienced fluctuations over the years, growing at an overall CAGR of 3% from 2018 to the present in 2024. Meanwhile, the size of outstanding bonds has grown significantly, at a CAGR of 6%

Investing in cat bonds can help investors diversify their investment portfolios, mitigating risks. Benefits for investors and issuers include the following:

-

Transfer of risk: Insurance companies can transfer risk to investors in the capital market through cat bonds

-

Diversification of investments: Advantageous for investors, as it provides diversification of investments because catastrophe risk is unrelated to conventional financial markets and their instruments

-

Innovative product: Encourages innovation in risk modelling and financial engineering

-

Maturity period: The short maturity period is an added advantage to investors, as the probability of large-scale calamities costing millions of dollars to insurance companies in a short period of time is less

-

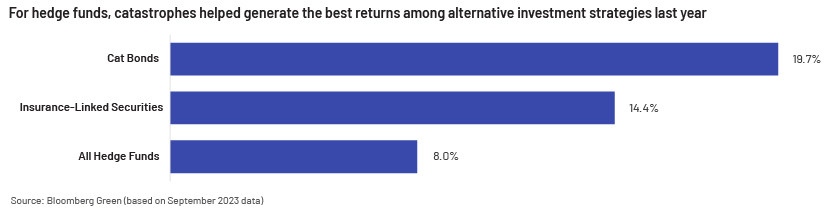

Higher returns: The investment returns in 2023 from cat bonds were significantly higher than those from other insurance-linked securities

-

Portfolio returns for cat bonds are not driven by economic factors such as GDP growth, interest rates and corporate profitability.

-

Instead, performance is driven by the occurrence of low-frequency, high-severity natural events such as earthquakes and hurricanes. This key distinguishing feature has resulted in the low correlation of cat bonds to other asset classes.

-

Although cat bonds are floating-rate securities and offer high levels of liquidity, investors may wish to use them as part of a strategic asset allocation with a long-term investment horizon.

-

No other asset class generated more returns for hedge funds in 2023. Firms such as Fermat Capital Management and Tenax Capital booked high returns.

The top-performing hedge fund strategy of 2023 invested in ILS securities, primarily cat bonds, which yielded 14%+, according to Preqin, a consultancy specializing in alternative asset management data. This outperformed Preqin’s industry benchmark return of 8% across strategies and compared to a 19.7% gain in the Swiss Re Global Cat Bond Total Return Index.

Potential risks in investing in cat bonds:

-

Complex structure: The structure of cat bonds can be complex, making it challenging for investors to understand it

-

Risk involvement: In the event of a catastrophe, investors may face losses, leading to concerns about default risk

-

Liquidity risk: These bonds can have limited liquidity, impacting the ability to buy or sell them easily in the open market

Key elements and triggers of cat bonds

One of the key elements of any cat bond is the terms under which the securities begin to experience a loss.

Cat bonds employ specific triggers with set parameters that must be met before losses begin to accumulate. Investors start to lose their investment only when these precise conditions are fulfilled. These events, typically catastrophic in nature, such as hurricanes, earthquakes or floods, are detailed in the bond’s contract.

A cat bond trigger is a specific condition that, once met, initiates the payout process for investors. These triggers are intended to shield insurers from substantial financial losses caused by catastrophic events.

These triggers can be structured in various ways, ranging from a sliding scale based on the issuer’s actual losses (indemnity) to a trigger activated when industry-wide losses from an event reach a certain threshold (industry loss trigger). Another structure involves an index of weather or disaster conditions, where catastrophic events exceeding a specific severity level trigger a loss (parametric index trigger).

Types of cat bond triggers

-

Indemnity triggers: An indemnity trigger initiates a payout to the sponsor based on their actual losses. Verifying these losses can take time, potentially delaying the payout process for the bond’s issuing sponsor. The situation can be complex and confusing, much like the protection segment. Nevertheless, the most frequent triggers for CAT bonds are indemnity incidents and industry loss events

-

Industry loss triggers: When a catastrophic event affects the insurance industry as a whole, the industry loss trigger triggers a payout to the sponsor. The misfortunes should surpass a sum, called a connection point, which the support sets ahead of time. Again, as data trickles in following a serious disaster, data collection on this trigger could take a long time. State legislature and individual backup plans would deliver introductory evaluations, but this number would change frequently as additional realities and information are factored in.

-

Parametric triggers: A parametric trigger is activated when an event exceeds a predefined threshold. Coverage payouts begin only when specific statistical parameters are met or surpassed. These triggers typically depend on third-party consultants to verify whether the conditions have been fulfilled.

-

Modelled triggers: These triggers are similar to indemnity triggers but with a key difference. Rather than relying on actual claims, they depend on computer and third-party models. Because these models are estimations, they generate data much faster than indemnity triggers. Modelled triggers currently represent only about 1% of the trigger mechanisms in use and were more common in the early development stages of cat bonds.

Conclusion

Cat bonds have an advantage over traditional reinsurance and are an attractive investment opportunity for private equities.

Cat bonds are essential in risk management, offering a way to transfer catastrophic risks to the capital markets. Despite their complexity and potential drawbacks, the continued development of these instruments highlights a dynamic and resilient financial market that adapts to the evolving landscape of natural disasters and emerging risks.

In part two of this series, we shall cover the current trends and how private markets can benefit from the increasing popularity of cat bonds.

How Acuity Knowledge Partners can help

We cater to investors focusing on the re/insurance and insurtech sectors, supporting them with in-depth research, analysis, investment decision-making and strategy amid an ever-changing business environment. Our more than two decades of experience and expertise in supporting investors and finance professionals position us well to partner with financial services firms and support their teams in daily workflow.

Sources:

-

https://agentsync.io/blog/insurance-101/understanding-cat-bonds

-

https://www.chicagofed.org/publications/chicago-fed-letter/2018/405

-

https://www.elibrary.imf.org/downloadpdf/journals/066/2022/004/066.2022.issue-004-en.xml

-

https://www.financialprotectionforum.org/sites/default/files/SECO%20Webinar%205_Presentation_V6.pdf

-

https://development.asia/explainer/catastrophe-bonds-explained/

-

https://www.wallstreetmojo.com/catastrophe-bond/#pros-and-cons

-

https://agentsync.io/blog/insurance-101/understanding-cat-bonds/

-

https://partnerre.com/wp-content/uploads/2017/08/Catastrophe-Bond-Pricing.pdf

-

https://www.insurancejournal.com/news/international/2023/01/11/702771.htm

-

https://agentsync.io/blog/insurance-101/understanding-cat-bonds

-

https://www.insurancejournal.com/news/national/2024/01/22/756464.htm

-

https://www.amundi.com/usinvestors/Local-Content/News/Opportunities-in-Catastrophe-Bonds2

-

https://www.biznews.com/global-investing/2024/02/26/rising-complexity-cat-bond-sparks-concern

-

https://www.morningstar.com/bonds/catastrophe-bonds-strategic-diversifier

What's your view?

About the Author

Shrey is a Senior Associate at Acuity Knowledge Partners, having more than 2 years experience in the Private Markets team. Worked as a senior auditor with Deloitte before joining Acuity. Holds a Bachelors of Commerce degree from University of Delhi

Like the way we think?

Next time we post something new, we'll send it to your inbox