Published on May 6, 2020 by Archana Kanojia

COVID-19 has redefined global cooperation and interaction, particularly as China, one of the largest suppliers to the global market, was the epicentre. The private equity (PE) market has not remained unscathed. Although it is too early to gauge the impact, we doubt whether the global economy is strong enough to weather this storm.

Then and now

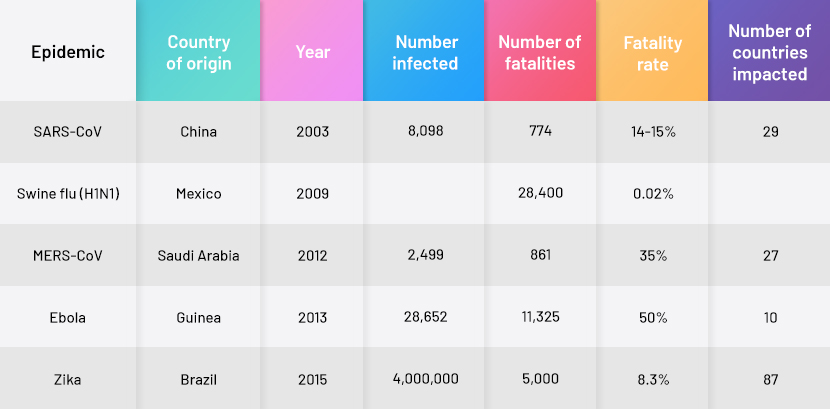

China was mainly exporting clothes and sneakers to the world market before the SARS outbreak in 2002. Its stock market fell by 15% subsequently, but recovered soon enough. The world has also faced other epidemics, many of which were deadlier than the current one.

However, two factors make this pandemic scarier than the past ones – first, it is spreading faster and more silently, secondly, it started in China, the world’s second largest economy (after the US), which contributes 9.3% of world GDP. Also referred to as the “world’s factory”, China produces a variety of consumer products – from beauty products to industrial machinery. Being the first epicentre, it had a domino effect on the global economy. In c.40% of the 364 company earnings calls conducted from 1 January to 13 February, “coronavirus” was mentioned, according to FactSet.

COVID-19: How it is impacting the global economy

The Nikkei (Japan), Hang Seng (Hong Kong), and Shanghai Stock Exchange (China) in Asia, and the FTSE (London), DAX (Germany), CAC (France) and FTSE MIB (Italy) in Europe are all witnessing a downward swing amid the global outbreak. Economists predict a recession in 2020.

The Organisation for Economic Co-operation and Development has confirmed that the impact of the outbreak will be much worse than the global economic slowdown of 2008. It has already wiped out USD5tn from the global economy. Industry experts predict that this will only increase in the coming quarters, since China is more connected to the global economy now than it was during the SARS outbreak.

-

Blackstone has released a statement to confirm that the outbreak will impact the performance of its funds

-

Temasek (a Singapore-based firm with c.42% of its investment in private markets) expects salary and annual bonus cuts

-

Goldman Sachs revised the 2020 growth forecast for S&P 500 earnings to zero

How it is impacting PE activity

Although it is too early to calculate the outbreak’s impact on the financial markets, we expect one or more of the following operations of PE firms to be affected:

-

Fundraising: PE and venture capital (VC) firms reported fundraising of USD595bn in 2019 (40% more than the USD426bn raised in 2014, of which North America and Europe accounted for USD342.9bn). PE fundraising has been badly affected amid the current global travel restrictions.

-

Portfolio monitoring: General partners (GPs) are now actively involved in managing their portfolio holdings, to keep track of each company’s performance and analyse the impact the outbreak may or may not have on them.

-

Due diligence: Travel restrictions have affected GP-led activities such as company-level due diligence.

-

Deal making: New deal making has been impacted by travel restrictions, with GPs currently focusing on mitigating the impact of COVID-19 on their existing portfolios.

-

Company valuation: With China being a global supplier, the closure of many of its factories has disrupted the supply side of a number of companies and, in turn, their sales figures.

-

PE exits: PE exits, whether via IPOs, buyouts or acquisitions, have been impacted as PE firms that have spent years on grooming their portfolio companies, hoping to exit through an IPO or buyout, have put such exits on hold.

-

KKR has postponed its plan to sell Singapore-based Goodpack (a shipping and logistics company), owing to a dip in its valuation since the outbreak (the proposed deal value was USD2bn)

-

Adapting to the new normal

We believe COVID-19 will have a deep impact on how we do business around the world. Private Equity firms will need to be agile to adapt to this new normal of business as they rethink their strategy for 2020.

Here is where Acuity Knowledge Partners can help you navigate through these challenging times. Our global offices can enable you to handle business demand and uncertainties with ease. Currently, we are helping many of our clients with our understanding of the market to chart their 2020 strategy.

To help our clients navigate both the people and business impact of COVID-19, we have created a dedicated hub containing a variety of topics including our latest thinking, thought leadership content and action oriented guides and best practices.

Sources

Tags:

What's your view?

About the Author

Archana Kanojia started her career with Acuity Knowledge Partners in 2010. She currently provides oversight to various teams assisting client business development teams’ in proposals drafting, managing proposal content, lead generation and consultant databases. Previously, she provided oversight to teams that assisted clients to set up fund databases for private equity funds of funds, analyzing private equity (PE) firms and their funds from an investment standpoint, and also extended investment support to PE firms through industry studies, information memoranda and similar activities.

Archana holds a Post Graduate in Business Management with a specialization in Finance..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox