Published on by Ankit Chaturvedi

Introduction

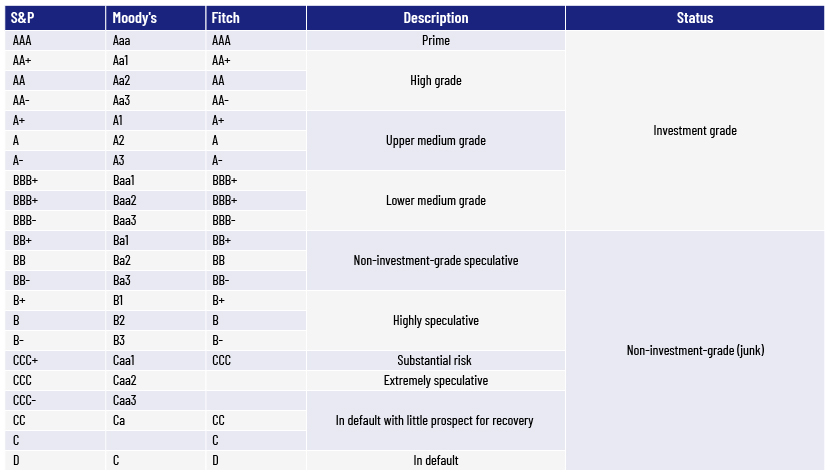

An investment rating, also known as a credit rating or financial rating, is a crucial tool in the world of finance and investing. It is an assessment or evaluation of the creditworthiness or investment potential of a company, government or financial instrument. These ratings are typically expressed in letter grades (such as AAA, A, B and C) or alphanumeric codes and convey the agency's opinion on the issuer's ability to meet its financial obligations. The higher the rating, the lower the perceived risk, and vice versa.

Most common investment ratings

Credit ratings for bonds and fixed-income securities:

-

AAA or Aaa: This is the highest rating and represents an extremely low credit risk. Investments with this rating are considered very safe, and the issuer is expected to meet all financial obligations.

-

AA or Aa: This rating indicates a high credit quality. While not as secure as AAA-rated investments, AA-rated securities are still considered to have a low risk of default.

-

A: A rating of A signifies an investment with low credit risk. It suggests that the issuer has a good ability to meet its financial obligations.

-

BBB or Baa: This is an investment-grade rating, indicating a moderate level of credit risk. An investment with this rating is considered to be relatively safe but may carry a slightly higher risk than higher-rated securities.

-

BB, Ba or lower: This rating indicates a speculative or junk bond. It represents a higher level of credit risk, and investors may expect higher returns to compensate for the increased risk.

Credit ratings for stocks:

-

Stock ratings are often assigned by equity research analysts rather than credit rating agencies. These ratings can range from "Strong Buy" to "Strong Sell" and provide guidance on whether to buy, hold or sell a particular stock.

Issuer credit ratings:

-

These ratings assess the overall creditworthiness of a company or government entity. They take into account factors beyond a specific security, such as the issuer's financial health, business outlook and management quality.

Country credit ratings:

-

Credit rating agencies also assign ratings to countries, reflecting their ability to meet sovereign debt obligations. These ratings influence the cost of borrowing for governments and can impact a nation's access to international capital markets.

Role of ratings in investment compliance

Ratings play a crucial role in investment compliance by providing investors, regulators and financial institutions with valuable information and benchmarks to assess the creditworthiness, risk and suitability of investment products and assets. The role of ratings in investment compliance can be understood in several ways:

-

Risk assessment: Ratings agencies, such as Moody's, Standard & Poor's and Fitch, assign credit ratings to financial instruments, including bonds, stocks and other investment vehicles. These ratings indicate the credit risk associated with these instruments. Investment compliance professionals use these ratings to evaluate the risk profile of investments and ensure they meet the risk tolerance and objectives of their clients or funds.

-

Regulatory compliance: Many regulatory bodies, such as the US Securities and Exchange Commission (SEC), have specific requirements regarding the types of investments that financial institutions can hold or recommend to clients. Ratings can be used to determine whether an investment complies with these regulations.

-

Investment policies and guidelines: Investment compliance often involves adherence to internal investment policies and guidelines set by asset managers, investment committees or fiduciaries. These policies may reference credit ratings as a factor in determining which securities or assets are eligible for inclusion in a portfolio.

Factors contributing to a rating downgrade or upgrade

Credit rating agencies assess factors such as the following when determining whether to upgrade or downgrade a credit rating for an entity, such as a corporation or government:

-

Financial performance: The financial health of the entity, including factors such as revenue, profitability and cash flow, is a critical consideration. A strong financial position can lead to an upgrade, while deteriorating financials can trigger a downgrade.

-

Debt levels: The level of debt relative to income or assets is crucial. High levels of debt compared to earnings can lead to a downgrade, as they increase the risk of default.

-

Legal and regulatory environment: Changes in laws and regulations can affect an entity's creditworthiness. Legal issues, compliance problems or regulatory changes can lead to rating changes.

Provisional ratings

Provisional ratings for new issuances, such as financial securities or bonds, are determined by credit rating agencies or financial institutions. These ratings are used to provide an initial assessment of a new financial instrument. An experienced analyst at a rating agency or financial institution reviews the provided information and assesses factors such as the issuer’s financial stability, industry environment, economic outlook and the specific terms of the new issuance. They also consider historical data and similar market issuances.

Nationally recognized statistical rating organization (NRSRO)

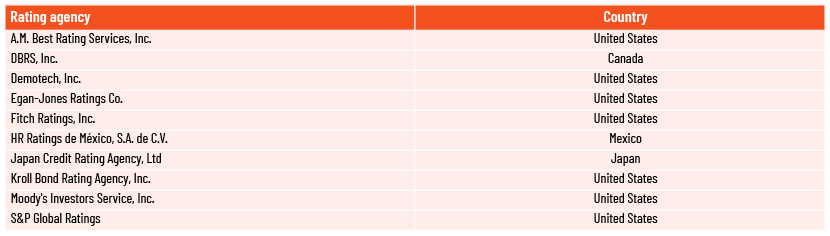

Investopedia defines an NRSRO as a credit rating agency that assesses the creditworthiness of a firm or financial instrument that is registered and approved by the SEC.

NRSROs also evaluate the creditworthiness of national governments. For example, in August 2023, Fitch Ratings joined Standard and Poor's in downgrading the US government from the top AAA tier to the slightly lower AA+ level, due to "repeated debt-limit standoffs" that threatened to impact the country's debt repayments.

How Acuity Knowledge Partners can help

We create tailor-made dynamic functions with a robust, responsive and proficient control framework and process delivery. Our experienced, tool-agnostic team provides support in investment compliance, trade surveillance and corporate, forensic and crime compliance. We are experienced in providing unique solutions with the help of our state-of-the-art technology.

We have a pool of subject-matter experts for process delivery, training, projects and automation to mitigate costs. Our established compliance capabilities help clients identify problems and opportunities to navigate a challenging business environment.

credit rating advisory servicesSources:

What's your view?

About the Author

Ankit has an experience of 5 years in data management and post trade monitoring compliance, and has been with Acuity Knowledge Partners since 2022. As an associate, Ankit specializes in post trade monitoring, rule coding, and IMA review.

Like the way we think?

Next time we post something new, we'll send it to your inbox